Posts Companies Liberty Steel 4700 18 December 2023

The indicators of the steel division of the company are affected by the unfavorable situation in the EU steel market

LIBERTY Steel, an international steel and mining company with a steel production capacity of over 14 million tons per year and a rolled steel production capacity of over 24 million tons per year, is gradually losing ground in the global steel market.

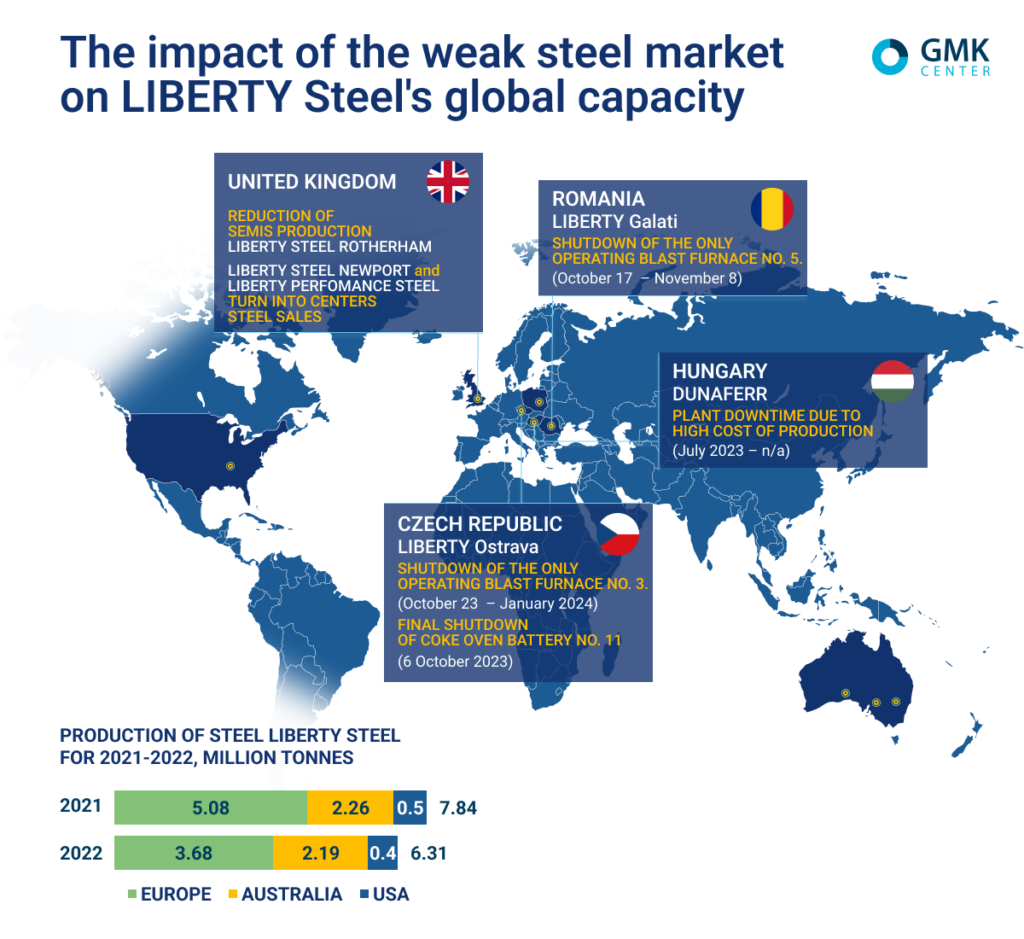

The main factor affecting the company’s performance is the unfavorable situation on the European steel market. In 2022, the European division of LIBERTY Steel reduced steel production by 1.396 million tons (-27.5% y/y) – to 3.68 million tons.

BF-BOF steel production in 2022 amounted to 3.34 million tons, down 1.22 million tons (-26.8% y/y). At the same time, EAF steel production decreased by 173 thousand tons compared to 2021 (-33.9% y/y) – to 337 thousand tons. Last year’s results of the company’s European division declined due to the high cost of energy, macroeconomic problems in the EU, which provoked a decline in steel demand, and the growing presence of cheaper imported products in the European market.

European steelmakers, including LIBERTY, have been reducing and suspending capacity to cope with weakening demand and rising production costs. In 2023, the situation continues to be difficult as steel prices and demand are at low levels and production costs are still high.

As a result of these factors, the company had to introduce temporary shutdowns and reduce production at its plants in the Czech Republic and Romania. The recently acquired Dinaffer plant in Hungary is also idle and there are liquidity problems at the Belgian Liberty Liege plant.

The main shutdowns began in the fall and winter. Thus, on October 23, 2023, the Czech plant LIBERTY Ostrava was suspended. The company suspended its only operating blast furnace No. 3 amid falling demand in Europe. Initially, the unit was scheduled to resume operation in two weeks, but the company adjusted its plans and the blast furnace is now expected to start up no earlier than January 2024.

Overall, the annual capacity of LIBERTY Ostrava reaches 3.6 million tons of steel, but actual production volumes are lower. In particular, in 2021, the plant produced 2.28 million tons of steel, up 33% compared to 2020, which is the highest level since 2016. Production of rolled products reached 1.48 million tons, and pipes – 136 thousand tons.

LIBERTY Ostrava’s problems are related to debts. According to Argus.Media, LIBERTY Ostrava owes its electricity supplier Tameh Czech more than CZK 2 billion (€81.8 million) and has outstanding bills of more than CZK 1.2 billion. At the same time, the steel company is the only customer of this energy supplier, and non-payment of bills threatens bankruptcy. It is noteworthy that 50% of Tameh Czech shares belong to the former owner of the plant in Ostrava, the ArcelorMittal Group.

Currently, LIBERTY Ostrava has received a court order for protection from the energy supplier and is preparing a restructuring plan, which includes the discontinuation of certain products that are not profitable.

In addition, on October 6, 2023, the Czech plant announced that one of its three coke oven batteries (No. 11) was shut down permanently. The company explains this decision by saying that the operation of the unit was unprofitable given the excess production capacity on the market. The process of shutting down the coke oven battery will take several months.

From October 17 to November 8, 2023, the only operating blast furnace No. 5 at LIBERTY Galati’s steel plant in Romania was suspended. The company attributed the shutdown to the high cost of energy and rising raw material prices.

LIBERTY Galati also reported that it is adapting to the current challenges by adjusting its product range and work schedules. In addition, the company is working with the government to reduce the impact of high energy costs on production.

«We continue to work with the government to find solutions to reduce the energy share in the cost of steel, which currently stands at almost 40% per tonne of output compared to just 8% in 2019,» commented plant director Prasanta Mishra.

In 2021, LIBERTY Galati achieved a record pig iron production volume of 2.1 million tons at Blast Furnace No. 5. The total steel output amounted to 2.35 million tons with a production capacity of 3 million tons of steel per year. The hot strip mill produced 1.62 million tons of products, up almost 20% y/y.

In mid-July 2023, Liberty won a tender for the acquisition of Hungary’s Dunaferr, offering €55 million for the company. Thus, the company’s European division increased its nominal capacity by 2 million tons of rolled steel per year.

The plant still has one blast furnace in operation, which is currently idle due to high production costs. In July, the company’s rolling shops were idle due to a lack of raw materials and a weak order book. In August 2023, they were restarted, but later the company planned to shut them down after rolling the remaining slabs and re-rolling hot-rolled coils.

The company’s US and Australian divisions did not suffer such significant losses in 2022. In particular, in 2022, the company’s US operations produced 438 thousand tons of steel, down 11.7% compared to 2021. Finished products amounted to 513 thousand tons (-7.7% y/y).

LIBERTY Steel USA employs about 1,500 people. The annual rolling capacity of the US facilities is estimated at over 1.5 million tons. The division is vertically integrated and produces almost all of its products from scrap.

LIBERTY Steel Australia employs nearly 7,500 people. In 2022, the Australian division reduced steel production by 13.3% y/y – to 886 thousand tons, while its annual production capacity reaches 3 million tons. Accordingly, the available production capacity is not fully utilized.

In the UK, LIBERTY is one of the three largest steel companies. It owns one electric arc furnace in Rotherham (LIBERTY Specialty Steels – Rotherham Steel & Bar) and several rolling mills that produce specialty steels, pipes, hot-rolled coils and other products. The total annual capacity of the company’s rolling mills is about 3 million tons.

Amid the unfavorable situation on the domestic and global steel markets, LIBERTY Steel United Kingdom plans to focus on high-value products for the aerospace, energy and machine-building industries to break even.

In addition, the company plans to reduce the production of semi-finished products for rolling mills at its Rotherham plant and replace these volumes with imported products due to high in-house production costs. Production at LIBERTY Steel Newport (with a production capacity of 1 million tonnes of hot-rolled coils per year) and LIBERTY Performance Steel West Bromwich has already been suspended. In the future, the parent company plans to turn these facilities into sales and distribution centers.

Thus, the UK division is also affected by high energy prices and the difficult realities of the steel market, forcing it to cut back and restructure production, similar to European mills. In addition, the company is on course to turn its UK unit into a 2 million tons per year green steel hub, which will also affect production volumes in the long term.

Liberty Steel’s prospects are negatively affected by a dispute with ArcelorMittal over debt for previously acquired assets. In 2019, Liberty Steel acquired ArcelorMittal’s plants in Ostrava (Czech Republic), Galati (Romania), Skopje (Macedonia), Pembino (Italy) and Dudelange-Liege (Luxembourg, Belgium). Under the terms of the agreement, Liberty Steel agreed to pay £140 million in deferred compensation, but this was not done.

ArcelorMittal won an arbitration court that ordered Liberty Steel to pay compensation. On September 19, 2023, the Singapore High Court banned the transfer of Liberty’s Singapore assets outside the country for up to €140 million. Additionally, ArcelorMittal plans to file an international injunction in the English courts to prohibit the transfer of any Liberty assets anywhere in the world worth up to €140 million.

Thus, 2023 was a challenging year for the company, both in terms of the steel market and financial disputes. Prolonged shutdowns of production facilities at some plants in the EU and the UK will have a negative impact on the production performance of LIBERTY Steel’s plants, demonstrating that the company is losing its position in the global market. A similar situation is observed in one of the world’s leading steel producers, ArcelorMittal.