Posts Infrastructure logistics 818 20 May 2022

Ports blockade leads to systemic and long-term problems for Ukrainian goods exports

In peacetime, about 75% of Ukraine’s foreign trade was shipped via ports. Under the blockade (and unclear prospect of unblocking) of seaports, Ukrainian companies start developing new logistics routes. A number of companies can transport products by road, but they face the challenges to buy fuel and cross the border. Such cargoes as grain, iron ore and some metal products cannot be transported only by road, although grain producers actively use road transport.

The main thing is the price for the country. Ukraine loses $170 million daily due to the blockade of ports. According to the Dragon Capital investment company, in 2022 Ukraine’s GDP will collapse by 30% if the war continues until the end of the year, and by 22-25% if a truce achieved and ports opened. What is the way out of this situation, and how can Ukraine save at least part of its exports?

Ports situation

The situation in Ukraine’s ports is depressing. Seaports “Mariupol”, “Berdyansk”, “Skadovsk” and “Kherson”, which are located in the temporarily occupied territory, are closed. Also, Ukraine cannot use the Dnipro river logistics, since the Kakhovka reservoir has been captured. Other ports, although not occupied, are completely blocked by the Russian Navy and mine danger.

Even the full load of the working Danube ports – Ust-Danubsky, Izmail and Reni – cannot be considered a way out of this situation. In April these ports almost quadrupled their cargo transshipment compared to February, to 850,000 tons, but heir capacities are small (they can provide exports or imports of no more than 10% of the peacetime turnover). Transshipment is limited on the European side, and the railway infrastructure is under constant missile threat from the Russian Federation, while only Reni and Izmail ports has railway connections. The Ministry of Infrastructure believes Danube ports transshipment can rise up to 1 million tons per month.

According to the Ministry of Agrarian Policy, the export of Ukrainian agricultural products to the EU countries, including deliveries via Danube river ports, cannot exceed 1.5 million tons per month, while before the blockade of Ukrainian seaports by the Russian troops, the country could monthly transship over 5 million tons of agricultural products per month.

Earlier, the International Maritime Organization (IMO) and Ukrainian business proposed creating safe corridors to unblock ports, which would require the involvement of the UN and the countries of the Black Sea basin. However, the situation has not changed in any way. Everything depends on the security situation and the will of the Russian Federation. According to UN estimates, if the blockade of Ukrainian seaports continues, some poor countries will inevitably face food shortages.

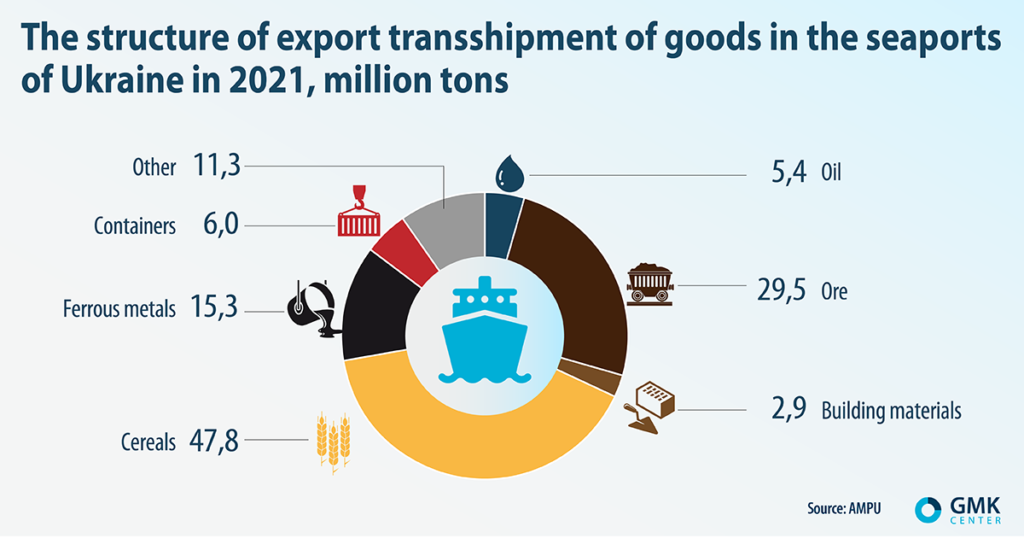

The key logistical artery of Ukraine remains the railway, but it will not be able to immediately take out everything that passed through the ports. According to the GMK Center, the average share of exports in Ukrainian seaports is 77.1%. For example, for grain – 95.6%, ferrous metals – 94.7%, oil (mainly vegetable) – 90.2%. In particular, 49.8 million tons of grain (+2%), 29.5 million tons of ore (-13.8%) and 15.3 million tons of ferrous metals (+1.8%) were exported via seaports in 2021.

The level of problems in the industry, including due to logistics, can be understood from the current figures. Ukrainian mining and metals companies in January-April 2022 reduced the export of pig iron by 52.7% compared to the same period in 2021, to 451.1 thousand tons, and iron ore by 8.6%, to 13 million tons. Steelmakers now name logistics as the main problem in their work, which is why many enterprises are forced to operate at 40% of their capacity.

“Iron” difficulties

The ability of Ukrzaliznytsia to export products is limited both by the lack of border infrastructure now, and by military operations, in particular, by rocket attacks on the railway infrastructure. Therefore, now the average daily loading of Ukrzaliznytsia is 40% of the pre-war level. In April, 9.15 million tons of cargo were transported by rail, of which only 3.9 million tons were exported. At the same time, today Ukrzaliznytsia does not control 10% of its infrastructure.

The main difficulty for exporting exports by rail is the different gauges. In Europe the railway gauge is 1435 mm, while in Ukraine it is 1520 mm. According to industry sources, the total daily capacity of Ukrzaliznytsia and companies from neighboring countries to changing cars chassis from 1520 mm gauge chassis to 1435 mm gauge chassis is 175 cars. In fact, these are only three full-fledged trains with cargo.

According to Ukrzaliznytsia, more cars can be taken on the border of Ukraine with Hungary (75 cars per day), including at the Chop-Zahony crossing (54 cars). There is also a high potential at the Ukrainian-Romanian border (70 cars). Three border crossings between Ukraine and Poland allow changing chassis on 61 cars daily. In total, there are four locations for the changing chassis of cars from the wide to the standard European track.

In general, according to Ukrzaliznytsia, there are 13 cargo border crossings with neighboring countries in the west and south of the country. Their daily capacity for receiving rolling stock is 3422 cars, or 222 thousand tons of cargo. In terms of grain transshipment capacity, Ukrzaliznytsia can potentially transport 731 cars (up to 50,000 tons of grain) daily through these crossings. If this is translated into monthly figures, then the potential of railway exports could be 6.6 million tons of cargo, including up to 1.5 million tons of grain. The existing potential is used only by about 55-56%. According to Oleksandr Kamyshyn, the head of Ukrzaliznytsia, in fact, only three out of 10 crossings are 100% loaded. The rest are 30-50% loaded.

Although Ukrzaliznytsia plans to increase the capacity of the western border crossings, a significant increase of cargo transporting by rail will not happen quickly. It will take time and large investments.

“The priority of Ukrzaliznytsia №1 now is the “joining” of the western border crossings. We pay a lot of attention to them, we will make a presentation of new projects and agreements with our European partners in the next 2-3 weeks,” Olexandr Kamyshyn said earlier in an interview with GMK Center.

Meantime, according to Valery Tkachev, Deputy Director of the Department of Commercial Work at Ukrzaliznytsia, the low capacity of border crossings has led to the accumulation of railcars at border stations (at the end of April, almost 30,000 railcars were expecting to pass 13 border crossings), there are also problems with the locomotives availability.

Even the creation of a joint logistics enterprise by Ukraine and Poland in order to increase the volume of railway transportation of Ukrainian exports to the EU and to world markets through Europe will not quickly solve the Ukrainian logistics problems. In particular, Ukrzaliznytsia calls on businesses to organize points for reloading goods from wagons running on 1520 mm gauge to wagons on 1435 mm gauge. However, business will not be able to do this without the help of the state, neighboring countries and Ukrzaliznytsia itself.

For a complex solution to the problem, you need quick solutions and a lot of investment. It is also necessary to build additional terminals for reloading goods on both sides of the border, which are currently not enough, and intensify container delivery of exports and imports, which greatly facilitates the handling of goods.

Logistic options

One of the options for resolving the issue could be the transshipment of Ukrainian export products through the ports of the Baltic countries. However, railway delivery through Poland is complicated there. In the Baltic countries, the gauge is 1520 mm, in Poland the railway has a European gauge, which means double transshipment of goods from wagon to wagon along the way, for example, to Estonia. Delivery of bulk exports through Belarus (which is already being discussed for the export of grain) does not yet look like a realistic option.

If we consider the Romanian option, then the port of Constanta is already operating at almost full capacity (imports to Ukraine go through it), congestion occurs there, logistics costs increase, and there is insufficient railway infrastructure in the port.

At the same time, Romania is trying to transfer part of the cargo turnover to the port of Galati. To this end, the repair of the railway line with a gauge of 1520 mm between the village of Giurgiulesti (Moldova) and the port of Galati for the transportation of goods from Ukraine and to the country begins. Due to this route, Ukraine will be able to ship and receive goods through Moldova and the port of Galati.

Of course, Ukraine mainly relies on Poland. Ukraine can count on the capacities of the ports of Gdansk (transshipment capacity more than 50 million tons), Szczecin-Swinoujscie (more than 30 million tons) and Gdynia (more than 20 million tons). All ports of Poland handled 113 million tons of cargo in 2021.

In the case of the delivery of Ukrainian exports to Polish ports, the main problem is the different railway gauge. Currently, Poland is working on the creation of a “dry port” on the border with Ukraine in order to increase the throughput for the export of Ukrainian agricultural products. But there are many such “ports”.

“Export, for example, of grain is growing every year. And new capacities will appear not in the south near the ports, but in the west. (…) Now everyone in the EU understands that Ukraine needs help, to protect itself. The main paradigm with which I speak is the following: I tell the Europeans that, in addition to avoiding a supply crisis, they can earn money with us. We have millions of tons of cargo that will now go to you (in the EU) by rail. In the future, we will provide 50 million tons of grain, more than 20 million tons of ore,” says Olexandr Kamyshyn.

According to Olexandr Kamyshin, there is no free rolling stock in Europe now, there are no large free capacities in the ports for our cargo. The most promising are the ports of the Baltic countries. The ports of Poland and Romania are already loaded, they work according to their plan.

According to the estimates of the CASE Ukraine analytical center, only a military deblockade will restore full-fledged Ukrainian exports, because it will not be possible to compensate these flows by rail export.

“Ukrainian steel companies still need to import coking coal. Domestic coal enterprises produce only grade K coking coal or the so-called hard coking coal. But only these coals are not enough, since coals of other grades are needed. For example, Zh and G. Previously, they were supplied from Russia and other countries. Today we are talking about the need for 3 million tons. If we assume that enterprises reach pre-war loading, this is more than 5 million tons of imports coal. The same applies to the import of anthracite for pulverized coal injection. Supplies of this brand of coal to Europe were provided by Russia. Now Australia is the only source,” says Andriy Tarasenko, chief analyst at GMK Center.

International partners promise to help solve the logistical problem of exports. Perhaps this will be in the form of simplifying exports and customs clearance, providing “green corridors” for railway trains with grain, increasing the capacity of warehouses for temporary storage in border areas. The European Commission also asked operators to send mobile grain loaders to border stations and terminals.

“All this is not easy. To organize new routes, you need to see the western crossings with your own eyes, decide where there will be a mobile transshipment, where there will be a warehouse, where cranes will be installed, etc. That is, a huge number of issues arise that need to be solved anew by all participants in the supply chain,” emphasizes Olexandr Kamyshyn.

In other words, at the official level, mainly the export of grain is being discussed, while the range of Ukrainian exports is much wider, and it is still not clear what exporters of other products should do. So far, exporters of other products are largely solving their problems themselves. A partial solution for exporters may be to reduce the export of raw materials with an increase in the share of processing in Ukraine, but this also takes time and considerable investment.

So far, the issue of replacing blocked port facilities for the export of Ukrainian export products is still far from being resolved. In the current conditions, the liberalization of road transportation with all neighboring countries will become more important and give a faster result. Although both the EU and Ukraine were not ready for such amount (kilometer-long queues of trucks confirm this) of Ukrainian vehicles, and only four checkpoints are capable of passing large trucks.