Posts Global Market sanctions 4401 20 December 2023

Restricting imports of pig iron from Russia is the most important decision in the new sanctions package

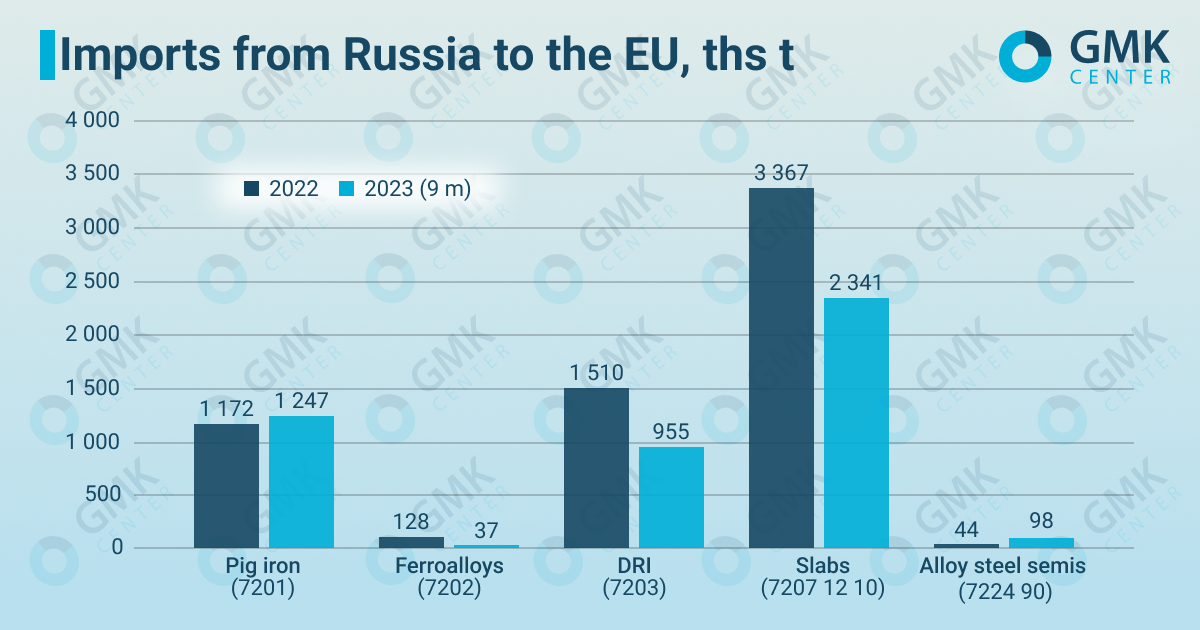

EU continues to increase sanctions pressure on Russia. The 12th package of sanctions introduces new and expands existing restrictions, closing existing loopholes for circumventing sanctions. The new bans have also affected steel imports from Russia, in particular pig iron and ferroalloys, which for a long time remained “untouchable” for inclusion in the sanctions lists. At the same time, the Europeans eased the conditions for imports of Russian slabs and alloy steel billets, lengthening the transition period.

What’s in the package?

After lengthy preparations and heated discussions, the European Union approved the 12th package of sanctions against Russia on December 18.

The main block of sanctions includes:

- a phased ban on direct or indirect import, purchase and transfer of diamonds from the Russian Federation, including those processed in third countries and diamond products;

- a ban on re-export to the Russian Federation of goods and technologies for military needs or dual-use;

- expansion of the list of goods and technologies prohibited for sale.

- Following items were added to the list: lithium batteries, thermostats, DC motors and servos for drones, machine tools and equipment parts, lasers and batteries, etc. (total cost of €2.3 billion per year);

- a ban on providing Russian companies with software for enterprise management, industrial design and production;

- a ban on the import of liquefied petroleum gas (LPG) from Russia with a 12-month transition period. This measure will reduce Russia’s income by more than €1 billion per year.

A separate block of decisions in the 12th package concerns strengthening existing restrictions:

- extending the transit ban to all military goods;

- Tightening control over the oil price ceiling: strengthening the information exchange mechanism and the need to notify any third country of tanker sales;

- expansion of individual sanctions (freezing of assets) – inclusion of more than 140 new individuals and legal entities, including those from the military and defense industry, as well as persons from the economic sphere and IT. Export controls have also been tightened with respect to 29 legal entities, including those in third countries, which directly support the Russian military-industrial complex. They will be subject to stricter export restrictions on dual-use goods and technologies, as well as goods and technologies that may contribute to the technological improvement of Russia’s defense capabilities.

There are also relaxations in the new sanctions package – cars with diplomatic license plates are allowed to enter the EU, EU countries may allow EU citizens to import cars from Russia if they are used for personal purposes, and some goods such as personal hygiene items and clothing are allowed to be imported.

Iron and steel part

The 12th package expands the ban on imports of iron & steel products from Russia, including pig iron and spiegeleisen pig iron, direct reduced iron (DRI), copper and aluminum wire, foil, and aluminum pipes. Such a ban could cost Russia a loss of €2.2 billion a year. This decision was quite expected – despite the resistance of metallurgical lobbyists (consumers of Russian pig iron), at the fifth attempt the EU was able to approve a ban on pig iron imports.

The reverse movement of steel products is also restricted. Thus, the package includes a ban on exports to Russia of industrial goods, including processed steel, copper and aluminum products.

Source: Eurostat, GMK Center calculations.

The most important products that fell under the new restrictions in the 12th sanctions package are pig iron and DRI – their imports is significant. The European steel industry has traditionally relied on such supplies from Russia, which is why it took so long to impose sanctions on pig iron and DRI. Let’s take a closer look at the nature of the restrictions imposed and how painful they may be for both Russian suppliers and European consumers.

Slabs and billets

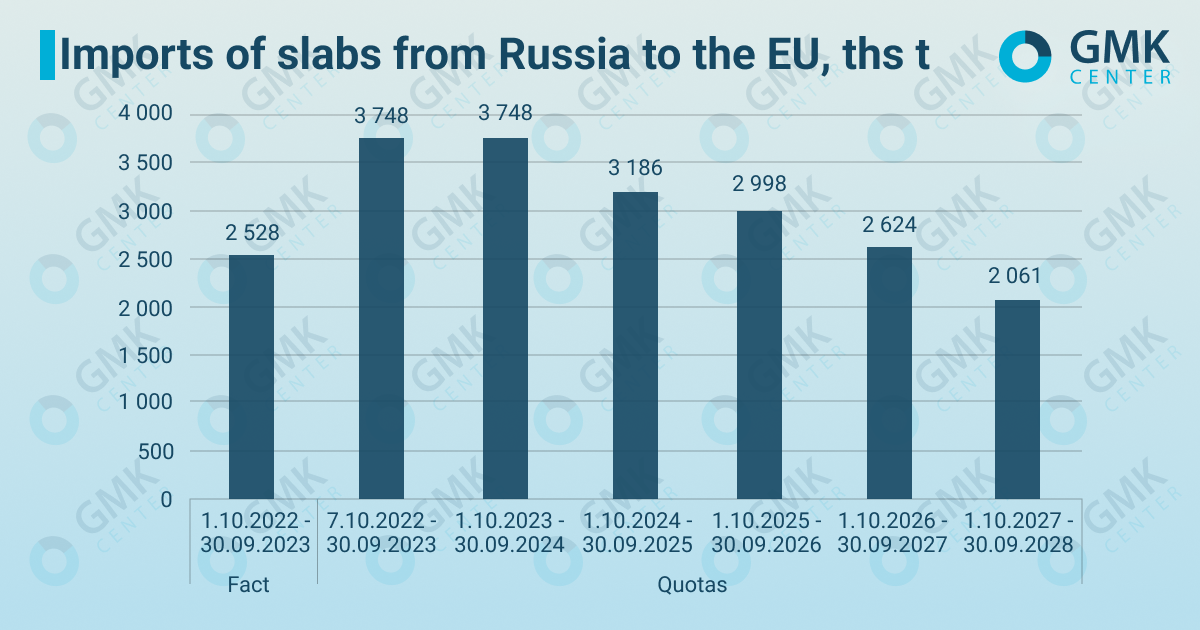

In the 12th package, the EU extended quotas on Russian slabs for another four years. In particular, the total quota on imports of Russian slabs from October 2024 to September 2028 is 8.5 million tons, with a more detailed breakdown by periods.

The previous sanctions on slab imports were imposed in October last year (as part of the 8th sanctions package), when it was decided that slab imports could continue until the end of September 2024 within the established quotas, and that imports would cease on October 1, 2024. However, as we can see, the 12th package of sanctions actually eased the previously imposed restrictions.

Source: Eurostat, GMK Center calculations.

“The actual import volumes of Russian slabs during October 2022 – September 2023 were 32.5% less than the established quota. In other words, the quota was not fully utilized during the first period. Despite this, the European Commission did not revise the quota for the second period. Moreover, we can see that the allocated quotas (until the last quota period) exceed the actual supplies from October 2022 to September 2023. This indicates that European buyers lobbied for such authorized volumes of Russian slab supplies that will allow them to continue operating under the current business models for a long time. This situation will have a negative impact on the competitive situation in the European market: rolling mills operating on Russian semi-finished products will remain in a more favorable position compared to integrated producers using BF-BOF route,” Andriy Glushchenko, GMK Center analyst, noted.

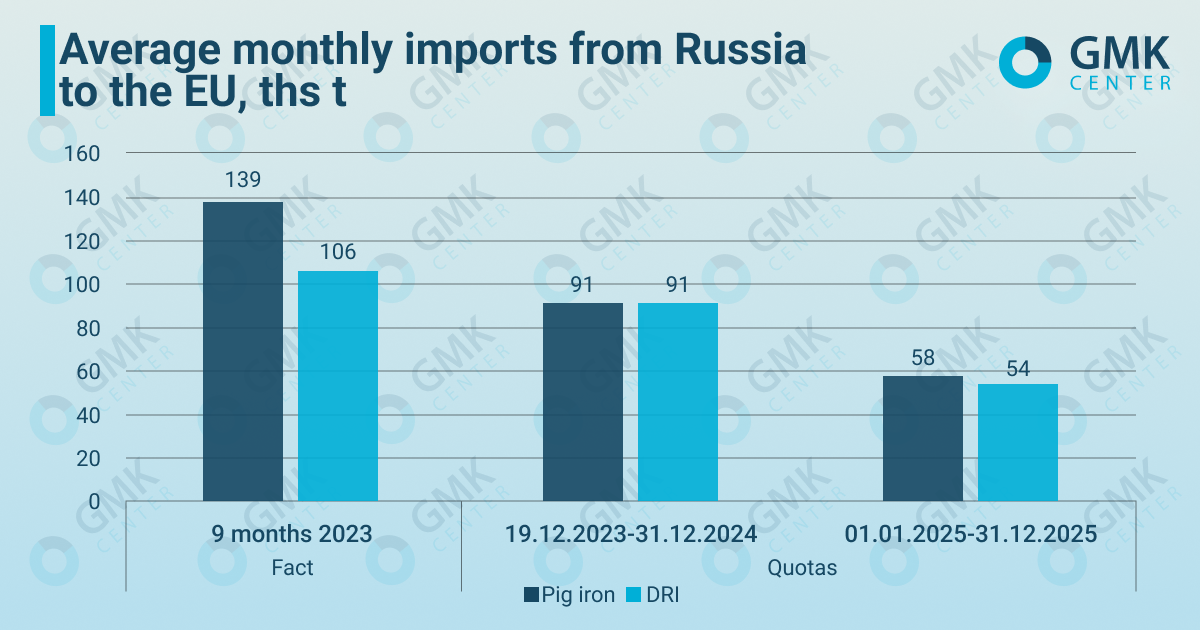

Pig iron and DRI

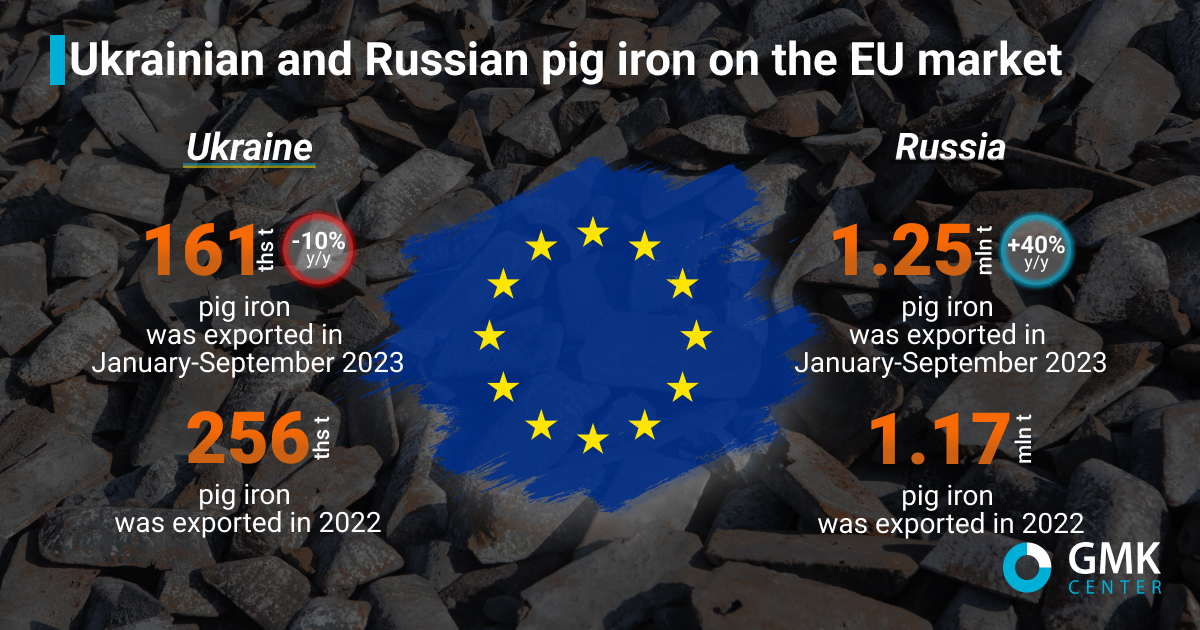

The imposition of sanctions on pig iron and DRI was a painful issue for the EU, as local plants traditionally depended on supplies of these products from Russia. The EU postponed the resolution of this issue, which allowed Russian suppliers to take advantage of the situation and continue exporting to the EU.

In particular, in 2022, according to Eurostat, Russia increased its pig iron supplies to the European market by 74% – to 1.17 million tons. While Ukrainian exports for the same period collapsed by 73% – to 255.5 thousand tons due to destroyed production facilities in Mariupol and disruption of logistics chains.

This trend continued in 2023. In January-September, Russia managed to increase pig iron exports to the EU by 40.4% y/y – to 1.25 million tons. Russian pig iron is more favorable to European consumers due to lower prices offered by Russian steelmakers to compete in global markets.

The 12th package of sanctions aims to change the situation on the market. The new restrictions prohibit imports of pig iron and DRI from 01.01.2026, and until then quotas will be in effect, providing for a reduction in the volume of supplies. Thus, during the first quota period, the allowed average monthly imports of pig iron are 34.5% less than the actual supplies for 9M2023, and DRI – by 14.1%. In the second quota period, supplies are to be further reduced by 40%.

“The main supplier of DRI to the EU is Metaloinvest, associated with Alisher Usmanov, against whom personal sanctions have been imposed. However, in practice, these sanctions did not apply to the company’s activities and DRI supplies could continue. The new sanctions package, on the one hand, seeks to change this situation. However, on the other hand, the absence of restrictions on iron ore imports leaves loopholes for circumventing the sanctions,” GMK Center analyst says.

Source: Eurostat, GMK Center calculations.

The imposition of sanctions on pig iron imports from Russia is a positive signal for Ukrainian steelmakers, who get an opportunity to take the place of Russian suppliers on the market. According to estimates by the Ministry of Economy (as of September), Ukraine could export up to 1.5 million tons of additional pig iron to the EU market instead of Russian suppliers as early as this year. The increase in demand from the EU would make it possible to utilize more capacities of Ukrainian mining and processing enterprises and steel plants.

Other products

The EU imposed a ban on imports of ferroalloys, but allowed to close existing contracts: deliveries under contracts concluded before 19.12.2023 can be made until 20.12.2024. Imports of Russian ferroalloys to the EU market in 2022 amounted to 127.8 thousand tons (+80.3% y/y), and in January-September of the current year – 37.3 thousand tons (- 67.9% y/y).

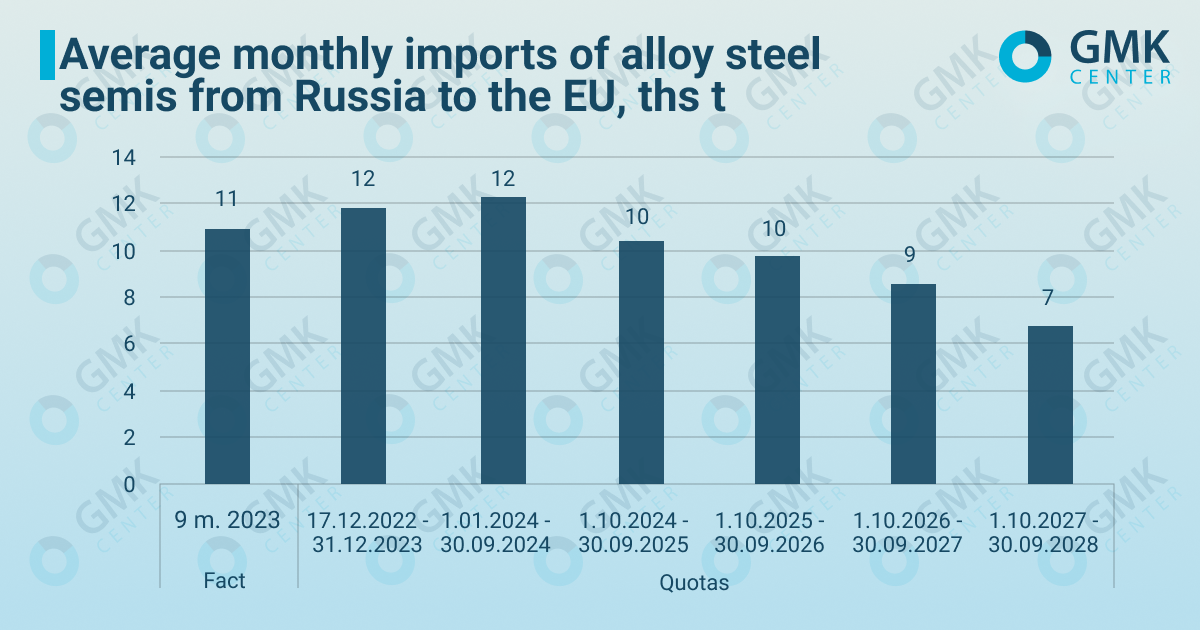

The European Commission also extended the transitional period for imports of alloy steel billets: if the 8th package stipulated that such imports should stop on 1.10.2024, the 12th package extends imports for another 4 years. Supplies of alloy billets under the code 7224 90 are small (within 11 thousand tons monthly) and do not significantly affect the balance of the European steel market.

Source: Eurostat, GMK Center calculations.

Conclusions

The EU is gradually closing its market to imports of Russian products, but it has been doing so for too long and inconsistently, loosening previously imposed restrictions. Long transitional periods allow Russian steelmakers to make profits.

“In our previous article on the eighth package of sanctions, we admitted that European rolling mills could approach the European Commission and ask for another postponement in order to continue importing slabs from Russia. The European Commission listened to their requests and prolonged the import permit. We cannot rule out similar relaxation of imports of pig iron, DRI and other products in the future,” Andriy Glushchenko points out.

Restricting pig iron imports from Russia is the most important decision in the new package of sanctions. It opens up opportunities for Ukrainian steelmakers to increase pig iron supplies to the EU. Russian suppliers have gained advantages on the European market due to Russia’s military aggression against Ukraine and now the competitive situationmay start to change due to the sanctions.