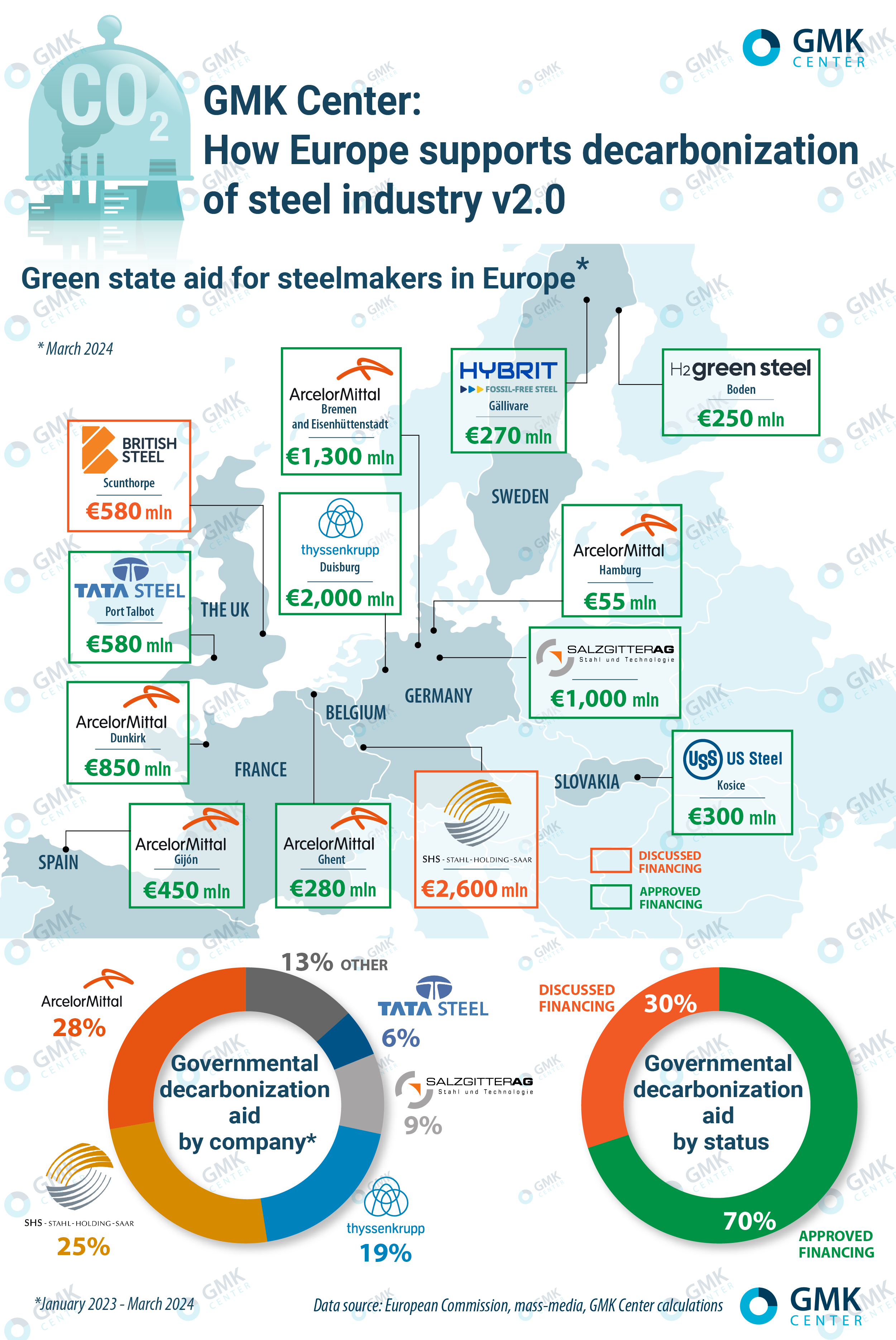

Infographics decarbonization 10117 08 April 2024

Up to 70% of total funds (€7.0 bln) released by Germany

European countries are supporting steel producers on their path to carbon neutrality by participating in the financing of decarbonization projects. European state authorities in January 2023 – March 2024 announced €10.5 billion in grants to steelmakers. Of this amount, support of €3.2 billion is currently under discussion.

Update over the last 6 months, according to official publications and media:

- Stahl-Holding-Saar may receive support from the German Government in the amount of €2.6 billion

- H2GS received a €250 million grant from the Innovation Fund

- LKAB received a grant equivalent to €270 million from the Swedish Energy Agency as part of the HYBRIT project

- ArcelorMittal Bremen and ArcelorMittal Eisenhüttenstadt received a grant of €1.3 billion as part of the German Recovery and Resilience Plan, the possibility of allocating €2.5 billion was previously discussed.

- Tata Steel received a support package from the UK Government for the Port Talbot plant in the amount equivalent to €580 million, previously discussed the possibility of allocating €880 million.

- British Steel may receive support in an amount similar to the Tata Steel Port Talbot project, the possibility of allocation of €380 million was previously discussed.

The main recipient of state aid in the EU is ArcelorMittal – up to 28% of the total, as the company is the largest steelmaker in Europe, has a wide presence and is a pioneer of the green transition in the steel industry with well-developed decarbonization roadmaps.

The funding structure by country is disproportionate to steel production. Germany is the most active country in providing funding for decarbonization projects, accounting for up to 70% of all announced support projects – about €7 billion for 5 projects. This amount also includes €2.6 billion that is being discussed for allocation to SHS.

Other European steelmakers also expect to receive state assistance for decarbonization. For example, Voestalpine and Tata Steel Ijmuiden submitted applications for public funding, but any official decisions hasn’t released yet. It is likely that the change of investor in Acciaierie d’Italia is preventing decisions on the allocation of specific funding from the Italian government. Also, there is no publicly available data on state support of decarbonization to the Liberty Galati and Liberty Ostrava.

European governments plan to allocate aid in different forms: direct grants, soft loans, OPEX compensations etc. European Commission assumes that all support measures will contribute to the achievement of the EU Hydrogen Strategy, the European Green Deal targets and fast forward the green transition in line with the REPowerEU Plan.

The projects that received state support mainly aim at transition from BF-BOF to DRI-EAF route. But steel companies face the challenge of obtaining permits for new construction when pursuing decarbonization projects in the EU.