Posts Global Market sanctions 4070 03 April 2024

Continued supplies from Russia create imbalances in the European market and damage local producers

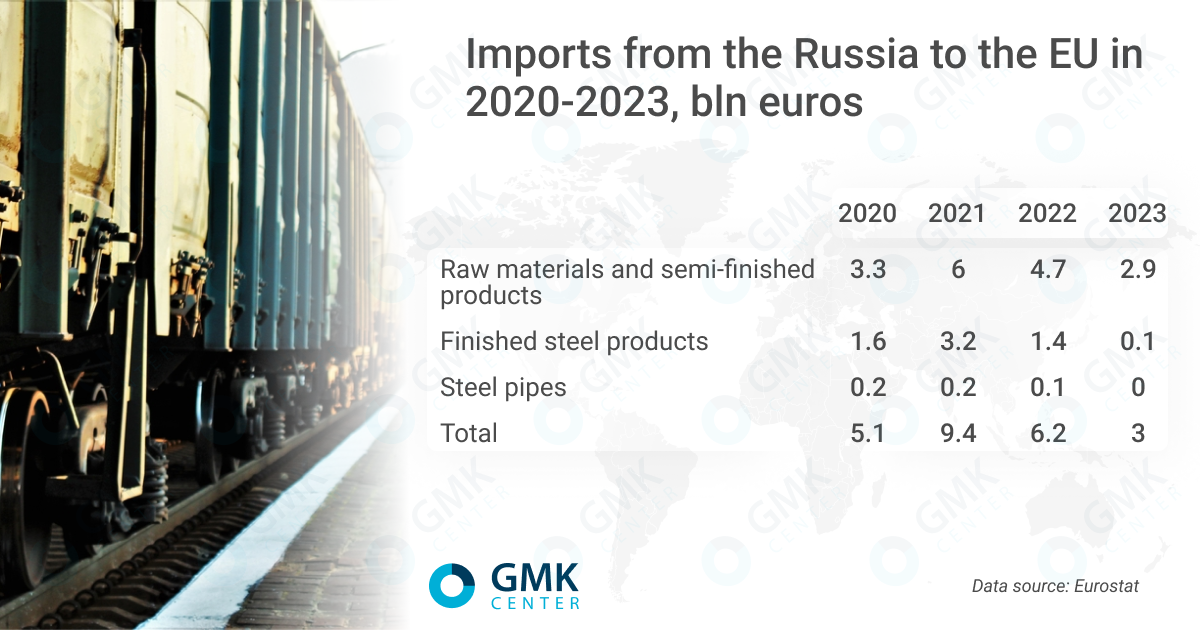

Numerous European sanctions against Russia in general and its iron and steel complex in particular were aimed at limiting the possibility of financing a full-scale aggression against Ukraine. The first sanctions against steel products were imposed in April 2022, when the EU banned imports from Russia of steel products included in the import quota system (rolled steel and pipes). Two years after the first sanctions were imposed, we see that export revenues of Russian iron and steel companies from supplies to the European market have decreased by about 50%. To what extent the EU’s original goal has been achieved remains unclear, as in 2023 EU countries imported 4.8 million tons of iron and steel products from Russia worth €2.4 billion.

Development of the sanctions story

The first sanctions against Russian steel products became effective on April 1, 2022 (4th package) – the EU banned imports of rolled steel and pipes from Russia.

The 8th package of sanctions, which came into force on September 30, 2023, extended the previously adopted restrictions – imports of all products from HS 72 “Iron and steel” (except for 7201 «Pig Iron» and 7202 “Ferroalloys”) and HS 73 “Articles of iron or steel” were banned. That is, imports of semi-finished products (square billets and slabs) also fell under sanctions. Imports of square billets (HS 7207 11) were prohibited from April 1, 2024, and imports of slabs (HS 7207 12 10) – from October 1, 2024. Until then, a transitional period was established, during which imports of semi-finished products were allowed, but in volumes not exceeding the established quotas.

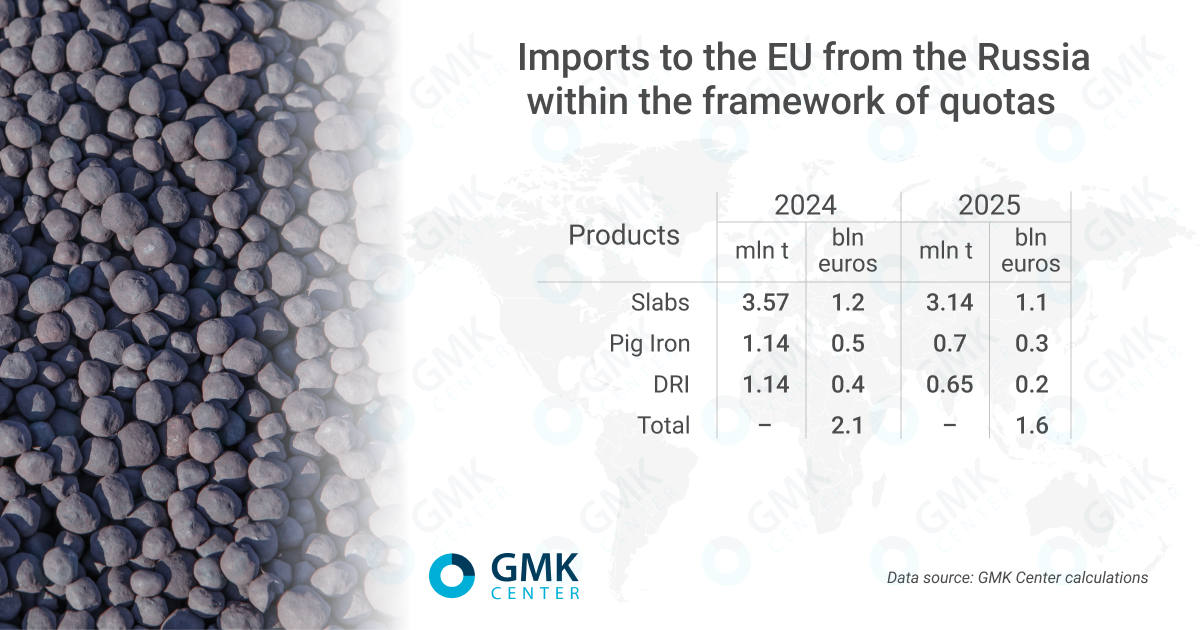

The 12th package of sanctions, approved on December 18, 2023, imposed restrictions on imports of pig iron, ferroalloys and direct reduced iron (DRI) from Russia. The ban on imports of pig iron and DRI will come into effect on 01.01.2026, and until then, quotas will be in place to reduce supplies. At the same time, the European Union extended the import permit for slabs and billets from alloy steel for 4 years – until September 2028.

Preventing third countries and companies from circumventing sanctions remains a topical issue for the EU. And this is not a far-fetched problem at all. For example, India has been buying cheap Russian oil, refining it and selling diesel fuel as its own products to the EU, which earlier imposed a ban on offshore imports of oil and oil products from Russia.

As part of the 8th and 11th sanctions packages, the EU extended and tightened the ban on imports of steel products from third countries if they were made from Russian raw materials or semi-finished products. To a large extent, this ban affects Turkey, which did not impose sanctions against Russia and continues to buy semi-finished steel products from Russian companies.

Inconsistent sanctions

Due to the lack of consensus within the EU, imposing restrictions on imports of Russian iron and steel products faces difficulties. Since decisions in the area of common foreign policy are taken unanimously, one country may well block a common decision.

The EU approved the ban on pig iron imports under the 12th package only at the fifth attempt. It was actively opposed by Italy, the largest consumer of Russian pig iron in the EU – 1.18 million tons in 2023. In addition, the ban was adopted with a transition period – a complete ban on imports of pig iron and DRI from Russia comes from 2026, and until then there are quotas in the total amount of 1.84 million tons and 1.79 million tons respectively. This will allow Russian companies to continue making profit on the European market.

In addition, the 12th package provides for relaxations for imports of slabs. The main beneficiary from the extension of slab imports is NLMK Europe (affiliated with the Russian NLMK), which has five rolling production facilities – two sites in Belgium and three plants in Denmark, France and Italy with a total capacity of 3.1 million tons of finished steel products per year.

The main argument in favor of continuing slab imports from Russia is the preservation of jobs, about 2,000 of them at all NLMK Europe production facilities. Direct lobbyists for easing restrictions on slabs were the authorities of Belgium and the Czech Republic. The latter motivated this by the inability to find other suppliers and the risk of shutting down its industry.

Despite efforts of European steelmakers, steel industry failed to overcome the pressure of the countries – beneficiaries of slab imports from Russia. The EUROFER Association opposed the extension of supplies because consumers of Russian slabs in Europe get a price advantage over other suppliers – about €30/t per HRC cheaper. This leads to unfair competition and an unequal playing field in the EU’s domestic steel market.

«It is likely that the European Commission incorrectly assessed the impact of this decision on the market, considering the possible saving jobs at NLMK plants, but not taking into account the possible losses of the entire EU steel industry due to pressure on prices. European steelmakers will make €30 less per ton because of this ill-conceived decision. We estimate the production of flats in the EU at about 6 million tons per month in 2023. Accordingly, the European steel sector could lose up to €180 million per month,» says Andriy Tarasenko, Chief Analyst at GMK Center.

Participants of the European market also pay attention to the fact that since the import of slabs from Russia remains legal, it is still possible to import products from third countries made from Russian slabs (such products are not subject to the import ban). This situation further distorts the competitive situation on the EU steel market.

Sanctions figures

The EU sanctions against Russian iron and steel products were aimed at limiting the possibility of financing military actions against Ukraine. Due to the sanctions imposed in the iron and steel sector, the export revenue of Russian companies was significantly reduced: according to Eurostat, imports of raw materials, steel semi-finished and finished products, pipes decreased by 68% compared to pre-war 2021 – to €3.0 billion.

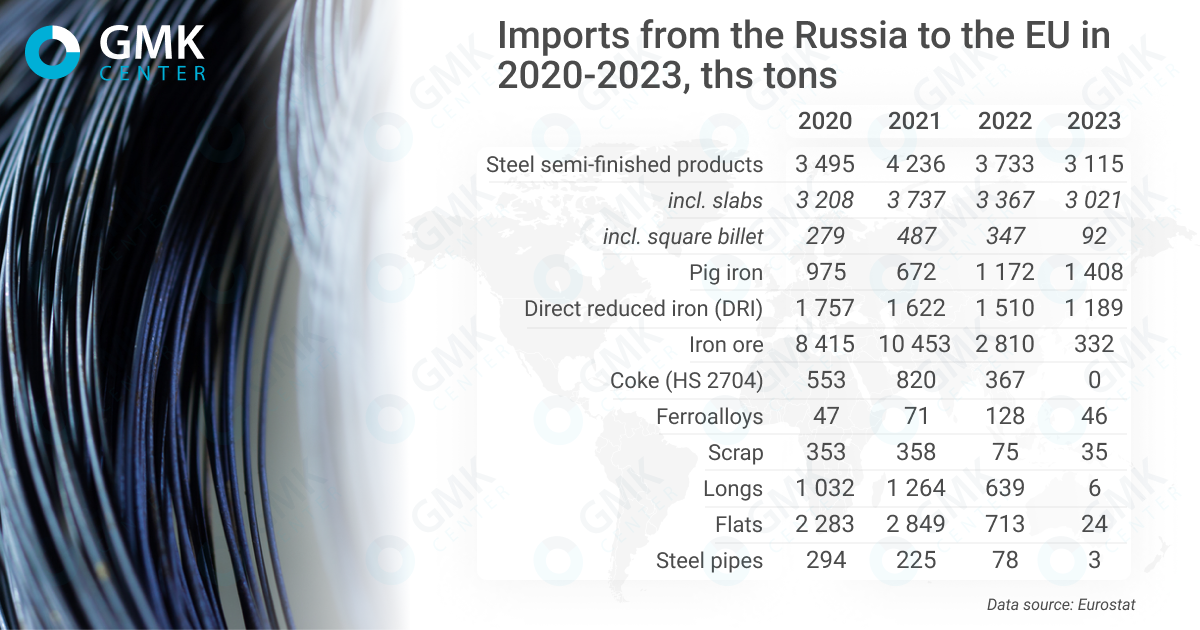

In 2023, the main items of European steel imports from Russia remained semi-finished products, pig iron and DRI. The situation in these segments is as follows:

- Steel semi-finished products. Imports in physical terms in 2023 compared to 2021 decreased by 26.5% – to 3.11 million tons, in monetary terms – by 35.6%, to €1.68 billion. Slabs account for approximately 90% of semi-finished steel imports from Russia. In January 2024, 188.4 thousand tons of semi-finished products were imported from Russia.

- Pig iron. Physical imports last year increased 2.1 times compared to 2021 (from 672 thousand tons to 1.4 million tons). Over the same period, export revenues rose from €321 million to €567 million. In January 2024, Russian companies exported 36.3 thousand tons of pig iron to the EU.

- DRI. Supplies from the Russian Federation in physical terms for the period decreased by 26.7% – to 1.19 million tons, in monetary terms – by 31.4%, to €420 million.

Thus, Russian producers continued their expansion in the European pig iron market, while Ukrainian companies lost the opportunity to continue supplies in previous volumes due to active military actions and loss of control over the largest production facilities in Mariupol.

In 2022, the EU banned the import of metallurgical coke (HS 2704) from the Russian Federation, as a result of which its supplies to the European market decreased by 55% y/y – to 368.9 thousand tons. In 2023 imports stopped completely.

A similar situation is observed in the import of rolled steel and pipes – after a direct ban in 2022 the supply volumes are at the level of statistical error.

Currently, the EU is least dependent on Russian iron ore, ferroalloys and scrap. Although the EU has not imposed restrictions on imports of iron ore from Russia, its supplies have been reduced to a minimum. Apparently, this is a conscious refusal of European consumers from Russian ore. Last year, the EU iron ore imports fell to 332 thousand tons compared to 10.5 million tons in 2021. Russia’s share in the total import of iron ore to the EU from third countries (72.7 million tons in 2023) amounted to 0.5%.

The presence of Russian ferroalloys is also not very significant for the EU market. Their supplies last year compared to 2021 decreased by 35% – to 46 thousand tons. In turn, the import of scrap from Russia in the amount of 35 thousand tons in 2023 has no significance for the EU market. The EU itself is a net exporter of scrap with external deliveries of 18.5 million tons at the end of last year.

Opportunities for Ukraine

Sanctions against Russian steel industry may, to varying degrees, create opportunities for Ukrainian producers to increase supplies to the EU market. In particular, the adoption of the 12th package has created opportunities to increase exports of pig iron and ferroalloys. Now our country has underutilized blast furnace capacities, and ferroalloy plants have been idle since the end of 2023 and up to the present moment.

According to the estimates of the Ministry of Economy, Ukraine can additionally supply up to 1.5 million tons of pig iron and up to 7-8 million tons of iron ore pellets to the EU market. However, these are hypothetical possibilities, the practical realization of which depends on various factors, including the situation on the European market.

For example, the presence of iron ore from Russia in the European market has decreased to a minimum (332 thousand tons in 2023). Obviously, there is no deficit in the market and Ukrainian companies will have to compete with other suppliers for additional export volumes.

The share of Ukrainian pig iron in the EU market decreased to 8.6% in 2023 from 40% in 2021. The Russian share in the same period increased to 58.5% from 28.5%. Despite the future restriction of Russian pig iron imports by quotas (19.12.2023 – 31.12.2024 – 1.14 million tons, 01.01.2025 – 31.12.2025 – 700 thousand tons), its market share there will remain significant until the end of 2025.

It will be difficult for Ukrainian suppliers to displace Russian pig iron in the European market due to its lower price, although there are opportunities to increase supplies. Gradual takeover of the Russian share on the EU pig iron market by Ukrainian producers is possible only from next year.

Further sanctions

The inconsistency of European sanctions, as well as quotas for a long transition period, are costing both the EU itself and Ukraine dearly. In the EU, they create an imbalance in the EU’s domestic steel market, while Ukraine is deprived of the opportunity to increase its exports.

The latest package of sanctions fixed the fact that Russian pig iron and DRI will disappear from the European market only from the beginning of 2026, while slabs will remain there until the end of September 2028. In total, continued supplies of slabs, pig iron and DRI to the EU could bring Russian companies 3.7 billion euros in export revenues in 2024-2025.

The Ukrainian authorities say it is necessary to further expand sanctions against steel products from Russia.

«EU leaders have reached a consensus on the need to introduce restrictions on food imports from Russia and Belarus. This is a good document that allows us to extend a similar mechanism to non-food products that were not subject to sanctions. First of all, it concerns metallurgical products. This is important for us, as it will help implement the initiative to displace Russian raw materials and semi-finished products and replace them with Ukrainian ones,» Taras Kachka, deputy head of the Economy Ministry and Ukraine’s trade representative, said.

However, further expansion of sanctions faces a lack of consensus in the EU. A certain “reserve” for the expansion of sanctions is the reduction of quotas for imports of slabs and pig iron and a ban on imports of iron ore from Russia.

Supplies of iron and steel products continue in 2024, in January the EU imported 240 thousand tons of Russian iron and steel products. The main share of imports is semi-finished products – 78.5% of supplies, 69 thousand tons of semi-finished products imports went to Belgium.

Now it is still not very clear when and what new sanctions decisions may be taken. The last sanctions package was adopted with great efforts in December last year. There are players within the EU steel sector that can both oppose and support the tightening of sanctions. Political support for Ukraine does not go well with preserving Russian steel companies’ access to the European market. Especially since such access violates the interests of other European steel companies. We can only hope that in the future the European Commission will be able to make decisions that would support Ukraine’s economy and the EU steel industry as a whole.