Europe

News Global Market steel production

07 October 2022

Activity in the European HRC market remains low

News Global Market energy crisis

26 September 2022

The steel sector replenishes the budgets of European countries with tens billions of euros, but mass shutdowns of capacities will negatively affect the amount of tax revenues

News Global Market river transportation

13 August 2022

This leads to additional costs for logistics operators

News Global Market steel prices

08 August 2022

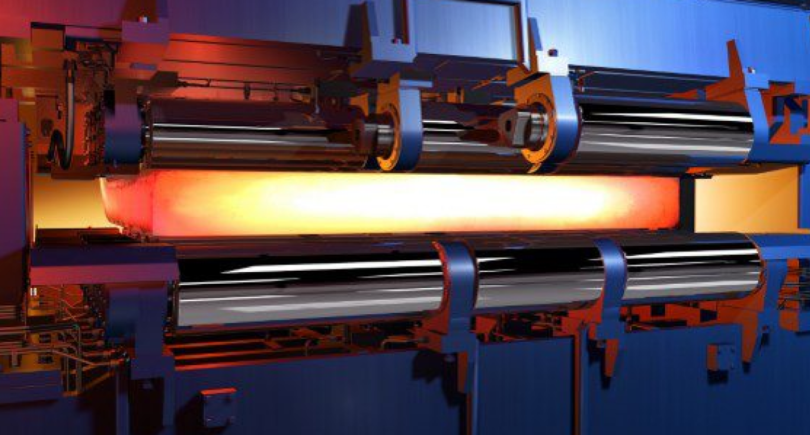

In this way, enterprises stimulate the purchase of hot-rolled coils

News Global Market ArcelorMittal

02 August 2022

At the same time, the corporation is reducing capacity amid weak current demand

News Global Market decarbonization

27 July 2022

This is likely to result in significant demand for steel

News Global Market steel prices

15 June 2022

Base prices for hot-rolled coil fell by almost a third after March record