Posts Global Market economy 4301 17 March 2023

At the beginning of the year, analysts improved forecasts for the growth of the Eurozone economy to 0.6-0.9% in 2023

Europe managed to overcome the most difficult phase of the energy crisis, paying for it about €1 trillion. From October 2022, business expectations of industry in the Eurozone are rising, but the European Central Bank’s fight against high inflation by increasing rates is limiting the scope for economic growth.

Energetic struggle

The main factor affecting the EU economy in 2022 was the energy crisis and, as a result, high energy prices. However, Europe managed to give up Russian gas and persevere, paying a high price for it, – estimates vary slightly, but they are huge.

Research company Bruegel estimated that European countries spent €768 billion between September 2021 and January 2023 to protect households and businesses from high energy prices. According to Bloomberg estimates, the cost of saving Europe from the energy crisis amounted to about $1 trillion – this is the level of price increases for energy resources for consumers.

However, the mentioned costs were partially compensated by the state. According to Bruegel’s estimates, in absolute terms, Germany (€264 billion), Italy (€92.7 billion) and France (€92.1 billion) were the leaders in providing financial assistance. In relative terms, Slovakia became the leader –subsidies amounted to 9% of GDP. These subsidies will continue to operate in 2023 and, most likely, will exceed €1 trillion by the second half of the year.

Practically all European countries reduced gas demand this winter, exceeding the target level of 15%, and in some countries the reduction was 40% or more (Finland, Lithuania, Sweden).

Reference: The EU has set a goal of reducing gas consumption by 15% for the period from August 2022 to March 2023. In general, consumption in the EU from August 2022 to January-2023 decreased by 19% compared to the average figure for the previous five years.

The success of Europe’s struggle was also reflected in the reduction of gas prices by 3-4 times – at the beginning of March, they were at the level of $450-500 per thousand cubic meters compared to the peaks of 2022. This was the result not only of a decrease in gas consumption, but also of sufficient reserves in gas storages in the European Union (now they are 58.9%, while in mid-March 2022 this indicator was at the level of 25.5%), as well as warm and windy weather.

China’s intention to achieve economic growth of 5% in 2023 will lead to increased competition with Europe for energy resources, in particular liquefied gas. Thus, the 2023-2024 season may be no less difficult for European countries than 2022-2023.

Game with rates

The energy crisis in Europe and high inflation around the world forced the central banks of developed countries and, in particular, the European Central Bank (ECB) to start raising key rates last year. The ECB raised the rate from 0% to 0.5% last July, bringing it to 3,5% in March 2023.

Such a policy to a certain extent made it possible to reduce the rise in prices. Inflation in the Eurozone slowed down from 8.6% in January to 8.5% y/y in February, but turned out to be higher than the forecast, which predicted a weakening of consumer price growth rates to 8.2% y/y. In November and December 2022, inflation was at the level of 10.1% y/y and 9.2% y/y, respectively.

At the same time, inflation in Europe’s largest economies still remains high: in February it was at the level of 9.3% in Germany (8.7% in January), 6.2% in France – (6%), and in Italy – 9.2% (10%).

The target level of inflation in the Eurozone is 2%, and the ECB intends to do everything to reach this level. The marginal rate level will depend on the ECB achieving its goal. The market and the regulator expect that the rate may rise for another year – until February 2024. Fitch expects that the peak level of the base interest rate on ECB loans will be 4%, this value will be reached in June. The European Commission forecasts inflation in the Eurozone in 2023 and 2024 at the level of 5.6% (previously – 6.1%) and 2.5% (2.6%), respectively.

“Inflation risks continue to exert their pressure. The fall in energy prices has not yet been reflected in the expected decrease in prices for other goods and services. In these sectors, inflation continued its growth in February. This may be a consequence of a satisfactory state of economic activity. The market expects inflation to decline in the coming months. But if this does not happen, the ECB will continue the strengthening policy, cooling the economy,” says Andriy Tarasenko, chief analyst at GMK Center

Weak link

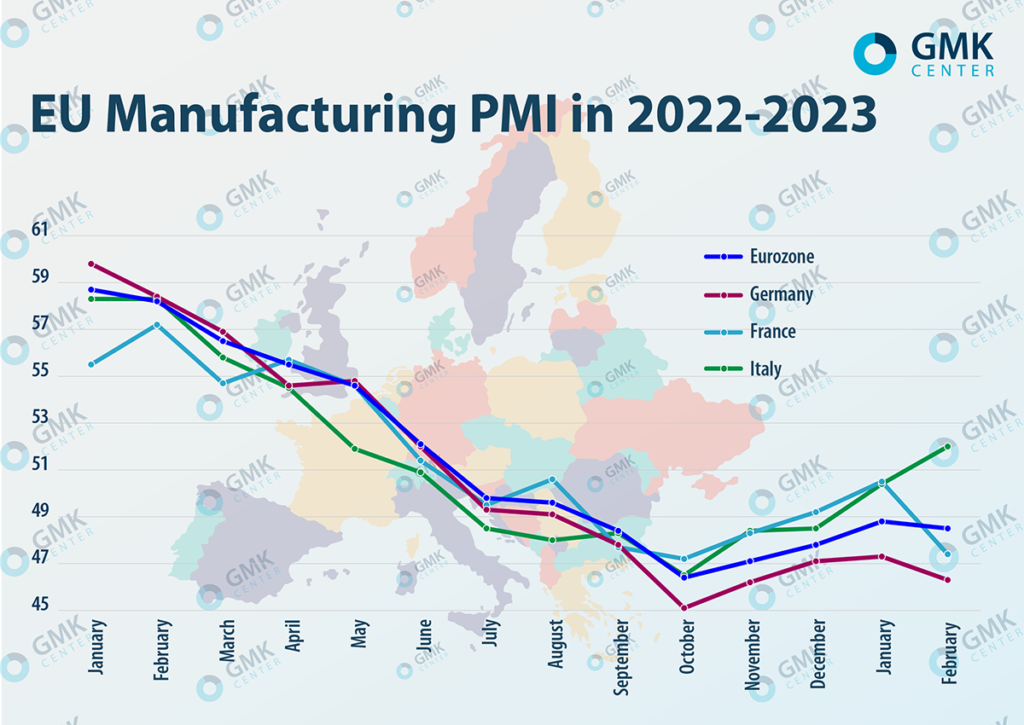

The economic situation in the Eurozone is largely shaped by the situation in the largest countries. Business conditions in the manufacturing industry (The Manufacturing PMI) based on the February results of the key European economies – Germany (46.3 points) and France (47.4 points) show the presence of problems. German business valuations have been below the 50 p. mark for eight months, and French business valuations have fallen into this range after a short-term rise in January (50.5 p.). This led to a decrease in the general index of the Eurozone – from 48.8 points in January to 48.5 points.

Reference: PMI above the 50-point mark indicates an increase in activity in the industrial sector.

The increase in estimates in the Eurozone from October 2022 is very modest. For comparison: The Manufacturing PMI in the world in February was 50 points, in China – 52.6 points. The majority of developing countries showed the dynamics of increasing estimates. In the USA, the index is also gradually recovering – 47.3 points against 46.9 points in January.

Estimates of the processing industry in Germany fully correspond to the macroeconomic situation in the country. The German economy decreased by 0.2% q/q in the fourth quarter of 2022 (up 0.5% q/q in the third quarter), although it increased by 1.9% y/y in 2022. Moreover, the country’s central bank predicts a reduction in economic indicators in the first quarter of 2023. Weak industrial production, a decline in exports and a slowdown in the construction sector contributed to the deterioration of the forecast.

All this indicates signs of recession in one of Europe’s largest economies. The median forecast in Bloomberg’s monthly survey of analysts was a 0.3% drop in GDP in the first quarter. Although estimates of the dynamics of German economy development in 2023 vary in a wide range – from minimal growth of 0.2% y/y to slight decrease. In any case, problems in the German economy will drag down the European economy as well.

The index of expectations indicator Ifo rose more than expected in February to the highest level in a year. Industrial production increased by 3.5% in January – more than twice as high as predicted.

“Germany is approaching the end of the first quarter with a sense of quiet optimism that its crisis of 2022 has been consigned to history. Forecasters no longer predict Europe’s biggest economy will shrink this year, escaping instead with a mild recession that it’s likely to exit in the spring. Some, including Goldman Sachs, even reckon that short downturn can still just be averted. Germany’s corporate sector provides grounds for hope. Industrial output and business expectations have reached the highest levels since Russia invaded Ukraine. The resumption of work in China opens up good prospects for German exporters. Sensing what might happen, German factories are talking about a surge in new foreign orders in January,” writes Bloomberg.

Light in the tunnel

The Eurozone economy is showing better dynamics than expected. Preliminary data for the fourth quarter of 2022 indicated a 0.1% q/q growth in Eurozone GDP and by 1.9% in annual terms. However, revised data showed 0% q/q and 1.8% y/y. Analysts generally forecast a contraction in GDP for the fourth quarter of 0.1% q/q and growth by 1.8% y/y. In the third quarter of 2022, the economy of the Eurozone increased by 0.4% q/q. (It was revised from 0.3% q/q).

Dynamics of the economic development of the eurozone countries in 2022.

| I quarter | II quarter | III quarter | IV quarter | |

| Eurozone GDP, % q/q | 0,3 | 0,6 | 0,4 | 0 |

“The energy crisis and tightening of monetary policy did not lead to a recession in the eurozone countries, the pessimistic estimates were exaggerated. The pace of economic development has, in fact, remained the same as we have seen since and before COVID. Construction is lagging behind, but volumes in the industry are secured in advance by the existing order book, and negative sentiment is associated with a lack of new orders and fears that higher interest rates will delay new construction projects. But it will have an impact only in the second half of 2023, when other industries should recover. This may mean that the subsidence in construction will not be significant,” notes Tarasenko.

According to Eurostat, industrial production in the Eurozone increased by 0.7% m/m in January (analysts expected 0.4% m/m) compared to 1.3% m/m in December. Annualized growth was 0.9% y/y with expectations of 0.2% y/y.

In addition, according to Eurostat estimates, the increase in producer prices (PPI index) in the Eurozone in January was the lowest in 17 months – it amounted to 15% compared to the same month in 2022. Analysts predicted an average growth of 17.7%.

At the beginning of 2023, the growth forecasts of the Eurozone economy for 2023 were improved:

- Goldman Sachs expects an increase of 0.6% instead of the previously expected decrease of 0.1%;

- the IMF raised the forecast to 0.7% from 0.5% in October 2022;

- European Commission adjusted the forecast to 0.9% from 0.3% in November 2022;

- Fitch raised expectations from 0.2% to 0.8%.

If we talk about forecasts for individual countries, the European Commission has improved its expectations of GDP growth for Germany in 2023 to 0.2% (previously -0.6%), France – from 0.4% to 0.6%, and Italy – from 0.3% to 0.8%. At the same time, all these estimates are below the level of the global economic growth forecast for the current year. Thus, the IMF increased the forecast of global GDP growth for 2023 from 2.7% in October 2022 to 2.9%.

And if we talk about the current situation of the European market, then this is rather a short-term rebound due to the fact that Europe was able to survive the difficult phase of the energy crisis, wait for the reduction of energy prices and start curbing inflation. With very modest growth prospects, the high interest rate will hold back economic development in the Eurozone in the short term and, in particular, bank lending, which is key to business.

“As elsewhere in developed economies, the growth of the EU economy will depend heavily on the actions of the ECB and the success of its fight against inflation. Europe will also continue to be in the process of restructuring its energy sector after the break with the Russian Federation, and therefore it may again face shortages or very expensive energy resources. Such a development will be painful both for business directly and at the macroeconomic level, as it will undermine the ECB’s efforts to contain price growth. However, the reverse scenario is quite likely – activity in China does not grow much, and therefore oil and gas prices remain at a low level,” summarizes Konstantin Fastivets, head of the analytical department of IC “Adamant Capital”.