Posts Global Market steel production 7545 14 April 2023

Problems of local steel plants hinder finding balance between demand and supply

In the second half of last year EU steel plants decided to stop production capacities. They feared a decrease in demand and tried to reduce steel stocks in such way. At the time, the decision was seemed reasonable because of rising energy prices and accelerating inflation. In December 2022 Fastmarkets estimated that EU steel companies suspended 14-15 mln tons of steel capacities.

According to estimations of GMK Center, in January-February 2023 destocking continued. Steel companies focused on ideas from Q4, which pushed them to reduce production, but demand did not decrease. Market needed the same volumes of steel, as in previous years. Steel companies realized that real demand has not fallen as expected, so it is necessary to increase steel production. At the same time current supplies are not enough. Gap between real demand and supply at EU market remains.

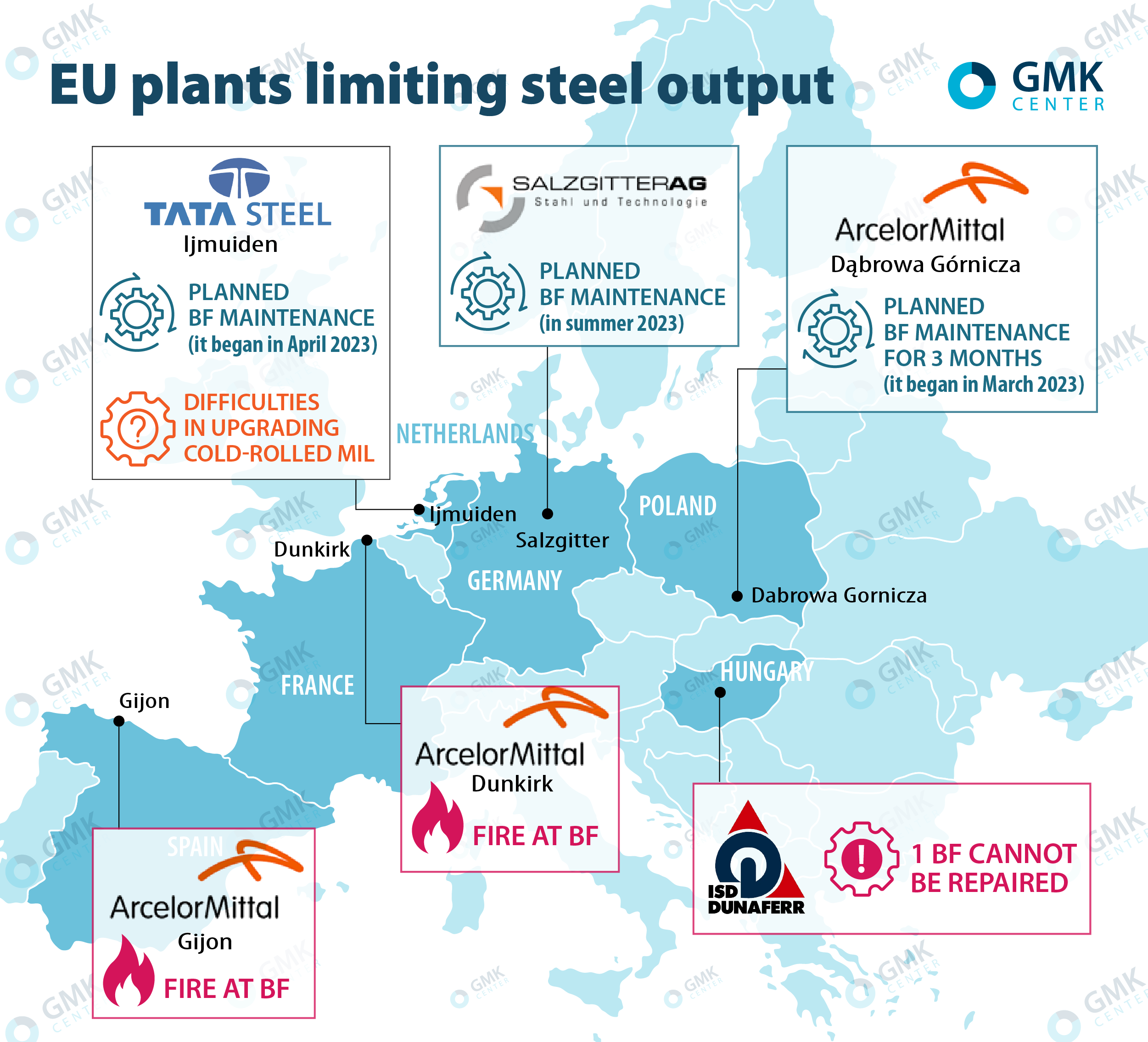

Incidents at blast furnaces

On March 22, 2023, ArcelorMittal stopped blast furnace A at the Gijon plant after fire. Before this incident blast furnace A was restarted in February after being idle in September 2022 to run at reduced rates in line with market conditions. ArcelorMittal has not yet been determined how long BF A will not work. According to local media, the blast furnace will be shut down for at least two months. Blast furnace B at the enterprise continues to work normally. The 2 blast furnaces of Gijon plant have a capacity of 4.5 million tons per year. Blast furnace A has a capacity of 2.35 million tons.

On March 30, 2023, fire hit BF 4 at ArcelorMittal Dunkirk plant. BF 4 was not damaged as a result of the fire, but during the investigation of the origin of the explosion, the plant will operate with only one blast furnace. Dunkirk has three blast furnaces, with a combined pig iron capacity of 7 mln tons per year. Blast furnace 4 is the largest – about 3.6 mln tons per year.

ArcelorMittal has informed customers that there may be delays in deliveries of flat products across Europe due to fires at Gijon and Dunkirk plants. The accidents affected furnaces that mainly produce pig iron for slab and flat products. European buyers expect 1 million ton HRC shortage due to fires at ArcelorMittal plants. Peak of supply tightness is anticipated during June-August.

In conditions of existing demand-supply gap every working blast furnace is important for finding market balance. But in fact, producers can not utilize all capacities because of needed repairs.

Planned maintenance

Salzgitter will reline blast furnace A in the summer of 2023 – maintenance is likely to continue until September. At the same time in May the company plans to resume the operation of blast furnace C, which has been idle since 2019. Salzgitter does not yet have an answer to the question of whether it will remain in operation BF C after the completed maintenance of BF A. Capacity of blast furnace A is 3.4 mln tons per year, while capacity of BF C – 600 ths tons.

More likely maintenance at Salzgitter’s blast furnace will not influence market because the company began producing slabs in advance in autumn 2022. So, the company has certain reserve which can be used to stabilize supplies. Moreover, Salzgitter can use slabs from Hüttenwerke Krupp-Mannesmann (HKM), the Duisburg plant, owned with Thyssenkrupp Steel and Vallourec.

ArcelorMittal Poland shut down BF 2 at Dąbrowa Górnicza plant for maintenance. Modernization will last three months. At the same time the company restarted BF 3 in January 2023 as preparations for the shutdown of blast furnace 2. BF 3 has not been operating since October 2022. Capacities of these blast furnaces is almost equal (BF 2 – 2.3 mln tons, BF 3 – 2.2 mln tons). So, in opinion of GMK Center, the company will maintain production at current level.

Tata Steel Nederland began a major modernization and relining program for blast furnace 6 at its Ijmuiden steelworks in the first week of April. Ijmuiden plant operates 2 blast furnaces. Blast furnace 6 has capacity of 2.5 mln tons. Blast furnace 7, which continues working, has capacity of 3.5 mln tons. Tata Steel Nederland produces hot- and cold-rolled coils, so shut down of blast furnace will influence company’s supplies.

Other difficulties

In February 2023 Tata Steel Netherlands has declared force majeure because of difficulties upgrading its cold-rolled mil. The company has been upgrading cold mill 21 since August 2022 to improve surface quality and gauge control, but several problems have extended the outage. The force majeure is still in place.

According to Argus, the first blast furnace that was idled at Dunaferr in summer last year is irreparably damaged and will not restart. Dunaferr has 2 blast furnaces. BF 2 with capacity 800 ths tons per year was relaunched in February 2023. Total capacities of two blast furnaces were estimated at 1.2-1.4 mln tons, so 400-600 ths of capacities are lost. Liberty Steel can use external slab supplies for Dunaferr, for example, from Galati. Dunaferr can produce hot-rolled, cold-rolled, hot-dip galvanized flat products.

External factor

The earthquake in Turkiye became an additional problem for the market. The earthquake affected facilities producing a third of steel in the country. Iskenderun steel mills announce force majeure in response to a state of emergency in southern Turkiye. Port of Iskenderun is damaged. Although steel plants in other parts of Turkiye did not make force majeure announces, export possibilities of Turkiye decreased. Even if the plants were not damaged, it will take time to resume their work. Some workers died, and the rest have to adapt to new conditions.

In 2022 Turkiye exported to EU 2.5 mln tons of flat products. These supplies are under threat. Even if steel plants fully resume production, the country need steel for reconstruction and recovery after earthquake. Satisfying the needs of the domestic market will be a priority.

In opinion of GMK Center, current market situation is twofold. On the one hand, EU steel plants are forced to increase supply because they do not meet needs of customers and unsatisfied demand pushes HRC prices in EU to €900/t. On the other hand, market participants expect economic situation to worsen in the second half of the year. Nobody wants to accumulate steel stocks. The fear hinders steel imports and relaunch of local steel capacities. In such conditions prices will stay high for a long time.