Posts Global Market scrap prices 3964 01 February 2024

The trend was supported by increased demand from steelmakers after the New Year holidays

In today’s world, the role of scrap is becoming increasingly crucial in the context of sustainable development and efficient use of resources. A growing number of developed countries are imposing export restrictions on the relevant raw materials, based on the growing focus on environmental issues and the rapid depletion of natural resources. The reuse of scrap metal helps reduce emissions and energy consumption, making it an important element in sustainable production strategies.

Current state of the global scrap market

At the beginning of the year, the European scrap market saw a moderate rise in prices amid increased demand from local steelmakers and a pickup in exports after the holidays. However, this trend was temporary, and the maximum price increase remained in the range of €5-20 per tonne, depending on the region.

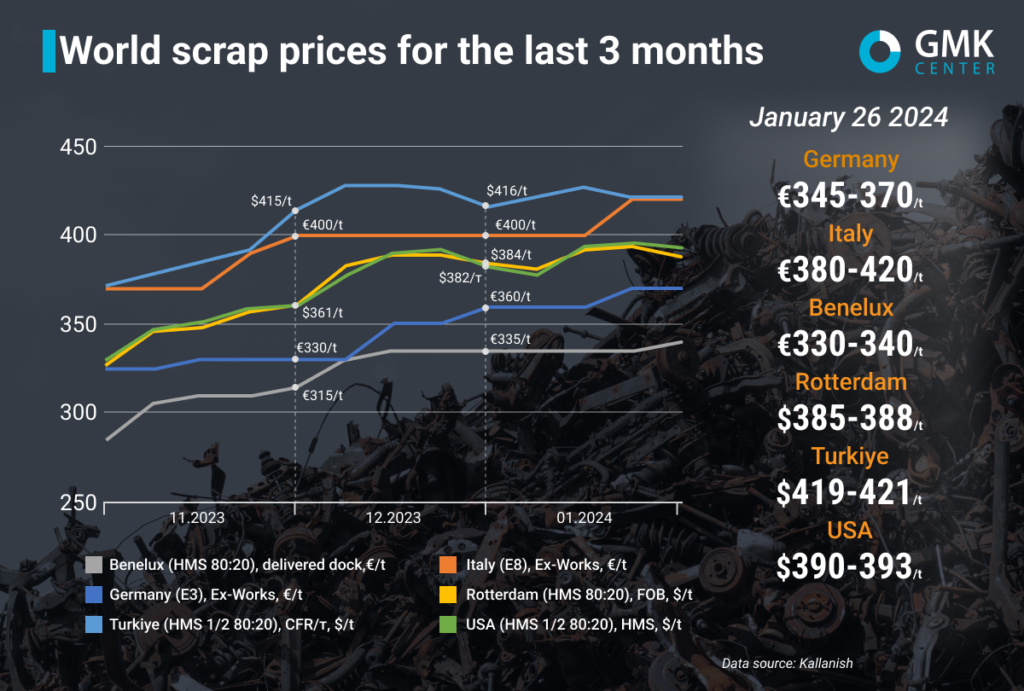

In the first two weeks of January, European steelmakers actively replenished their stocks of raw materials, which led to a decline in purchase prices in the second half of the month. In Germany, prices for E3 scrap increased by 2.8% compared to December – to €345-370/tonne Ex-Works, while in Italy, E8 scrap prices rose by 5% – to €380-420/tonne Ex-Works.

In the Benelux region, prices for HMS 80:20 scrap in January 2024 increased by 1.5% compared to the price at the end of December – to €330-340/t. The price increase occurred between January 19 and 26, while the first three weeks of the year saw stable prices.

Prices for HMS 1/2 (80:20) scrap in Rotterdam in January rose by only 1% to $385-388/t, as prices fell by 1.5% compared to the previous week, from $393,394/t, during the week of January 19-26, probably due to a decrease in demand from Turkey.

Currently, the situation and trends in most regions of Europe are basically the same. Most consumers are trying to find raw materials in their region, as transportation costs have increased significantly. Some steel mills are emphasizing lower purchase prices for raw materials, citing high production costs and weak demand for finished products. Scrap procurement companies, in turn, disagree with such proposals, as the pace of raw material collection is rather slow and delivery times are up to one month.

In general, the state of the European scrap market largely depends on the demand for raw materials in Turkiye, the main export destination for EU scrap companies, which has been quite volatile over the past two years. During 11 months of 2023, the EU exported 9.53 million tons of scrap to Turkiye (54.4% of total scrap exports).

In January, prices for HMS 1/2 (80:20) scrap in Turkiye increased by 1.2% compared to prices at the end of December 2023 – to $419-421/t CFR. At the same time, in the middle of the month, quotes reached $425-427/t, when demand was at its peak. Since then, prices have been gradually declining.

The first half of January was marked by increased purchasing by Turkish steelmakers, similar to the situation in the EU. Many bookings were made in the first ten days of the month. However, the market remained calm later on, and consumers began to assess further prospects after the immediate need for raw materials was met. Some market participants predicted that prices could reach $430/t.

Turkish steelmakers are cautious about purchasing raw materials, counteracting a sharp rise in prices, as they still face serious liquidity problems. Although energy prices for Turkish industry remain stable, rising labor and transportation costs are putting significant pressure on the industry. In addition, domestic demand for steel is volatile in the current economic environment, which is reflected in the volume of raw material purchases. Steelmakers keep only small stocks to be able to respond quickly to changes in the market.

Due to difficulties in selling rolled steel on the domestic and export markets, scrap trading activity in Turkiye remained low at the end of January. Steel companies refuse to make purchases despite the need for raw materials for March. Suppliers, in turn, are in no hurry to cut prices, knowing about the needs of steelmakers and the slow pace of collection.

Exporters from the Benelux countries are confident that prices for raw materials for Turkish steelmakers will not fall below $360/t (delivered dock). In the US, supply has decreased by 20-30% due to weather conditions, which will also help keep prices at the current level. Turkish steelmakers are still focused on purchasing scrap in the EU at a price below $420/t CFR.

While the mills consider the upward trend in scrap prices to be untenable, suppliers do not recognize lower levels as workable. Turkish steelmakers are likely to face difficult negotiations for scrap purchases when they return to the market.

In the US market, in January, prices for HMS 1/2 (80:20) scrap rose by 2.9% compared to prices at the end of December – to $390-393/t FOB (US East Coast).

The beginning of the year was unfavorable for the US scrap market due to lower prices driven by weak demand from Turkiye and mild weather conditions. As February trading approached and demand from Turkiye grew, US scrap prices began to rise in mid-January. This was facilitated by deteriorating weather conditions, which led to a decrease in scrap collection rates and supply in the market. Some suppliers report a 20-30% decrease in scrap collection compared to the beginning of January.

However, despite the decline in supply and higher prices for raw materials, domestic consumers of hot-rolled coils did not support the price increases that producers had hoped for. This trend is likely to lead steelmakers to insist on lower scrap prices. In addition, weak steel sales in Turkiye will also put pressure on US exporters.

Prospects

Prices on the EU scrap market are expected to remain largely stable in February, with some slight downward fluctuations depending on the needs of steel mills. Local suppliers are anticipating a recovery in demand for large volumes of raw materials from Turkiye and North Africa for delivery in March. This will foster competition and increase price levels, as supply is quite limited.

In the US market, the trend is similar to the EU, as local steelmakers will try to reduce raw material prices due to weak demand for finished products and market resistance to higher rolled steel prices.

In Turkiye, trade prospects will be governed by the capacity of local steelmakers, which depends on steel sales and economic factors. Turkish demand will have a direct impact on price regulation in the EU and the US.