Infographics ArcelorMittal 3634 01 December 2023

In 2022, the company took second place in the ranking of global steel producers. In 2023, Chinese companies are likely to displace ArcelorMittal into third place

The overcapacity and deteriorating steel market conditions that have been observed since the beginning of Russia’s full-scale invasion of Ukraine have had a negative impact on global steel producers, especially the large ones with plants around the world, including ArcelorMittal.

Since the bulk of ArcelorMittal’s steelmaking capacity is located in Europe, the war in Ukraine has a significant impact on the company’s production results. Macroeconomic problems, rising production costs along with low demand for finished products and other factors have been negatively affecting the results of the European division for almost two years in a row. In addition, the company’s Ukrainian unit has significantly reduced its capacity utilization during the war.

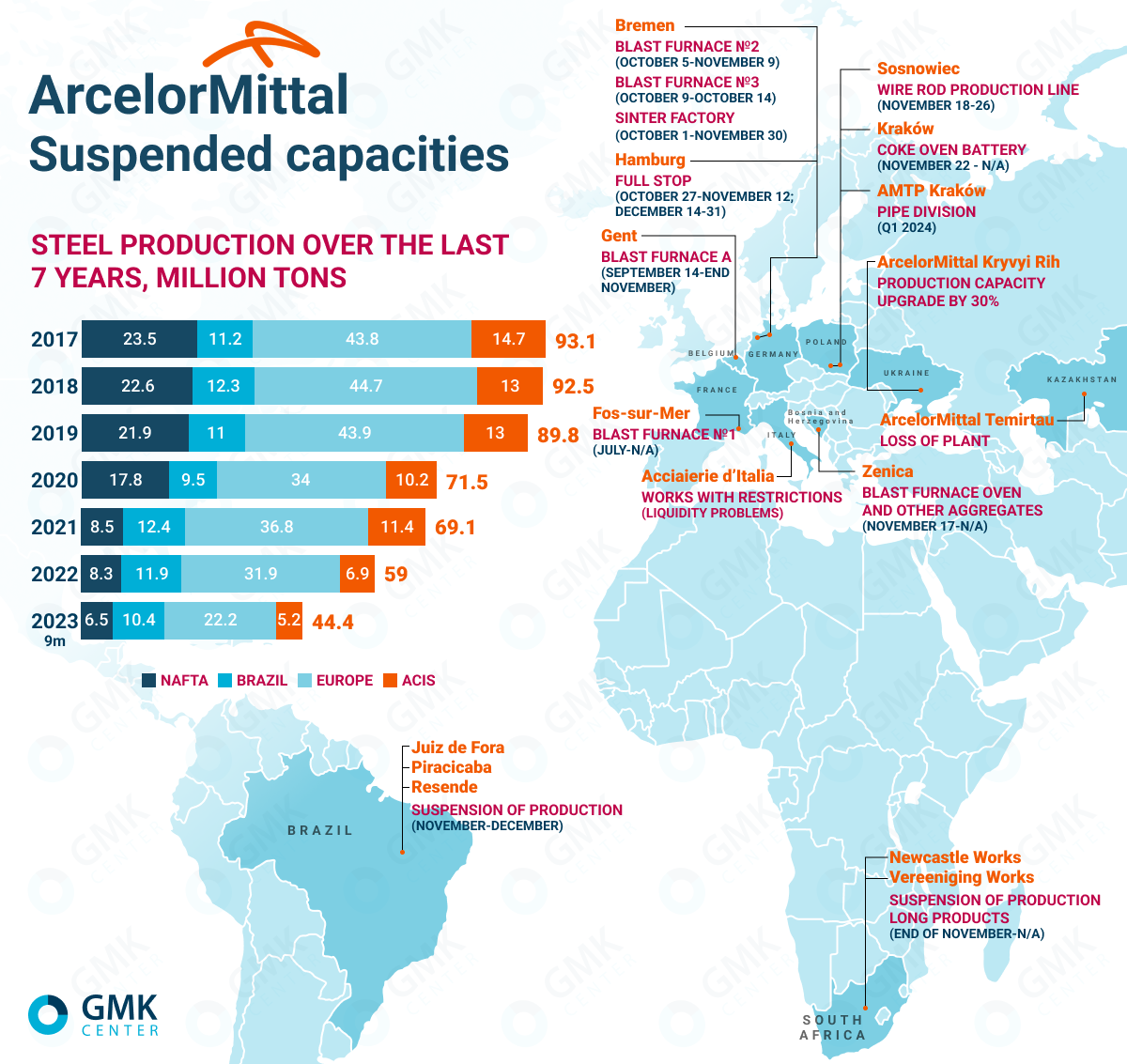

In January-September 2023, ArcelorMittal reduced steel production by 3.1% y/y – to 44.4 million tons, and in the third quarter of 2023, it increased by 2% y/y – to 15.2 million tons. This means that the company is unlikely to produce as much steel, as it did in 2022, because the fourth quarter results are expected to be worse than the third quarter due to production shutdowns and restrictions at some plants in Europe, Africa and Brazil, and the loss of a plant in Kazakhstan.

In 2022, ArcelorMittal produced 59 million tons of steel, down 14.6% compared to 2021. The company was then ranked second among global steel producers after China Baowu Group (131.8 million tons). China’s Ansteel Group (55.65 million tons) took third place with a small gap. Thus, in 2023 the gap between Ansteel and ArcelorMittal may narrow even further, or the Chinese producer will take second place, as China is gradually increasing steel production in 2023, and production restrictions for the current year have not yet been implemented.

ArcelorMittal’s results in the fourth quarter of 2023 are likely to deteriorate as the company has been suspending or reducing the use of its European operations, particularly at its plants in Belgium, France, Germany and Bosnia and Herzegovina, since early fall. The suspended capacities include blast furnace (BF) A in Belgium, BF No. 1 in Fos-sur-Mer (France), BF and rolling lines in Zenica (Bosnia and Herzegovina), and a coke oven battery in Krakow. At the plants in Hamburg and Bremen (Germany) and Sosnowiec (Poland), some units are temporarily shut down during the fall and winter periods. The company decided to permanently shut down its pipe division in Poland due to unprofitability.

ArcelorMittal is also experiencing liquidity problems and is cutting steel production at Acciaierie d’Italia (ADI), the largest and only integrated steel producer in Italy. The company is 62% owned by ArcelorMittal and 38% by Invitalia. Currently, the troubled plant is on the verge of shutting down due to the main shareholder’s unwillingness to invest in its rescue and further development.

In addition to the European division, the company’s South African and Brazilian assets have been suspended.

Recently, ArcelorMittal Brasil confirmed that it is temporarily suspending production at three steel mills in southeastern Brazil due to low domestic demand and unprecedented levels of imports. The temporary shutdown affects the plants in Juiz de Fora (a major producer of long products), Piracicaba and Resende, where a “technical” break will be announced until December. This will lead to a drop in steel production in the country by about 1.2 million tons per annum in 2023.

ArcelorMittal South Africa (AMSA) announced at the end of November that it plans to wind down its long products operations. The decision was driven by weak demand, ongoing infrastructure problems and the worsening power crisis. The move will affect the Newcastle Works, Vereeniging Works and rolling mills that use Newcastle Works products as raw materials.

In addition, due to the constant accidents with fatalities, the Kazakh authorities decided to terminate investment cooperation with the shareholders of ArcelorMittal Temirtau. By December 2023, the country intends to close the deal to acquire the plant by an unnamed Kazakh investor.

ArcelorMittal’s Ukrainian unit is currently operating at 30% of capacity and produced 390 thousand tons of steel in the first half of 2023, down 57% y/y. Amid the war, the company is unable to increase production due to the threat of shelling and logistical problems.

«A few years ago, ArcelorMittal gave up its status as a global leader in terms of production volumes, ceding this position to Chinese companies. Instead, ArcelorMittal has focused on product quality. Reducing production is a logical consequence of this strategy. Moreover, production cuts can be explained now by additional reasons related to the market conditions», said Andriy Glushchenko, GMK Center analyst.

In January-September 2023, ArcelorMittal’s ACIS segment, which includes plants in Ukraine and Kazakhstan, reduced steel production by 6.8% y/y – to 5.18 million tons.

Thus, the impact of the above factors is gradually reducing the importance of ArcelorMittal in the global steel market. The company is unlikely to be able to maintain its leading position, which is being taken over by Asian companies.