Posts Infrastructure 385 29 July 2019

Starting from 1 April, Ukrainian steelmakers will pay much more for cargo transportation

Ukrainian cargo owners are expecting another hike in rates. It’s just a matter of time. On 15 February, the Ministry of Infrastructure of Ukraine published the draft order on cargo rates adjustment by industrial producer price index in 2018, i.e. by 14.2%.

Public consultation on the draft order will take a month. According to Andrii Riazantsev, Director of Economics and Finance, Ukrzaliznytsia, cargo rates can be expected to increase by 14.2% following the public consultation and registration of the order with the Ministry of Justice. That is from 1 April.

In the beginning, the financial plan of Ukrzaliznytsia for 2019 provided for increasing the rates in four phases: by 16.6% from 1 February (indexation at the end of 2018), by 2.5% from 1 April, by 2.5% from 1 July, and by another 2.5% from 1 October. In fact, it provided for increasing the rates by 25.5% by the end of the year. In such case, on average, the railway rates would increase by 19.6% compared to 2018.

Likelihood of consensus

In general, the mining & metals sector has little impact on the rates increase plans. Public consultation and appearance of the industry representatives in the media can just postpone such plans.

“All changes in rates should be made with an account taken of the opinion of key consignors. The mining & metals companies are among the key customer of Ukrzaliznytsia. Therefore, a difficult dialogue between steelmakers and Ukrzaliznytsia is underway. It has not finished yet, that’s why rate indexation was postponed from 1 March to a later date”, explained Andrii Glushchenko, analyst of GMK Center.

It is important to understand that this year’s increase will not probably be the last one.

“The basic rate should be increased by 3.4 times for the railway to be able to renew its fixed assets”, — Andrii Riazantsev insisted in his recent interview to GMK Center.

Value at stake

Experts differ in their estimation of consequences of the cargo rates increase. According to Andrii Glushchenko, consignors will lose UAH 6.3 billion due to the 14.2% rates indexation estimated by Ukrzaliznytsia. According to the estimates of GMK Center’s analysts, it will be UAH 7.3 billion. These amounts do not include costs that may arise due to quarterly automatic indexation in the future.

According to Metinvest, a 23% increase in the regulated railway rate (December 2019 as compared to December 2018) will raise consignors’ costs by around UAH 11.7 billion per annum. In his turn, Sergiy Bilenkyi, Chairman, Federation of Metallurgists of Ukraine, estimates additional costs of industrial producers at UAH 12.7 billion.

Any financial implications will entail lower competitiveness of mining & metals companies, scaled-down investment programs and modernization as well as decreased production.

According to the explanations of Metinvest, “as the sector is oriented towards foreign markets with established prices, increased logistics costs will affect the sector and substantially reduce its competitiveness.”

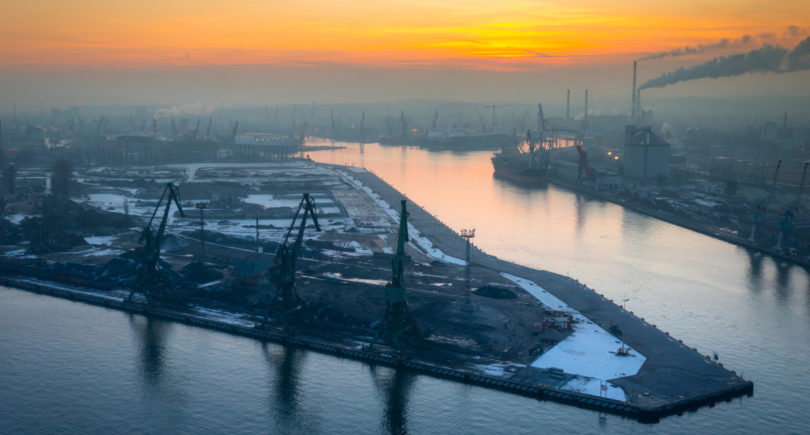

shutterstock.com

Ukrainian cargo owners are expecting another hike in rates. It’s just a matter of time. On 15 February, the Ministry of Infrastructure of Ukraine published the draft order on cargo rates adjustment by industrial producer price index in 2018, i.e. by 14.2%.

Public consultation on the draft order will take a month. According to Andrii Riazantsev, Director of Economics and Finance, Ukrzaliznytsia, cargo rates can be expected to increase by 14.2% following the public consultation and registration of the order with the Ministry of Justice. That is from 1 April.

In the beginning, the financial plan of Ukrzaliznytsia for 2019 provided for increasing the rates in four phases: by 16.6% from 1 February (indexation at the end of 2018), by 2.5% from 1 April, by 2.5% from 1 July, and by another 2.5% from 1 October. In fact, it provided for increasing the rates by 25.5% by the end of the year. In such case, on average, the railway rates would increase by 19.6% compared to 2018.

Likelihood of consensus

In general, the mining & metals sector has little impact on the rates increase plans. Public consultation and appearance of the industry representatives in the media can just postpone such plans.

“All changes in rates should be made with an account taken of the opinion of key consignors. The mining & metals companies are among the key customer of Ukrzaliznytsia. Therefore, a difficult dialogue between steelmakers and Ukrzaliznytsia is underway. It has not finished yet, that’s why rate indexation was postponed from 1 March to a later date”, explained Andrii Glushchenko, analyst of GMK Center.

It is important to understand that this year’s increase will not probably be the last one.

“The basic rate should be increased by 3.4 times for the railway to be able to renew its fixed assets”, — Andrii Riazantsev insisted in his recent interview to GMK Center.

Value at stake

Experts differ in their estimation of consequences of the cargo rates increase. According to Andrii Glushchenko, consignors will lose UAH 6.3 billion due to the 14.2% rates indexation estimated by Ukrzaliznytsia. According to the estimates of GMK Center’s analysts, it will be UAH 7.3 billion. These amounts do not include costs that may arise due to quarterly automatic indexation in the future.

According to Metinvest, a 23% increase in the regulated railway rate (December 2019 as compared to December 2018) will raise consignors’ costs by around UAH 11.7 billion per annum. In his turn, Sergiy Bilenkyi, Chairman, Federation of Metallurgists of Ukraine, estimates additional costs of industrial producers at UAH 12.7 billion.

Any financial implications will entail lower competitiveness of mining & metals companies, scaled-down investment programs and modernization as well as decreased production.

According to the explanations of Metinvest, “as the sector is oriented towards foreign markets with established prices, increased logistics costs will affect the sector and substantially reduce its competitiveness.”

shutterstock.com

Class convergence

According to Oleksandr Kryvoruchko, Head of the Association of Wagon Owners, in addition to increased cargo rates, there are some other equally important initiatives, such as convergence of cargo classes, which will lead to an increase in costs by around UAH 3 to 7 billion. In addition, guaranteed shipments can be introduced. However, being a monopoly, Ukrzaliznytsia is obliged to make all declared operations without any charges for “guarantees”. Moreover, possible access of private carriers will require large investment from the business.

In the context of the current indexation of rates, Ukrzaliznytsia offers no guarantees of timely supply of wagons and exports. Neither they guarantee locomotive traction corresponding to the size of transportation.

“The business is ready for a certain increase in cargo rates. It is justified. However, the question is how these funds will be used,” Oleksandr Kryvoruchko sums up. “I am sure that if it were this way: we will increase rates by 25%, but we will guarantee that we export everything in time, the business would agree. And private carriers would be out of question.”