Posts Infrastructure sea transportation 3833 29 January 2024

The shipping crisis in the Red Sea affects global trade, but has not yet significantly affected the transportation of steel products

Indexes. On January 26, 2024, the overall Baltic Dry Index (BDI), which factors in rates for Capesize, Panamax and Supramax vessels, increased by 19 points, or 1.3%, to 1518, Hellenic Shipping News reports.

The overall index rose due to higher rates for small ships, while the Capesize segment was rather weak.

The Capesize index, which tracks iron ore and coal cargoes of 150 thousand tons, rose by 49 points, or 2.4%, to 2135. However, the weekly drop was almost 5%. The average daily earnings for vessels of this class increased by $410 – to $17.7 thousand.

The Panamax index, which tracks coal and grain cargoes of 60,000 to 70,000 tons, grew for the tenth consecutive session, adding 6 points, or 0.4%, to 1696 on January 26. The average daily earnings for vessels of this class increased by $54 – to $15.26 thousand.

At the beginning of last week, on January 22, the overall Baltic Dry index rose to 1518, the highest level since January 11, due to the growth of rates for Capesize and Panamax.

General situation

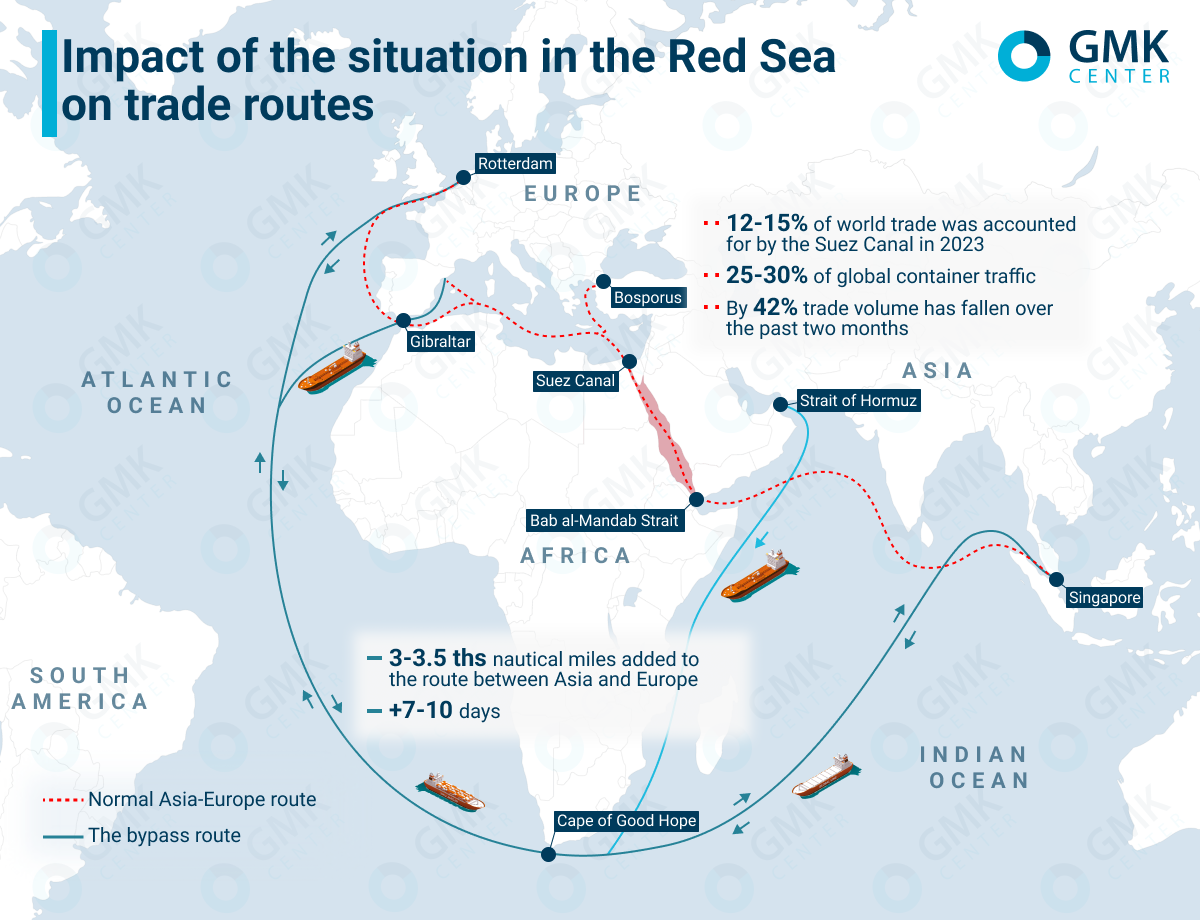

One of the biggest challenges for global logistics today is the shipping crisis in the Red Sea, which accounts for about 12-15% of global trade, including 25-30% of global container traffic. The Houthi attacks on ships have caused delays, rerouting and increased costs for shippers and consumers.

According to World Bank analysts, major carriers, including Maersk and Hapag-Lloyd, have suspended operations through the Suez Canal to avoid the Red Sea and are rerouting ships around the Cape of Good Hope. This adds 3-3.5 thousand nautical miles (5.5-6.5 thousand kilometers) and seven to ten days to the voyage between Asia and Europe. Re-routing ships means additional fuel costs and higher insurance costs.

Leading shipping companies, including MSC, Maersk and Hapag-Lloyd, have announced additional fees, such as contingency fees and transit disruption fees, and other companies are considering similar measures.

The logistics crisis, according to the World Bank, poses a serious risk to global economic growth as it affects the supply and demand of goods and energy.

According to UNCTAD, the volume of trade through the Suez Canal has fallen by 42% over the past two months. The UNCTAD also reminded that the war in Ukraine has caused significant changes in oil and grain trade. And the Panama Canal, another key global artery, is struggling with a severe drought that has lowered water levels. As a result, the total volume of transit through the canal has decreased by 36% over the past month compared to last year. Maritime transport plays a critical role in international trade, accounting for about 80% of the world’s goods movement.

However, the beginning of the year is traditionally a soft period for dry bulk and container shipping, which has seen intense volatility in recent years. However, if the shipping crisis continues in March and April, when global trade usually returns to recovery, it will lead to increased supply chain disruptions.

BIMCO expects that the cost per ton-mile in the Red Sea could increase by 5% if all ships are diverted to bypass Africa. In the first half of January 2024, the number of bulk carriers passing through the Suez Canal fell by only 6% compared to the same period in 2023. Therefore, experts assume that the situation will have only a minor impact on demand and will be resolved in the short term. In the Panama Canal, the expected end of El Niño may help restore water levels in the second half of this year, which is the most intensive for bulk shipping.

Impact on global steel industry

The direct impact of the logistics crisis in the Red Sea on China’s iron ore and steel trade is, according to SMM, negligible. The main suppliers of iron ore to China are Australia and Brazil, while the largest export markets for Chinese steel products are Asia (70% of total exports), Africa and South America. Therefore, none of the main routes for transportation of ore and steel included the Suez Canal.

Nevertheless, the indirect impact of the shipping crisis on China’s trade in mining and metals products is worth noting. It will increase global shipping costs and, indirectly, steel production costs in China, affecting market sentiment in the short term. In the medium and long term, the price of freight transportation to Europe and the US may rise.

The logistics crisis in the Red Sea has not yet had a major impact on the German steel industry. At least Thyssenkrupp Steel has not experienced any supply bottlenecks so far, the company said in a statement to Reuters early last week. However, the group is considering alternative options and is in close contact with its transportation partners to be able to respond flexibly in case of an escalation.

At the same time, MEPS believes that the logistics crisis in the Red Sea will reduce the impact of new steel imports from Asia on European markets and may help European producers to secure higher prices offered by steel mills in January.

Some Asian steel producers have left the European market after shipping costs rose by about $75/t and increased to three weeks.

MEPS partners report that this has led to different reactions from Asian steelmakers. Some of them have switched to FOB offers, leaving buyers to organize transportation on their own, while others have eliminated the payment of customs duties.

In addition, in January 2024, CBAM reporting was introduced, which significantly reduced the attractiveness of imports in the European market.

The Wall Street Journal, citing sources, reported that the Australian BHP Group diverts almost all of its supplies from Asia to Europe away from the Red Sea, bypassing the Cape of Good Hope.

In turn, the company said that the situation is forcing some of its cargo service providers to use alternative routes. Others still prefer the Red Sea with additional control, Reuters writes.

«The Red Sea is one of the key shipping routes in the world, but the majority of BHP’s cargo does not travel through this route,» the company said in a statement.

Earlier, Gerard Ang, head of BHP’s marine iron ore division, reminded at an industry conference that about 320 million tons of bulk commodities pass through the Suez Canal and the Red Sea, which is 7% of global trade in them. In his opinion, in the short term, this could lead to a reduction in tonnage supply in the North Atlantic market, which means more volatile dry bulk transportation. In the long term, the company does not see a significant impact on trade.

At the same time, India’s largest stainless steel producer, Jindal Stainless, has cut its export forecast for the current fiscal year, which ends in March, due to the crisis in the Red Sea and weaker demand in the EU and the US. The company expects to ship 10-12% of its total sales abroad (2.1 million tons in FY2023/2024). In the previous forecast, the share of exports was 15%.

According to Abhyuday Jindal, managing director of Jindal Stainless, the company is exploring «new options» and a «variable freight model» amid the situation in the Red Sea. He noted that cargo disruptions, rising freight costs and weakening demand in Europe and the US occurred in the third quarter. Jindal acknowledged that some of the company’s export volumes suffered due to logistical problems and higher transportation costs.

«The global maritime trade in general and the EU steel market in particular have already adapted to the constant crises and changes in supply chains. The Evergreen stuck in the Suez Canal, the pandemic, the war in Ukraine, the war in Israel, the Houthi attacks and the conflict in Yemen – all of this is a continuous series and has become a new reality for global maritime trade, logistics companies, traders, and manufacturers. Unfortunately, in the turbulent 21st century, stable supply chains require additional organizational and financial costs for all market players,» commented Stanislav Zinchenko, Director of GMK Center.