Posts Industry steel trading 2772 16 January 2024

Domestic steel consumption, taking into account imports, is approximately 3.5 million tons in 2023

The partial revitalization of business activities and the restoration of infrastructure in certain regions led to a significant increase in demand for steel products last year.

Although steel trading companies continue to face numerous problems caused by the war, they have learned to quickly restructure their operations, offer customers the full range of products they need and avoid shortages.

Demand recovery

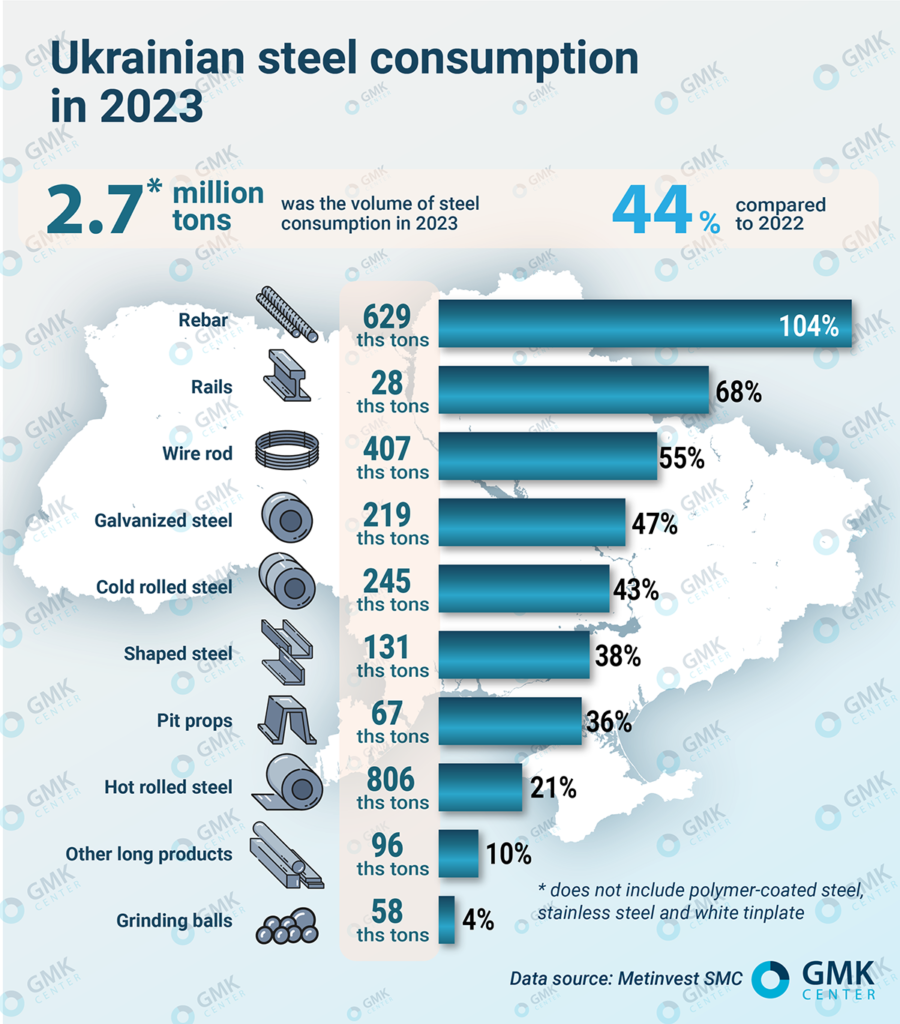

After a significant drop in 2022, the demand for steel products in Ukraine recovered last year and grew significantly. According to Oleksandr Vedernikov, Head of Marketing Department of Metinvest-SMC, the capacity of the domestic steel consumption market in 2023 increased by 44% y/y – to 2.7 mln tons (excluding polymer-coated rolled products, stainless steel and poorly-coated steel products) – to 2.7 mln tons (excluding polymer-coated rolled products, stainless steel and white tinplate). The revised market volume target for 2022 is 1.9 million tons (previously 2 million tons).

More complete data, but without detailing individual types of steel products, operates Ukrmetallurprom, according to which the consumption of rolled steel in Ukraine for 11 months last year increased by 2.06 times y/y – to 3.25 million tons, to 3.25 million tons. In 2023, domestic consumption of steel, including imports, will amount to about 3.5 million tons.

“This growth is primarily due to the activation of state projects – restoration of various infrastructure, including bridges, construction of energy covers. There are also such projects as, for example, an underground school in Kharkiv – one of the examples of large state orders, which in turn leads to an increase in the consumption of rolled steel. However, this would not have happened without financial assistance from international partners. In case of further financial support of Ukraine, the trend of consumption growth will continue further,” Sergiy Kovalenko, commercial director of the Vartis National Network of Metal Centers, explains.

Amid an increase in overall steel consumption, individual companies, including those specializing in the sale of certain types of steel products, also showed significant growth. For example, sales of Evrometal, which specializes in imported rolled metal products, increased by 50% in 2023 compared to the previous year, while sales of Modus, which focuses on stainless steel products, increased by 60%.

Market trends

Among the key market trends, steel trading companies name the following:

- Intensification of construction and rehabilitation of infrastructure, construction of energy covers, as well as increased renovation of destroyed housing. According to Metinvest-SMC, the growth in demand for steel for infrastructure projects has become significantly noticeable in the rebar segment, the capacity of which has almost doubled, as well as heavy plate.

- Significant increase in the inflow of imports to Ukraine, especially the growth of imports of thick plate (from 10 mm). In total, according to OP Ukrmetalurprom, for 11 months of 2023 imports increased by 86% y/y – to 1.03 million tons. However, the specific weight of imports decreased to 31.6% from 34.9% in January-December 2022.

- Exit of small metal traders from the market and consolidation of existing players.

- Regional shift in the main share of sales. In the central regions the volume of rolled steel consumption increased due to increased business activity and infrastructure restoration, and in the western regions – due to new construction. As Vikant notes, the volume of steel trading in the western regions is already at approximately the pre-war level.

- Rapid adaptation of enterprises to the constantly changing external environment – mobility and efficiency in decision-making, work in conditions of uncertainty and complexity of forecasting, constant control of the entire supply chain and search for new logistics routes.

- Impact of relocation of enterprises to safe regions. As Sergiy Kovalenko notes, the relocated enterprises influenced the demand for rolled metal products as early as in the fall of 2022. After the end of the blackouts, around the end of February 2023, they increased production volumes and achieved constant consumption of rolled steel products, which also became one of the drivers of market growth in 2023.

- Increase in logistics costs at the end of 2023. According to Vitaliy Pritula, director of Evrometal, the border blockade in November-December led to the fact that due to the high price of delivery (tariffs for delivery of rolled steel products from Europe increased 3-4 times) and the corresponding increase in its own prices, the company did not import new batches of steel products. The situation is the same for many other steel traders, who have become very cautious about new imports and have begun to build up stockpiles. For their part, consumers expect the border to be unblocked and prices to fall after the situation stabilizes, so demand at the end of the year was somewhat lower.

In addition, the entry of European companies into the Ukrainian market is not yet an obvious trend (and may not become one). On the one hand, under the conditions of post-war recovery of infrastructure, steel consumption in Ukraine will certainly grow, which will create interest for European companies. However, the Ukrainian stee; trading market is already quite structured and it is difficult to take a significant share in it «in a hurry». Ukrainian companies are not afraid of the possible entry of European companies into our market.

«All European companies are aware of the high competition in the domestic market of Ukraine, so they are unlikely to come here today. The only thing to worry about is an excessive influx of imported steel products, but we hope that Ukrainian manufacturers will protect the domestic market from imports,» Vartis noted.

Consumption of steel products

Steel consumption in different segments of the Ukrainian economy is uneven, as a result of which the structure of demand for certain types of steel products is changing. Thus, in 2023, there was active growth in the long products segment, primarily due to rebar and wire rod.

«Last year, the capacity of the rebar market grew by 104% – to 629 thousand tons, while the wire rod segment grew by 55% – to 407 thousand tons. The market of other long products (round, strip, square) increased by 10% – to 96 thousand tons. The high growth rate in the long products segment allowed the share of this segment in the total consumption structure to grow to 52% in 2023 against 47% in 2022,» Olexander Vedernikov says.

According to Metinvest-SMC, last year the market capacity of hot-rolled steel increased by 21% to 806 thousand tons, cold-rolled steel – by 43%, to 245 thousand tons, and galvanized steel – by 47%, to 219 thousand tons. Over the same period, the market for shaped products (beams, angles, channels) grew by 38% – to 131 thousand tons.

At the same time, the situation with the sales structure varies depending on the specialization of metal trading companies.

«In comparison with the pre-war period almost nothing has changed here. As before there is a half division of demand between stainless steel sheets and tubes, another small percentage of sales is taken by long products. At the same time, the percentage of construction companies purchasing stainless steel has slightly decreased,» Sergiy Savenko, CEO of Modus, says.

The situation in the thick plate segment developed separately. According to Vitaliy Pritula, in the second half of 2023, steel fabrication plants noted an increase in demand for infrastructure rehabilitation, in particular for the production of protective structures for power facilities. It is estimated that 14-15 thousand tons of steel structures were used in this direction. In total, in January-September last year, the production of building metal structures and products increased by 24%.

“For the production of structures for power facilities, thick sheet steel 40-100 mm was mainly used. Since such demand was sudden, it even led to a shortage of these metal products from 40 mm in Europe. Ukrainian importers almost simultaneously bought out all the stocks there for these orders,” expert says.

The growth of steel consumption in the construction of protective structures for power facilities will continue in 2024, as in 2023 was only the first stage of the implementation of the relevant program. In early December-2023, it was announced that the State Agency for Infrastructure Restoration and Development of Ukraine received 20 thousand tons of steel for the construction of the second level of protection of power facilities under the USAID project, which will cover 22 substations and 63 autotransformers in 14 regions. In total, USAID is working on three levels of protection.

In general, as Vartis notes, now in Ukraine the whole range of rolled metal products is in sufficient quantity, i.e. there is no deficit – all steel trading companies of Ukraine have eliminated it by joint efforts. Moreover, now there is even a surplus of thick plate – from 10 mm and more.

Directions of consumption

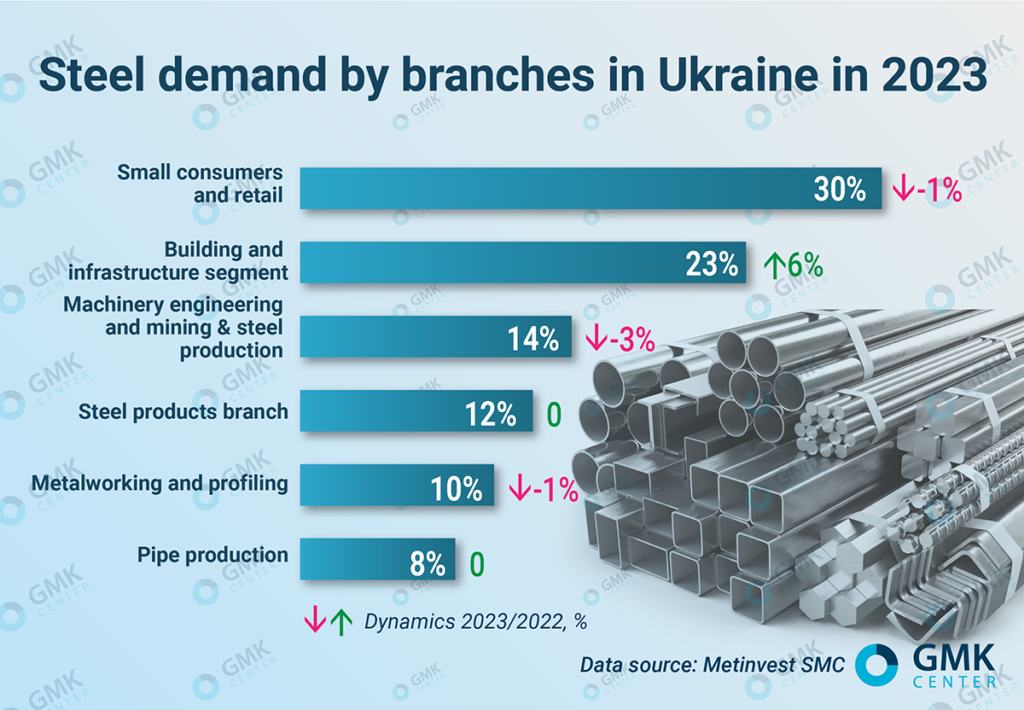

The sectoral structure of steel consumption fully reflects the current economic situation in the country and the dynamics of individual industries. The segment of small consumers and retail trade remains the largest consumer of metal products. Its specific weight has significantly increased in 2022 – up to 31% against 24% in 2021 and remained at a relatively high level of 30% at the end of last year.

According to Metinvest SMC estimates, the construction segment in 2023 showed an increase in specific weight in the consumption structure up to 23% against 17% in 2022 due to infrastructure projects. This is confirmed by official statistics. According to the State Statistics Committee, in the first 9 months of 2023, the volume of construction works increased by 21% y/y, including the construction of engineering structures increased by 34%, non-residential buildings – by 14%.

«There was active construction of warehouse and logistics centers, grain elevators in the western regions. Therefore, in the first half of 2023 there was a high demand for steel products for construction purposes – beams, channels, angles, etc.,» Vitaliy Pritula adds.

In other words, the construction segment and its steel consumption is growing due to the restoration of infrastructure and construction of commercial projects in a number of regions, while housing construction is stagnating, with a decline of 4.3% in the first 9 months of 2023.

«Now the situation in the housing construction market is very difficult. If developers sell housing, in most cases, it is already finished objects. Few people are ready to invest in housing at the foundation stage. Therefore, we have lost a lot in this sector,» emphasizes Inna Ponomareva, General Director of Vikant.

According to Olexander Vedernikov, during 2021-2023, there was a systematic decrease in the share of large consumers, in particular, machine, railcar and shipbuilding enterprises and the steel sector. Their specific weight in the structure of steel consumption decreased to 14% in 2023 from 19% in 2021.

This also fully corresponds to the dynamics of industrial production, which grew by only 2.4% y/y in the first 9 months of 2023 after falling by 36.9% y/y in 2022. Although in January-September 2023 machine building and production of arms and ammunition showed growth of 15% and 76% respectively, but many other industries showed a more modest increase or even decline, such as steel industry – by 14%.

Among the large industries, we can note the maintenance of the share in 2023 at 12% of the consumption structure in the metalware industry, a significant part of whose products are exported. Although, in general, export orders are not the prevailing factor of domestic demand for steel products in Ukraine now.

«The main industry in Ukraine that consumes stainless steel today is food machinery. Most of the orders processed by this industry are Ukrainian, and the industry itself works mainly for the domestic market,» Sergiy Savenko says.

Steel expectations

Steel trading companies expect continued sales growth in 2024 and the key trends of 2023, in particular the recovery of infrastructure and strong demand for steel products for construction purposes. It is expected (based on current economic assumptions) that demand for metal products may grow by 10-17% this year. Thus, taking into account the current situation on the rolled steel market, Vartis plans to increase sales volumes this year by 10-15%, which is approximately the same as it was in the forecast for 2023. In turn, Metinvest-SMC plans to achieve sales growth of 17%.

«We plan to achieve this figure through the loading of domestic metal enterprises that are part of Metinvest Group, redistribution schemes with other Ukrainian producers, as well as through the active development of imports – hot-rolled thick plate, galvanized rolled products, shaped and long products that are not produced in Ukraine. Another task is further development and renewal of the distribution network,» Olexander Vedernikov explains.

Estimates of growth of the domestic market of metal consumption in the current year by market operators are in the range of 8-10%. Thus, Metinvest-SMC estimates that the capacity of the domestic steel consumption market in 2024 will grow by 8% – up to 2.9 million tons, but, at the same time, it will be only 2/3 of the consumption level of 2021.

«We have a general forecast is a 10% growth in sales figures. This will happen due to the gradual restoration of infrastructure to destroyed facilities, construction of shelters of energy facilities. Also in 2024, we expect a gradual increase in rolled steel prices throughout the period,» Sergiy Kovalenko adds.

Despite the fact that in the current situation in the country, all forecasts and expectations are very relative, since the beginning of the war, steel trading companies have already gained considerable experience of working in an uncertain environment and have a significant «safety margin» to quickly respond to all the challenges of the external environment. At the same time, we observe cautious optimism and interest of foreign suppliers of steel products related to potential projects for the reconstruction of Ukraine, which should be supported by financing from international partners.