Posts Global Market metal products 4514 22 January 2024

Turkish supplies accounted for almost 40% of all imports of steel products in 2023

After the outbreak of the war, steel production in Ukraine dropped dramatically, but the demand for steel products, although more than halved, did not disappear. There was a deficit on the domestic market for a number of items, which was quickly filled with imported steel products, including Turkish. But even after the improvement of the situation with logistics in 2023, Ukrainian iron and steel enterprises were unable to increase their exports to Turkiye.

Overall balance of trade

Total Turkish steel exports in January-November 2023 decreased by 29% y/y – to 13 million tons, but our country was not affected by this trend. Imports of Turkish steel products to Ukraine at the end of last year increased by 2.6 times – to 486 thousand tons, in money terms – by 2.1 times, to $430 million. The decrease in the indicator in 2022 was 15.7% .y/y – to 189.6 thousand tons and by 11.7% y/y – to $206 mln, respectively.

In this review we use Turkish data to estimate exports of Ukrainian iron and steel products to Turkiye. This is due to the fact that the volumes of exports of steel products from Ukraine to Turkiye according to the data of the State Customs Service of Ukraine (SCS) and the Turkish statistical office (TUIK) differ. For example, according to the SCS, Ukrainian pig iron exports to Turkiye in January-November amounted to 14 thousand tons, while according to TUIK – 109 thousand tons. The data on iron ore exports also differ significantly – 3 thousand tons versus 499 thousand tons. The reason for this could be exports from Ukraine to Turkiye via Romania or other countries as a transit hub.

Because of the war and the difficulties caused by it, Ukrainian exports of steel products to Turkiye, according to the UN Comtrade database, collapsed – from 2.7 million tons in 2021 to 263 thousand tons in 11 months of 2023, and in monetary terms – from $2 billion to $180 million. In contrast to imports of steel products to Ukraine, which increased in 2023 compared to 2022, exports continued to fall – in physical and monetary terms it fell by 60-65%.

Since February 2022, Ukraine has turned from a net exporter to a net importer of steel products in relation to Turkiye. Before the war, Ukraine supplied a lot of flat rolled steel to Turkiye, and now a significant volume of these Turkish steel products is going to our country. In 2023, 39% of Ukrainian steel imports came from Turkiye.

Türkiye is increasing its presence on the Ukrainian market

In 2022, due to the consequences of the war in Ukraine, there was a shortage of certain types of steel products, as a result of which Turkish rolled products partially filled the empty niches. Between pre-war 2021 and 2023, Turkiye increased supplies of such types of steel products to the Ukrainian market:

- hot-rolled steel – 48 times, from 3.2 thousand tons in 2021 to 155.8 thousand tons in 2023;

- cold-rolled steel – 7.5 times, from 7.1 thousand tons to 53.2 thousand tons;

- shaped steel – doubled, from 22.8 thousand tons to 46 thousand tons;

- pipes – doubled, from 15 thousand tons to 29.8 thousand tons;

- coated rolled products – by 64%, from 84.5 thousand tons to 138.4 thousand tons;

- rolled alloy steel – by 50%, from 3.4 thousand tons to 5 thousand tons.

Among other significant types of steel products, we can note the decrease in imports of Turkish rebar to Ukraine in the period 2021-2023 by 41% – to 45.4 thousand tons. However, even these supplies last year increased by 56% compared to 2022.

Main imports of steel products from Turkiye to Ukraine in 2021-2023, thousand tons

| 2021 | 2022 | 2023 | |

| Hot rolled steel | 3.2 | 38.5 | 155.8 |

| Cold rolled steel | 7.1 | 12.5 | 53.2 |

| Coated rolled products | 84.5 | 65.4 | 138.4 |

| Rebar (HSN Code 7214) | 77.3 | 29.0 | 45.4 |

| Shaped products | 22.8 | 23.2 | 46 |

| Rolled alloy steel | 3.4 | 2.8 | 5 |

| Pipes | 15.0 | I, I | 29.8 |

Data source: SCS

In 2023, Turkish steel products in certain positions occupied approximately such market shares in the total volume of consumption (number of imports to the total steel consumption in Ukraine):

- shaped rolled products – 35.1%;

- cold rolled steel – 21.7%;

- hot-rolled steel – 19.3%;

- rebar – 7.2%.

Turkish steel imports in 2023 amounted to approximately 40% of all foreign supplies of steel products to Ukraine. According to Ukrmetalurgprom, in 2023 imports increased by 80% y/y – to 1.1 million tons, but its specific weight decreased from 38.9% to 31.9% in 2022.

The growth of Turkish supplies of steel products was realized due to quite convenient, although relatively close logistics. Until August-2023, imported products could be delivered by containers to Ukrainian ports on the Danube or Romanian Constanta or via Bulgaria and Romania by road. The latter option, although quite long in distance, longer in time and costly in cost, but it turned out to work in comparison with the “floating” capacity of Ukrainian ports and railroads. Since last fall it has been possible to deliver large shipments of Turkish steel products to the ports of Greater Odessa.

Ukrainian iron and steel exports

The level of deliveries to the Turkish market of key items of Ukrainian exports of steel industry over the period 2021-2023 has strongly decreased:

- iron ore – from 1.2 million tons in 2021 to 499 thousand tons in January-November 2023;

- hot-rolled steel – from 1.17 million tons to 9.5 thousand tons;

- collection – from 877 thousand tons to 73 thousand tons;

- pig iron – from 295 thousand tons to 109 thousand tons.

Main items of Ukrainian exports of iron and steel products to Turkiye in 2021-2023 (January-November), th. tons

| 2021 | 2022 | 2023* | |

| Iron ore | 1184.5 | 585.2 | 499.2 |

| Scrap | 494.1 | 360.5 | 2.2 |

| Pig iron | 295.5 | 158.1 | 109.3 |

| Ferroalloys | 138.5 | 37.6 | 52.5 |

| Billet steel | 877.6 | 168.6 | 73.5 |

| Hot rolled steel | 1173.7 | 235.7 | I,5 |

| Cold rolled steel | 26.4 | 2, I | 0.0 |

| Coated rolled products | 3.8 | 1.5 | 0.0 |

| Wire rod | 11.5 | 0.0 | 0.0 |

| Alloy steel and semi-finished products | 96,9 | 15.3 | 0.0 |

| Rolled alloy steel | 41.4 | 5.1 | 0.0 |

| Seamless pipes | 56.4 | 28.2 | 17.7 |

* – for January-November

Data source: UN Comtrade

Last year, compared to pre-war 2021, supplies of alloyed steel products, cold-rolled steel, wire rod and coated steel to the Turkish market completely ceased. In addition, the export of scrap has almost completely disappeared, although in pre-war 2021 it amounted to 491 thousand tons. According to Ukrainian data, there were no exports of scrap to Turkiye in 2023, Comtrade database says about deliveries of 2.2 thousand tons. At the same time, according to some data, Ukrainian scrap exporters supply raw materials to Bulgaria and Poland, which are then re-exported to Turkiye. In total, at the end of 2023, scrap exports from Ukraine amounted to 182.5 thousand tons.

The minimum presence in the Turkish market remains at the Ukrainian ferroalloys, the level of decline in exports of which in the period 2021-2023 (January-November) years amounted to more than 60% – from 138 thousand tons to 52 thousand tons. Also, during the same period the supplies of seamless pipes significantly decreased – from 56 thousand tons to 18 thousand tons.

In total, in 11 months of 2023, steel imports to Turkiye increased by 14.8% y/y – to 17.6 million tons. The country became a net importer of rolled products, especially wire rod, for the first time since 2015. At the same time, steelmaking in the country is on a downward trajectory. According to Worldsteel, Turkish steelmakers produced 30.5 million tons of steel in January-November 2023, down 6.1% from the same period in 2022. On an annual basis, Turkiye’s steel production in 2022 fell 12.9% y/y – to 35.1 million tons.

At the end of last year, Turkiye was seriously concerned about protecting the domestic market from the influx of imported steel products. From January 30, 2024, the rates of customs duties and additional duties on certain types of hot-rolled, cold-rolled, stainless and galvanized steel products will be increased. In addition, anti-dumping duties may be imposed on hot-rolled coils from China, Japan, India and the Russian Federation in the near future, which are already under investigation. In addition, an investigation has been launched regarding protective measures on imports of wire rod supplied by Egypt, Malaysia and the Russian Federation. All these measures will not affect supplies of Ukrainian products.

FTA impact on trade

Last December, the Economy Ministry predicted that Ukraine and Turkiye would soon ratify the Free Trade Zone Agreement (FTA) signed in February-2022, after which it would enter into force. This may happen in the near future.

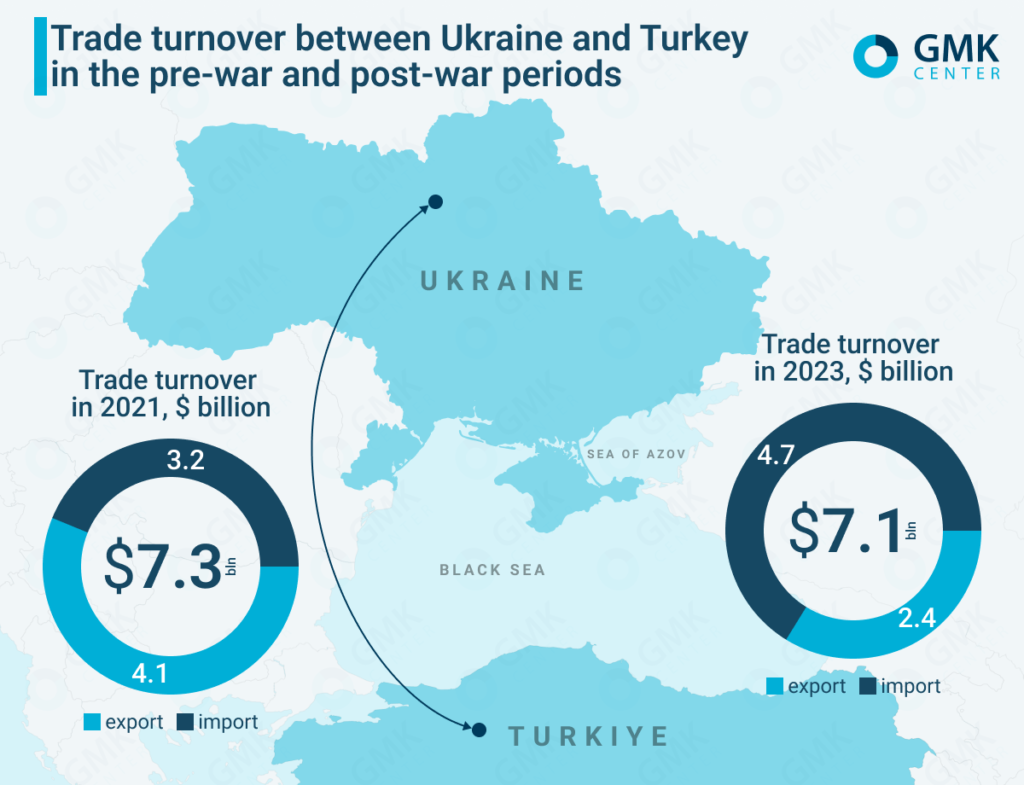

Since the beginning of the war, the balance of trade in goods has changed not in Ukraine’s favor. In 2021, the trade turnover between Ukraine and Turkiye amounted to more than $7 billion, of which Ukrainian exports amounted to $4.1 billion and imports – to $3.2 billion. In 2023, the trade turnover between the two countries was at the level of $7.1 billion, but now our exports amounted to $2.4 billion and imports to $4.7 billion.

The Ukrainian market will become more open for Turkish products. The total nominal export duty rate in Turkiye for Ukrainian goods under the FTA will be 10%, while the Ukrainian rate will be only 0.5%.

Pre-war assessments of this agreement for Ukrainian steel industry showed no significant impact, but it was likely to expand the range of exports. Earlier Ukraine supplied semi-finished products and billets to Turkiye in the processing mode, but due to the war and decline in steel production the situation has changed, and our steelmakers will no longer be able to supply as many products as before.

The opportunities for Ukrainian exports of steel products have significantly improved due to the operation of the sea corridor, but this is not a significant advantage for Ukrainian steel companies against the background of a big drop in production after the outbreak of the war.

For a long time Ukraine and Turkiye have been traditional partners in steel trade. During the war, deliveries continued, although the status of the participants changed: Ukraine became a net importer of steel from Turkiye. It is highly likely that this status will remain for some time after the end of the war. Turkiye has a developed steel industry and can supply steel products needed for post-war reconstruction.