Posts Companies ArcelorMittal 3289 26 December 2023

During the pandemic, blast furnace and steel production in Krakow was closed, and from 2024 the coke battery at this enterprise will be decommissioned

Since the beginning of the fall, ArcelorMittal has been suspending or reducing the capacity of its European division. Poland has become part of this trend. In November, the company decided to permanently shut down its pipe division in the country, and it also announced the hot mothballing of a coke oven battery at its Krakow steel plant. The shutdowns are causing concern among trade unions representing local steelworkers. ArcelorMittal plays a leading role in the local steel industry, so the company’s decline will have a negative impact on the country’s steel industry.

Place on the market

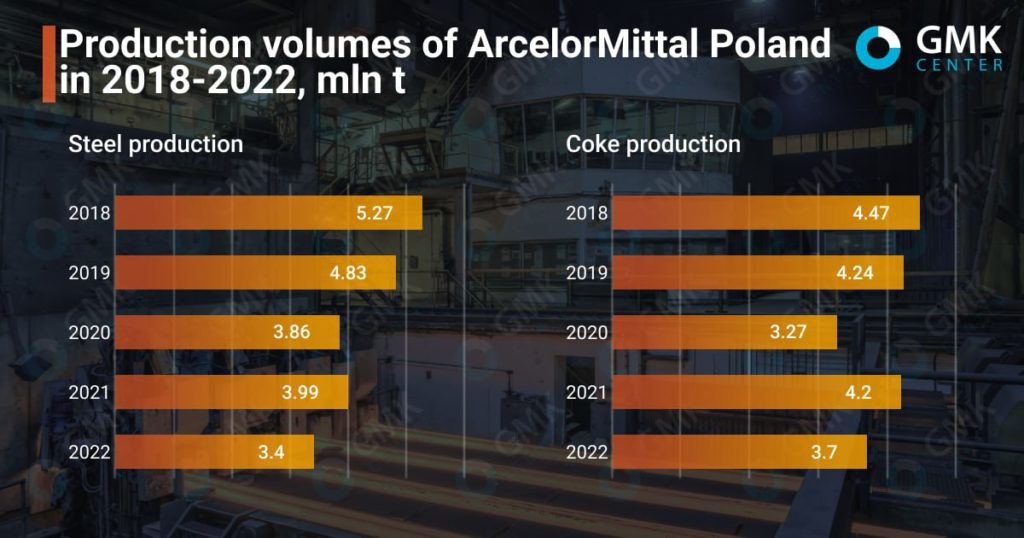

ArcelorMittal Poland (AMP) is the largest steel producer in Poland and accounts for almost half of the country’s steel production capacity. In 2022, the company reduced steel production by 15% compared to 2021, to 3.4 million tons, falling even below the level of the pandemic year 2020 (3.9 million tons). The country’s total steel production last year amounted to 7.73 million tons.

ArcelorMittal Poland employs about 10 thousand people. The company’s assets include plants in Krakow and Dąbrowa Górnicza (both had a full steel cycle until 2020), as well as Sosnowiec, Świętochłowice and Chorzów (rolled steel production). In addition, the group includes Zaklady Koksownicze Zdzieszowice, the largest coke producer in Europe (about 3.5 million tons per year).

In recent years, ArcelorMittal has almost invariably cited declining demand and high production costs when introducing downtime or closing certain facilities in Poland. Demand for steel products in Poland and prices have been falling since mid-2022.

According to the Polish Chamber of Commerce and Industry (Hutnicza Izba Przemysłowo-Handlowa, Polish Steel Association), in 2021, the apparent consumption of steel products in the country reached a record high of 15.3 million tons. In 2022, this figure decreased by 13% y/y – to 13.3 million tons, and in 2023 it may reach about 12.5 million tons. Last year, the share of imported steel in the Polish market was 80%.

«Poland is one of the top 5 largest importers of almost all types of long and flat products to the EU (wire rod, rebar, structural shapes, hot-rolled and cold-rolled sheets). The largest imports are of flat products: in 2022, Poland imported 6.3 million tons of these products, of which almost 1.3 million tons came from non-EU countries,» GMK Center analyst Andriy Glushchenko,said.

Poland is one of the largest markets for Ukrainian exports, especially in the context of Russia’s full-scale invasion. According to Eurostat, the main imports to the Polish market are iron ore, hot-rolled flat products, and semi-finished products (3.5 million tons, 334 thousand tons, and 195.5 thousand tons in 2022, respectively).

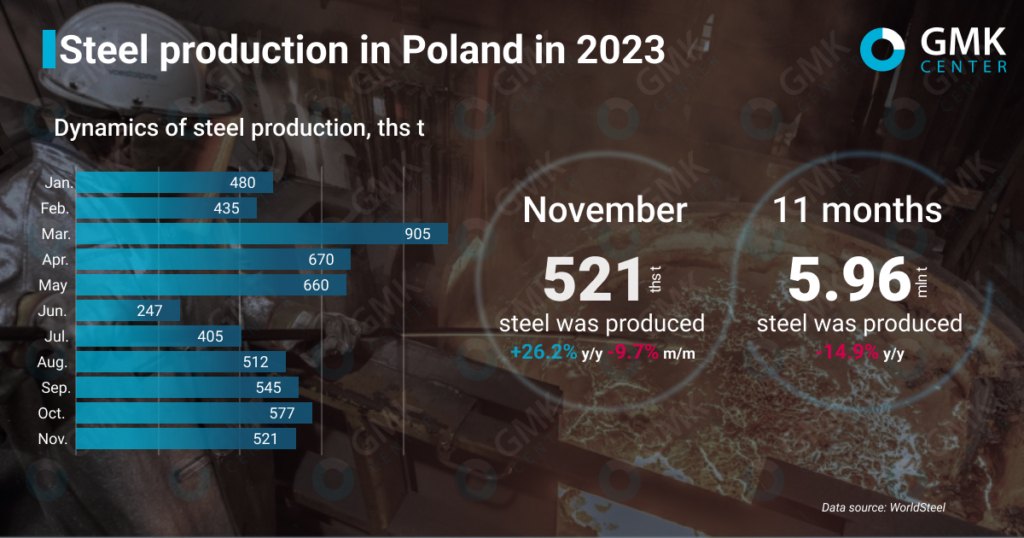

In addition, Poland is reducing steel production. In 2022, this figure fell by 8.6% year-on-year, and in the first 11 months of 2023 – by 14.9% y/y, with the largest drop in June (-62.6% m/m). Therefore, the reduction or suspension of AMP’s production capacity affects the industry as a whole.

Steel production in Poland in 2023, GMK Center

Krakow

In November of 2023, ArcelorMittal Poland (AMP) announced that it had put the coke oven battery at its Krakow plant on hot mothballing. The decision was made due to low demand for coke and high coking coal prices. All employees of the coke plant will continue to work until the end of the year to prepare the unit for a safe shutdown. Less than two weeks later, an agreement was signed with the trade unions: 129 out of 229 employees of the unit will be employed at other Polish assets, and about 100 people will be involved in further maintenance of the coke oven battery.

Polish mining company Jastrzebska Spolka Weglowa (JSW), following the news of the coke oven battery mothballing, said it was in talks with ArcelorMittal to continue cooperation and maintain coking coal supplies for the next year in accordance with the agreement signed by the companies. The contract between JSW and AMP was extended for 2023-2025 in October 2022, with a value of more than 7 billion zlotys ($1.48 billion).

Investors on the Warsaw Stock Exchange reacted nervously to the events. The news of AMP’s decision and the publication of JSW’s third quarter results signaled a massive sell-off in the latter’s shares at the end of November.

The decision to mothball the coke oven battery is another step by ArcelorMittal Poland to reduce production at its Krakow steel plant. In the fall of 2020, the company announced that it was permanently shutting down the blast furnace and steel production at the plant.

At that time, the blast furnace and steelmaking shops had already been idle since November 2019, when the shutdown was explained by a decline in steel demand and high imports from outside the EU. In March 2020, following the coronavirus outbreak, AMP postponed the restart of its facilities indefinitely. The final decision to close the blast furnace and steelmaking divisions was made in the fall of 2020, when ArcelorMittal Poland announced the negative effects of the coronavirus pandemic on the company and the need to adapt to the new environment.

Other negative factors that prompted the company to close part of its capacity at the Krakow plant were the lack of effective measures to protect the European market from imports, high energy costs, and high carbon costs under the EU ETS. Therefore, AMP decided to concentrate pig iron production at only one location – the two blast furnaces at the plant in Dąbrowa Górnicza.

At the same time, the company kept the coke plant and rolling facilities of the Krakow steel mill in operation, in which it had invested PLN 500 million over the past five years.

«The closure of blast furnace and steelmaking facilities has meant that the company has to import steel billets to keep its rolling mills running. Currently, one of the suppliers of square billets to Poland is ArcelorMittal Kryvyi Rih, a Ukrainian plant. In other words, we can see how ArcelorMittal is actually redistributing production across different plants to optimize costs and maintain its competitive advantage,» Andriy Glushchenko notes.

Production results of ArcelorMittal Poland

Pipe division

In November 2023, the corporation announced that ArcelorMittal Tubular Products (AMTP) Europe plans to stop producing pipes at its Krakow plant from the first quarter of 2024 in response to market volatility and the desire to reduce its carbon footprint. However, this asset is not part of ArcelorMittal Poland.

The Krakow unit’s products – longitudinal welded pipes used in construction and water supply – were sold domestically, in the Czech Republic, Germany, Denmark, Slovakia and the Baltic States. The annual production capacity of the company was 250 thousand tons of products per year.

The trade unions were surprised by this decision, in particular, referring to the fact that AMTP would end the year with a profit, the Polish portal WPN writes. There were talks of a strike, but on December 11, ArcelorMittal Tubular Products signed an agreement with the workers’ representatives.

Amid the closure of the Krakow pipe plant, AMTP Europe continues to develop plants in other countries, including the Czech Republic. The Czech plant in Karvin has a wider range of products than the Krakow plant. From 2020 to 2021, 200 million Czech crowns ($8.9 million) were invested in this facility. This year, ArcelorMittal Tubular Products Karvina is implementing 15 investment projects, the cost of which is about 15% higher than in 2022 (last year the amount was more than CZK 50 million).

Sosnowiec

In the fall 2023, ArcelorMittal also suspended the rolling mill at its Polish plant in Sosnowiec. This facility produces wire rod and cold-rolled plates using billets supplied by Dombrowa Górnicza. The rolling shop was idle from November 18 to 26, which was justified by the difficult situation on the domestic steel market. The second shutdown, according to Polish media, was scheduled for mid-December, but has not yet been announced.

Two years earlier, in December 2021, the Sosnowiec branch had just completed a PLN 125 million investment project that included the modernization of the wire rod rolling shop (which took place in two stages over two years) and the overhaul of the cold rolling mill. The upgrade increased the line’s production capacity. This step was expected to ensure reliable operation of the equipment in the coming years.

Dombrowa Górnicza

However, the good news for AMP this year was the modernization of blast furnace No. 2 in Dąbrowa Górnicza. The overhaul of the unit cost more than PLN 720 million ($167 million) and, according to the company, was the largest modernization of a blast furnace ever carried out in Poland. The blast furnace was shut down for maintenance in March 2023, and was blown back up in early August after the modernization. Nearly 50 third-party companies took part in the project, and the repairs extended the unit’s service life for the next 15 years.

Blast furnace No. 2 was already modernized in 2018, at which time it had been in service for 40 years. The cost of investment then amounted to PLN 85 million, and the reconstruction of the unit extended its service life by another 3-5 years.

However, the major overhaul of blast furnace No. 2 was preceded by uncertainty about the future of another blast furnace. At the end of September 2022, the company announced the shutdown of BF No. 3 (production capacity of 2.2 million tons per year), explaining it by falling steel demand, rising energy prices, excess imports on the market and record carbon prices.

This blast furnace was supposed to return to operation at the end of 2022, but was postponed until early next year. This caused concern among trade unions, as it reminded them of the situation in Krakow. Finally, blast furnace No. 3 was launched in January 2023. This blast furnace was reconstructed in 2010 after a two-year shutdown.

Plans for decarbonization

This year, the EU approved state aid and grants for the decarbonization of ArcelorMittal’s operations in Belgium, Germany, France, and Luxembourg. The strategy for AMP, according to the heads of the Polish division, is also to build electric arc furnaces and direct reduction units, although this has been discussed for several years. In 2021, the company discussed this with the Polish authorities to get support and understand the feasibility of the project given the high energy consumption.

Now plans to move away from blast furnace technology at Dombrowa Górnicza remain a matter of the next decade. According to Tomasz Słęzak, a member of AMP’s board, the plant plans to build two electric arc furnaces by the end of 2028. The cost of the investment could reach several billion zlotys. The new electric arc furnaces will replace blast furnace No. 3, which will reduce CO2 emissions by 35%. The next stage will be the construction of a third new generation electric arc furnace. AMP is also analyzing the possibility of implementing CO2 capture, storage and utilization (CCUS) projects in Poland.

The construction of electric arc furnaces, as well as the use of CCUS technologies, will significantly increase the demand for electricity at ArcelorMittal’s Polish operations. In addition, bureaucracy and the availability of scrap for the local steel industry will be a problem. However, last year, ArcelorMittal acquired four scrap processing subsidiaries in Europe that collectively process more than 1.5 million tons of this raw material per year, one of them being Złomex in Poland.

AMP currently operates an electric arc furnace shop at a mini-plant in Warsaw (ArcelorMittal Warszawa), which was commissioned in 1998 and has been modernized since then. This plant is capable of producing over 500 types of steel. Its main equipment is an 80-ton electric arc furnace. At the end of January 2023, ArcelorMittal Warsaw received the ResponsibleSteel certificate.

The company is also investing in local projects to decarbonize and protect the environment (noise reduction, carbon emissions reduction, coke oven gas use, energy savings, etc.) In particular, this year, work is underway in the annealing shop associated with the cold rolling mill at the Krakow plant. The company is building hydrogen furnaces there to replace the old units. A total of nine hydrogen furnaces will be built in Krakow, costing PLN 52 million.