Posts Infrastructure cargo transportation 2345 14 November 2023

A quick compensation of nearly $550 million from the insurance fund will partially improve the situation

The second month of the sea corridor’s operation confirmed its viability. In the beginning, the remaining blocked vessels left Ukrainian seaports, then empty vessels came to load with exports, successfully making return voyages with cargo. Then imported cargoes began to enter Ukrainian ports through the sea corridor.

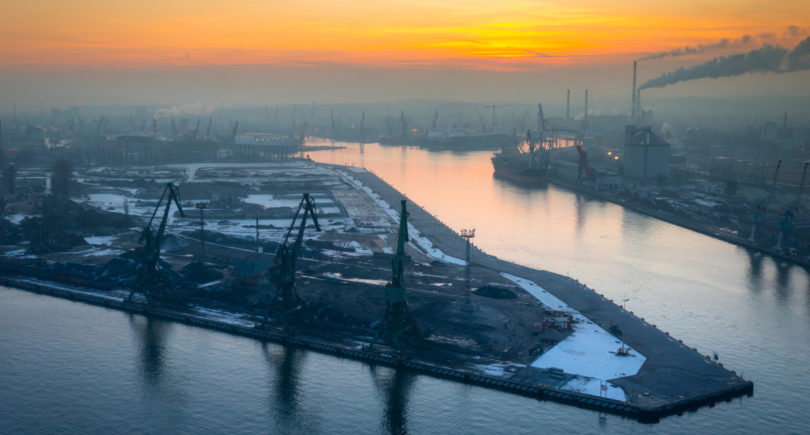

According to the Ministry of Infrastructure, from August 8 to November 9, 2023, 116 ships came under loading in the seaports «Odessa», «Chоrnomorsk» and «Pivdenniy». During the same period, 91 vessels left the ports with export cargoes with the aggregate size of 3.3 million tons of AIC and iron and steel products. At the same time, the issue of ensuring the safety of the corridor has not gone anywhere, and, on the contrary, has become more acute.

Security impact

The operation of the time corridor depends heavily on the information component. On the one hand, the authorities need to show that the corridor is working to give peace of mind and confidence to shipowners, shippers and insurers. On the other hand, the authorities should release information in a measured and cautious manner in order to maintain the necessary level of safety of the corridor and ships in the ports. However, the information on the passage of ships and their presence in ports is available in information systems (although for security reasons some ships do not include the AIS system) and on satellite images, i.e. it is not a secret for the aggressor.

Along with the positive examples of the maritime corridor’s operation, risks characteristic of it have also become apparent. According to the head of the Ministry of Infrastructure Oleksandr Kubrakov, after the withdrawal from the grain deal in July 2023, Russia has already attacked the port infrastructure of the Odessa region 21 times. As a result of the shelling, 160 infrastructure facilities and 122 vehicles were damaged.

However, on the evening of November 8, what many feared in relation to the work of the corridor itself happened. In the port of Pivdenniy, a Russian missile hit the 91,800-ton bulk carrier Kmax Ruler (Liberian-flagged). As a result of the attack, a Ukrainian pilot was killed and three crew members – citizens of the Philippines and a port employee – were injured. The bulk carrier arrived at the port to collect iron ore for China.

Earlier large bulk carriers owned by Chinese shipowners – Ying Hao 01, Wu Yang Glory, Xin Shun – have already called at the ports of Greater Odessa and arrived, loaded and departed with cargo to China without any problems. However, the owner of Kmax Ruler is the British company Blenheim Shipping UK. At this point, it is difficult to say whether this vessel was the target of the Russian attack or whether it was another vessel and the Kmax Ruler was an accidental victim of a missile attack (according to one version, the target of the attack could have been a military radar).

The issue of security is key to the continuation of the sea corridor. According to Andriy Klymenko, head of the Monitoring Group of the Institute of Black Sea Strategic Studies on the situation in Crimea and the Black Sea region, the solution to the security problem of the sea corridor in the light of the attack on the bulk carrier Kmax Ruler may be such measures:

- Prompt and effective compensation from the established insurance fund to the family of the deceased and injured, as well as compensation for the shipowner. This will be appreciated by all participants in the process and the maritime community worldwide.

- Further strengthening of air defense coverage of the corridor and ports.

- Prompt and reasoned appeals to international organizations (including maritime and maritime trade unions) regarding the qualification of the Russian Federation’s actions as maritime piracy with retaliatory consequences for Russian shipping.

Non-operational insurance

Even before Russia’s withdrawal from the grain deal, Ukraine was preparing insurance and compensation options for charterers and shipowners to reduce the risks of entering Ukrainian ports. At the end of May this year, the Cabinet of Ministers approved the Procedure for Providing Guarantees of Compensation for Damage Caused to Charterers, Operators and/or Owners of Maritime Vessels and Inland Navigation Vessels as a Result of the Armed Aggression of the Russian Federation. Compensation was expected to be provided to those shipowners who had concluded an insurance contract but were denied compensation for losses by the insurer.

The state budget-2023 allocated UAH 20 billion ($547 million) for these purposes, but these funds were not used. In the state budget-2024 the size of the fund for insurance of ships against military risks was reduced 10 times – to UAH 2 billion (at the expense of the reserve fund of the state budget).

Thus, so far, the insurance fund has not worked, insurance payments from it have not been made, and the potential size has decreased. According to Taras Vysotskyy, the first deputy head of the Ministry of Agrarian Policy, only last week the Cabinet of Ministers allocated $20 million for the creation of the insurance fund for marine cargo transportation. The total volume of this fund could reach $500 million if individual British insurance agencies join it. The goal of the fund is to bring Black Sea shipping insurance back to the pre-war level of 1% of cargo value.

Agro-interruptions

At the end of October there was an incomprehensible information situation in the work of the temporary corridor. On October 25, AMPU information about temporary suspension of the sea corridor operation due to military restrictions appeared. They say that the Navy did not coordinate the movement of vessels due to a mine threat after the activation of Russian aviation. However, later the Ministry of Infrastructure said that the information about the cancelation or stoppage of the corridor is not true. During the same period, there was less data from the authorities about new ship calls, i.e. positive information about the corridor’s operation.

Apparently, the suspension of the corridor is related to cargo inspections in the ports of Greater Odessa as part of the fight against shadow grain exports. Almost simultaneously, the Cabinet of Ministers tightened the rules for export of agricultural products – registration in the state agro-registry was introduced and the terms for return of foreign currency proceeds were reduced from 180 to 90 days. Exports of some types of agricultural products under the new rules began on November 11.

Iron export

For security reasons, shippers and authorities most often specify the size of the cargo and the country of destination. It is known that the bulk of cargoes exported through the corridor are agro-industrial products. Another notable part of exports is iron and steel cargoes. According to rough estimates, in September, four vessels blocked in the ports earlier exported from Odessa and Pivdennyi more than 90 thousand tons of metal products and more than 170 thousand tons of iron ore concentrate.

Later, «new» iron anf steel exports went through the corridor (rather than cargoes stuck in ports at the beginning of the Russian invasion in late February-2022), followed by empty bulk carriers coming to Ukrainian seaports. According to industry sources, in October, MMC exports through seaports tentatively amounted to:

- port Odessa – 2 vessels with 213.5 thousand tons of steel products left;

- port Pivdenniy – 4 vessels with 507 thousand tons of iron ore left.

The real launch of an insurance fund may support Ukrainian exports of iron and steel amid the attack on a bulk carrier in the port of Pivdennyi. Meanwhile, it was initially assumed that the fund would be focused on insuring maritime exports of Ukrainian agricultural products, i.e. at the moment it is not clear whether the risks of exporting other export products through seaports will be insured.

In 10 months, the situation with the balance of exports and imports in Ukraine is close to catastrophic. In January-October, commodity imports amounted to $52.2 bln, while exports amounted to only $29.8 bln. Thus, the foreign trade deficit amounted to $22.3 bln. Therefore, under current conditions, it is important to support all available exports – not only agro-industrial complex, but also steel industry. For the country, this means foreign exchange earnings and stability of the national currency exchange rate, taxes received and financing of state budget expenditures, salaries and support of the army.