Posts Global Market eurozone GDP 2777 24 October 2023

One step away from recession: Europe shows minimal economic growth According to the consensus forecast, the eurozone economy is expected to grow at 0.2% and 0.3% Q/Q in Q1 and Q2 respectively

Although the increase in key interest rates in Europe has helped to reduce inflation, it has further slowed down the economic development in the eurozone countries, which have not yet recovered from t the sharp rise in energy prices in 2022. In addition to the numerous domestic factors that are dragging the economy down, external factors have been added, such as the slowdown in the Chinese economy and geopolitical instability in the Middle East.

Fighting inflation

Since the beginning of 2023, the European economy has shown minimal growth. GDP growth in the eurozone in the second quarter compared to the previous quarter amounted to 0.1%. The same growth rate was recorded in the first quarter. At the same time, the dynamics of the largest European economies was multidirectional. Thus, the GDP of Germany in the second quarter compared to the previous quarter did not change, in France – increased by 0.5%, in Italy – fell by 0.4%.

Although the European economy is now characterized by weak domestic demand, especially consumer spending, which is caused by high prices for goods and services, it has not slipped into recession even despite high interest rates. This suggests that it has a sufficient margin of safety. The main thing everyone feared was stagflation, but the EU managed to avoid it. Initially, there were expectations that the first half of 2023 would bring recession, and the second half – recovery of economic activity. However, it turned out to be the opposite – the second half of the year is more challenging.

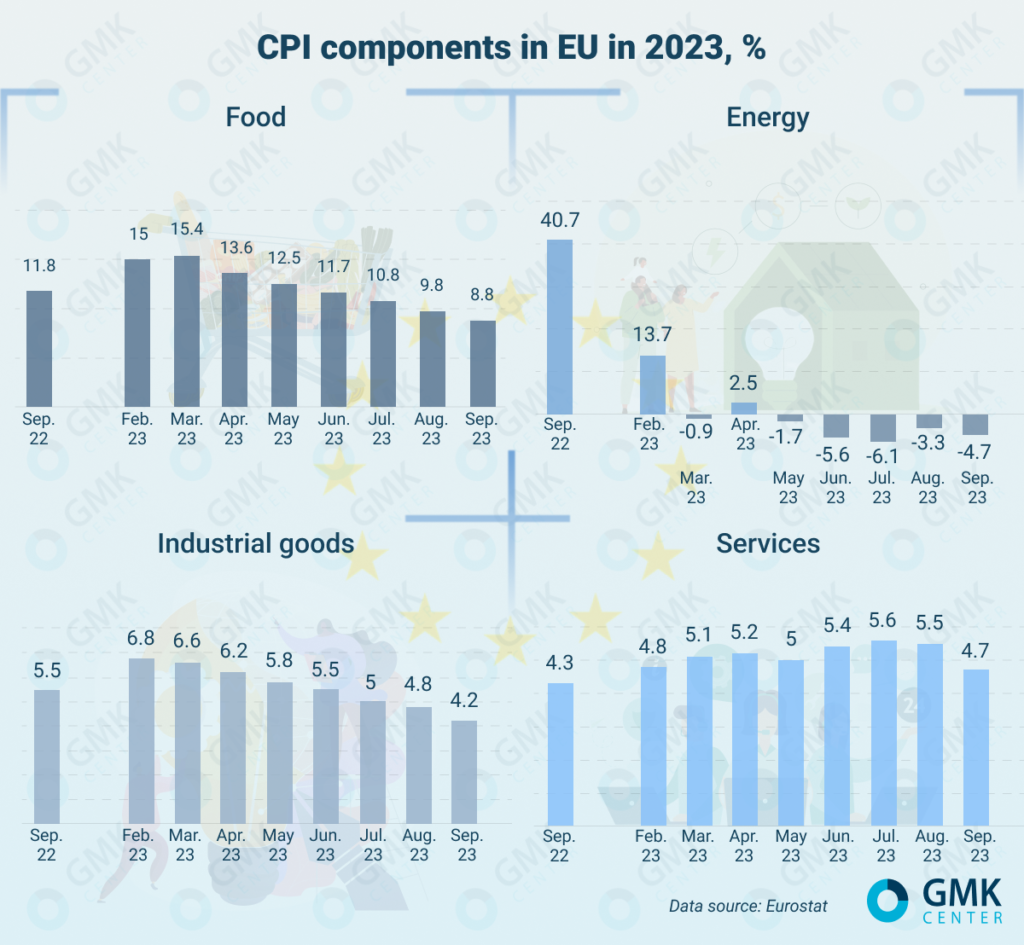

To combat high inflation, the European Central Bank (ECB) raised the annual benchmark lending rate from 0% to the current 4.5% in 10 cycles since June 2022. This has helped to slow consumer price growth. Eurozone inflation fell to 4.3% y/y in September, down from 5.2% y/y in August. The rate was the lowest since October 2021.

The rate hike is being implemented to «cool» the services sector, but it is slowing the momentum in manufacturing and construction even more because of the significant slowdown in bank lending. Now inflation remains high in the services sector, while prices in manufacturing are falling. According to Eurostat, producer prices in the eurozone rose by 0.6% in August relative to July, but collapsed by 11.5% year-on-year in August-2022. This sharp fall in annualized terms is due to a high base of comparison caused by huge energy prices last year. The year-on-year decline in producer prices has been witnessed for four consecutive months.

The ECB says that the rate will remain high as long as necessary, i.e. the European Central Bank may raise it in case inflation increases. According to a Bloomberg survey, analysts expect the rate to be at peak levels for most of next year, until about September 2024.

«Inflation on an annualized basis is falling due to September’s high base. But the month-to-month dynamics remains significant at 0.3% m/m, which suggests that inflation rates will not go below 3% in 2024. So, we should expect some weakening only in the second half of the year. This is possible, if no significant negative events occur, the risks of which are now enough», says Andriy Tarasenko, Chief Analyst at GMK Center.

The target level of inflation in the eurozone is 2%, and the ECB intends to do everything to achieve it. The European Commission forecasts inflation in the euro area in 2023 and 2024 at 5.6% (previously – 5.8%) and 2.9% (2.8%), respectively.

Business fears

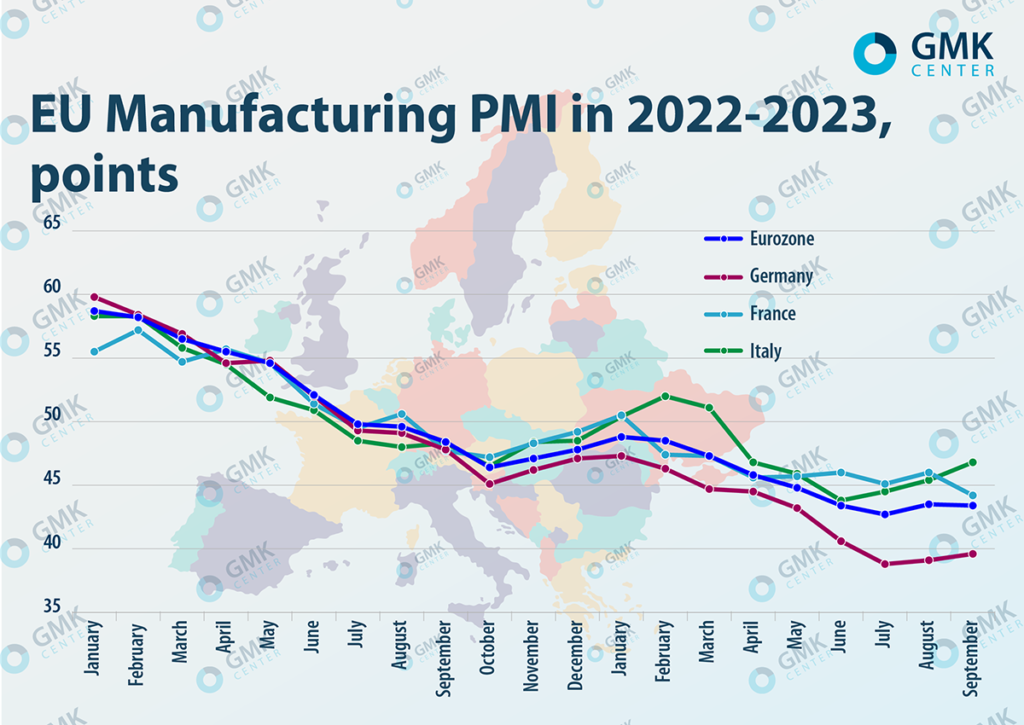

The eurozone economy has yet to feel the impact of the latest rate hike cycle, which makes businesses wary of a further deterioration in the economic situation despite the fact that the eurozone’s macroeconomic indicators are moderately good. Such concerns affect business expectations. For example, the eurozone’s overall Manufacturing PMI fell to 43.4 points in September from 48.8 p. in January.

Germany, the eurozone’s largest economy, was particularly affected, now showing major problems. The index in the German processing industry in July-September fell even below the 40 p. level, amounting last month to 39.6 p. The main problem is a strong drop in new orders, which forces to reduce production. The situation is slightly better in France and Italy, where the PMI in September amounted to 44.2 p. and 46.8 p. respectively.

Reference: PMI above the 50 p. mark indicates an increase in activity in the industrial sector

At the same time, leading indicators of business expectations in Europe show multidirectional dynamics. Thus, the monthly Eurozone Sentix Investor Confidence index (business expectations for the next 6 months) amounted to -21.9 p. in October compared to -21.5 p. and -18.9 p. in September and August, respectively.

At the same time, the ZEW Economic Expectations Index, which is calculated as a percentage ratio between favorable and unfavorable estimates of investors and analysts for the next six months, shows an improvement in expectations in the eurozone. This is despite the negative effects of rising tensions in the Middle East, where the regional conflict between Israel and Palestine could escalate into a global war. The impact of this conflict on the global and European economies will be even stronger than the war in Ukraine, which mainly affected Europe.

“The ZEW Institute’s Eurozone Economic Expectations Index, released on October 17, showed an extremely sharp rise and was above zero for the first time since April. The survey was conducted in October and its results take into account the reaction to the war in the Middle East. Therefore, the improvement in economic expectations in such a situation was unexpected. This is a good sign, it indicates the stability of European business sentiment to external risks”, says Andriy Tarasenko.

Also, European business is afraid of the growing level of government debt. In some countries it exceeds 100% of GDP. In particular, the highest level of public debt at the end of March-2023 was in Greece (168.3% of GDP), Italy (143.5%), Portugal (113.8%), Spain (112.8%) and France (112.4%). According to Eurostat, the total government debt of 20 eurozone countries at the end of March 2023 amounted to 91.2% of GDP, while for the 27 EU member states – 83.7%.

The deterioration of the situation on the debt market has already manifested itself in the fact that the yields on government bonds of Germany and Italy have risen to the level of 2011-2012. Some analysts expect that amid a record budget deficit, the situation with Italian government debt may become the next point of crisis in the eurozone. In general, according to the forecast of the Financial Times, the state debt of the European Union by 2026 may reach €900 billion compared to the current €450 billion.

In addition, business activity in the eurozone is significantly affected by the slowdown in economic growth in China. The number of export contracts in Europe is decreasing, and, for example, the German economy is heavily dependent on exports to China. In September, international institutions lowered their forecasts for the dynamics of China’s economic development in 2023, estimating it in the range of 4.5-5.1%.

Euro forecasts

At the end of 2022, the eurozone economy grew by 3.5%. In the current year, economic growth will be significantly lower. According to the consensus forecast (as of September), it is expected that in the III and IV quarters of 2023, the dynamics of the European economy will be at 0% and 0.1%, respectively, while in January-2023 expectations for both quarters were equal to 0.3%.

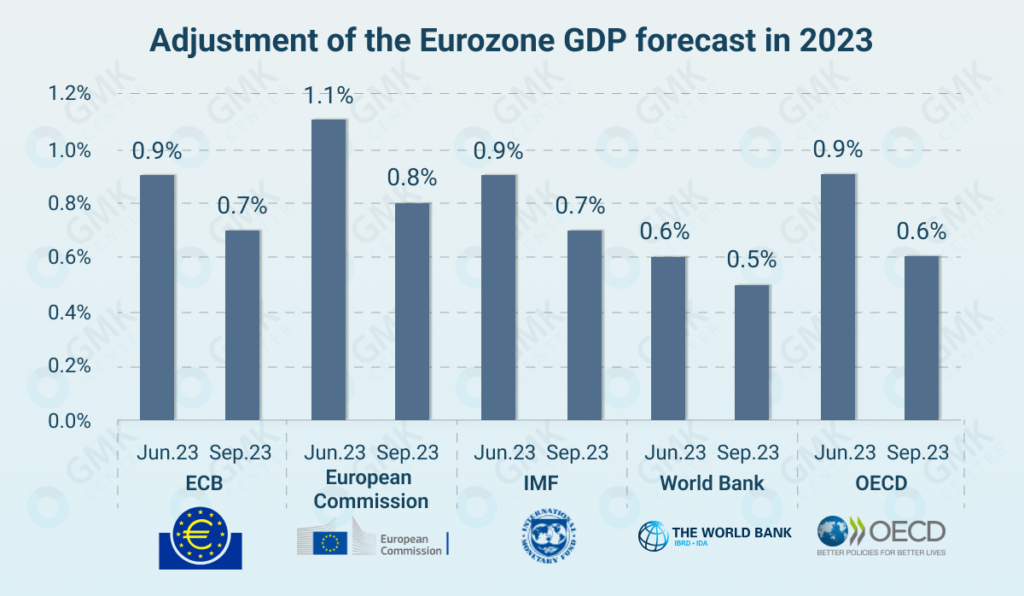

In September, analysts adjusted forecasts of the euro area GDP dynamics for 2023 (compared to June expectations) downward:

- ECB – from 0.9% to 0.7%;

- European Commission – from 1.1% to 0.8%;

- IMF – from 0.9% to 0.7%;

- World Bank – from 0.6% to 0.5%;

- OECD – from 0.9% to 0.6%.

It is expected that the driver countries of the European economy will have multidirectional dynamics in 2023. According to the forecast of the European Commission, the GDP of Germany in 2023 will decrease by 0.4%, France and Italy – will grow by 1% and 0.9%, respectively.

At the moment, analysts forecast a decline in inflation and GDP growth in the eurozone for 2024 in the range of 1-1.3% y/y, which is higher than the current year. The first half of next year is likely to be challenging – high interest rates and geopolitical instability in the world limit the prospects for the EU economy. According to the consensus forecast, the euro economy is expected to grow at 0.2% q/q and 0.3% q/q in Q1 and Q2 2024, respectively, 0.4% q/q each – in Q3 and Q4.

“The weaker growth momentum in the EU is expected to extend to 2024, and the impact of tight monetary policy is set to continue restraining economic activity. However, a mild rebound in growth is still projected next year, as inflation keeps easing, the labour market remains robust and real incomes gradually recover,» the European Commission said in its report.