Posts Global Market protectionism 2150 15 June 2022

The new reality has learned Ukrainian mining & metals industry to be flexible and make quick market decisions

Globalization has been a key trend in international trade for many years, determining the development of industries, countries and regions. But the world has changed: trade wars, Covid-19 lockdowns, wartime production and supply chains disruptions, structural changes in markets and prices caused by sanctions. How did we ended in regionalization instead of globalization?

Problem identification

GMK Center made its first study on the global trends back in November 2018, at the very beginning of its work. Even then, it was amazing for me to see how the world, which was heading towards the globalization of the economy and uniformed WTO rules, started to change in the 2000s. The global trend for regionalization of trade and deglobalization popped up. We studied in detail how Ukraine, its economy and mining & metals industry are adapting to these changes and what strategies were needed. Among these strategies, the key one in the long term was the domestic steel consumption increase in Ukraine through increased investment in infrastructure projects. This is what we have observed over the past 5 years in most developing and developed countries. They all created and developed their own domestic markets to support their steel industries.

Reasons for the global trend

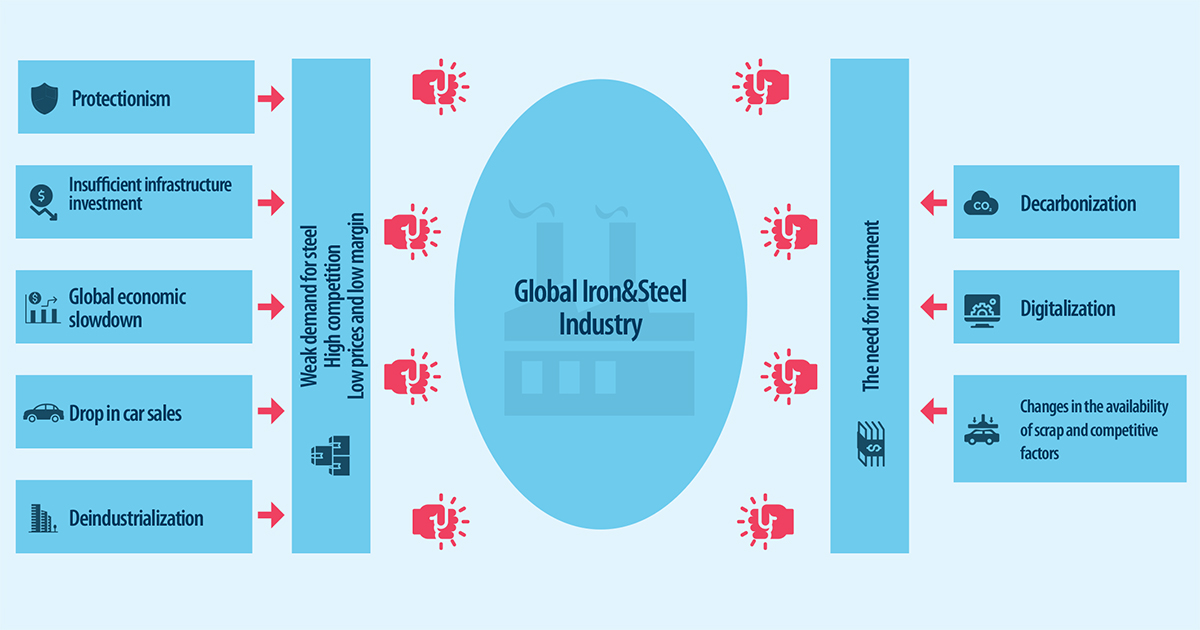

The second stage of assessing global trends we made at the beginning of 2020 in partnership with Metinvest Group. Monitoring trends and understanding possible changes is crucial for any large corporation. Therefore, Metinvest became a partner of “The Iron & Steel industry. Global Trends 2020” study. In this study, we have stressed that the global economic growth was slowing down, risks were growing, investments in infrastructure were insufficient, and protectionism was becoming the new normal of world trade.

Many experts have warned that the globalization has reached its peak and there was a significant and underestimated risk that the reverse process started. Moreover, it will go much faster than globalization. In 2020, it was clear that the combination of trade restrictions with technological barriers is harmful to economic growth and geopolitical stability. The metals industry experienced weak steel demand and high investment needs – and governments have responded with increased trade barriers and safeguards. Ukrainian steel industry, as an export-oriented industry, was more vulnerable to these negative trends than others were. It had to adapt.

New “Pandora’s box” – CBAM

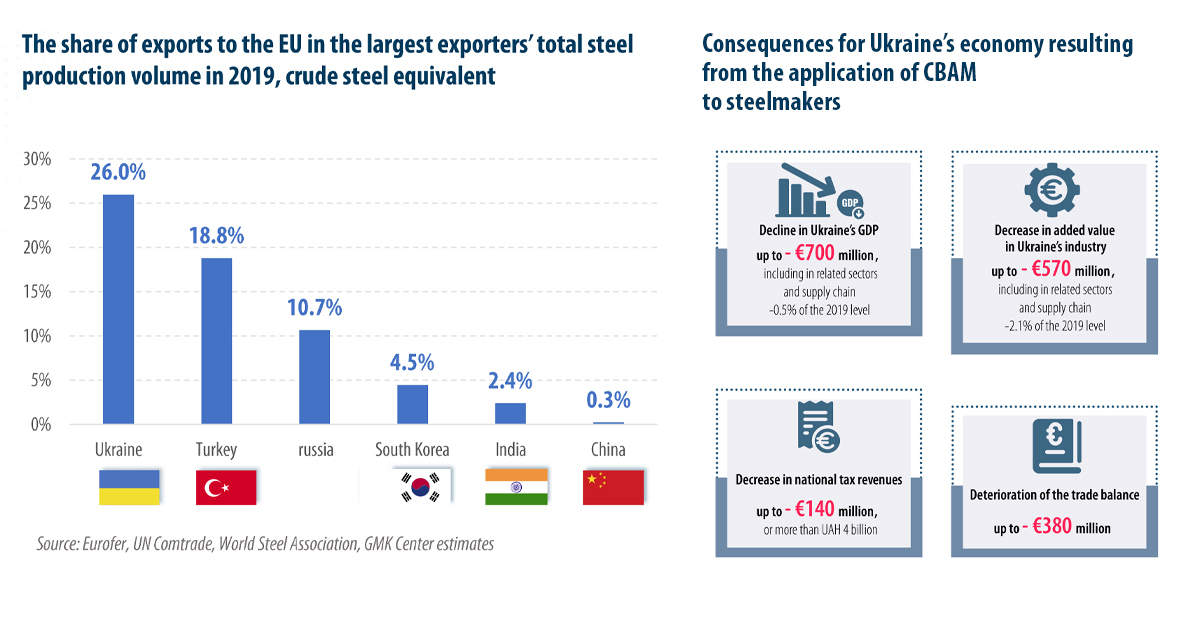

Climate protectionism has become yet another globalization disrupter and a new challenge for Ukrainian steel industry. The next step of understanding the depth and long-term trend of increasing trade restrictions and regionalization of markets was our study on the impact of CBAM on Ukrainian exports to the EU, which we prepared in August 2020. The EU announced this initiative as an element of balancing competition, as an encouragement of a “green” transition of importing counties. Our preliminary calculations indicated that exporters of steel products, fertilizers and electricity from Ukraine would pay €600 million of additional fees after the implementation of CBAM, and this will significantly affect competitiveness, and as a result, prices in the EU will increase. That is, CBAM is not about the climate, but about protectionism, just slightly covered with “green” leaves.

At the European Steel Conference in Milan, which was held by GMK Center and Word Steel Dynamics on October 28-30, 2019, European colleagues openly discussed the inevitability of introducing CBAM to protect the European market and European manufacturers. They were losing their production levels year by year, losing the global trading war against the “young” economies of Turkey, India, China and other countries.

In March-April 2021, GMK Center, together with Horst Wiesinger Consulting, prepared a comprehensive study on the impact of the CBAM on the Ukrainian steel industry and on the EU markets. A study clearly showed that this tool is the most discriminatory towards Ukraine. It showed how much drastically Ukrainian steel producers would be affected.

Our calculations showed that product prices would rise in the EU. Ukraine’s mining & metals industry was taken for granted while it was very important for the European steel industry. These chains are very fragile in the face of the growing tsunami of global protectionism and the regionalization of markets.

Speaking at international conferences, Ukrainian forums, round tables, we warned that it is Pandora’s box, that the CBAM tool is incomplete and very contradictory, and the European economy itself is not ready for its implementation. The reasons are clear and prosaic: technologies for the decarbonization of the steel industry are only at the development stage, and their prospects will not be clear until 2035. This thesis was fully confirmed at the international forum “Decarbonization of the steel industry: a challenge for Ukraine”, where the leaders of steel production in Ukraine, global engineering companies, leaders of EU scientific developments discussed the potential and opportunities for decarbonization of the steel industry in Ukraine.

The climate change fighters kept saying in response only that this is not protectionism, but concern for the future of the planet. Concern about the future of the planet would be a 5-10-fold increase in investment in “green” energy and energy-saving technologies, but then few people wanted to hear about it. Many believed that “green” energy had already won.

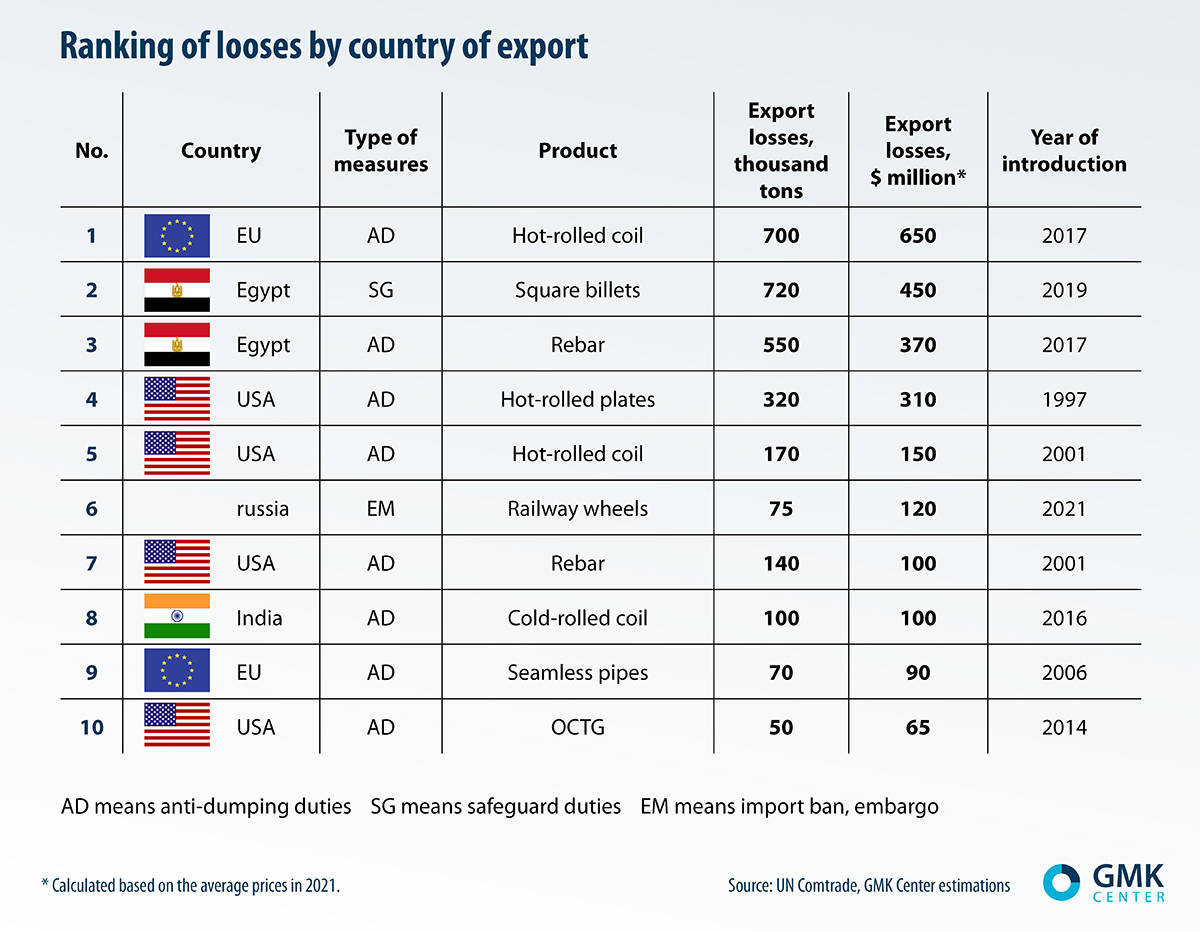

Protectionism is killing Ukraine’s economy

The negative impact of trade barriers has significantly affected steel production in Ukraine over the years, and continued to increase from 2018 to 2021. In December 2021, we completed a systematic study “Trade restrictions in the steel markets” with analysis of all trade restrictions and protective measures over the past 10 years in the steel industry. Protectionism in the global economy continues to grow. In 2020, 4569 government interventions were recorded. Steel industry in the world ranks first in terms of the number of interventions. During 2009-2021, 1817 protectionist measures were implemented in the industry. They were aimed at restricting imports and supporting local steel producers. The peak in the number of various measures introduced to support steelmakers was in 2019-2020, when a third of all measures over the past 12 years were adopted. Particularly active were China (54% of all measures) and the US (36%).

Various trade barriers introduced in different periods have led to a decrease in steel exports from Ukraine. Losses amounted to 3.3–3.5 million tons, or about $3 billion in export earnings. The damage to the Ukrainian economy from the introduced trade barriers in foreign markets is estimated at 1.8-2.0% of GDP annually. At the same time, Ukraine is a very liberal and open country for its partners.

COVID-19: the first chain disruption

In 2020, the pandemic started. The whole world felt what the chains disruptions are, and understood all the weaknesses of globalization. An excessive number of suppliers “scattered” around the world has made manufacturers dependent on lockdowns in each particular region. COVID-19 did not create new problems for the global economy, but highlighted the existing ones: excessive specialization and localization production around the world to reduce costs and receive additional profits. It led the world’s manufacturing giants to depend on the situation in a particular region. With trade restrictions introduced in 2018-2020, this caused a new increase in prices for raw materials, finished products, and also worsened a number of problems, beginning an inflationary flywheel and an energy crisis.

Surprisingly, COVID did not teach national economies anything, and they continued to use the same tools in 2020-2021. There were fewer new trade restrictions, but no one was about to lift the existing ones. The increase in steel prices in the EU in late 2020 and early 2021 happened due to the shutdown of production and underestimation of the speed of economic recovery after the first lockdowns. But the in-depth reason of the prices rise were trade restrictions (duties and quotas). So European companies did not increase imports of products to the EU to cover a temporary shortage. At the same time, trade wars did not stop for a second.

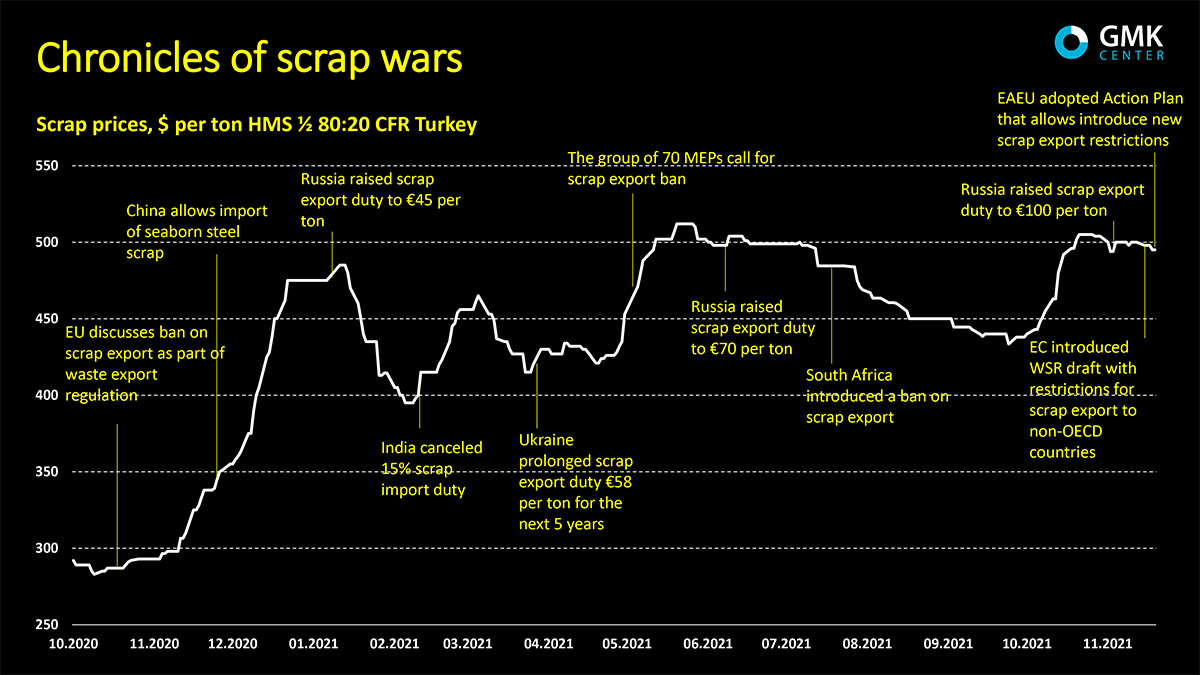

At the end of 2021, the Dubai Steel and Raw Materials Hybrid Conference, organized by MMSteel Club, discussed the problems of raw materials markets: ferroalloys, iron ore and ferrous scrap. The topic of our report was restrictions on the export of scrap and the importance of scrap in world trade and the steel industry as a strategic raw material for decarbonization. In fact, we have talked about trade wars for ferrous scrap.

The increase in commodity prices was also partly the result of rising prices, protectionism and the increase the number of trade barriers. At the same time, many conference participants during the discussions agreed that the prices for steel products will be regionalized, that is, they will differ quite strongly by region in certain periods of time. This confirmed the thesis that we are witnessing not only temporary trends in the regionalization of prices, but also medium and long-term trends of increasing regionalization of markets and trade.

War and sanctions: looming end of the global market

With the start of the war, new challenges for the world economy and trade popped up. And this time it was the looming end of the global market and global trade. The basic problem is that COVID has not gone away (the Shanghai lockdown has had a strong impact on world trade), the negative market trends caused by trade wars are not going anywhere, and the chains were hit again with the war between Russia and Ukraine.

Russia’s war against Ukraine caused global and regional food shortages, various types of steel products and raw materials (for example, Europe lost 70% of slab supplies and 50% of pig iron supplies), energy and logistical shocks. The introduction of sanctions finally divided the world economy into regional markets for raw materials and finished products.

For example, there is now a very clear difference in price and market conditions between the steel markets, which have Russian products, and the markets for steel products, which do not.

In fact, world trade has become regional, that is trade within and between regions. Logistics flows of raw materials and finished products are changing, freight rates and transportation costs are rising along with fuel prices around the world.

The results of the war and sanctions for the world economy were:

- rising prices for raw materials;

- logistics cost increase;

- growing demand for investment in the EU logistics infrastructure;

- production decline;

- growing deficit;

- rising inflation.

We published detailed data on the negative impact of war on the economy in our study “Economy during the war”. The war must be stopped, as both the Ukrainians and the whole world are suffering!

At the same time, we are witnessing the regionalization of foreign exchange markets and the separation of payment systems because of the sanctions policy, inflation, and the policies of central banks. This, too, undermines global trade and accelerates regionalization.

Exports restrictions are yet another reason of the old world trade order ending (how long have you heard something about the WTO?). We have already talked about restrictive measures for the export of ferrous scrap: the European Union, in the past a major exporter of it, has been tightening and restricting exports over the past 6 months. The same thing, but on an even larger scale, is happening in other world markets. All countries care of their economies and interests in the first place. They limit the export of grain, rice, corn, fertilizers (Russia, India, etc.). Once Pandora’s box is opened, it cannot be closed. If export restrictions (permanent or temporary) imposed, then all countries will do the same, which will negatively affect both prices and markets.

So, the realities that allow us to argue about the beginning of the end of global trade are:

- trade restrictions, barriers for product imports leading to higher prices;

- wars causing supply disruptions and temporary shortages;

- sanctions leading to trade regionalization and structural changes in the markets;

- export restrictions that lead to higher prices, shortages and regionalization of trade;

- environmental protectionism (following the EU, the US also announced its intention to introduce CBAM).

We knew all this, predicted, waited… But the “winter” of the world trade comes unexpectedly!