Despite all the difficulties, production of crude steel and steel finished products remain stable

2023 was another year of challenges for the Ukrainian steel industry. Companies continued to operate despite shelling, power outages, and logistical challenges. Steel industry has been and remains the main sector that keeps the Ukrainian economy afloat.

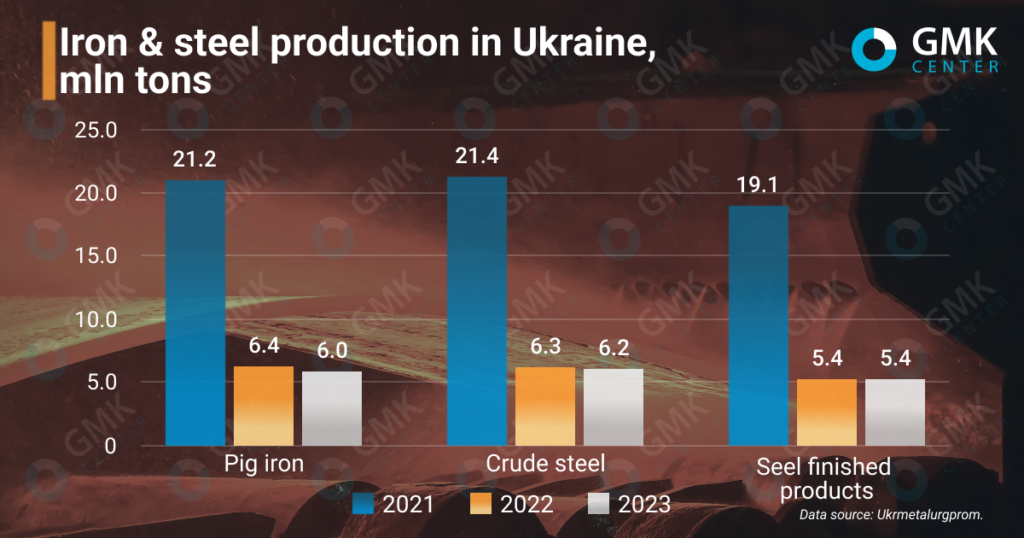

Due to the war, the size of the Ukrainian economy has decreased significantly. The same thing happened in the steel industry, but we can say that the situation has stabilized to some extent: production of crude steel and finished steel products in 2023 was almost the same as in 2022. Only pig iron production fell by 6.1%, which can be explained by the loss of steel mills in Mariupol, which is occupied by Russian troops. Last year, pig iron production at those enterprises that remained in the government-controlled territory increased by 17.0% compared to 2022.

The Ukrainian steel industry has refocused on meeting the needs of the domestic market. In 2023, only half of the steel products produced were exported, which is significantly less than the pre-war share of exports (about 80%). In 2023, the Ukrainian steel industry also became even more integrated with the EU, as more than 80% of steel exports went to the EU (in 2022, the same figure was 60%).

The European Commission’s abolition of import quotas also contributed to the deepening of ties with European companies.

«Last year, we received great support from the European Union in the form of a temporary suspension of all quotas and duties. This allowed us to partially compensate for the rising cost of logistics. Moreover, the absence of quotas now allows us to develop in the European market, search for and enter new niches and more complex products,» said Denis Morozov, Director of Interpipe’s Pipe Division.

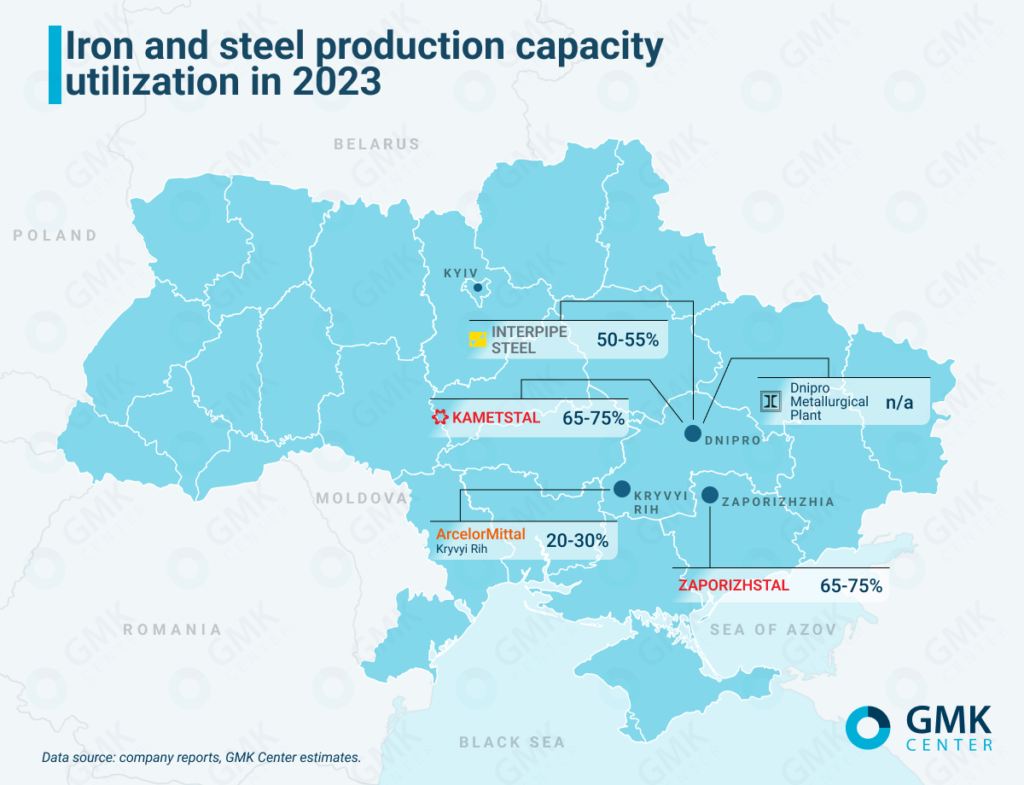

Depending on the enterprise, the utilization of iron and steel production capacities ranged from 20% to 70%. In March 2023, Zaporizhstal brought blast furnace No. 2 out of hot mothballing, and since then the company has operated 3 blast furnaces out of 4. In 12 months of 2023, the plant produced 2.72 million tonnes of pig iron (+35.3% y/y), 2.47 million tonnes of steel (+65.4%) and 2.05 million tonnes of finished steel products (+57.2%).

ArcelorMittal Kryvyi Rih operated only one blast furnace out of four. In the first half of 2023, the plant produced 390 thousand tons of steel, down 56.2% from the same period in 2022. With only one blast furnace in operation, the company can operate at only 20-30% of its capacity.

Kametstal operated two blast furnaces out of three. In 9 months of 2023, the plant produced 1.3 million tons of pig iron (+11% y/y) and 1.5 million tons of steel (+17%). In Q3 2023, pig iron production decreased by 10% quarter-on-quarter due to the shutdown of blast furnace No. 1 for scheduled overhaul.

Interpipe increased steel production by 14.5% year-on-year in 9M2023 (to 530 thousand tons), while pipe production remained virtually unchanged (at 309 thousand tons). The company attributed the growth in steel production to the accumulation of billet stocks ahead of the autumn-winter period, during which it expected possible power outages.

Dnipro Metallurgical Plant operated only a rolling mill, with billets supplied by Kametstal. In 11 months of 2023, Dnipro Metallurgical Plant produced 100.4 thousand tons of finished steel products against an annual production capacity of about 1.1 million tons, meaning that rolling capacity utilization was 10%.

Ukrainian steelmaking companies are located close to the contact line where military operations are taking place, so the biggest risk is associated with the consequences of shelling, which pose a threat to both production assets and personnel. It is currently impossible to fully neutralize this risk, and the companies continue to operate with due regard for possible security measures.

At the beginning of last year, power outages caused by shelling of energy infrastructure became a significant challenge for steelmakers. Blackouts significantly limited the operation of steel mills and this is evident in production figures: in January 2023, steel production amounted to 283.9 thousand tons, in February – 423.7 thousand tons, while the average monthly steel production in 2023 was 500.2 thousand tons. In addition, emergency power outages led to increased equipment wear and tear, necessitating further investment in repairs.

The stabilization of power supply in spring 2023 allowed steelmakers to increase capacity utilization. We cannot completely rule out the possibility of recurring power outages in the future, as the power grid has been severely damaged and shelling may recur. However, the Ukrainian government has made certain decisions that will help minimize the negative effects of possible blackouts. In particular, it has built engineering protection for the electricity distribution network, strengthened air defense, and expanded electricity imports. In particular, industrial enterprises were able to enter into direct contracts for electricity imports. The existence of such contracts creates the preconditions for uninterrupted power supply even in the event of emergency outages.

A specific challenge in June 2023 was the undermining of the Kakhovka Reservoir dam by Russian troops, which disrupted water supply to enterprises in Kryvyi Rih. ArcelorMittal Kryvyi Rih even temporarily suspended steel production to reduce water consumption. Subsequently, the water problems were resolved by arranging for supplies from alternative sources.

Logistical constraints remain the biggest challenge for Ukrainian steelmakers. Since the beginning of the war, seaports have not been fully operational. From July 2022 to July 2023, a grain agreement was in effect, under which three Ukrainian ports (Odesa, Chornomorsk, and Pivdennyi) could send ships loaded with grain and other food products. This allowed to free up rail and road transport to some extent for the transportation of other goods, including metallurgical products.

In July 2023 Russia withdrew from the grain deal, and in the fall, Ukraine managed to launch an alternative sea corridor, which began to transport not only agricultural products but also mining and metals. The functioning of this sea corridor is fraught with a number of problems and limitations, as this route is not completely safe and cannot be used for the same volume of transportation as before the war.

In addition, in parallel with the launch of the sea corridor, Polish road carriers began a prolonged blockade of the border, thereby reducing the possibility of exporting products from Ukraine by road. The limited capacity of border railroad crossings also remains a weakness, creating queues and delaying the movement of goods to the EU. In our view, logistical issues will remain a major factor determining steel production volumes in the future.

Despite all the difficulties of wartime, ArcelorMittal Kryvyi Rih is considering increasing production in 2024, which may seem logical, as the company’s capacity utilization is lower than that of Kametstal and Zaporizhstal.

«In 2024, we plan to increase production and expand our production capacity due to the operation of two blast furnaces. Thus, our production capacity utilization will increase from 30% to 50%,» Mauro Longobardo, CEO of ArcelorMittal Kryvyi Rih, said.

On the other hand, amid uncertainty and high military risks, it is highly likely that the production increase will have to be abandoned. In our view, the baseline (realistic) scenario for the current year is to maintain production output at the level of 2023. Such production levels can be maintained given the existing logistical constraints and other wartime problems – the production figures for 2022 and 2023 confirm this thesis.

Of course, crude steel production will also depend on the European market, which is currently our main export destination. We do not expect a significant deterioration in the EU economy, so we believe that demand for steel and pig iron from Ukraine will remain more or less stable.

Deeper economic integration with the EU is prompting Ukrainian steelmakers to raise issues related to the longer term, including the decarbonization of steelmaking capacity. Of course, the war has put investment programs on hold, but in the context of post-war reconstruction, green transformation is a major topic of discussion. In the long term, steelmakers are seeking to restart production with the latest green technologies to be competitive in the European market.

«If we sum up the investments in the green transformation of our Ukrainian assets – mining and processing plants, Kametstal and Zaporizhstal

– the total amount is about $9 billion. It is feasible and we plan to do it after the war is over. This is an investment program for 5-10 years,» Yuriy Ryzhenkov, CEO of Metinvest Holding, in an interview with Forbes, said.

Despite the war, the Ukrainian steel industry has survived and continues to operate. Steelmaking companies have demonstrated endurance and high adaptability in difficult times. Therefore, there is every reason to believe that in 2024, the steel industry will retain its role in the Ukrainian economy and will be the basis for the recovery of Ukraine’s infrastructure and economy.