Posts Infrastructure logistics 2527 12 July 2022

In recent years, the share of Danube ports in the total Ukraine’s freight shipment was 2.5-4.2%

Every day Ukraine loses $170 million due to the blockade of the Black Sea ports and the occupation of those at the Azov Sea coast. Of the seaports, only the Danube ones are currently operating, namely Izmail, Reni and Ust-Dunaysk.

These are typical ports for river navigation, while earlier Ukraine relied on sea and ocean shipping. However, now these ports are forced to partially reorient themselves to coastal navigation for offshore transshipment of grain in the port of Constanta. In addition, recently the Ministry of Infrastructure opened the passage of ships through the Danube-Black Sea canal through the Bystre mouth. This became possible after the liberation of Snake Island from Russian troops.

Even the full loading of Danube ports and a significant increase in their throughput will not significantly help Ukrainian exports if the blockade of the Black Sea ports continues.

Unloved children

Before the war, the Danube ports did not cover any significant share of the total Ukraine’s port cargo turnover.

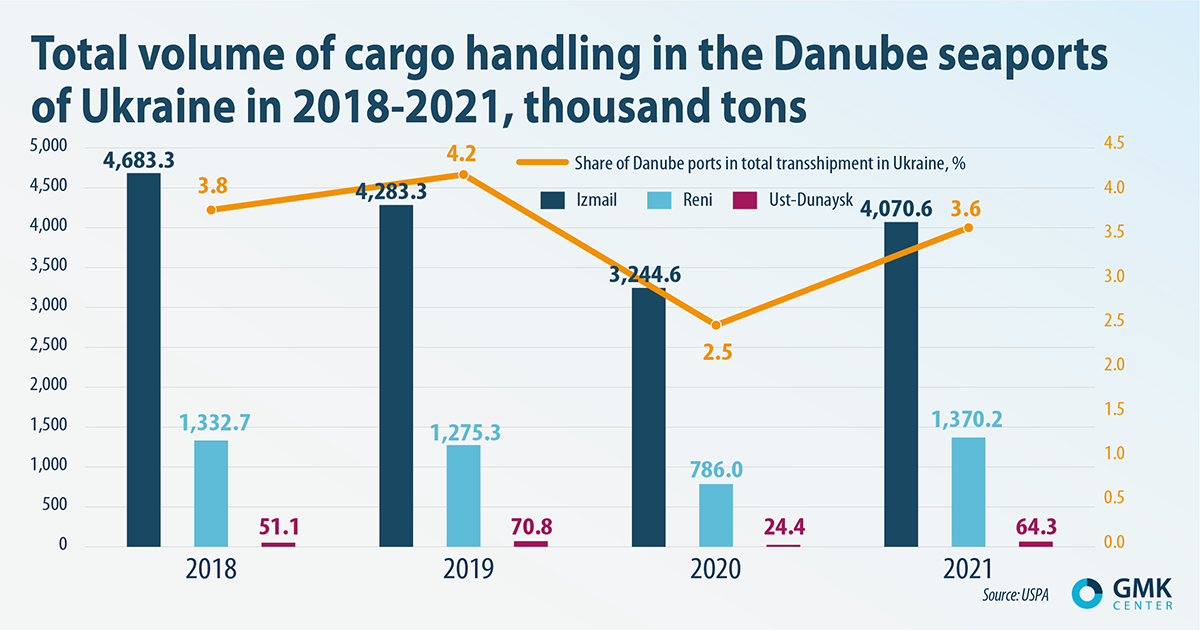

Share of Danube ports in total Ukraine’s cargo shipment in 2018-2021 was 2.5-4.2%, or 4-6 million tons of cargo. These ports were used by a rather narrow list of shippers, when it was necessary to deliver goods to customers along the Danube. The dynamics of the total volume of cargo handling in the Danube seaports of Ukraine in 2018-2021 was like at the picture below.

It is obvious that the port of Ust-Dunaysk is a complete outsider, which is due to its general manginess, the lack of the necessary depths and railway communication (the railway was built only to the ports of Reni and Izmail).

At the same time, the design throughput of the Danube seaports is significantly higher than their current indicators:

- port of Izmail – 8.5 million tons;

- port of Reni – 8 million tons;

- port of Ust-Dunaysk – 4 million tons.

The existing infrastructure, insufficient depths (Ust-Dunaysk), slow navigation on the Romanian side, often low water on the Danube and other factors, limit the actual capacity. In addition, the railway infrastructure is under the constant threat of missile attacks from the Russian Federation.

According to the results of April, the Danube ports increased their cargo transshipment by almost four times compared to February of this year, up to 850 thousand tons. However, current transshipment do little to improve exports after the huge backdrop of pre-war volumes. The damage to the bridge across the Belgorod-Dniester Estuary and the overload of railway border crossings with neighboring countries also add to the tension.

Export opportunities

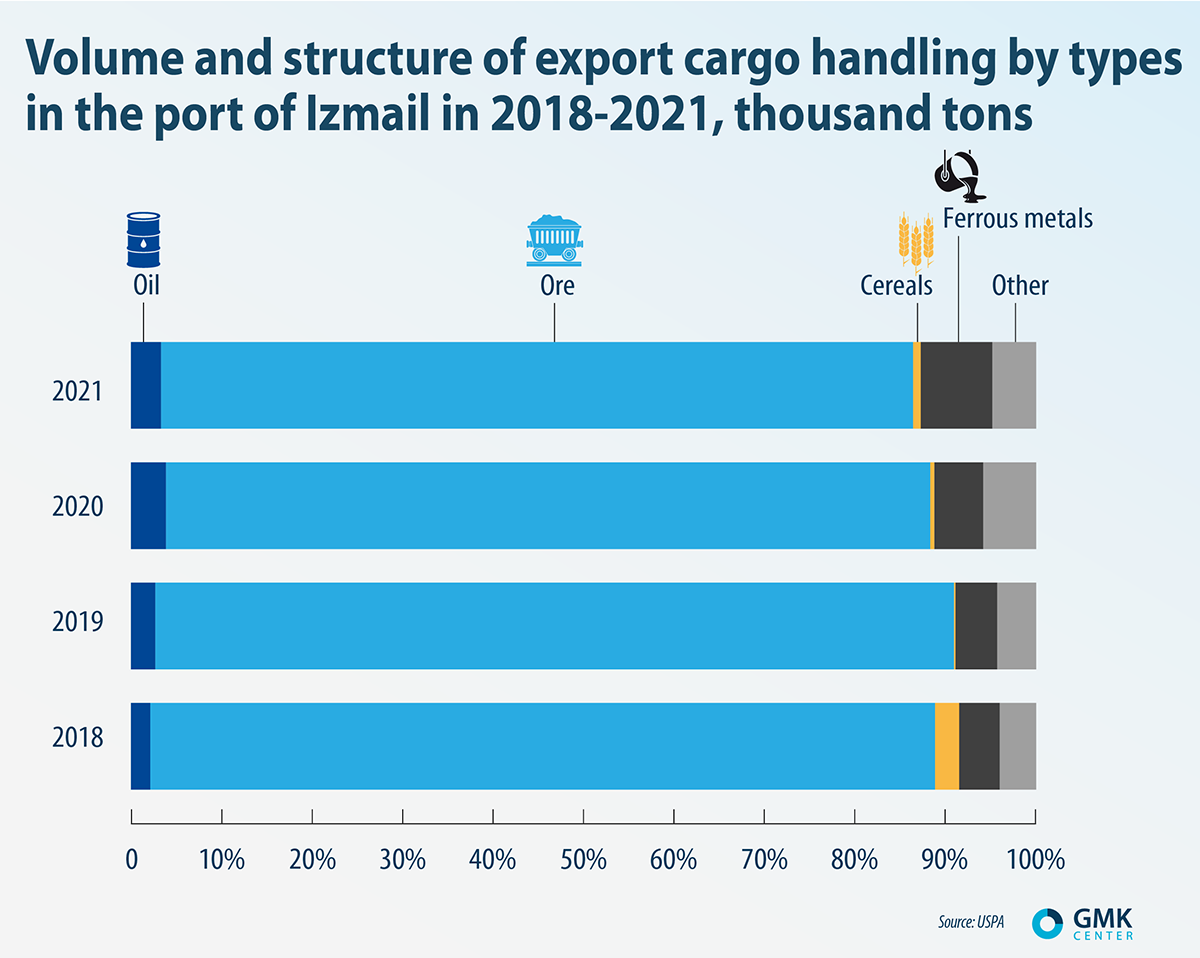

Share of Danube ports in export transshipment in Ukraine in 2018-2021 varied within 2-4% or 2.6-3.6 million tons of cargo. If look at the export opportunities of the three Danube ports in the retrospect of 2018-2021, then the bet should be placed on Izmail. In general, the volume and structure of processing of export cargoes in the port of Izmail in 2018-2021 looked like at picture below.

In the same period, the port of Reni relied on the shipment of transit cargo (on average 1.3 million tons per year), namely grain and other bulk cargo. Transshipment of Ukrainian export cargoes in the port of Reni in 2018-2021 did not exceed 60 thousand tons. Thus, Reni is open for transshipment of “own” cargo (if there is no transit).

At the same time, the performance indicators of the port of Ust-Dunaysk with an annual export of 30-60 thousand tons of grain do not allow us to consider it seriously as important export cargo shipment facility in the short term. The port may operate as the transshipment facility for goods delivered by road, which is expensive and inefficient. Although in the current conditions, even this option should be taken into account.

Increase capacity

Earlier, the Ministry of Infrastructure estimated the potential of transshipment growth in Danube ports up to 1 million tons per month, but now they plan to increase the throughput of Ukrainian ports on the Danube by 1.7 times, up to 25 million tons per year. Ministry plans to modernize the ports of Izmail, Reni and Ust-Dunaisk, build new terminals and hubs, connect the ports of Reni and Izmail with rail, and attract private investment for the construction of terminals.

In addition, the plan for the development of the Danube ports include:

- dredging;

- further implementation of the “Danube – Black Sea” deep-sea navigation project;

- construction of the inland navigation fleet;

- repair and modernization of the existing park;

- attraction of a used fleet for the fastest possible effect;

- construction and modernization of access railway tracks;

- direct railway connection;

- unconstrained road traffic conditions.

The planned investment in the project implementation is about $200 million.

Probably, Ukraine wants to increase the capacity of ports at the expense of Western funds, since such intentions were announced during the forum on the post-war reconstruction of the country in Lugano, Switzerland. However, many economists are critical of this plan and its expenditures (many are taken from pre-war reality). Until the sources of funding are identified and real works are not started, the plans of the Ministry are nothing more than intentions.

It is difficult to say how large their share will be in the total transshipment of seaports in Ukraine if the Ministry fulfill its intention, since the Black Sea ports may already be open by that time. It is also necessary to take into account the decrease in the cargo and the impossibility of processing transit cargo due to the war. If we correlate possible future capacities with transshipment at all seaports of Ukraine in 2020-2021, then 25 million tons is 15-16% of the “old” indicator of port cargo turnover.

As part of the empowerment of the Danube ports, one can also consider an initiative that has already acquired tangible forms. In autumn 2022, it is planned to restore the movement of freight trains on the Berezino (Ukraine) – Bessarabska (Moldova) section of the railway: Moldova will build 1.2 km of tracks, and Ukraine about 23 km. Due to this, Moldova plans to export and import goods after the resumption of railway communication through the Ukrainian port of Izmail. Ukraine, in turn, will be able to establish imports to Moldova and the European Union. However, in the current conditions, we lacked only the loading of the port of Reni with the export-import of Moldova!