Posts Global Market protectionism 480 28 April 2022

World steel industry is a leader in protectionism among industries

Russia’s military aggression against Ukraine has significantly affected the world economy, but has not changed the measures developed countries introduce to protect their markets. In practice, the real reason of the excessive protection of markets usually related to their vulnerability.

The process of global trade globalization was simultaneous with global economic growth. But it had a number of negative consequences too and it led to the deglobalization of trade. Deglobalization of trade involves building barriers to reduce imports, i.e. increase protectionism.

Reasons for the rise of protectionism:

- deindustrialization in developed countries

- low population mobility

- surge in popularity of the right-wing forces

- differences in regulatory approaches

- WTO’s unpreparedness to arbitrate

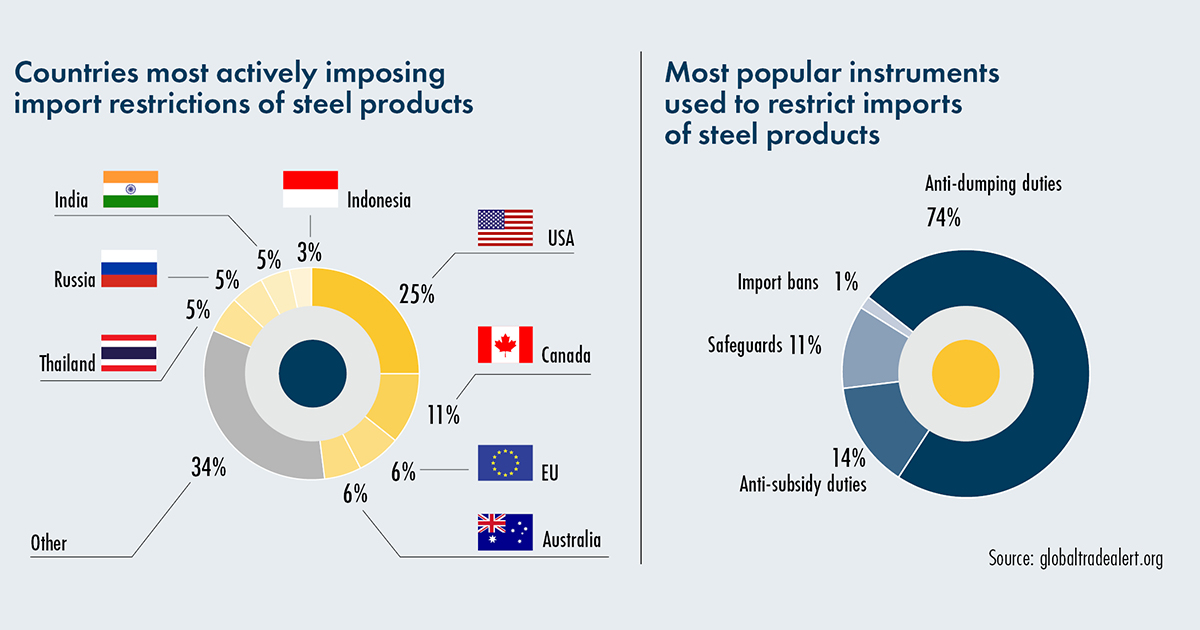

Steel industry is regulated by protectionist measures more than others are. It is highly important and developed in many countries. When the situation in the markets worsens, players oppose exports. Developed countries are particularly active when it comes to protectionism. The US and the EU, free market leaders, are among them.

In recent years trade barriers often introduced with aim of achieving climate goals. The examples are Carbon Border Adjustment Mechanism (CBAM) and scrap export restrictions.

“Steel” self-defense

Protectionism in the world economy continues to grow. In 2020, 4569 state measures were recorded, compared to 2-3 thousand such measures annually in the last 10 years. Steel industry ranks first in the world in the number of interventions. During 2009-2021, 1817 protectionist measures were introduced in the industry. They are aimed at restricting imports and supporting local steel producers.

Restricting imports is just one of the tools of protectionist policy. Only every third measure of state intervention in the economy is aimed at restricting imports (a total of 402 measures). Other measures include support for local producers. For example, localization of public procurement, grants and public loans, tax benefits, which account for a total of two of the three state measures, or 1415 for 2009-2021 are actively used. The peak of various measures to support steelmakers was in 2019-2020, when have taken a third of all measures in the last 12 years. China (54% of all measures) and the United States (36%) were particularly active.

The dynamics of the introduction of measures to restrict trade is clearly correlated with the state of the market. When prices are low, we see barriers to trade. The peak was in 2016, when prices reached local lows.

In 2021, favorable market conditions have contributed to fewer new trade restrictions. However, the expected easing of barriers to imports did not happen, despite supply shortages in some regions. This is due to the long-term nature of factors in the development of protectionism. So, as market conditions deteriorate, we will see a surge in trade restrictions again.

Despite the shortage of supply in some segments, the EU market still remains closed. In early 2022, EUROFER called on the European Commission to review quotas. The association insisted that the current level of quota liberalization of 3% be revised and reduced to 1%. It was also proposed to abolish the regime of access to remaining quotas without restrictions on certain products.

In the first nine months of 2021, due to favorable market conditions, only 13 new measures were introduced, excluding ongoing investigations. For example, the high prices of 2021 contributed to the fact that the Gulf countries refused to introduce protective measures. At the same time, they did so despite the findings of a protective investigation into the damage caused by imports to local steel producers. The share of steel industry in the Gulf economy is small. Therefore, the policy of the region takes into account the interests of consumers of steel (oil and construction industries) than its producers.

However, the expected weakening of previously implemented measures on good market condition did not happen. For example, the protective tariff quota system in the EU has been extended for another three years, despite supply shortages in some segments. The only exception is the early abolition of protective customs tariffs on imports of rebar and square billets in Egypt due to high energy prices in autumn 2021. That is, the decision to cancel is largely due to a random factor. However, new safeguard measures are already being discussed instead of the old ones, a system of tariff quotas.

Thus, market cyclicality affects the number of measures introduced, but not their easing. It should also be noted that the policy of restricting the import of metal products is long-term. Therefore, if the situation in the metal markets worsens, countries are likely to increase trade barriers.

Anti-dumping measures

To limit imports most often used instruments of anti-dumping customs tariffs, which account for 74% of all measures implemented. Anti-dumping measures are popular for several reasons:

- their duration is not limited and can be extended in contrast to the safeguard measures, for which a period is established by the WTO regulation;

- anti-dumping investigations require no specific conditions as opposed to the safeguard measures;

- anti-dumping investigations are easier to justify, they are meant to restore fair trading conditions;

- dumping is easier to prove than, for example, subsidies;

- anti-dumping investigations are often used as the instrument for pressure, since only 66% of investigations conducted in the last 10 years resulted in the introduction of anti-dumping measures.

Introduction of anti-dumping measures peaked in 2016–2017. Consequently, 2021–2022 will see the peak of administrative reviews of measures introduced for a period of 5 years. Given the long-term nature of the trade policy, lifting or easing of the anti-dumping measures following such review is unlikely.

For example, the anti-dumping measures introduced back in 1984 are still in place in the USA. The USA traditionally ranks first in the world by the number of measures imposed to protect the local market from imports. Canada is also actively restricting imports, since, largely due to the bilateral agreements with the United States.

The European Union is among the top active economies in terms of import restrictions, ranking third after the USA and Canada. In 2021, the EU has become a trendsetter with its import restrictions based on the environmental concerns. The so-called carbon border adjustment mechanism (CBAM) aims to equalize payments of European companies for carbon emissions with those paid by producers of imported products. The decision to introduce this instrument paved the way for a similar dialogue in the USA and the EAEU. In other words, the introduction of new environmental trade barriers was become a trend in 2021.

At the intersection of environmental goals and export restrictions, a new trend has emerged: restrictions on exports of ferrous scrap. Scrap is an important raw material for reducing greenhouse gas emissions in steel industry. In 2020-2021, 8 measures affecting scrap exports were introduced in the world. A number of measures have also been introduced to stimulate scrap imports.

Effects

We see that the factors that have led to excessive activity of countries in the field of protection of their own markets are long-term in nature and will not go anywhere in the near future. But the protectionism in developed countries added to their vulnerability during production chains disruptions.

Declining supplies from Ukraine and Russia have left producers in various countries unable to close the loophole in supply. It turned out that there is no free capacity, especially in the EU market for flat products. The European market has lost supplies of both rolls and slabs, which are raw materials for the former. Ukraine and Russia provided 84% of the slab market in the EU. Russia’s import quotas have been shared among the other players. But other countries have not been able to block the fall in supplies from Ukraine. The result was rising prices. At the same time, the supply of flat products from Ukraine will be significantly reduced due to the loss of Mariupol plants. We expect this loss to be temporary. But the problem of the shortage of flat products Europeans need to solve. Previously, this segment was actively protected by additional anti-dumping investigations.

The situation is similar in the United States. There, the reason for rising prices was a drop in pig iron supplies, which other countries could not cover. But the United States was apparently aware of the problem, and in 2021 it gradually began to conclude bilateral trade agreements. According to them, trading partners were excluded from the 25% import duty on steel supplies in exchange for quotas. This policy works today. The United States recently signed such an agreement with the United Kingdom, and previously with Japan and the EU. That is, the United States is quite flexible in its approach.

In the current conditions, strict protectionism will have a negative impact on the prospects of the world economy. Economic growth in the world has slowed down since the start of the war in Ukraine. Ukraine is part of European and global supply chains and is ready to replace the supplies from Russia. And it is already happening. However, for this, the world community needs to help our country in establishing new logistics routes, and later – in the postwar recovery of the country’s economy.