European consumers are preparing for the entry into force of sanctions on slabs and are looking for alternative suppliers

The war in Ukraine has greatly changed the logistics and supply chains of raw materials and semi-finished products for European steel industry. Previously, 80% of steel semi-finished products imported to the EU were supplied by Ukraine and the Russian Federation. Ukrainian steel exports predictably collapsed in 2022 after the loss of key steel plants in Mariupol and a reduction in production at the remaining plants. At the same time, Russian exports of slabs (a semi-finished product for the production of flats) to the EU continued. A number of European consumers have partially switched to slabs from Asian suppliers.

Global market

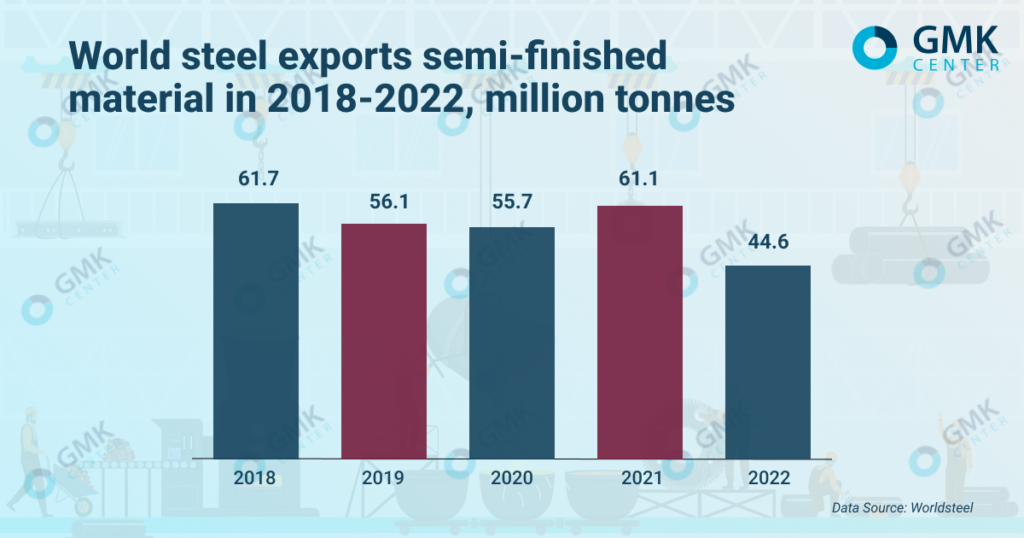

According to Worldsteel, in 2022, global trade in semi-finished products fell by 27% y/y – to 44.6 million tons. Last year, this figure reached a 5-year low. This is due to a reduction in supplies from the Russian Federation as a result of sanctions from various countries and the deliberate refusal of a number of suppliers from Russian semi-finished products, as well as a drop in supplies from Ukraine due to the destruction of steel capacities in Mariupol and logistical difficulties for the remaining enterprises.

In general, global exports of semi-finished products are very small compared to total steel production. This means that the largest steel companies produce semi-finished products for their needs within their value chains.

European market

The European steel market was significantly dependent on the import of slabs (code 7207 12 10) from Ukraine and Russia. According to Eurostat, in 2022, imports of slabs to the EU decreased by 16% – to 5.3 million tons, and in the four months of 2023 this figure fell by another 24% – to 1.58 million tons.

As a result of the war, the supply structure changed significantly – Russia reduced the shipment of slabs, Ukrainian exports collapsed due to the loss of production capacity. Russian exports of slabs to the EU last year amounted to 3.36 million tons, and in the four months of 2023 EU companies have already imported 1.17 million tons.

In turn, Ukraine exported 366.1 thousand tons of slabs to the European Union in 2022 (-82.5% y/y), imports in January-April amounted to only 21 thousand tons (-94.2%). The sharp decline in Ukrainian slab exports in 2023 is due to the loss of production capacity in Mariupol, and the relatively high result for the entire last year is associated with pre-war deliveries in January-February in the amount of 267.4 thousand tons.

Ukrainian customs statistics show that in the first half of 2023 the main importers of semi-finished products (including slabs) from our country were Poland (35.5% of supplies in monetary terms), Bulgaria (29.8%) and Italy (7.5%). The structure of importing countries has not changed compared to 2022: Bulgaria (25.5%), Poland (14%) and Italy (12.1%). The presence of Bulgaria and Italy in the list of consumer countries is associated with the supply of semi-finished products to the foreign assets of the Metinvest group – the Promet Steel plant (Bulgaria), as well as the Italian Metinvest Trametal and Ferriera Valsider.

At the same time, there was no acute shortage of steel semi-finished products on the EU market. European consumers have found a replacement for Ukrainian and partially Russian slabs in supplies from Asia – China and India, as well as from Brazil:

- Chinese exports of slabs to the EU in 2022 amounted to 366.6 thousand tons (in 2021 – only 1.7 thousand tons), in January-April – 8.2 thousand tons (for the same period in 2022 – total 86.8 tons);

- Indian exports to the EU more than doubled last year – to 207 thousand tons (in 2021 – 95.7 thousand tons), but in January-April there was a sharp decline – to 24.8 thousand tons (-26,8%).

- Brazil began exporting slabs to Europe in September 2021 and managed to increase it 3 times in 2022 – up to 463.9 thousand tons. In January-April, exports amounted to 63.7 thousand tons (-53.3% compared to the same period last year).

In the future, it is possible to increase the share of Brazilian slabs in European markets. ArcelorMittal acquired Brazilian slab producer CSP for $2.2 billion in mid-2022. In this regard, ArcelorMittal Pecem, as the company is now called, plans to increase production and export of slabs to Europe. At the first stage, the plant plans to increase production from the current 2.85 million tons/year to 3 million tons/year.

Turkiye’s importance as an exporter of slabs is minimal for Europe. In 2022, the country reduced by 77.2% y/y shipments to the European Union – to 13.3 thousand tons. No deliveries were made in 2023.

European market protection

At the beginning of the war, European re-rollers opposed in every possible way a complete ban on the import of semi-finished products from the Russian Federation into the EU. As arguments, they told about the lack of alternatives to Russian semi-finished products and the inability of third countries (with the ban on imports of semi-finished products from the Russian Federation) to ensure stable supplies. They called sanctioned factories in Iran and American producers that provide the US and Mexico as affordable alternatives.

The situation on the European market of semi-finished products will be changed by tougher sanctions against Russian steel products. From September 30, 2023, the 8th package of sanctions will come into full force, with the exception of certain steel semi-finished products, including slabs. A transitional period is provided for them – the import of slabs (code 7207 12 10) is prohibited from October 1, 2024. At the same time, quotas are introduced for the import of slabs from the Russian Federation. Permitted monthly slab imports will be only 20% below the actual average monthly imports in 2022.

Quotas for the import of slabs from Russia

| Code | Product | Quota period | Import volume, ths t |

|---|---|---|---|

| 7207 12 10 | slabs | 7.10.2022 – 30.09.2023 | 3 747,9 |

| 7207 11 | square billet | 1.10.2023 – 30.09.2024 | 3 747,9 |

Such sanctions will mainly affect NLMK Group, which supplies slabs to its rolling mills in Europe (Belgium, France, Denmark, Italy). In 2021, NLMK supplied 2.4 million tons of steel products to its European enterprises. These measures forced the company to look for alternative suppliers for its European factories.

As part of the 11th package of sanctions, the EU will demand from exporters documents on the origin of steel products. The new requirements will come into force on September 30, 2023. Türkiye, Egypt and the countries of the Middle East will suffer the most from these measures. These measures will practically not affect Asian producers.

Turkish imports of Russian slabs

Last year, Turkiye became a transshipment base for the processing of Russian slabs and the subsequent import of steel products to other countries, in particular, to the European Union. Most Turkish hot-rolled coil producers rely on Russian slabs. The attractiveness of their supplies for Turkish producers is caused by significant discounts.

According to the Turkish Statistical Institute (TUIK), in May, Türkiye imported from six countries 480.7 thousand tons of slabs (in April – 329.2 thousand tons), which is 23.9 times more than in May 2022. In January-May 2023, Turkiye imported 19.6% more slabs than in the same period of 2022 – 1.3 million tons. Deliveries from Russia amounted to 209.8 thousand tons in April, 276.5 thousand tons in May, the total share of the Russian Federation in the total import of slabs to Turkiye amounted to 57.5%.

Also, imports came from Asian countries – Indonesia, Malaysia, China and South Korea. At the same time, in 2023, slabs were supplied to Turkiye from Uzbekistan and the United Arab Emirates – countries that do not produce this type of semi-finished products. Thus, these supplies can theoretically be considered as Russian ones (it makes no sense for other countries to supply products in such a complicated way). With this assessment, the share of slabs from the Russian Federation in the Turkish market reaches 70%. In 2022, Turkish steelmakers increased imports of slabs by 50.1% compared to 2021 – up to 2.29 million tons.

Ukrainian market

It is possible to evaluate the Ukrainian export market only partially, since official customs statistics do not allow distinguishing slabs from other types of semi-finished products. In total, in the first half of 2023, Ukraine exported 549.5 thousand tons of semi-finished products, which is 61.5% less compared to the same period in 2022. At the same time, according to Eurostat, 284.3 thousand of square billets were exported in January-April. In 2022, the export of semi-finished products from Ukraine decreased by 72% y/y – to 1.89 million tons, and 710.6 thousand tons were square billets of them.

At the same time, the monthly export dynamics reversed sharply in June. In June, the export of semi-finished products decreased by 33.1% compared to the previous month – to 101.5 thousand tons. At the same time, there was a positive trend in previous months. In particular, in February, exports of semi-finished products in physical terms increased by 80.6% m/m, in March – by 25.5% m/m, in April – by 24% m/m, and in May – by 54.8% m/m. This trend is due to the fact that exports fell in June amid a reduction in production due to the undermining of the Kakhovska hydroelectric power station’s dam. This caused problems with water supply at a number of iron and steel enterprises.

In Ukraine, slabs have traditionally been produced at the steel facilities of Metinvest in Mariupol. After the destruction and loss of control over these assets, Zaporizhstal Iron and Steel Works remained the only producer, which produces slabs in small volumes – according to various estimates, 30 thousand tons of slabs were produced in 2023 in total. Thus, the export potential of the production of Ukrainian slabs is worse than another type of semi-finished products – square billets.

However, Zaporizhstal plans to increase the production of commercial slabs to 60-80 thousand tons per month for the Italian enterprises of Metinvest and its English plant Spartan UK. For the normal utilization of Italian assets, 130-140 thousand tons of slabs per month are needed. Thus, Metinvest plans to increase the share of Zaporizhstal slabs at Italian rolling mills to about 50%. At present, steel plant is waiting for the certification of these products. Previously, Mariupol steel mills were suppliers of semi-finished products for Metinvest’s foreign assets, but since the end of summer 2022 they have been replaced by slabs from Asian countries.

The war led to massive changes in the supply chains of steel companies. Obviously, these changes will continue in the future because a complete ban on the import of Russian slabs into Europe has not yet come into force. The acquisition of the Hungarian Dunaferr plant by Metinvest could partially compensate for the cessation of slab supplies from Ukraine and arrange the processing of Ukrainian iron ore in Europe, but Liberty Steel won the tender.

Future supply in the slab market will be determined by such factors as the resumption of trade with Iran (unlikely, given the lack of negotiations on the resumption of the nuclear deal), the construction by Metinvest in partnership with Danieli of a new plant in the EU, which would allow the production of slabs from Ukrainian iron ore, as well as a potential increase in supplies from the Asian region in case of a shortage.