Posts Global Market exports 4236 21 July 2022

Market operators expect that scrap prices will rise in autumn due to the increase in demand for steel

After the beginning of the military aggression of the Russian Federation against Ukraine, prices for scrap metal (as well as for steel products) went up sharply in almost all regional markets – everyone was frightened by the uncertainty of the current situation and the possible deficit of products and raw materials. As war became everyday for the world public, the situation returned to market factors of influence.

However, due to the war in Ukraine in particular, the economic conditions in many countries have deteriorated significantly, which partly affected the decline in steel production in the world. Now the market players expect that the price floor has already been reached, and in the fall it is even possible to increase the demand for steel products and, as a result, the price of scrap metal will rise.

War and scrap

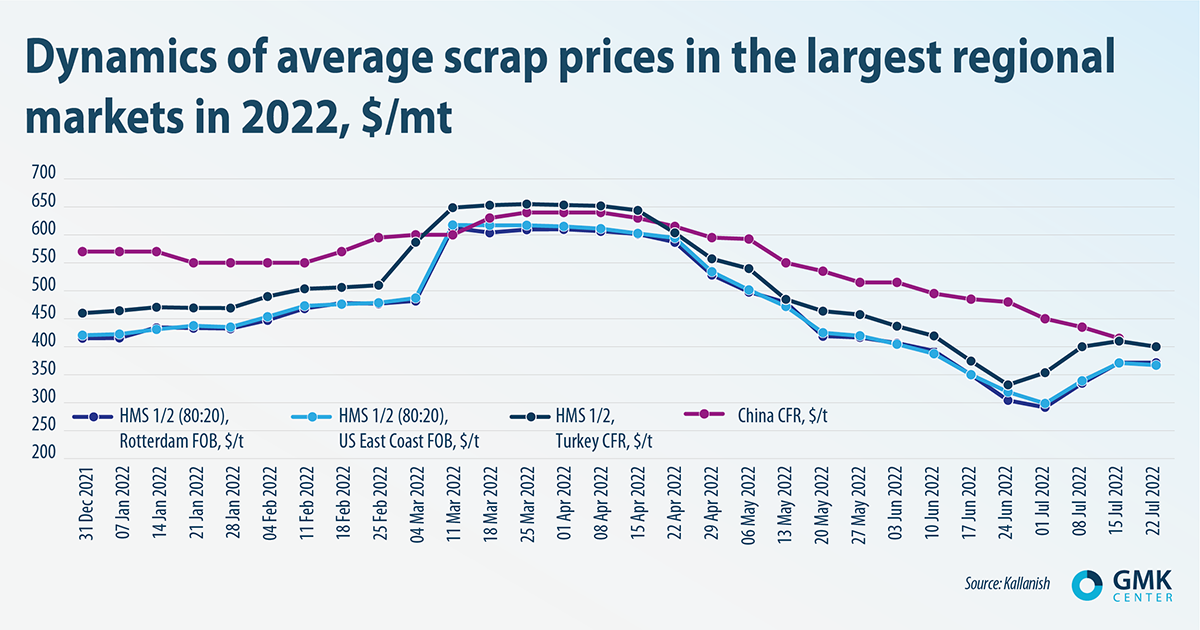

Prices for scrap metal rose in March-April due to hyped purchases of both steel products and scrap, which are bought for stock against the background of market uncertainty at the beginning of the war in Ukraine. The dynamics of average prices for scrap metal in the largest regional markets since the beginning of this year looks like this.

On the European market, the average scrap prices rose at their peak by $134 per ton, to $612/t, on the American market by $141 per ton, to $617/t. Quotations on the Chinese scrap metal market reacted the least to the war in Ukraine, but under the influence of the general trend, they also rose at the peak by $70 per ton, to $640/t.

As the market calmed down, prices began to decline in all markets. In this case, the prices of steel and iron ore went down, which dragged down the quotation of scrap metal.

In addition, the increase in supplies of steel products from Russia at dumping prices also put pressure on scrap quotations. For example, it was more profitable for Turkish producers to buy Russian square blanks in April. It created conditions for a decrease in demand (and prices) for scrap ferrous metals. However, this factor is now being leveled due to the fact that the cost of production at Russian steel mills has become very high due to the strengthening of the ruble. According to some estimates, the profitability of Russian exports in June constituted -46%.

At the end of June – beginning of July, scrap quotations bottomed out on all markets, except for China, and began to rise again. Although there are no objective market conditions for scrap quotes to rise above the market, it is clear that in this case a psychological level was reached below which prices could not fall. In addition, delayed demand played its role.

Thus, in the current realities, there is no reason to expect a long-term increase in scrap metal prices – at least until mid-August. This can be seen from the graph, which shows that in the period from July 15 to 22, quotations leveled off. This is partly due to the fact that Turkish manufacturers did not purchase raw materials during the Eid al-Adha holiday (July 8-12), which contributed to the stabilization of prices.

Each regional market has its own scrap market situation. Although Turkey actually determines the movement of European quotations for raw materials, in each EU country, in the short term, price dynamics may differ from the Turkish market. A lot depends on the structure of steel production (ratio of electric steelmaking and converter capacities), producers’ need for raw materials, etc. For example, in Italy July prices for scrap metal fell down by $101-106 per ton compared to June, as steel producers have high raw material inventories and the recent increase in the cost of imported scrap in Turkey has not affected the situation with domestic Italian prices.

Turkish coast

The war in Ukraine had the most significant impact on scrap metal quotations on the Turkish market, which is highly dependent on this type of raw material. Average prices for scrap here at the peak increased immediately by $149 per ton, to $655/t. They also held the highest level for the longest time in the compared price sample. In addition, the quotations went up earlier than all others in the period from June 24 to July 1 in Turkey.

This is due to the fact that Turkey remains the largest regional consumer of scrap metal. Import of scrap to this country for January-May increased by 0.8% compared to January-May last year, to 10.91 million tons. It is interesting that in April and May, Turkey increased imports at a fairly high rate compared to the same months of last year – by 13% and 10%, respectively. According to the results of 2021, the country increased the import of scrap metal by 11.5% compared to 2020, to 25.1 million tons.

At the same time, iron and steel production in Turkey is falling. According to the World Steel Association, in January-May, pig iron production decreased by 9.9%, to 3.9 million tons, steel smelting by 2.8%, to 16 million tons. Now, against the background of weak demand, Turkish producers are trying to limit production products, therefore, the volume of imports of scrap metal may decrease.

Export protection

The policy of protecting the domestic scrap metal market and restricting its export continues throughout the world. On the one hand, Europe is trying to play on compliance by importers of European scrap with its own social and environmental standards. Association EUROFER offers stop the export of scrap to countries that do not implement a policy that meets the environmental and social standards of the EU. It is interesting that the association already has a similar proposal voiced in the spring of 2021.

Discussions are still going on around this issue, but a solution is already brewing. In the fall of last year, the European Commission, based on the results of the review of the waste transportation policy offered limit the export of scrap to countries that are not part of the Organization for Economic Cooperation and Development (OECD). The European Parliament’s environment committee is expected to vote on the proposed amendments in October.

At the same time, representatives of the European processing industry consider, that the proposed by EU scrap export controls will hit the industry hard and will lead to a decrease in the amount of scrap metal collected in Europe, an end to investments in the industry and a reduction in the pace of decarbonization. Also, the idea of the European Commission is criticized by Turkish steel producers, as it does not correspond to the signed agreements between the EU and Turkey.

On the other hand, the export of scrap metal is restrained by classic tools of trade restrictions. From August 1 until the end of 2022, Russia extended the scrap export quota. Its volume will be 1.35 million tons, which will be subject to an export duty of 5% of the customs value, but not less than €100 per ton. Any Russian restrictions can only affect the markets of individual countries, such as Turkey, so these decisions are important for the global market.

General conclusions

In the current conditions, buyers are not interested in overpaying for scrap metal, since weak demand, lower prices for metal products and rising energy costs already put many steel companies in a stalemate. Manufacturers cannot dramatically raise prices for steel products, while production costs are rising.

According to the European Commission, in 2020 the export of scrap to non-OECD countries accounted for 25.6% of the total export of scrap from the EU. The adoption by the EU of a new waste export regulation may partially change the situation on the world scrap market. With this decision, the European Commission protects itself from the growing influence of China on the scrap market with the help of environmental standards.

At the same time, the import of scrap to China has not yet affected the global market configuration. Now Chinese steel industry reduces production, although in the future the share of the Celestial Empire in imports will certainly grow. By 2025, China intends to increase consumption of steel scrap by 23%, up to 320 million tons. The Chinese authorities will support the import of scrap metal to achieve climate goals.

Currently, steelmakers all over the world stop power due to the drop in demand for steel products. As a result, steel producers have good scrap stocks and may not increase purchases for now, even at low prices. Steel mills expect an increase in demand and an increase in steel prices in the fall, after the end of the summer slump in business activity. Only under such conditions scrap quotations can also go up.