Posts Infrastructure sea transportation 5943 15 February 2024

Two thirds of export cargo through the ports of Greater Odesa are agricultural products

Half a year of operation of the sea corridor has shown that Ukrainian exporters of agro-industrial complex and steel sector may well count on faster and cheaper (relative to European ports) shipment of cargoes through the ports of Greater Odesa (Odesa, Chornomorsk and Pivdenniy). This logistic route is under constant missile and drone threat, but, judging by the statistics of exports through the ports, cargo shippers are ready to take such a risk. Another problem is the limited capacity of rail and port infrastructure, which since October last year has led to queues of freight cars at railway stations, with an average waiting time of 5-7 days for unloading.

Corridor performance

Before the war, port logistics was the most widespread and affordable – more than 70% of Ukrainian export cargo was shipped through ports. Last August opening of the temporary maritime corridor had a huge positive impact on the opportunities for exporters of grain, oilseeds and iron and steel cargoes, and therefore for the entire economy of the country.

On August 10 last year, the Ukrainian Navy announced temporary routes for commercial vessels. The first to use this route were ships that were blocked in seaports after the outbreak of war. Since September 16, the temporary corridor has been working for ships coming for Ukrainian export products. Around the beginning of November-2023, import cargoes started arriving at the ports of Greater Odesa.

In 2023, 430 ships were accepted for loading through the corridor, 400 ships departed out of Ukrainian ports, exporting 12.8 million tons of cargo. The corridor made it possible to increase cargo transshipment in Ukrainian ports by 5% year-on-year at the end of last year – up to 62 million tons, although of all the seaports in the Odesa region, only Odesa showed an increase in transshipment by 9% in 2023, to 8.4 million tons.

In just six months of the corridor’s operation (as of February 13), 736 vessels left the ports of Greater Odesa, which transported almost 23 million tons of export cargo, of which more than 2/3 were agro-products. It is obvious that in the work of the sea corridor is prioritized to ship grains, which restrains the export of other goods.

«More than 22 million tons in six months is not the limit. Modernization of both the ports themselves and the related infrastructure – the network of roads and railways – with a proper safety component will allow to increase volumes by at least a quarter,» notes Oleksandr Kubrakov, Deputy Prime Minister for Ukraine’s recovery.

Iron exports

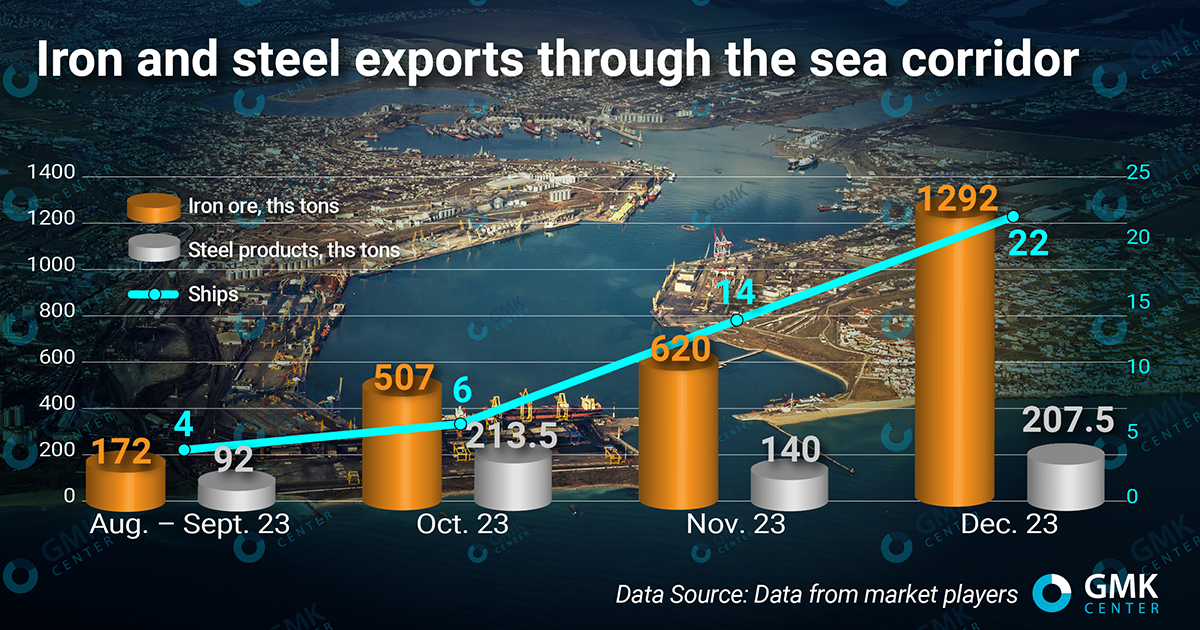

Iron and steel products are the second largest share of total exports through the maritime corridor. According to GMK Center estimates, in August-December last year at least 46 vessels – 17 bulk carriers with 2.6 million tons of iron ore and 29 vessels with 653,000 tons of steel products – left the ports of Odessa and Pivdenniy with iron and steel cargoes. This number includes bulk carriers Primus, Anna Theresa, Ocean Courtesy and Puma, blocked in the seaports since February 24, 2022, and left the ports in August-September.

As the sea corridor was operating, the number of ship departures with iron and steel export products also increased – from four in August-September last year to 22 in December. In particular, in December, 13 vessels with 157.5 thousand tons of steel products left the port of Odesa, eight bulk carriers with 1.29 million tons of iron ore and one vessel with 50 thousand tons of steel products left Pivdenniy port.

Iron ore is exported exclusively by large-capacity bulk carriers from Pivdenniy. In general, iron ore exports shares in total exports of raw materials through the ports of Greater Odesa reached 31.6% in November and 80.2% in December.

Steel products are exported in smaller shipments mainly from the Port of Odesa. The volume of export of steel products is still limited to 140-215 thousand tons, which is due to both the production capacity of enterprises and logistical constraints.

Export disruptions

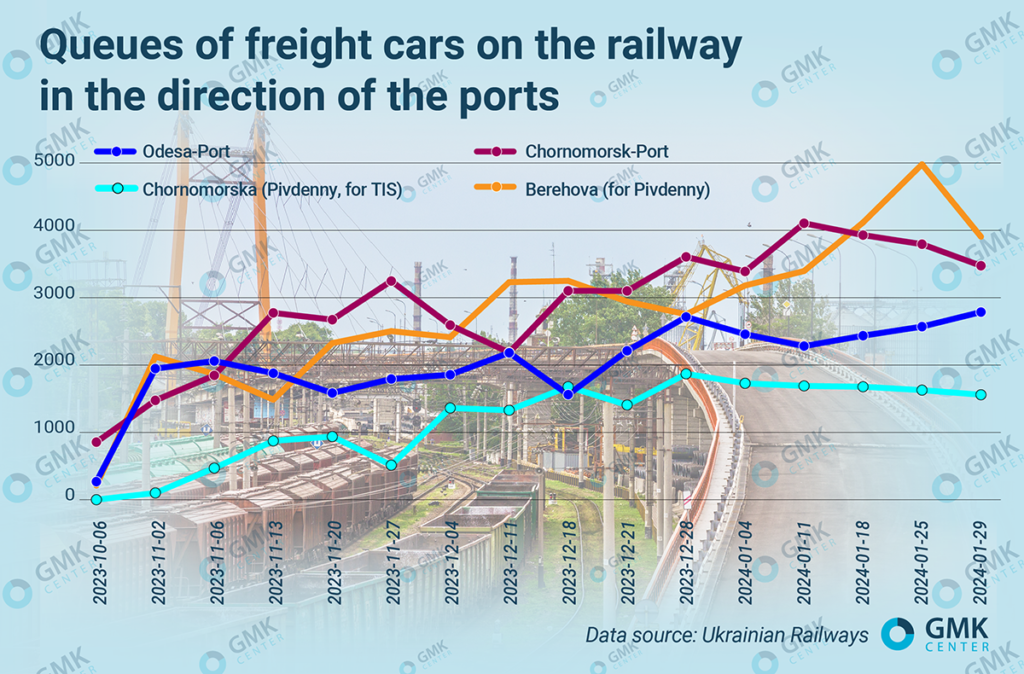

After the first positive results of the sea corridor operation around the beginning of October last year, the cargo flow in the direction of the ports of Greater Odesa sharply increased. According to Ukrainian Railways’ (UZ) data, In November-December 2023, a record monthly volume of loading of all types of cargo in the direction of ports was recorded – more than 3.5 million tons per month (mainly grain and iron and steel cargo). In December last year, grain shipments in the direction of ports increased by 30% compared to November – to 2.14 million tons, iron ore – by 20% m/m, to 1.53 million tons, ferrous metals – by 5.3% m/m, to 276 thousand tons.

Due to a sharp increase in freight traffic by rail, the work of railroad stations and ports began to experience disruptions, which inevitably led to the accumulation of cars for unloading at the port stations.

At railroad stations near the ports of Odesa and Chornomorsk, the railcar congestion in November-December last year ranged between 1.5-2.7 thousand and 2.6-3.6 thousand units, respectively. At Pivdenniy port, the queue was at the level of 1.4-1.8 thousand railcars. The waiting time for railcars for unloading averaged 5-7 days. By mid-January 2024, the situation at Chornomorsk-Port and Beregova stations worsened significantly, with more than 4,000 railcars piled up. At the same time, the launch of the corridor eased the pressure on the port of Izmail, where the queue decreased from more than 4 thousand cars in early October-2023 to 1.5-1.8 thousand cars.

The accumulation of railcars at the port stations was caused by:

- Limited throughput capacity of Ukrainian Railways’ infrastructure and, as a consequence, overloaded direction to seaports. The bottleneck is located on one of the sections of the Odesa railroad, whose capacity is 49 pairs of freight trains per day.

- Increase in the number of missile and drone threats. In November, traffic in the direction of the port of Izmail was stopped for almost two days. During an air alert, ship cargo handling is stopped (port personnel go to bomb shelters), so the duration of loading increased by 30% on average.

- At the end of November, due to a large amount of snowfall, icing and power outages in the Odesa region, cargo handling in the ports of Greater Odеsa and cargo delivery by rail became more complicated.

- In November, the railroad was undergoing repair work, which partially complicated the movement of freight trains in the direction of the ports of Greater Odesa.

- In October 2023, there were problems with the shipment of grain for export – law enforcers conducted searches and checks of accompanying documents as part of an investigation into illegal grain export schemes. This was also related to the NBU’s statement that agro-industrial complex exporters had not returned approximately $8bn of revenue to Ukraine. The solution to the problem of illegal grain exports was the creation of a list of verified AIC entities that export grain and oilseeds.

Key among the above problems is the limited capacity of Ukrainian Railways’ infrastructure, which reduces the ability to deliver cargo by rail to ports in the Odesa region and remove empty railcars.

«In fact, this bottleneck limits all exports along the sea corridor. The capacity of the existing seaports and their terminals can handle twice as much, about 100 pairs of trains per day. In addition, not only grain cargoes, but also iron ore and metals share the capacity of this section. Thus, exporters are limited in their ability to ship products for export,» says Yuriy Shchuklin, owner of Vantage+, a member of the Logistics Committee of the European Business Association.

Security issues

The security of the maritime corridor remains precarious. The good news is that the process of forming a coalition to demine the Black Sea has moved forward – on January 11, Türkiye, Bulgaria and Romania signed a memorandum. Practical implementation of the document may begin as early as April-May. These actions will help reduce the mine threat to Black Sea shipping.

The security situation may be improved by the convoying of commercial ships by warships. At the end of November last year, President Volodymyr Zelenskiy said that Ukraine had agreed with its partners to obtain warships for convoying ships in the sea corridor.

At the same time, mine and missile-drone threats to shipping and port infrastructure remain relevant. Since the end of the grain agreement in July last year, Ukrainian ports have been hit by more than 30 combined attacks, resulting in the deaths of five port workers. In total, almost 200 port infrastructure facilities and seven commercial vessels have been damaged. The damage amounts to at least UAH 1 billion. The increase in insurance rates associated with these risks affects all cargo owners who operate in the Black Sea; the cost of insurance severely limits the volume and frequency of transportation.

Thus, the safety of ships that use the sea corridor is not yet sufficiently guaranteed. At the moment the situation seems to be under control, allowing commercial cargo ships to move in both directions, but threats still exist.

Impact on the economy

The sea corridor solves a significant part of the problems of Ukrainian exporters, first of all – agro-industrial complex and iron and steel companies. Export through the seaports of Greater Odesa allows to reduce logistics costs of Ukrainian exporters, which positively affects their financial and production indicators.

Ukrainian seaports are not fully loaded and are capable of increasing export transshipment, the key problems remain safety and increasing the capacity of railroad infrastructure. It is also important to expand the use of insurance mechanism for cargo transportation along the sea corridor.

«In the last days of January, among all vessels moving to the ports of Greater Odesa, there was a vessel that was insured against military risks thanks to the UNITY insurance created by the Ukrainian government together with a pool of insurance companies led by Ascot. The cost of the insurance amounted to 0.75% of the vessel’s value. More than a dozen more insurance applications are in the works. The normalization of the insurance market in trade is a cornerstone of resuming value-added exports. That is why it is so important for us that insurance is becoming more affordable and is already actually being used to export Ukrainian products,» emphasizes Yulia Sviridenko, First Deputy Prime Minister and Minister of Economy of Ukraine.

At present, the priority in exports through the sea corridor is given to grain cargo. For their part, iron and steel companies are ready to increase exports through the ports.

«We expect that by the end of the first quarter of 2024 iron ore exports by sea will reach its maximum – 2-3 million tons per month for all Ukrainian producers. Before the war, only Metinvest delivered a maximum of 2 million tons of ore per month. However, there is still a potential for expansion of other types of products of Ukrainian exporters: metals, coal, cement,» Yuriy Ryzhenkov, CEO of Metinvest Group, said earlier.

Continued operation of the sea corridor will have a positive impact on the entire economy. According to Dragon Capital’s estimates (as of October-2023), it may increase export revenues by $9-10 bln and support GDP growth up to 5 p.p. in 2024. The Ministry of Economy estimates the economic effect is more modest – an increase in exports of at least $3.3bn and 1.23 p.p. of additional GDP growth.

«In 2024, average monthly shipments of goods through the new maritime corridor are expected to be about 7 million tons, of which 4 million tons will be food. This will support agriculture, industry, transportation and wholesale trade,» the NBU said.