Posts Global Market sea ports 2370 13 September 2023

A year and a half of war has not changed anything in the readiness of Polish ports for Ukrainian exports, the prospects for the growth of port shipments remain vague

Already in the first few months of the war, export products from Ukraine flowed to the ports of neighboring countries. At first, Ukrainian shippers tested new logistics routes for their products, and then chose the optimal ones based on route length, cost, delivery terms, and the presence of certain obstacles.

«The port terminals of Germany, the Netherlands, and the Baltic countries were under consideration, but work with these terminals was abandoned due to the higher cost of logistics than in Poland and in the direction of southern ports, as well as due to the lack of a sufficient amount of rolling stock warehouse for cargo delivery to terminals in Germany, the Netherlands, and the Baltic States. Rolling stock operators were not ready to give their wagons for long routes outside of Poland and were mainly focused on quick turnover of wagons on short distances,» stated the company Metinvest.

Polish ports turned out to be the shortest and relatively cheapest:

- Gdansk (transshipment capacity – more than 50 million tons),

- Gdynia (over 20 million tons),

- Szczecin-Swinoujscie (over 30 million tons).

When choosing other European ports, the lengthening of the logistics arm had a negative effect on the cost of delivery per ton of cargo and made exports economically unprofitable. In some cases, the cost of cargo delivery increased by 4-5 times.

As with railways, Ukrainian exporters and importers face the following problems in ports:

- priority for own cargo;

- lack of port capacity for transshipment (loading/unloading) of Ukrainian exports;

- lack of warehouse space for the accumulation of shipping lots.

“Everyone, without exception, faced the problem of limited capacity of European ports. The ports were not ready for a multiple increase in demand, the port and railway infrastructures could not cope with the influx of cargo,” explains Andrii Myagkov, Director of Logistics at ArcelorMittal Kryvyi Rih.

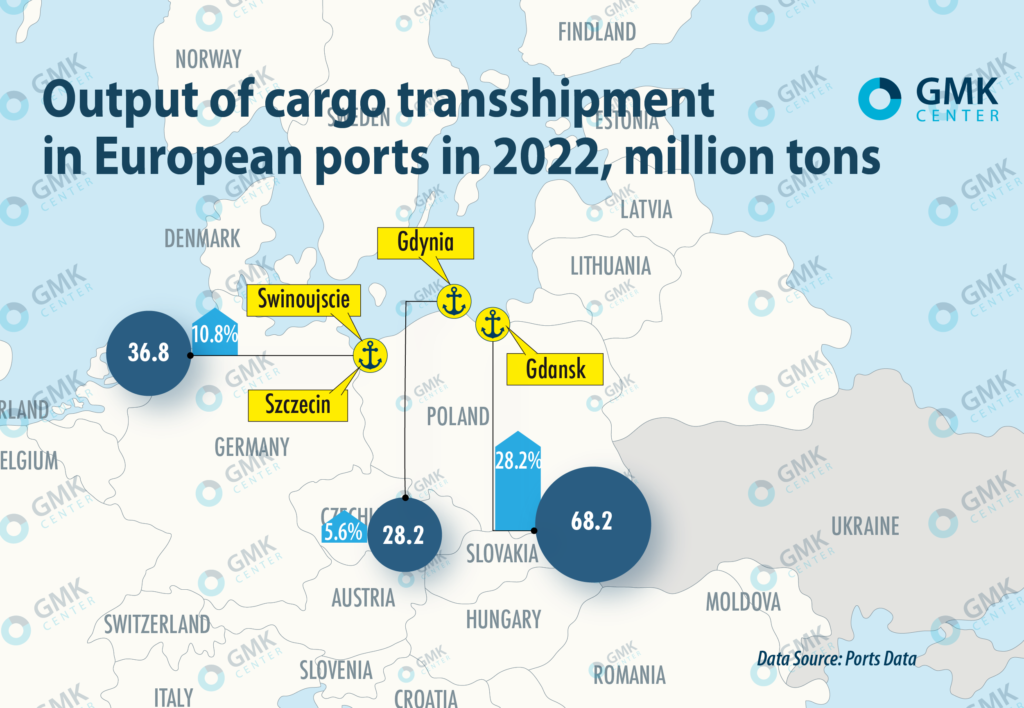

However, amid the growth of Ukrainian exports and imports, Polish ports were able to increase the volume of cargo transshipment in 2022:

- Gdansk – by 28.2%, up to 68.2 million tons;

- Szczecin-Swinoujscie – by 10.8%, up to 36.8 million tons;

- Gdynia – by 5.6%, up to 28.2 million tons.

Improvement of the situation

Ukrainian shippers note an improvement in the situation with transshipment of goods in Polish ports compared to last year. In 2023, the dynamics of transshipment in Polish ports became even higher. In particular, in the first half of the year, transshipment growth in Gdańsk was 36% – to 40.8 million tons, in Szczecin-Świnoujście – 3.5% to 18.1 million tons.

At the same time, transshipment of products through Polish ports depends significantly on market conditions. Szczecin-Swinoujscie port complex in January-June 2023 reduced transshipment of iron ore by 59.1% compared to the same period in 2022 – to 650.6 thousand tons. While in 2022, transshipment of iron ore increased by 11.4% compared to 2021 – up to 2.11 million tons In general, during the first half of the year, the port complex increased cargo transshipment by 3.5% compared to January-June 2022 – up to 18.1 million tons.

«ArcelorMittal continues to use Polish ports. Ports are important because some shipping directions are most optimal when sent from Polish ports. Currently, problems with shipping from Polish ports are not as relevant as they were before. Their throughput increased in 2023 compared to 2022. Polish ports do well with bulk, but when it comes to finished products, load levels and prices rise. But until Ukrainian ports are unblocked, there are few alternatives,» Andrii Myagkov says.

Meanwhile, according to Dmytro Nikolayenko, commercial director of Metinvest, the route through Poland causes serious logistical difficulties – last winter, warehouses in Polish ports were filled with coal, and it was impossible to load their iron and steel products. In order to solve this problem and accumulate shiploads of iron ore, Metinvest uses a dry port on the territory of Poland near the border with Ukraine.

The record volume of transshipment of the port of Gdansk last year is due to the high demand for coal for energy and oil for oil refineries. The priority for own (Polish) cargo to a certain extent limits the movement of Ukrainian exports and imports to and from the ports of Poland. In the first half of 2023, transshipment of coal and oil for domestic needs increased again in Polish ports.

The situation in Polish ports has improved both for shippers and receivers, primarily in terms of container transportation. Polish seaports have sufficient capacity for this.

«Now there are no particular complaints about Polish logistics. At the beginning of the war, it was overloaded because it was not ready, but in 1.5 years the Poles managed to increase the cargo capacity enough that there were no serious problems when importing metal by sea. We mainly use Gdansk, sometimes Gdynia. The choice is influenced only by the fact that different logistics flows go to both of these ports. Now the only problem is that they can overload containers for a long time,» notes Oleksiy Didenko, head of the marketing department of UTS (Ukr-Tech-Service).

In general, cargo owners choose the optimal routes for their export or import. Despite the fact that the majority of steel companies operate through Polish ports, Ferrexpo uses the Romanian port of Constanta for sea transportation to the countries of Western Europe, the Middle and Far East and others.

«In 2022, Ferrexpo shipped products through Polish ports, including the port of Gdansk. Small volumes can be exported from Polish ports to European ports. We temporarily abandoned this route, as it is an unpopular destination, and the cost of freight is several times higher than from deep-sea ports,» says Dmytro Spatar, first deputy chairman of the board of Poltava Mining.

Port investments

Polish ports are quite actively implementing investment projects to modernize infrastructure and expand their throughput capacity, but they do so based on their current cargo flows, only to a small extent taking into account the volumes of Ukrainian export-import.

Gdansk

In 2022, the Port of Gdańsk completed a $134 million project to modernize the fairway, expand berths, and improve shipping conditions in the inland port. Implementation of the project began in 2016. During this time, almost 5 km of berths and more than 7 km of the internal fairway were reconstructed. After deepening, the permissible draft of ships entering the inland port increased. Now vessels up to 250 m long, 35 m wide and 10.6 m draft can be served in the port channel. The EU financed this project by 85% through the CEF.

The port also received subsidies of almost €100 million under the CEF for the reconstruction of four berths with a total length of almost 2 km together with underground and railway infrastructure.

At the beginning of last year, the DCT deep-sea container terminal in the port of Gdansk completed the implementation of an investment project to expand the railway infrastructure – the number of tracks was increased from 4 to 7, the length of each track was increased from 618 to 750 m, the railway capacity increased to 750 thousand TEU, the number of mooring cranes at Terminal 2 has been increased to 8, etc.

In addition, the port operators plan to build a second deep-sea berth for oil transshipment and a third deep-sea container terminal. Investments in the second project will amount to about €470 million. The construction of a quay wall 717 m long with a depth of 17.5 m and a rear area of 36.5 ha is planned. The new terminal is scheduled to be put into commercial operation by mid-2024. At the first stage, the new terminal will increase the capacity by 1.7 million TEU – up to 4.5 million TEU per year.

Gdynia

In 2022, the construction of two concrete-covered warehouses with an area of almost 18 hectares was completed in the port of Gdynia. Also last year, the port completed the first stage of modernization of the railway hub with investments of $206 million. As part of the first stage, track, drainage, road, cubature works related to the aerial contact line and railway traffic management were performed. As part of the entire project, 115 km of tracks and more than 350 switches will be modernized, as well as access to the port will be electrified. 13 km of roads, a railway bridge and 2 railway crossings will be restored. The investment is co-financed through the CEF, and its total value is approximately $370 million.

The construction of an external deep-sea port is also planned in Gdynia. Its expansion will make it possible to almost double the port area for transshipment of goods and, accordingly, to receive large container ships. The size of these investments is estimated at approximately $370 million.

Szczecin-Świnoujście

The Szczecin-Świnoujście port complex is currently implementing investments amounting to more than $485 million. In 2022, the dredging of the Dębice Canal was carried out, which reached a depth of 12.5 m. The port also invested $320 million in the reconstruction of railway tracks. The investment allowed the construction of 96 km of new tracks , 285 detours, 84 km of new roads and 22 crossings. In addition, the construction of a new Norwegian wharf and the modernization of the existing Czech and Slovak wharves were planned. These projects are co-financed by the EU. The total amount of investments is about $84 million.

A deep-sea container terminal is planned to be built in the outer port of Świnoujscie. The investment can be implemented in two stages, the first stage will handle 1 million TEU per year. In general, the terminal will be able to process up to 2 million TEUs per year. The new terminal should be operational at the beginning of 2028. This investment is also linked to the expansion of infrastructure, including almost 100 km of the railway network and the S3 expressway along the Polish border, which is scheduled to be completed by 2024.

The implementation of these investment projects in Polish ports will expand the capacity of the port infrastructure for Ukrainian exports and imports. But this mostly applies to incoming and outgoing container traffic. In particular, the other day Baltic Container Terminal in the port of Gdynia launched a direct intermodal connection for the export of Ukrainian goods. Currently, the terminal receives trains with container cargo, mainly corn, grain and meal. In addition, the terminal is also working together to improve the flow of import transportation to Ukraine, using already existing connections.