Posts Global Market China 7397 16 September 2024

There are no signs of easing tensions in the global steel trade in the near term

Due to weak domestic demand, China has been rapidly increasing steel exports to many regional markets over the past two years. This forces many countries to react – to initiate anti-dumping investigations as quickly as possible and to introduce safeguard measures if they have not yet been taken. Already in the medium term, this threatens a trade war ‘all against all’ and the need to find some kind of global compromise given the complex challenges of decarbonisation of the global steel industry.

Chinese factor

Over the last year, the level of trade tensions on the global steel market has increased significantly. The reason for this was the increased presence of cheaper steel from China on the markets of many countries, which had a very negative impact on the work of local steelmakers.

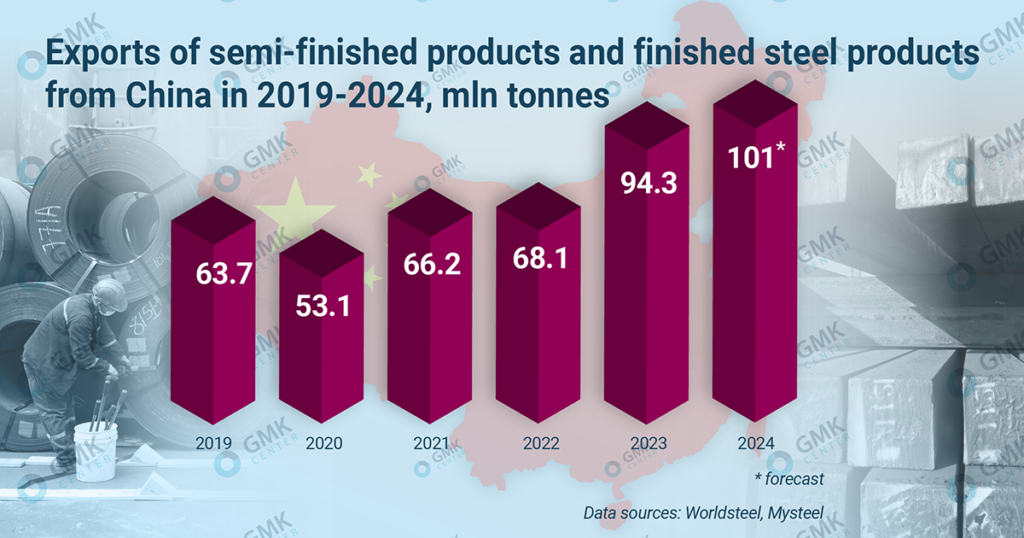

This situation is due to the stagnation of domestic steel demand in China, primarily due to the ongoing property crisis. This forces Chinese producers to increase exports of steel products. Thus, in the first half of 2024 it grew by 24% y/y – to 53.4 million tonnes, in 2023 – by 36.2% y/y, to 90.3 million tonnes.

The situation is exacerbated by local market trends. For example, domestic steel prices in China, particularly for hot-rolled coil (HRC), have recently fallen to levels at which they have become competitive in Europe, taking into account additional tariffs.

“Chinese steel companies can afford to operate at a loss for some time in order not to cut production. They are looking for ways to market their products. The hopes that more steel would be consumed in China did not materialize, as no effective measures were introduced to support construction. As a result, we are seeing more and more steel from China being shipped to foreign markets,” says GMK Centre analyst Andriy Glushchenko.

Backlash

The increase in steel imports from China leads to the fact that more and more countries are trying to protect local producers by applying various protective measures. The number of anti-dumping investigations worldwide has increased from five in 2023 to 14 in 2024 (as of early July), of which three and ten concerned Chinese products respectively.

Among the countries that have already imposed restrictions or are conducting anti-dumping investigations against Chinese steel products are: EU, USA, Canada, Vietnam, Turkey, Mexico, Brazil, Thailand, South Africa, Saudi Arabia and others. The largest markets like the EU and the US have long been systematically protecting themselves from Chinese imports.

At the end of June, the EU extended its protective measures on steel imports for two more years, until June 2026. The need for their prolongation and adjustment is caused, among other things, by a sharp increase in exports from China to third countries (mostly Asian), which themselves have been increasing their own supplies of steel products to the EU. There is also a problem that Egypt, India, Japan and Vietnam may re-export Chinese steel products to the EU market bypassing the existing quotas and restrictions.

It is natural that the EU is looking for new ways to counteract this. At the beginning of August, the EU launched an anti-dumping investigation on imports of certain types of HRC from Egypt, India, Japan and Vietnam. Supplies of HRC to the EU from these countries have grown significantly over the last year and account for about 50% of the total imports of HRC to the EU.

A rather significant ‘signal’ for Chinese exporters may be the decision of Vietnam, which initiated an anti-dumping investigation after an increase in Chinese steel inflows by 73% y/y in the first half of the year. This is not surprising, as Chinese steel exports went mainly to Southeast Asian countries, where Vietnam (6.4 million tonnes) and South Korea (4.4 million tonnes) were the leaders in imports in H1.

Protective trends

Some of the major trends in the implementation of safeguard measures in the global steel market include:

- Thus, in July, Vietnam launched an anti-dumping investigation into certain types of HRC from China and India. Almost simultaneously, India’s Steel Ministry initiated an investigation into steel imports from China and Vietnam, and steelmakers called for measures to curb imports of steel products.

- Protectionism has become a common mode of geopolitical confrontation. As part of this trend, the US has raised tariffs on Chinese steel and aluminium three times to 25%. This is implemented under Section 301, which is levied in addition to Section 232 tariffs. At the same time, this increase will have minimal impact on the volume of Chinese imports. U.S. steelmakers are also proposing to strengthen protective trade measures, suggesting that the Playing Field 2.0 bill be included in a future package of unfair import protection laws.

- Squeezing exports by imports. There is a strange situation in the Indian steel market. On the one hand, the local Steel Ministry claims to be developing domestic steel production to meet local demand. However, on the other hand, the growth in domestic demand is being met by increasing imports (mainly from China), while local producers are increasing exports.

- Hot-rolled coil is the most ‘popular’ target of trade restrictions. In early August, Turkey imposed preliminary anti-dumping duties on HRC from China, India, Japan and Russia. While Vietnam launched an anti-dumping investigation on HRC from China and India at the end of July.

Ukrainian realities

The increase in the number of protective measures in the world now has less impact on the work of Ukrainian steelmakers than before the war.

Production capacity has fallen almost threefold as a result of the war and is significantly limited by domestic factors – stability of energy supply, logistical opportunities to receive raw materials and ship finished products, and availability of sufficient personnel. Even if the world markets were more open, Ukrainian manufacturers cannot supply significantly more products to customers for the above reasons. By and large, Ukrainian iron and steel companies are now more concerned with the ability to simply continue production and export.

At the same time, it is important for Ukrainian producers to continue the regime of cancellation of restrictions by the EU, as the EU is the key market for Ukrainian steel: deliveries of steel products to European countries accounted for 84% of Ukrainian exports in the first half of the year.

Apart from squeezing national steelmakers out of their own markets, Chinese steel exports have another extremely negative side – keeping world prices for steel products at a low level. If the prices for export products fall, the competitiveness of Ukrainian producers in markets that are relatively far from Ukraine will suffer. According to GMK Center estimates, Ukraine may lose 16% of pig iron exports (200 thousand tonnes), 13% of semi-finished steel exports (150 thousand tonnes), 8% of flat steel exports (100 thousand tonnes), 14% of long steel exports (50 thousand tonnes).

Protectionist prospects

Globally, Chinese steelmakers, despite weak domestic demand, are in no hurry to reduce production capacity, which favours continued export expansion. Mysteel estimates that steel exports from China are expected to exceed 100 million tonnes in 2024, the highest level since 2016.

Obviously, other countries will respond with more active application of protective measures, as Chinese imports become not just a competition issue, but also the cause of falling production margins and the risk of bankruptcies of steel mills.

It is likely that those countries that are currently conducting anti-dumping investigations against Chinese steel (Vietnam, Turkey) will impose full-fledged sanctions. And countries such as India and a number of Latin American countries, whose steelmakers are also not fond of Chinese steel imports, will soon start investigations.

In the near term, there is no sign of a downturn in global steel trade tensions. Clearly, within a year, efforts by many countries will already have caused the flow of Chinese imports into specific regional markets to begin to diminish. However, this will not be enough for world prices to rise to acceptable levels.

This situation emphasises the need to find a more balanced development and cooperation strategy at the international level, especially against the background of the complex and costly green transition processes in the steel industry.