Posts Global Market electricity prices 4148 09 February 2024

Average gas prices and CO2 emissions continued to fall last month

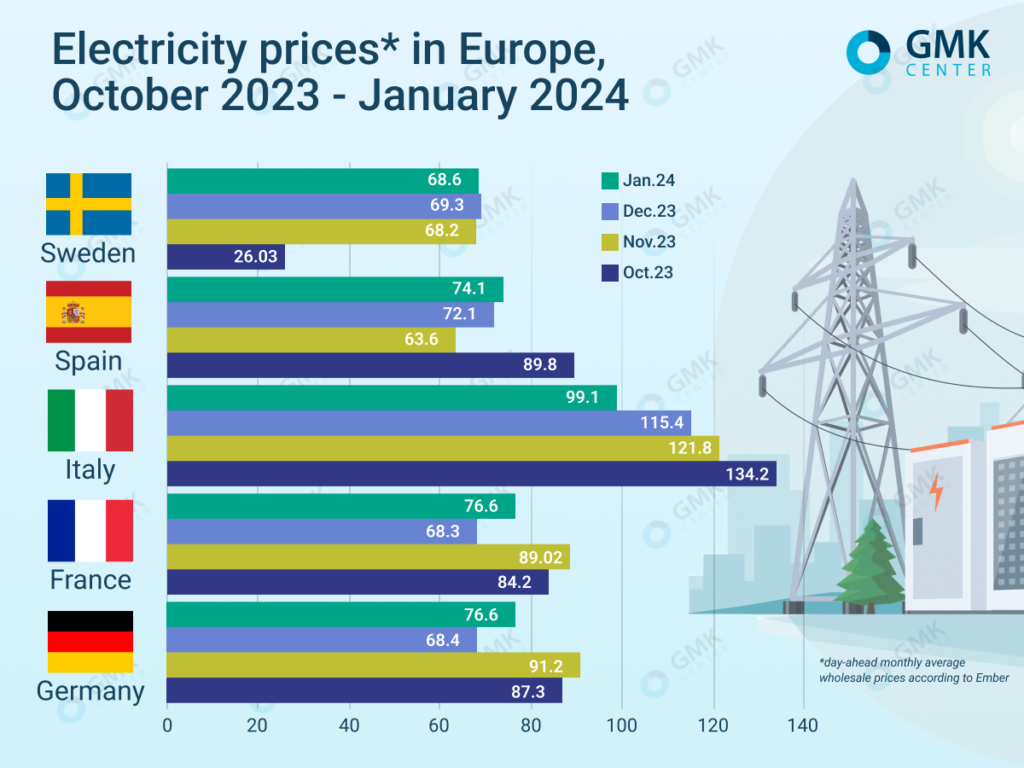

In the EU, the monthly average wholesale day-ahead prices in January 2024 in most markets showed higher average values compared to December.

According to Ember, they amounted to:

- Italy – €99.1/MWh (-14.1% m/m);

- France – €76.6/MWh (+12.2%);

- Germany – €76.6/MWh (+12%);

- Spain – €74.1/MWh (+2.7%);

- Sweden – €68.6/MWh (-1%).

Electricity prices in Europe, GMK Center

January trends

In January 2023, AleaSoft Energy Forecasting noted that due to lower temperatures in all European markets, an increase in electricity demand was recorded compared to the same period in 2023. The beginning of the year was colder than the same period last year in most countries. In addition, wind generation volumes were unstable in January, except for some markets. At the same time, solar power generation reached record levels for the month.

Average gas prices and CO2 emissions fell for the third and sixth consecutive month in January 2024, respectively. In particular, the average price for TTF futures for the month ahead last month amounted to €29.91/MWh, a decline that has been observed since mid-October last year.

In Ukraine, the weighted average price of electricity on the day-ahead market in January 2023 decreased by 5.9% compared to the previous month – to 3858 UAH/MWh (€95.2 at the rate of 40.51 UAH/EUR), according to Market Operator data. Demand for DAM last month fell by 16.15% compared to December, while supply decreased by 8.43% m/m.

Forecasts for 2024

In mid-January, the European Commission noted that although gas and electricity prices have fallen below their 2022 peak, they will not return to pre-pandemic levels in the foreseeable future. The institution warned of the long-term economic consequences of high energy costs for EU competitiveness.

The EU seeks to reduce dependence on global price fluctuations in the energy sector. The main ways to achieve this goal are to continue to diversify energy sources, accelerate the introduction of renewable energy sources, decarbonize the economy and strengthen interconnections in European electricity markets, explained Paschal Donohoe, Minister of Finance of Ireland.

The EC’s analytical note says that last year, compared to 2021, the share of renewables in the electricity production structure increased from 37% to 45%.

At the same time, McKinsey consultants believe that Europe should strive to halve electricity and gas prices to restore its competitiveness with China and the United States and support energy-intensive industries.

Expectations shared by Standard & Poor’s and some utilities indicate that wholesale electricity prices this year will be 1.5-2 times higher than in 2016-2019, according to the forecast of the ING financial group. A return to the prices observed during this period will be impossible in the short term, unless a serious economic recession occurs.

In 2023, electricity demand in the EU fell by 2.8% after a 4.5% decline in 2022, with Germany showing the largest drop. This year may repeat this trend.

According to ING’s estimates, European utility network companies will continue to increase both cash flow generation and investment in 2024, but at a slower pace than in previous years.

Support measures

Electricity prices on the EU wholesale market have been mostly on a downward trend in recent months. Some governments see this as an opportunity to remove subsidies introduced in response to the energy crisis. At the same time, the industry is emphasizing further support amid the energy transition.

Germany’s Stahlallianz, an initiative that brings together representatives of eleven German steel regions, in its resolution pointed to high energy costs and the impact of this factor on the industry’s international competitiveness. The Steel Alliance welcomes Berlin’s decision to reduce the electricity tax for manufacturing sectors. However, it believes that stabilization of grid fees and transitional financing of prices for energy-intensive industries are still needed.

In Italia, the Decree on Energy and Renewable Energy introduced innovations for companies regarding energy bonuses for the current year. Compared to the tax incentives provided until the end of last year, the nature of this support has changed.

The new energy bonuses for companies, effective from 1 January, 2024, include a partial exemption from paying fees for the use of the general energy system, allowances for the use of electricity from carbon-free sources, and incentives for the introduction of renewable energy generation facilities. The innovations also promise to reduce gas and renewable energy tariffs at preferential prices and simplify administrative procedures in the energy sector.

The 2024 Energy Bonus is intended for companies with annual electricity consumption of more than 1 GWh. In addition, they must be active in sectors identified as being at risk of displacement. This approach is aimed at supporting businesses that face high energy costs and are vulnerable to international competition.

At the same time, companies with financial difficulties are not participating in the energy incentive program to focus support on those with a stable operating position.

In mid-January, it was not yet known how exactly one could apply for an energy bonus, as the implementing decree was expected to be issued.

Fullness of gas storages

According to the AGSI platform, the EU average gas storage capacity utilization rate was 69.7% as of February 1, 2023.

The European Commission expects EU gas storage facilities to be 54% full at the end of March, provided that countries continue to reduce demand by 15%, Bloomberg reported. However, the institution cautions that a return to normal demand still cannot be assured in the medium term.

Although gas prices remain higher than before the energy crisis, the agency notes, the region has demonstrated that it is possible to find alternatives to Russian gas in a short time.

Last year, gas consumption in Europe, according to the International Energy Agency (IEA), fell by 7%, reaching its lowest level since 1995. This was due to the rapid development of renewable energy sources and the increased availability of nuclear energy. The IEA also warned that their forecast for 2024 contains a wide range of uncertainty – not only due to geopolitical risks, but also potential delays in the launch of new LNG plants, changes in the situation on old gas projects and in the maritime transportation market. This can contribute to price volatility due to growing demand and limited supply.

The agency added that gas prices have fallen sharply after record highs reached in 2022, which also contributes to the recovery in demand, particularly in the industrial sectors.

Equinor, the Norwegian state-owned energy company, which in 2022 overtook Russia’s Gazprom as the largest gas supplier in Europe, has also noted signs of a recovery in demand for industrial gas in the region, particularly in France and Germany. This was stated by Equinor CEO Anders Opedal, who recently presented the results for the fourth quarter. He also reminded that the weather remains a key factor determining the dynamics of the gas market.