Posts State Ukraine’s GDP 11406 29 December 2023

Next year steel production may reach 7.2-7.5 million tons

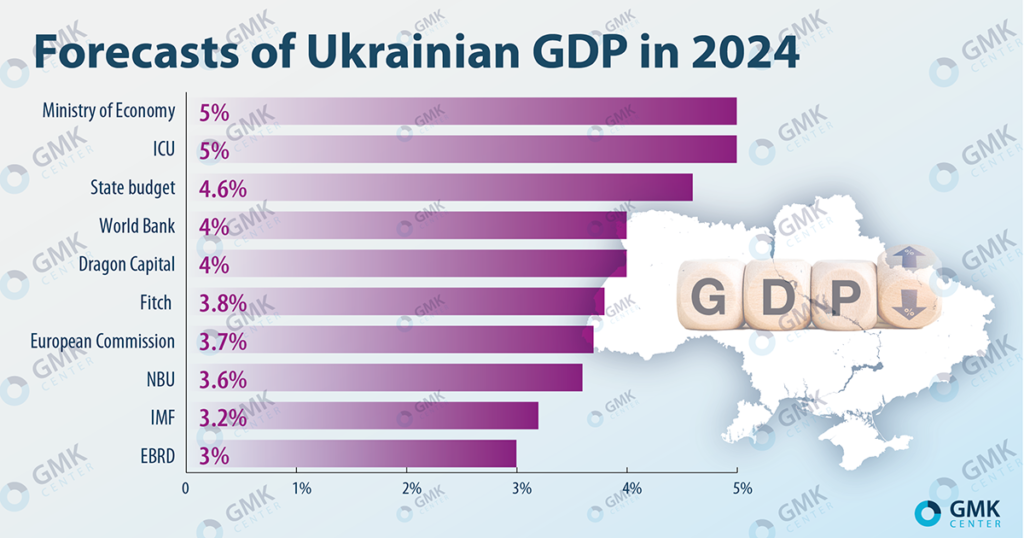

The Ukrainian economy has demonstrated quite high resilience to negative factors, which are still the majority. In 2023, the Ukrainian economy recovered faster than forecasted – after the outbreak of a full-scale war, economic growth in Ukraine resumed in the second quarter. Ukrainian business adapted relatively quickly to the complex and rapidly changing conditions, reconfiguring business processes, reorganizing logistics routes, etc. Despite many negative factors and a high degree of uncertainty, analysts expect the Ukrainian economy to grow by 3-5% in 2024.

Unstable 2023

Throughout 2023, analysts have been constantly adjusting their forecasts. The most illustrative examples of improvement in Ukraine’s GDP growth forecasts for 2023 are as follows (four corrections per year):

- Dragon Capital – from -5% up to 5.2%;

- NBU – from 0.3% up to 4.9%.

The emergence of some factors and disappearance of others affected the economy in 2023 both negatively and positively. The former included the blockade of the border with Poland, which could potentially reduce GDP by 1% and the undermining of the Kakhovskaya HPP dam, after which the Ministry of Economy worsened the economic growth forecast to 2.8% from 3.2%.

There was also a positive impact. The National Bank estimated that closing the “grain corridor” in July would cost Ukraine $2 billion in the second half of 2023. However, the relatively successful operation of the new corridor, as well as a stable energy situation (until the end of 2023) and a good harvest (according to NBU estimates, it adds 1.3 pp to GDP) led Dragon Capital to raise its 2023 GDP growth forecast from 4.5% to 5.2%, and Fitch – from 3.5% to 5.1%.

Taking into account the indicators of the second quarter and the impact of the transportation blockade, real GDP growth in 2023 is estimated in the range of 4.5-5.8%, while at the beginning of the year analysts expected the Ukrainian economy to grow by 2-3%. The Ministry of Economy estimates the dynamics of Ukrainian GDP for January-November at the level of 5.5%, including in November – about 4%. The functioning of the export corridor made it possible to partially compensate for the losses due to the blockade of the Ukrainian-Polish border, which are already estimated to exceed $1bn.

Business conditions

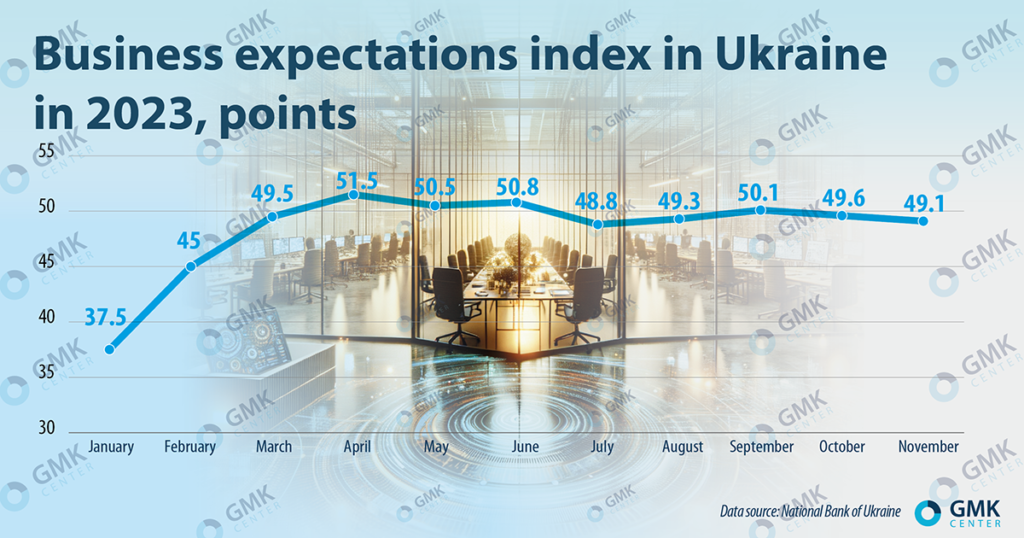

At the same time, it cannot be said that after the growth in early 2023, business activity has significantly improved. Thus, from January to March, the Business Activity Expectations Index (BAEI) calculated by the NBU, which shows the business assessment of the current state of the economy, rose from 37.5 points to 45 p. During the rest of the year, it varied between 48.1- 51.5 points (50 points – neutral level), reaching 49.1 points in November. In other words, fluctuations in assessments of the business environment were insignificant.

This year, different sectors of the economy showed different dynamics. According to the NBU, the size of companies’ revenues for the first nine months of 2023 even slightly exceeded the level of pre-war 2021, which is due to price growth. Among the industries that show the best financial condition, those oriented to the domestic market prevail. For January-September 2023, the key industries showed this growth dynamic compared to the same period in 2022:

- construction – by 20.4%;

- retail trade – by 14.9%;

- industrial production – by 2.4%.

Research shows that Ukrainian companies remain quite resilient despite financial difficulties, interrupted business processes and logistics, and lack of state support. According to a survey by the European Business Association (EBA), as of October, 77% of respondent companies have fully restored their operations.

Factors of influence

Positive factors that could contribute to economic growth in 2024 include:

- timely and complete receipt of international financial assistance;

- increase in economic activity of business;

- safe and stable operation of the sea corridor;

- extension of the effect of a high harvest in the first half of 2024;

- stable situation with energy supplies;

- return of migrants:

- reduction in the cost of bank lending due to a decrease in the discount rate, etc.

The restraining factors for economic growth next year remain or may become:

- prolongation of the active phase of hostilities, continued destruction of infrastructure and fixed assets;

- reduction in volumes or loss of rhythm in the flow of international financial assistance;

- high probability of increased military spending, including due to increased mobilization;

- prolongation of the border blockade by foreign road carriers;

- strengthening restrictions on export logistics;

- rising prices and production costs;

- lack of working capital in business;

- shortage of qualified personnel (according to Advanter estimates, as of August, 34% of businesses were experiencing a shortage of personnel, the share of such companies quickly increased from 20% in April);

- weak level of bank lending (84% of companies experience difficulties with access to financing).

The global factor that may restrain the growth of Ukrainian GDP is a possible slowdown in the global economy in general and the European economy in particular, which may result in lower demand for Ukrainian export products and lower prices for raw materials.

Financial aid

The most serious economic threat already in the short term may be the reduction of financial support from international partners. External financing covers about half of budget expenditures. For example, in the first 11 months of 2023, Ukraine attracted $37.4bn of external financing for social needs of the state budget. In 2023, donors’ assistance should amount to about $42.3 billion.

The 2024 state budget envisages external borrowings of $41bn, including $18bn from the EU, $8.5bn – from the USA and $5.4bn – from the IMF. The remaining amount ($9.1bn) the Finance Ministry planned to attract in the form of aid from Japan, Canada, Norway, South Korea and the World Bank. The Ministry of Finance has tentatively agreed to receive less than a third of the required amount.

The problems with the allocation of financial aid are caused by internal reasons of the partners themselves. The European Union’s allocation of €50bn to Ukraine for four years (€33bn in loans and €17bn in grants) was delayed due to internal disagreements. In turn, the U.S. authorities were unable to quickly pass through Congress military and financial aid to Ukraine for $61 billion (including $11.8 billion in direct budget support). The decision-making was postponed until 2024: the USA will be able to approve it in early January, the EU – in early February.

The Ukrainian authorities are trying to insure themselves against a negative scenario. The Finance Ministry has managed to reduce the need for external financing for 2024 to $37.3bn at the expense of domestic sources. However, problems with the financing of budget expenditures due to the lack of financial aid may start as early as March, while internal reserves and opportunities allow to survive the “cash gap” in January-February.

In case of a negative development of events, Ukraine will be forced to (and/or):

- carry out budget sequestration, refusal of non-critical expenses;

- increase taxes;

- devalue the national currency;

- “turn on the machine” – carry out a dangerous emission of hryvnia.

In any case, none of these options can compensate for the lack of tens of billions of dollars and will not provide the necessary funds (except for the “machine”) quickly and steadily.

Expectations 2024

Taking into account the current situation, expectations of Ukrainian GDP growth in 2024 are in the range of 3-5%. The forecast in the country’s main financial document – the state budget-2024 – is set at 4.6 percent in the final version, compared to 5 percent in the first reading.

Due to the prolongation of the war, Dragon Capital downgraded its economic growth forecast for 2024 from 8% to 4% back in the fall. In turn, ICU Investment Group worsened its assessment from 6.4% to 5%, largely due to the risk of reduced financial support for Ukraine.

Maintaining openness and security of logistics routes is crucial for Ukraine. Despite the protracted blockade of western road crossings and insufficient stability of maritime exports, there are some hopes for a speedy resolution of the former situation. In their forecasts for 2024, Ukrainian investment analysts proceed from the premise that there will be no border blockade in 2024.

According to Dragon Capital, the full-fledged operation of the sea corridor may increase export revenues by $9-10 bln and support GDP growth of up to 5 pp in 2024, while the Ministry of Infrastructure estimates the economic effect of the operation of the ports of Greater Odessa next year at up to 8 pp of additional GDP growth.

The drivers of growth of the Ukrainian economy in 2024 may be public and private consumption, defense industry and export industries (agro-industrial complex, steel industry), state investments in the restoration of infrastructure, etc., as well as the growth of the Ukrainian economy in 2024. Taking into account the budgeted nominal GDP in 2024 of UAH 7.73 trillion and the average annual exchange rate of UAH 40.7/$, the dollar GDP next year may reach almost $190 bln. In 2023, the dollar GDP is estimated to reach $170 bln.

Steel expectations

The demand for steel products in the country has increased by several times this year compared to 2022 due to the significant economic revitalization. According to Ukrmetallurprom, the consumption of rolled steel products for 11 months increased 2.06 times compared to the same period last year – up to 3.25 million tons. This trend is likely to continue next year as well.

“Since March 2023, steel-consuming industries have shown an upward trend against a low base of comparison. Relocation of enterprises, construction of housing for internally displaced persons, restoration of damaged infrastructure and development of new logistic routes contribute to activation in the construction industry,” Worldsteel notes.

According to Oleksandr Kalenkov, President of Ukrmetalurgprom, in 2023, domestic consumption of rolled steel, including imports, will reach about 3.5 million tons. It is expected that in 2024, domestic consumption will reach 3.7-4 million tons of rolled steel products, primarily due to an increase in the share of Ukrainian producers (today their share is about 68.4% of total consumption in the domestic market, in 2024, we can assume that their share will rise to 70-71%.

Unlike steel consumption (where there are a lot of imports), steel production in Ukraine in 2023 showed negative dynamics, i.e. it could not break away from the comparison base of the previous year. The decrease in key production indicators for January-November amounted to:

- steel – -7.3%, up to 5.71 million tons;

- pig iron – -11.3%, up to 5.45 million tons;

- rolled products – -7.2%, up to 4.86 million tons.

Given the high level of uncertainty, predicting the level of steel production in Ukraine in 2024 is quite problematic.

“It is difficult to predict anything yet, there are many factors to be taken into account – the same logistics, volumes of sales markets, technical capabilities of enterprises, the possibility of uninterrupted operation of the plants, etc.,” notes Alexander Kalenkov.

At the same time, according to Andriy Tarasenko, chief analyst at GMK Center, the situation in Ukraine’s steel industry has somewhat stabilized in 2023, but is subject to significant risks. There has been some development, in particular growth in monthly production volumes, compared to the beginning of the war. But any of the factors can dramatically change everything, the key one being the issue of export logistics.

“In 2023, steel output may reach 6.2-6.3 million tons. It is estimated that the average capacity utilization of the operating enterprises was about 60%. According to media reports, AMKR may launch a second blast furnace next year, which could add about 1 mln tons to total steel output, depending on the launch date. If critical risks are avoided and the export corridor continues to work effectively, Ukraine’s steel output next year could reach 7.2-7.5m tons,” sums up Andriy Tarasenko.