Posts Global Market rebar prices 6425 12 April 2024

The demand outlook for most markets remains negative

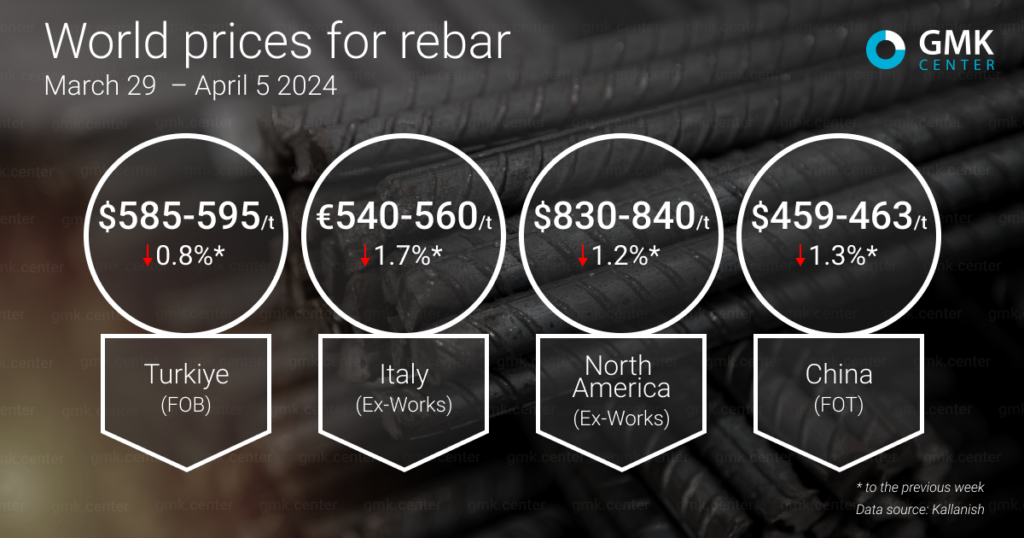

Global rebar prices declined in most major regions in early April. The main negative factor remains unfavorable conditions in the Chinese steel market and weak demand.

Rebar prices in Turkey decreased by $5/t, or 0.8%, from the previous week to $585-595/t FOB during the period March 29-April 5, 2024. As of April 11, they remain at the same level. At the same time, in March, quotes rose to $600/t from $595/t. That is, during the month, the price of rebar on the Turkish market was stable, fluctuating slightly by $5-10/t. Currently, the price of rebar is 3.2% lower than its peak in 2024 ($615/t).

Rebar quotations in Turkey have not fluctuated significantly since the beginning of the year, as demand for products remains limited amid unfavorable conditions on the global steel market, particularly in China, and macroeconomic uncertainty. Buyers are postponing rebar purchases as they do not see the market outlook and are trying to get products at the most favorable prices. In the short term, the market sees no positive signals of price increases other than pent-up demand.

The decline in scrap prices is putting additional pressure on the rebar market. Based on this factor, buyers of rolled steel are trying to get discounts from steelmakers, but the latter are resisting this, explaining that selling at lower prices is not possible in the face of rising labor costs and high energy prices.

In the second half of March, Turkish steelmakers noted a pickup in demand for rebar from the EU amid a slight increase in scrap prices, but there were no orders for significant volumes of products. Domestically, orders remained weak as macroeconomic concerns continued to weigh on consumer sentiment.

Overall demand and sales in both the domestic and export markets are far from sufficient for Turkish mills, given Turkey’s significant capacity, which is only 53-55% utilized. At the same time, some market participants predict a rise in prices due to expectations of higher energy tariffs and a weaker lira after the elections held in late March.

However, the positive outlook may be unjustified after the announcement that Turkey will impose restrictions on the export of a wide range of products to Israel, including steel, starting April 9 this year. Israel is an important market for Turkish steelmakers, although since the start of the war in the country, Turkish supplies have fallen significantly. At the end of February, Turkish steel companies shipped 30.3 thousand tons of rebar to Israel (-33.8% y/y), and in 2023, 726.41 thousand tons (-29.9% y/y), which is 21.4% of total exports.

In the European market, rebar prices also fluctuate slightly. In particular, in Northern Europe, product quotations for the period March 29-April 5 this year remained stable at €630-660/ton Ex-Works, while in Italy they decreased by €10/ton, or 1.7% compared to the previous week, to €540-560/ton Ex-Works. At the same time, as of April 12, Italian prices recovered to the previous level of €540-570/t. In March, prices in Northern Europe fell by 1.5% m/m, and in Italy – by 5%.

Negative sentiment prevailed on the EU market in March. Activity slowed significantly after Easter. For example, in Italy, heavy rain slowed construction work, particularly in infrastructure projects financed by the national recovery fund. The French market is experiencing weak demand: sales volumes are insignificant. Construction companies are purchasing only small tonnages and indicate that they have no further forecasts.

Some Italian companies reported temporary suspensions of production, but this did not result in any delays in deliveries or a reduction in supply. As scrap prices are expected to remain stable, rebar prices are unlikely to recover. At the same time, Italian steelmakers are seeking to increase prices by €30-40/t amid market stagnation, but this increase is likely to only worsen demand in the current environment.

In North America, during March 29-April 5, 2024, rebar prices fell by $10/t compared to the previous week to $830-840/t Ex-Works, while prices remained unchanged as of April 12. At the end of March, supply prices fell by 2.3% m/m.

Rebar prices in the US have stabilized amid weak imports, as well as increased domestic activity and stabilized scrap prices. At the same time, market participants do not have clear expectations about the further dynamics of scrap prices in April, so they are taking a wait-and-see attitude, refraining from purchases until the situation is clarified. It is believed that an increase in the cost of hot-rolled plates will support scrap prices, but most participants doubt that prices will rise significantly.

“So far, there are no signs of anything that could push prices up, no sense of urgency or abrupt changes. February and March started off terribly slow and then slowly started to pick up. April also started slowly. Relatively weak demand and large supply is not an ideal environment for price appreciation,» the US rebar producer notes.

In China, rebar prices for the week of March 29-April 5, 2024 decreased by $6/t, or 1.3% compared to the previous week, to $459-463/t FOT. In March, quotes fell by 9.3%, and since the beginning of the year – by 16.6%.

Chinese rebar prices have fallen to their lowest levels since April 2020, despite the fact that construction activity has begun to pick up. Amid the negative dynamics in the Chinese steel market, local producers have begun to offer consumers discounts on products and lower prices, as oversupply hinders the normal operations of companies. At the same time, companies are not cutting production on a large scale. They only briefly stopped for maintenance and quickly resumed production when steel prices rose and margins increased. Thus, the oversupply in the steel market remains.

At the end of last year, there were rumors that the Ministry of Industry would require steel mills to limit production to reduce supply pressure on the market, but no actual production cuts were made.

The demand stimulus policies announced by the central government for real estate, the automotive industry and key infrastructure projects will take time to lead to an increase in real steel consumption, so steel prices in China are expected to continue to weaken in April.

«According to Chinese analytical agencies, China is seeing a decline in rebar stocks. In addition, amid the prolonged negative dynamics, some buyers are refraining from purchases, expecting an even greater drop in prices. It is possible that the pent-up demand will eventually lead to an improvement in the market, at least temporarily,» said Andriy Glushchenko, GMK Center analyst.