Posts Global Market hot-rolled prices 7818 16 May 2023

Price optimism in the first quarter of 2023 did not find its confirmation in the future

Price decline

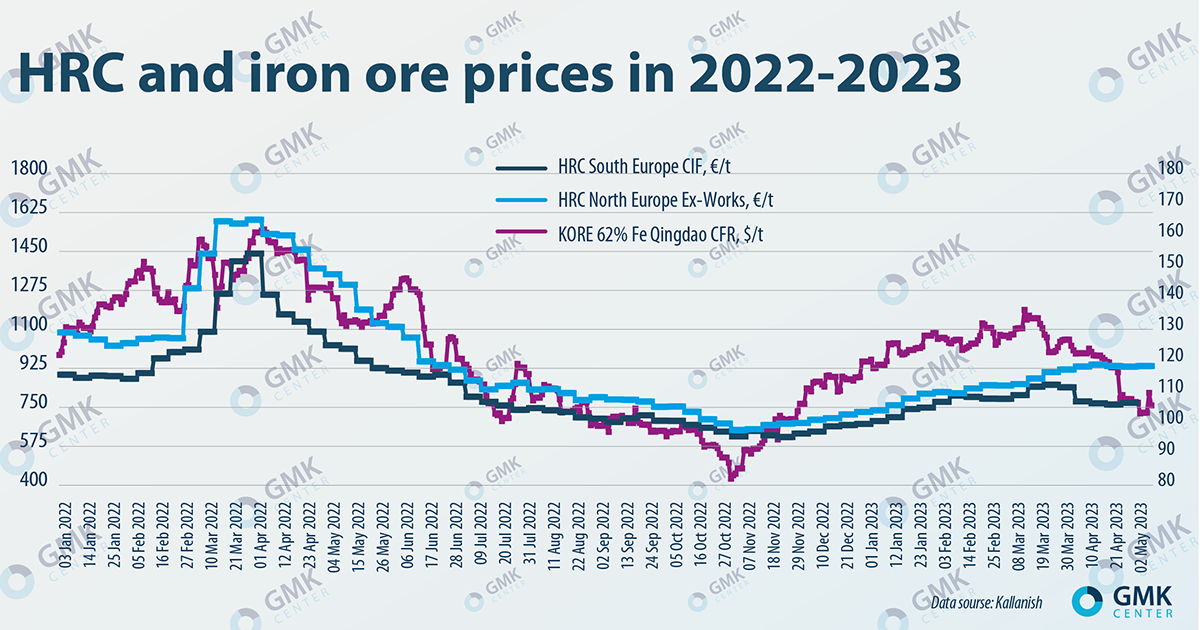

Starting around the end of March, there has been a significant decline in prices for steel and raw materials on world markets. For various positions, rolled steel prices fell by $50-70/t. Global prices for HRC are declining due to weak demand. Sales decreased due to negative market sentiment under the influence of uncertainty in the Chinese market and negative macroeconomic factors.

European producers react accordingly to the negative price environment. In January-March 2023, German steelmakers reduced steel production by 6.65% y/y – to 9.16 million tons, while their French counterparts produced 2.33 million tons of steel, which is 32% less compared to the same period last year. Italy in the first quarter reduced steel production by 6% compared to the same period in 2022 – to 5.63 million tons.

European companies have to compete with cheap imports in their own markets. According to GMK Center, the gap between European hot-rolled steel prices and Asian import offers is becoming dangerously large and volatile. This situation in the short term may lead to lower prices for European products. If demand does not recover in May, which is unlikely given the economic instability, Italian hot-rolled steel prices could fall to €750-770/t.

Factors that affect pricing in the steel market:

- Global geopolitical uncertainty and continued policy of central banks to raise key rates.

- Weak recovery of construction sector in China – the peak season was predicted for March-April. Soon the PRC will be covered by the rainy season, which will reduce the consumption of steel products, so the outlook for the iron ore market is still unfavorable.

- Until May 28 – the day of the second round of the presidential elections in Turkiye – the situation in this regional market will be highly uncertain. In addition, domestic demand weakened due to the sharp devaluation of the lira. However, after the election, the situation with steel sales and scrap purchases will remain unchanged, as there are more serious problems, in particular, the lack of foreign exchange and the unavailability of credit.

- Significant pressure on prices will come from the commissioning of facilities previously affected by the fire. ArcelorMittal in Dunkirk plans to resume production at BF №4 in mid-June. There have been fires at ArcelorMittal facilities in the EU, which may provoke a shortage of hot-rolled steel in the EU market at the level of 1 million tons. Technical problems at Tata Steel’s European facilities should also be noted.

- Consumers are pursuing a cautious policy of purchases, expecting an even greater reduction in prices for steel products.

- Fears about a banking crisis in the US, where several large financial institutions have already gone bankrupt.

Tata Steel expects improvement of the situation in Europe in July-September. This is due to lower energy costs. Company may consider closing a significant part of operations in the UK if it fails to obtain appropriate financial support from the government within the next two years.

According to World Bank estimates, this year, despite growth in the first quarter, the fastest drop in global commodity prices since the start of the COVID-19 pandemic is expected. Base steel prices are expected to fall by 8% in 2023 and another 3% in 2024. This will inevitably affect the quotations of ferrous metals downward.

Raw materials markets

The uncertain situation in the steel markets leads to lower prices for raw materials:

- Scrap.

World scrap prices continued to decline amid weak demand for steel and uncertainty about the economic outlook. The fall in steel prices is forcing steelmakers to refuse to purchase raw materials in order not to incur losses. Scrap prices in Turkiye are moving to $360/t. With no demand from Turkish steelmakers and steel prices continuing to fall, the market expects a possible reduction in scrap prices in the short term.

- Iron ore.

- Coking coal.

In the recent times, global prices for coking coal have been falling amid low activity of buyers. Raw material quotations for only one week of April decreased by 7%. Analysts predict that availability of Australian coking coal will improve within a few months due to favorable weather conditions. Earlier, S&P Global analysts expected falling prices for coking coal.

Global hopes

A positive signal for the market was the growth of China’s GDP in the first quarter at the level of 4.5% y/y, which exceeded analysts’ forecasts by 0.5 percentage points. Analysts at JPMorgan and Citi improved their forecast for China’s GDP growth in 2023 to 6.4% and 6.1% from 6% and 5.7% respectively.

At the same time, there are also negative trends in the Chinese economy:

- in April, all PMI (NBS) indexes unexpectedly fell, and the industry went below 50 points;

- exports in April amounted to $295.5 billion (8.5% y/y) compared to $315.6 billion (14.8% y/y) in March;

- April imports amounted to $205.3 billion (-7.9% y/y) compared to $227.4 billion (-1.4% y/y) in March.

The slowdown in exports is primarily an indicator of weak global demand, while the decline in imports is an indicator of suppressed domestic demand in China.

Overall, according to Fitch, the global economy started 2023 better than expected. This was due to the high pace of development in China and the largest economies – in January-March, the US economy increased by 0.3% against the forecast of 0.4%, the Eurozone – by 0.1%, which is at the level of expectations.

Ukrainian realities

Ukrainian producers of both steel and raw materials track trends in foreign markets. Price driver – expectations for the level of demand. A slight decline is expected on the key EU market for the Ukrainian iron and steel products. According to the Association of European Steel Producers (EUROFER) estimates, apparent steel consumption in 2023 will fall by 1%. This indicator in the EU at the end of 2022 decreased by 7.2% y/y.

In turn, the World Steel Association WorldSteel (WSA) expects that the demand for steel in EU and the UK in 2023 will amount to 151.3 million tons, which is 0.4% lower than in 2022. At the same time, according to WSA estimates, global demand for steel will grow by 2.3% y/y in 2023 – up to 1.82 billion tons.

In turn, the National Bank of Ukraine predicts a long period (until the third quarter of 2025) of a decline in world prices for steel products. A slight increase in steel and iron ore prices in 2023 is associated with Turkiye’s recovery from the consequences of the earthquake in early February 2023. At the same time, we can hardly expect a significant improvement in the price situation for scrap, especially in summer.

Turkish steel producers at current scrap prices are losing competition in the European market: quotations for rebar from Turkish plants are higher than from other producers. Turkish plants refuse to purchase scrap and put pressure on suppliers to reach an acceptable and competitive price level. The search for balance will take time and the fall in scrap prices may continue for the next 2-3 months.

This assumption looks especially realistic amid the dynamics of steel production in China. In fact, the price of scrap is largely determined by the price of iron ore, as steel products made from scrap and products made from iron ore compete with each other in the market. China sets the trend for iron ore prices to fall, thus indirectly influencing the scrap market.

GMK Center sees two possible scenarios for further market dynamics. First scenario – closer to autumn, the global steel market will come to a balance between supply and demand. Falling prices for raw materials and steel will stop amid increased demand.

Antonio Marcegaglia, Chairman of the Marcegaglia Group board, has a similar opinion. He believes that until July the flow of orders for European plants will be slow and small, while in September we can expect demand to pick up.

In the event of the appearance of «black swans», second (pessimistic) scenario with deepening negative price trends may appear. Reasonable fears are expressed about the banking crisis in the US, where several large financial institutions have already gone bankrupt – it is quite possible that negative trends in the banking sector will intensify in autumn. Negative events in the US economy may come earlier, as negotiations to raise the debt ceiling continue and no single solution has yet been found. In the case of a pessimistic scenario, the global economy will be in a crisis and the prices of steel and raw materials will fall even more.