Posts Infrastructure Ukrzaliznytsia 1976 03 August 2022

Given the weak demand, we should not count on a sharp increase in the export of mining&metals, but cargoes to Europe will go faster

The Grain agreement can not only bring benefits to the export of agricultural products, unload elevators and terminals for the new crop, but also help other sectors of the economy. It is expected that the flow of grain trucks across western railway border crossings will decrease, which should facilitate the export of other products. Although not everything is so simple in this question…

Grain matters

The grain agreement is taking on more and more specific forms. It is an indicator of the bargaining power of Russia, which also receives certain benefits within the framework of this agreement. The first attempt is always a flop – on the second day after the signing of the documents, the Odesa seaport was attacked by missiles, although the documents state that the Russian Federation will not attack the port infrastructure involved in the export of grain.

How the aggressor will behave in the future, no one can say, but at least the parties have operational communications within the framework of the Joint Coordination Center, created as part of the grain agreement. In addition, as part of the agreement, the Russian Federation gets the opportunity to export its grain and fertilizers, so compliance with the agreements seems to be beneficial even for the aggressor. In addition, Ukraine can also export fertilizers.

The first ship – “RAZONI” under the flag of Sierra Leone, which is heading to Lebanon with a cargo of corn – went from the seaport of Odesa, although earlier it was noted that the first port would be Chornomorsk.

In total, 17 vessels have already been loaded in the three ports participating in the agreement – Odesa, Chornomorsk and Pivdenny. So far, ships blocked by the Russian Navy in Ukrainian seaports are being loaded. In the future, the arrivals of new ships are also expected – they will be chartered by the participants of the agreement from the countries of the Black Sea region. At the same time, the Ministry of Infrastructure wants to limit the shipment of grain to three vessels per day for about two weeks.

Of course, new ships will be extremely reluctant to go to dangerous Ukrainian ports. This is evidenced, in particular, by insurance rates, which, according to Reuters, have already increased 20 times – from 0.025% to 5% of the ship’s value (according to other data, up to 3-3.5% ).

According to various estimates, 18-25 million tons of last year’s crop should be exported, or 3 million tons every month (according to the estimates of the Ministry of Infrastructure). This does not fit into the 120 days – the period of validity of the agreement, but it can be extended. It should also be taken into account that by the end of July this year, 11.8 million tons of grain had already been collected. In general, this year, according to FAO estimates, Ukraine can harvest up to 51 million tons of grain.

Ghost of Mining industry

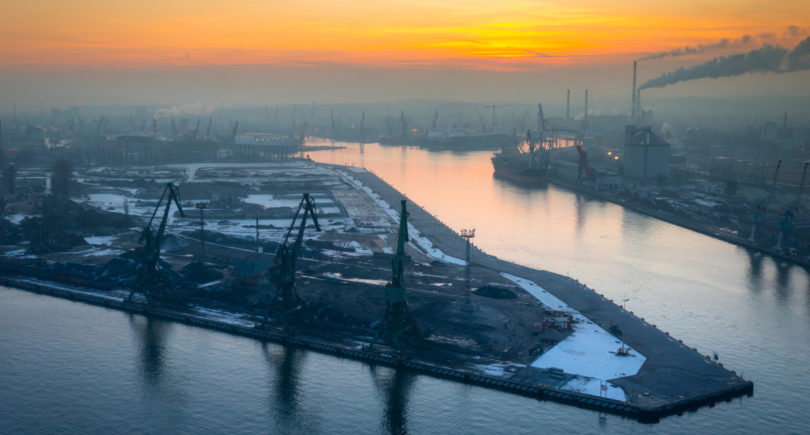

The agreement on grain will also affect other types of cargo. Metallurgical cargoes – steel and iron ore – are not included in the grain agreement, therefore, for their export, Ukrainian mining&metals companies are left with railways and, in isolated cases, motor vehicles with all the restrictions related to the capacity and road conditions of new logistics routes.

Adding the drop in prices and steel demand it will become clear that mining companies will not voluntarily increase either production or exports in the near future. Ukraine in January-June already reduced export of iron ore by 24.2% to 17 million tons, and ferrous metals to by 58.4%, up to 4.1 million tons .

“Logistics should improve, as customs crossings are expected to be unloaded. As a result, the choice of shipping priority – either grain or ore – will no longer be available, and the lion’s share of grain volumes will go to the ports. By September, we expect the railway logistics of our products to be facilitated. But all the same, railway transport will not be able to fully ensure the shipment of MMC products. The industry was also focused on sea ports, but there are no “ore” corridors yet,” emphasizes Serhii Henkulenko, chief engineer of the Rudomine mining company.

Another obstacle

One of the main problems in the logistics of metallurgical cargo was the low capacity of the western border crossings and queues of railway cars, which were formed because of it. The Grain agreement can contribute to the fact that queues will be shortened and the way will be opened for other types of cargo, not only for grain, which has been in the news and in priority recently.

“Undoubtedly, a significant part of grain cargoes from regions that were previously focused on port transshipment will return to the ports. No one wants to stand with their goods in multi-day queues at the western crossings, especially on the LHS line – the Polish broad-gauge line, which mainly exports steel goods. Another question is how much grain will be transported to the ports. On the other hand, the desire of cargo owners to go to some border crossings, including LHS, will decrease due to the opening of another logistics route,” says Yury Shchuklin, a member of the logistics committee of the European Business Association.

At the same time, Ukrzaliznytsia assures that the queues and the decrease in the transportation of steel cargoes are in no way interconnected.

“As a matter of fact, now the decline in export shipments of steel and ore is not connected with queues at the border. For the main directions, for example, Uzhhorod – Matevtse, Izov – Hrubeshuv, we coordinated transportation without any problems. Volumes were agreed in full – taking into account the availability of powerful unloading points and developed unloading infrastructure at metallurgists, grain and other cargoes went as an addition to the main cargo flow. At the same time, export shipments of grain have recently almost doubled – from 416,000 tons to 807,000 tons per month,” he emphasizes. Valery Tkachev, deputy director of the department of commercial work of Ukrzaliznytsia.

At the same time, according to Yuriy Shchuklin, the queues at the borders are created artificially, and their absorption will not lead to an increase in the flow of metallurgical cargoes.

“First of all, it is beneficial for the owners of wagons, including Ukrzaliznytsia, to keep the railcars loaded, because they are paid daily. Secondly, queues arose due to the lack of comprehensive planning. Ukrzaliznytsia and transport operators in neighboring countries plan their activities separately. Because of this, there is an imbalance and queues at the border are growing. In other words, I would not connect the decrease in queues and the increase in the flow of grain or steel cargo across the border. The implementation of integrated planning of freight transportation could really affect the increase in cargo flow,” adds Yurii Shchuklin.

According to him, the current decline in transportation of steel products is more related to the general drop in demand for iron ore in Europe, where steel production is falling and production facilities are shutting down.

“For example, in the direction through Uzhhorod, ore supplies decreased by 50-60% due to the shutdown of production facilities. Accordingly, Europe does not need ore in the current volumes and exports decreased. Thus, grain cargoes did not interfere with steelmakers in export transportation both in these directions and in general. Somewhere, perhaps, they overlapped, competed with each other in directions atypical for iron & steel exports, but it was insignificant. And on historically formed routes, where steel plants are located, transportation planning was first carried out for steel cargoes, and then the plans were distributed to the rest of the cargoes. Therefore, the grain agreement will, of course, have a positive effect on the transportation of all types of cargo. We can expect a decrease in the general queue at the borders, the train situation and carriage circulation will improve. We will be able to travel better at the border, part of the flow of grain cargoes will go through sea ports, and this will be a positive factor for iron & steel industry,” Valery Tkachev believes.

Previously, the Ukrzaliznytsia introduced temporary restrictions (conventions) on the transportation of iron and manganese ore to of the Czech Republic and of Poland, and this further limited export opportunities.

“Restrictions are mostly introduced by recipients or foreign carriers, not us. With a rare exception, in the direction where we see the presence of a long line, we introduce prohibitive conventions,” Valery Tkachev explains.

A question of traction

Even if the situation on the steel market improves in Europe, the question arises: will Ukrzaliznytsia have enough traction to ensure freight transportation with an increase in the flow of grain to ports and the export of mining&metals products to western border crossings.

“Before the war, we had enough traction, and now, with the reduction of the cargo base, it will definitely be enough,” Yuriy Shchuklin is confident.

During the war, Ukrzaliznytsia’s freight volume fell by 65%. If earlier the state operator transported 25-27 million tons of cargo, now it is 9.4 million tons. This is almost three times less. At the same time, the number of locomotives and wagons almost did not change.

“We are ready to transport more. When, in the current situation, we carry all export goods to the available 13 border crossings, with limited capacity, sections of the Lviv road, where there are weight restrictions, all this creates real difficulties for us as a carrier and significantly reduces the overall export potential of the country. If grain cargoes will partially go in the direction of sea ports, where we have completely different weight standards for trains, where the infrastructure is much more powerful, then the total volume of cargo transportation in the network will increase, that is, it will be unloaded in the direction of the western border crossings,” Valery Tkachev notes.

Situational conclusions

Therefore, the benefits of the mining&metals companies from the grain agreement will be minimal for the time being, except that the goods will reach consumers faster. In the current conditions, it is difficult to estimate even the amount of profit of mining&metals, if there will be any in the near future. For example, according to the results of June, Ukrzaliznytsia reduced transportation of iron and manganese ore through western border crossings and Danube ports by 16.1% compared to May – up to 1.5 million tons. Although in July Ukrzaliznytsia grew up transportation of iron and manganese ore by 3.2% compared to June – up to 2 million tons. The situation can still to improve since September, but no one can say for sure whether the demand for steel will increase and when.

Theoretically, it is possible to expand the agreement in the future, if, of course, the transportation of grain cargoes goes well. Turkey is already working on a fuel supply agreement that will help overcome the energy crisis. This arrangement will be analogous to a grain arrangement. So far, it is not very clear what and where will be delivered by sea – perhaps petroleum products and coal to Ukraine – but in any case, the implementation of such an agreement is also necessary for our country. Perhaps someday it will be the turn to reach an agreement on metallurgical cargoes, or seaports will be opened for transshipment of all types of cargo.