Posts Global Market electricity prices 2232 18 April 2024

The likely increase in demand in April-June is forecast to be insignificant

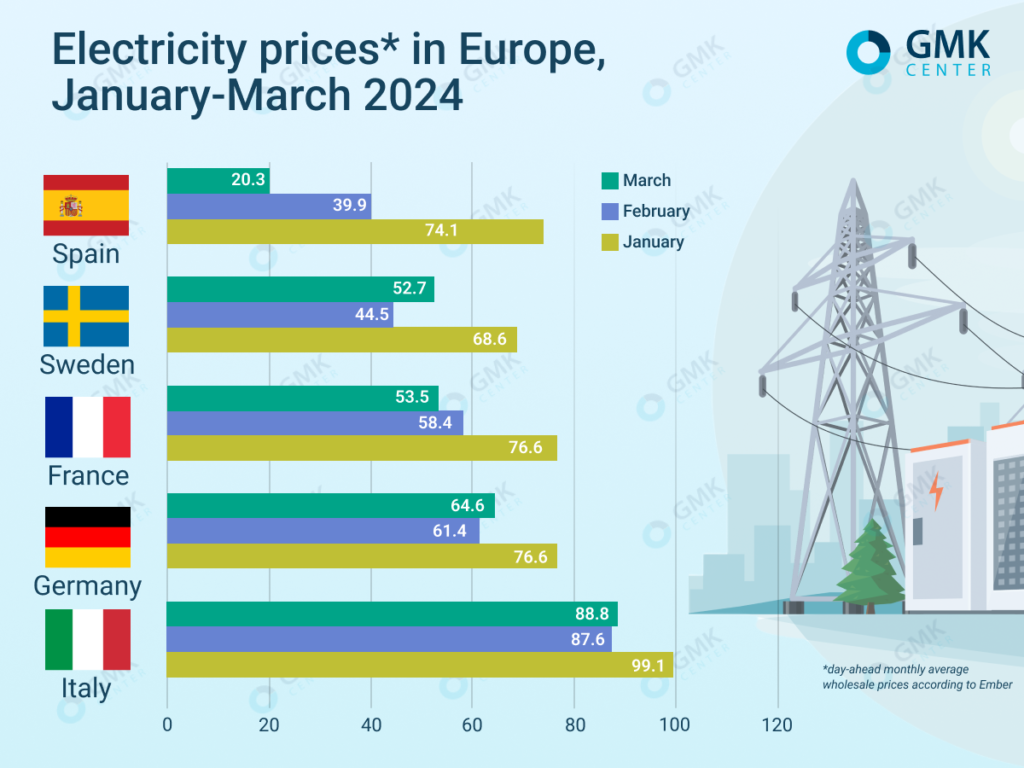

In the European markets, the average monthly wholesale day-ahead prices in March 2024 showed different trends depending on changes in the generation mix in a particular week.

According to Ember, they amounted to:

- Italy – €88.8/MWh (+1.4% m/m);

- France – €53.5/MWh (-8.3%);

- Germany – €64.6/MWh (+5.3%);

- Spain – €20.3/MWh (-49%);

- Sweden – €52.7/MWh (+18.4%).

Electricity prices in Europe, GMK Center

In Ukraine, the weighted average price of electricity on the day-ahead market (DAM) in March 2024 decreased by 5.5% compared to the previous month to UAH 3089.5/MWh (€72.1 at the exchange rate of 42.85 UAH/euro), according to Market Operator data. Demand for DAM last month increased by 21.27% compared to February, while supply increased by 4.71%.

According to The European Energy Exchange (EEX), the Central European exchange for electricity and related products, the basic settlement price of electricity futures on the German market in May 2024 will be €66.02/MWh, on the French market – €25.19/MWh, on the Spanish market – €25.44/MWh, on the Italian market – €93.45/MWh.

March trends

According to AleaSoft Energy Forecasting, in the first week of March, solar energy production reached the highest daily value for this month in history in most major European markets. However, prices during this period increased compared to the end of February due to higher demand, gas and CO2 prices, and lower wind power generation.

At the end of March, prices in most European markets fell compared to the previous week – in several of them it was the period with the lowest average or the second lowest average in 2024. The decline was driven by lower demand and increased renewable energy production.

EU measures

In April, the European Parliament approved a reform of the EU electricity market to protect consumers from price volatility. In particular, they will have the right to access fixed-price or dynamic-price contracts.

The legislation provides for so-called «contracts for difference» (CfD) or equivalent schemes with the same effect. Under these contracts, governments guarantee a minimum price to electricity producers if they make new investments in renewable or nuclear power. If the market price falls below the agreed price, the state intervenes and compensates for the difference. If it is higher, the surplus goes to the state. This is intended to stimulate domestic production of clean electricity.

There is also a mechanism for declaring an electricity price crisis. In a situation where they are very high, and under certain conditions, the EU can declare a regional or pan-European crisis, allowing member states to take temporary measures to set electricity prices for small and medium-sized enterprises and energy-intensive industrial consumers. The law is yet to be adopted by the European Council.

Forecasts

European energy markets, according to the Platts review, entered the second quarter of 2024 with better supply than at any time since 2020. Solar power generation is projected to exceed gas-fired power generation for the first time, and the likely increase in demand is seen as insignificant.

The growth rate of renewable energy is significantly outpacing the recovery in demand, even for the individual growth of solar power generation.

Demand in the ten major European energy markets is expected to grow by 1.7% or about 4 GW year-on-year in the second quarter. At the same time, the cumulative increase in wind, solar, hydro, and nuclear power will be 17 GW compared to 2023. This will lead to a 30% reduction in gas generation, or about 12 GW year-on-year.

S&P Global analysts believe that in the second quarter of this year, gas and coal generation will cover only 14% of electricity demand in ten EU markets, which is 5 percentage points less year-on-year. The growth of solar capacity may lead to a further increase in hours with negative or low prices in April-June.

According to a report by Montel EnAppSys, the EU recorded record renewable electricity generation in the first quarter of 2024 amid continued low demand. It reached a record level of 375.9 TWh, exceeding the previous peak of 358.4 TWh in the fourth quarter of 2023 due to an increase in hydro generation.

Renewables accounted for 50.1% of total electricity generation in Europe in January-March this year. Nuclear power accounted for 23.4%, gas for 14.7% and coal/lignite for 11.3%.

Fullness of gas storages

After the end of the winter heating season on March 31, EU gas storage facilities were filled by more than 58%, said European Energy Commissioner Kadri Simson. This is the highest level ever recorded at this time of year.

According to her, such high levels are the result of successful diversification of energy supplies, efforts by citizens and businesses to reduce gas demand, and investments in renewable energy sources. These three factors are part of the REPowerEU plan.

According to Simson, this means that markets are becoming increasingly stable, prices have returned to the level before Russia’s full-scale invasion of Ukraine, and the EU can confidently start replenishing gas reserves for next winter’s heating season.

According to the Financial Times, this level of gas storage capacity gives the bloc a good starting point in preparing for the next heating season during the summer. However, analysts warn that the EU may have to reduce LNG imports in the coming months to avoid filling up the capacity too early.

The EU could reach its target of 90% by early November as early as August if the injection rate is the same as last year, said Natasha Fielding, head of European gas prices at Argus Media.

Analysts at ING Financial Group predicted in early April that the comfortable level of reserves indicates that price growth during the current year is likely to be limited, provided there are no force majeure supply issues.

The experts left the TTF gas price forecast unchanged at €25/MWh for both the second and third quarters. The forecast for the fourth quarter at €35/MWh looks less likely, but ING takes into account the possibility of stopping Russian gas supplies through Ukraine at the end of 2024. Europe will be able to do without it, although the market is likely to react to the changes.

Andriy Tarasenko, Chief Analyst at GMK Center, notes that the escalation of the conflict in the Middle East threatens price stability in the European energy market. Oil prices are rising, which puts pressure on gas prices. In particular, spot prices on the TTF rose by more than €33/MWh on April 17, which is the highest since January 2024.