Posts Technologies ore mining 575 31 March 2021

Ukraine wants to attract investors with benefits and raw materials to produce electric vehicles and batteries for them

The transition to a green economy and climate neutrality will require huge investments, lead to growth and redistribution of demand for metals. Among the demand favorites will be nickel, cobalt, lithium, copper and rare earth metals. The first three are used for the production of batteries and energy storage devices. The need for them in the coming years will grow tenfold. Now the competition for resources is intensifying in the world. Everyone is interested in them: Europe, the USA and Asia.

Euroalliance

If we talk about Europe, here in October 2017 the European Battery Alliance (EBA) was specially created. The goal of the project is to create a closed ecosystem in the field of batteries – from the extraction of raw materials, design and production to their recycling. Thus, Europe wants to exclude dependence on other countries, in particular China.

“The European Union saw that they were lagging behind the US and Asian countries in a number of areas of innovative technologies. And one of them is battery technology. Europeans understand that they are critically dependent on external supplies of a number of metals that are used in the manufacture of batteries and energy storage devices. Therefore, they want to produce it at home and create value chains for this,” says Alexey Ryabchin, Adviser to the Deputy Prime Minister for European and Euro-Atlantic Integration, Adviser to the Minister of Environmental Protection and Natural Resources.

EBA, of course, already has successes. The loudest of them is the construction of Tesla’s first European plant near Berlin. However, new production facilities are already being built throughout Europe: by 2025, capacities for the production of at least 6 million electric vehicles per year should appear. The largest auto giants and industrial companies have already been involved in this project. Within the framework of the EBA, state funding will amount to €2.9 billion in the coming years. It is expected that this will also attract €9 billion in private investment.

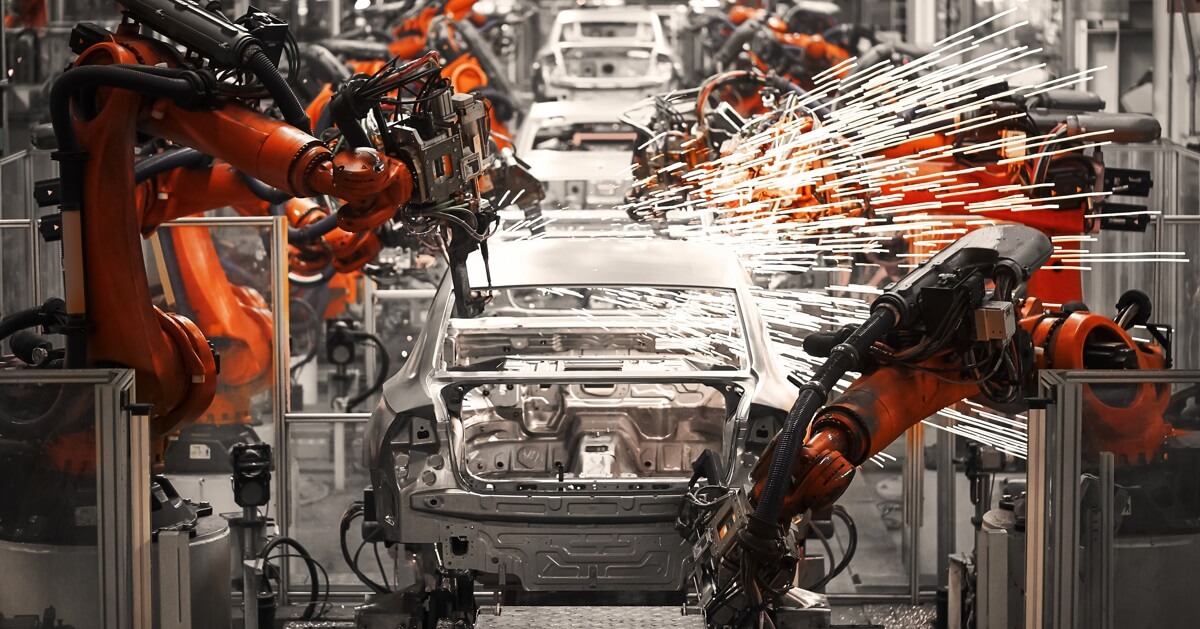

Tesla Motors assembly plant in Tilburg, the Netherlands (c) shutterstock.com

With the help of European integration, our country also wants to fit into this alliance. On the part of Ukraine, the State Service of Geology and Mineral Resources of Ukraine joined it. Our country and the European Union are already exploring the possibilities of cooperation in the production of batteries. The EU also allocated additional technical assistance for this area for €800,000.

Ukraine has certain opportunities to infiltrate production chains. This will create new technological production and jobs.

“In this chain, Ukraine can, taking into account the existing and forecast reserves of the so-called metals of the future, take several important places: from the extraction of raw materials to the production of concentrates and battery cells. This, in turn, would make it possible to attract investments, technologies and European partners, create new points of growth for the national economy, and facilitate the integration of the latter into European technological and production systems,” GMK Center said in a comment. Roman Opimah, head of the State Geotechnical Institute .

At the same time, as Aleksey Ryabchin notes, the Europeans themselves are interested in Ukraine’s participation in this project and have already contacted us to understand which Ukrainian enterprises can take an active part in the European Battery Alliance.

“So far, we see that the EU is considering using the Ukrainian potential in the extractive industry to help the EU build its competitive value-added production chains. But our interest is to have such value chains in Ukraine. Therefore, there is a big challenge for the authorities here: will it be able to defend our interest in such a partnership? We are interested in building factories with a full production cycle on our territory. After all, this does not just give us the opportunity to be a supplier of raw materials to Europe, we can get more – jobs, high incomes and, in the end, positive incentives for the economy,” notes Georgy Popov, Analyst of the National Association of Extractive Industries of Ukraine (NAEIU).

Ukraine can also participate in the EBA in terms of charging infrastructure for electric vehicles, where we have good initial positions. Thanks to preferential import conditions, the electric vehicle market in Ukraine has been developing quite vigorously since 2016. According to the Ukravtoprom association, in 2019, the number of registrations of electric vehicles amounted to 7.5 thousand: in the passenger car segment (7 thousand units), it increased by almost a third, and commercial (530 units) – by one and a half times. However, last year the market decreased slightly – by 1%, to 7.45 thousand units.

Of the minuses: there are still very few electric vehicles against the background of the total volume of new registrations (in 2019-2020 – 88.5 and 85.5 thousand, respectively) and the entire fleet (just over 25 thousand electric cars against the background of 10.2 million units of all vehicles), approximately 90-95% of imported electric vehicles are used.

(c) shutterstock.com

According to Bloomberg estimates, by 2040 the share of electric vehicles will be 57% of the total number of global passenger car sales. At the same time, according to UBS bank estimates, the cost of producing electric cars and cars with internal combustion engines (ICE) will equalize by 2024.

In the future, as part of the National Transport Strategy until 2030, it is planned to completely transfer all urban public transport to electric traction and create the appropriate infrastructure. In addition, the Ministry of Infrastructure, together with businesses, is working on a new concept for the development of electromobility in order to create conditions for the production of domestic electric vehicles.

In addition, Ukraine can also take part in the work of the European Raw Materials Alliance (ERMA), which operates on the EBA principle, but was created to provide strategic materials to the European carbon-free economy.

Lithium nebula

Ukraine’s first step was presentation a number of investment proposals for the extraction of “metals of the future”, including lithium. Actually, the basis of Ukrainian ambitions is that our country has the largest deposits of lithium on the European continent.

Lithium deposits are located in Kirovohrad (Polokhovskoe and Dobry area), Donetsk (Shevchenkivske) and Zaporozhye (Krutaya Balka area) regions. At the moment, none of them is actually producing. The volume of their stocks is a state secret. According to some estimates, the reserves at the Shevchenkovskoye field are about 14 million tons.

“We have two fields with proven reserves, and there are several potential sites with a good resource base. But there is only one valid license for lithium mining. As far as I understand, drilling has already been carried out and an assessment is underway according to international classifications of those resources and reserves that have been found. And all the rest are areas that require large investments, over $100 million. In addition to investments, modern technologies are needed, which are not available in Ukraine. The launch of such projects requires cooperation with foreign partners who have both the technology and experience in extracting such resources. I doubt that such projects can be implemented exclusively by internal forces,” Roman Opimakh said earlier in interview GMK Center.

In 2017-2018 Petro-Consulting (Shevchenkovske) and Ukrlitiydobycha (Polokhovskoye) received special permits for lithium mining. The companies did not have enough own funds for development: they planned to attract foreign partners. However, the state wanted to revoke the special permit for the Shevchenkovskoye field, but the case turned into mutually exclusive decisions of different courts. Thus, Gosgeonedra, other things being equal, wants to sell special permits for the Shevchenkovskoye field and the Dobry and Krutaya Balka sections.

“We can have a competitive advantage compared to African countries where lithium is mined without ethical and environmental standards. Yes, it will be more expensive at cost, but the European consumer – Mercedes, BMW, Volkswagen plants – are ready to pay more for goods that are produced in compliance with all standards in order to avoid reputational costs, ”notes Alexey Ryabchin.

As for other important metals, we also have reserves of nickel, cobalt and manganese in the country, which are used in the production of batteries. Nickel and cobalt deposits are located in the Kirovograd and Dnepropetrovsk regions. Stocks constitute: nickel – 215 thousand tons (12 deposits), cobalt – 8.8 thousand tons (11 deposits). It should be noted that in different sources the figures for the volume of reserves can vary significantly.

The main problem is that these reserves are not actively developed. These deposits were explored back in the days of the USSR, and their development was then recognized as economically inefficient due to the low content of metals in the ore. For example, Pobuzhsky ferronickel plant (Kirovograd region) imports ore from Guatemala.

Only for manganese ores the situation is different – their extraction is actually carried out. Ukraine ranks first in the world in terms of proven reserves of manganese and second in terms of total reserves.

Another fact is noteworthy. One of the “metals of the future” is titanium. Unlike lithium, ilmenite ore (raw material for titanium) is already mined in Ukraine, and there are also production facilities. State efforts to participate in international supply chains fit well with the idea of creating a state holding that could include state-owned assets: the Zaporozhye Titanium and Magnesium Combine, Sumykhimprom, and the United Mining and Chemical Company (OGCC). But the authorities put OGCC up for privatization. Without raw materials, the value of other businesses is drastically reduced. Just like an idea dies titanium state holding, over which the Ministry of Strategic Industry is thinking.

Battery factory

On a lithium basis, Ukrainian officials have already proposed to the EU to build a plant in Ukraine for the production of batteries for electric vehicles and verify Ukrainian data on deposits and reserves of critical metals. For the second goal, Ukraine wants to attract a loan from the EBRD in the amount of €200 million.

(c) shutterstock.com

The most common rechargeable car battery is the lithium ion battery. According to Vladimir Khmurych, CEO of the Belaya Tserkov industrial park, four conditions must be met in order to create a large-scale industrial production of lithium-ion batteries:

- Have proven mineral reserves.

- Create a modern material and technical base and build a developed infrastructure.

- Possess production technology and train personnel.

- Establish supply chains that will cover the sales market.

“Today, only one condition has been fulfilled in Ukraine. There are explored reserves of lithium – the largest in Europe, about 500 thousand tons. There are also proven reserves of other minerals needed for the production of batteries – nickel, cobalt, manganese, ”adds Vladimir Khmurich.

In Ukraine, there are factories for the production of car batteries. They are located in Donetsk, Dnipropetrovsk, Kherson and Khmelnytsky regions. They have their own range of trademarks that are in demand on the regional market.

“But this is a category of batteries for internal combustion engines, and the production volumes of these plants are not comparable with the design capacity of the gigafactories that are being built in Germany, France, Poland, Hungary. Cumulatively in EU countries in 2021-2022 eight projects are to be implemented with an estimated annual production capacity of up to 117 GWh. These projects should meet the needs of the domestic European market for electric cars and create a platform for the formation of export potential. Among these eight investment projects, Ukraine is not mentioned,” says CEO of the industrial park “Bila Tserkva”.

The strength of the factories for the production of lithium-ion batteries, which are being built in the EU countries, is the production technology, technical equipment, proximity to sales markets and personnel. Factories can hire engineers who worked in the same city in the factories for the production of internal combustion engines. The weak side of the factories is their equidistance from the sources of raw materials. Production volumes will depend on the supply of lithium, nickel, cobalt, manganese.

“Now Ukraine is interesting for European producers as a source of this raw material. Projects are being discussed to verify the reserves of mineral deposits. The EU is ready to invest in these projects and expand the program of technical support for the extractive industry. For Ukraine, this means that the bulk of the added value in the production of car batteries will be created outside its borders, for example, at processing plants in Belgium, Finland, and Norway. In such a scenario, there is little chance of extracting the maximum economic benefit from those minerals that Ukraine has in abundance,” emphasizes Volodymyr Khmurych.

Previously, the World Bank was scheduled to conduct a study on public electric transport infrastructure in Ukraine, one of the issues was to study the potential role of Ukraine in the battery supply chain in Europe. The report was expected by the end of June 2021.

Dream of Tesla

Ukraine also wants to attract investors to build a plant for the production of electric vehicles. Large industrial investors now come only in the case of very substantial benefits. Electric car maker Tesla, whose arrival is a long-awaited dream for any country, in fact, requires tax and other benefits. And she gets them. The company has already received several $1 billion in tax credits for the construction of its facilities in the United States. As part of the EBA, Tesla will receive €1 billion in subsidies from Germany for the construction of a battery plant near Berlin. India is also offering big incentives for the company to set up an electric car factory.

Factory for the production of batteries. © roskill.com

According to a study by Securing America’s Future Energy (SAFE), over the next 5-10 years, global automakers will invest $300 billion in the development and production of electric vehicles. Half of these spending will be in China.

And Ukraine is already taking real steps to create incentives for the development of electric transport production in the country. We are talking about exemption from VAT and import duties from 2021 to 2028 for equipment and components for the production of electric vehicles (cars, electric buses, electric trucks and special vehicles). It is also proposed, until the end of 2033, to exempt electrical industry enterprises selling electric motors for transport (with the exception of trolleybuses), lithium-ion batteries, chargers, as well as auto industry enterprises selling electric cars of their own production from income tax.

“Ukraine has a real chance of being chosen for the construction of the next gigafactory for the production of electric vehicles in the Zhytomyr region or a “nano-farm” for the production of energy storage facilities near Krivoy Rog,” – sure Roman Opimah.

In September last year, the Government in the first reading adopted the relevant bills on amendments to the Tax ( №3476 ) and Customs ( №3477 ) codes.

“Taking into account the benefits received within the framework of the free trade area with the EU, Ukraine can become a leading platform for the production of electric vehicles, components for it for the European car market,” reads the explanatory note to the bill No. 3476.

Both documents are included in the agenda of the current session of Parliament. The probability of adoption of bills as a whole is extremely high, since in the first reading each of the documents received more than 300 votes of people’s deputies.

“Ukraine can become a platform for building such factories. I am convinced that we have the technological potential, as far as I understand. The coronavirus has now given impetus to de-shoring as a counterbalance to off-shoring. That is, the idea of moving production closer to the “home”. It is obvious that Ukraine is much closer and cheaper,” said Veronika Movchan, Research Director of the Institute for Economic Research and Policy Consulting.

(c) shutterstock.com

Battery light

The dialogue on Ukraine’s participation in the battery alliance, in fact, is just beginning. Representatives of the European Commission at the highest level are scheduled to visit Ukraine in the near future on this very issue.

“We have a lot of interesting projects related to energy storage at our power plants, for example, on storage at Ukrhydroenergo stations. Also, the first energy storage device in Zaporozhye from DTEK is being prepared for launch,” notes Aleksey Ryabchin.

To implement Ukraine’s participation in the EBA, joint efforts of state institutions and businesses are needed. And the role of business here is even more important than the state. A number of private companies have already joined this alliance.

“The financial capabilities of the state are not enough for the relevant work on the study, verification, exploration, production and enrichment of raw materials. And here the main role should be played by private Ukrainian and foreign businesses in terms of investment, technology and the creation of supply chains. It is precisely in order to provide businesses with an appropriate incentive and certain guarantees that the format of a strategic partnership in the field of strategic raw materials between Ukraine and the EU is being created as part of deepening cooperation in the format of the Association Agreement,” emphasizes Roman Opimakh.

Officials say that our country can count on EU financial assistance for green transformation.

“This will be the subject of our next official dialogue with the European Commission, which will take place in a month. Moreover, the EU is already forming the so-called green transformation budget, part of which will be directed to the green transformation of the neighboring countries. Today we understand that it will be at least €19 billion in the next 3-4 years. The volume and possibilities of access to appropriate financial resources, credit, international, will depend on how we build this process within the country,” – stated recently Olga Stefanishina, Deputy Prime Minister for European and Euro-Atlantic Integration.

The key risk is the investment climate in the country. Or rather, its almost complete absence.

“Ukraine is very attractive in terms of resources, but we are weak in terms of the regulatory environment and business incentives. So far, everything is not going in our favor, and it is obvious that Ukraine is now attractive as a supplier of raw materials. However, we can work with the investor, talk and offer him attractive starting conditions. We have some success in this, connected with the adoption of the law on “investment women”. Further, it is up to the participants in the negotiations and whether the representatives of Ukraine are ready to act in these negotiations from the position of defending our interests,” emphasizes Georgiy Popov.

According to Alexei Ryabchin, investors need guarantees, working laws and courts, and effective public-private partnerships. For example, if an investor finances the mining and processing of lithium, then the state provides the infrastructure (logistics, power supply, etc.). For example, earlier the Petro-Consulting company estimated the necessary investments in the Shevchenko lithium deposit at more than $120 million. They include infrastructure – 40 km of an energy line, 20 km of a gas pipeline, 35 km of a railway line, etc., – construction of a mine with a depth of at least 500 m and processing plant.

(c) shutterstock.com

It should be noted that the adoption of the law “On State Support of Investment Projects with Significant Investments” and two related laws fits well into the idea of implementing such projects. According to these documents, projects with investments of at least €20 million in the extraction and processing of minerals (except for coal, oil and gas) will receive certain tax benefits.

Under these conditions, it is important to show the EU constructive proposals and real projects, and not just a passionate desire to participate in the “development” of the budget and grants for the production of batteries and green transformation. Otherwise, Ukraine will turn out to be “eternally promising”, but never realizing its capabilities and potential.

In general, to launch “accumulator” deposits, it is necessary to carry out additional geo-exploration and calculate the economic feasibility of their development, resolve issues in courts and with local communities (any type of production does not cause delight in them) and wait at least 5-7 years until the attracted investor can start the actual work. The issue with the construction of an electric car plant can be resolved a little faster. The prospects, to put it mildly, are not close and in our conditions are by no means 100 percent.