Posts Industry iron ore prices 5772 03 September 2024

Exports of steel products may decrease by 300 thousand tons in annual terms

In the first half of 2024, Ukrainian companies increased their exports of iron and steel products in many areas, but the second half of the year is challenging for exporters. Prices for the majority of iron and steel export items have already fallen and continue to fall, and instability in the economy and the European steel market only adds uncertainty and negative expectations. Ukrainian steel exporters may lose hundreds of millions of dollars in export revenues just because of the price drop.

According to GMK Center estimates, Ukraine may lose 16% of pig iron exports (200 thousand tons), 13% of semi-finished steel exports (150 thousand tons), 8% of flat rolled steel exports (100 thousand tons), 14% of long rolled steel exports (50 thousand tons). These are exports to markets that are relatively far away from Ukraine, so in case of lower prices for products, the competitiveness of Ukrainian producers will suffer the most.

Market trends

Export opportunities of Ukrainian iron and steel depend on the global and European market conditions. Demand on the world market remains low, so global steel and ore prices are declining. The situation on the EU steel market is even more significant for our country – deliveries of steel products to European countries amounted to 84% of Ukrainian exports in the first half of the year.

The current situation on the European market is characterized by low demand and high uncertainty. The industry cannot recover after the period of high energy prices and a number of geopolitical shocks.

Since the beginning of this year, EUROFER has twice successively worsened its forecast for the growth of apparent steel consumption in the European Union in 2024 to only 1.4% or 127 million tons. Even this minimal growth is no more than a “technical rebound” after the failed 2023 result, when apparent EU steel consumption fell by 8.7% y/y – to 126 million tons.

The overall dynamics of consumption is affected by the uncertainty of market prospects so that it balances on the verge of decline. In the first quarter of 2024, steel consumption in the EU fell by 3.1% q/q, which suggests that we can expect any significant increase in demand no sooner than 2025.

In early August, there was a stock market crash that started in Asia, but did not have a noticeable continuation in other regions. Nevertheless, amid negative trends in the Chinese economy, the risks of recession in the U.S. have increased, which has negative consequences for the entire world, including commodity markets. If such a scenario (global recession) happens in the foreseeable future, commodity prices will go down, and Ukraine will lose part of its export revenues. Analysts of the National Bank note that global prices for steel and iron ore will gradually decline. Let’s consider the price situation and forecasts for certain types of export products of Ukrainian iron and steel industry.

Iron Ore

The situation in the Ukrainian mining segment shows a significant recovery, which began after the opening of the sea corridor from September 2023. This allowed maintaining high production and export rates. For example, in January-July this year, iron ore exports from Ukraine increased 2.1 times compared to the same period in 2023, to 20.8 million tons.

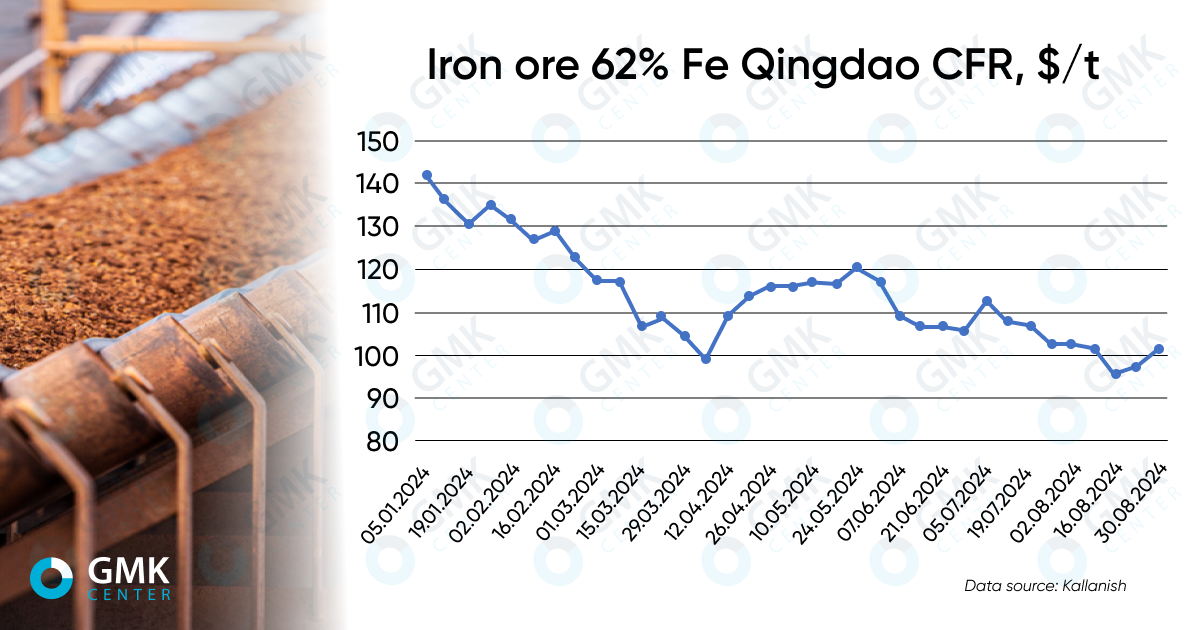

At the same time, a negative factor is the decline in iron ore prices, which has lasted since mid-May. Iron ore prices have fallen by more than $20/t during this period, and since the beginning of the year – by 27% to $101.2/t, falling below the important psychological mark of $100/t.

Analysts of financial corporation Citigroup worsened the forecast of iron ore price by the end of the current year to $85/t from $95/t. Such expectations are connected with the influence of two negative factors:

- Reduction of steel production and consumption in China due to the ongoing real estate crisis.

- Increase in iron ore supply in the global market.

Medium-term price prospects for iron ore also show a downward trend. According to NBU estimates, the average price of iron ore at China import 62% Fe will fall by 9% – to $109.7/t in 2024, and by 20% – to $87.6/t in 2025. But market conditions could bring ore prices down to $85 as early as this year.

Steel semi-finished products

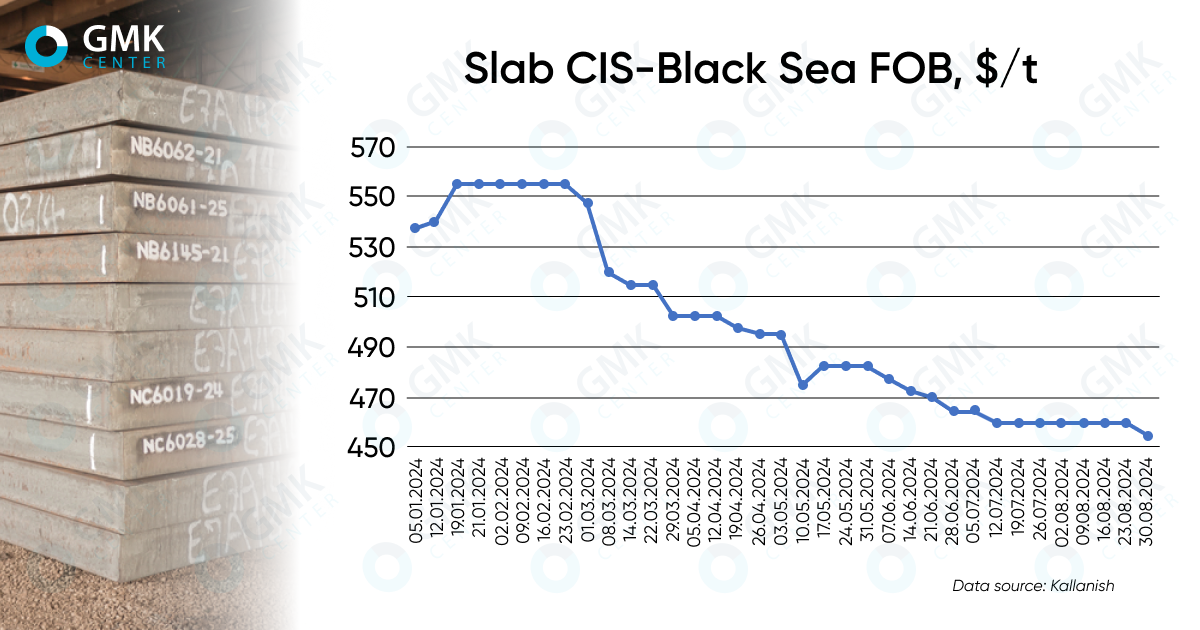

Exports of steel semi-finished products from Ukraine in the first half of the year increased by 68% y/y – up to 1.1 mln tons. However, it is likely that the growth dynamics will slow down in the second half of the year. Since the beginning of the summer, Metinvest has suspended production at its Italian plant Ferriera Valsider due to dumping imports of slabs from Russia, which may result in reduced supplies of steel billets from Ukrainian assets or purchases from third parties.

The price situation on the slab market is not favorable for production and export growth. Since the beginning of the year, slab prices in Black Sea ports have fallen by 15% to $455/t. According to NBU estimates, the average price of steel billets at FOB Ukraine will decrease by 4.2% to $517/t in 2024, and by 1.7% – to $508/t in 2025.

Pig iron

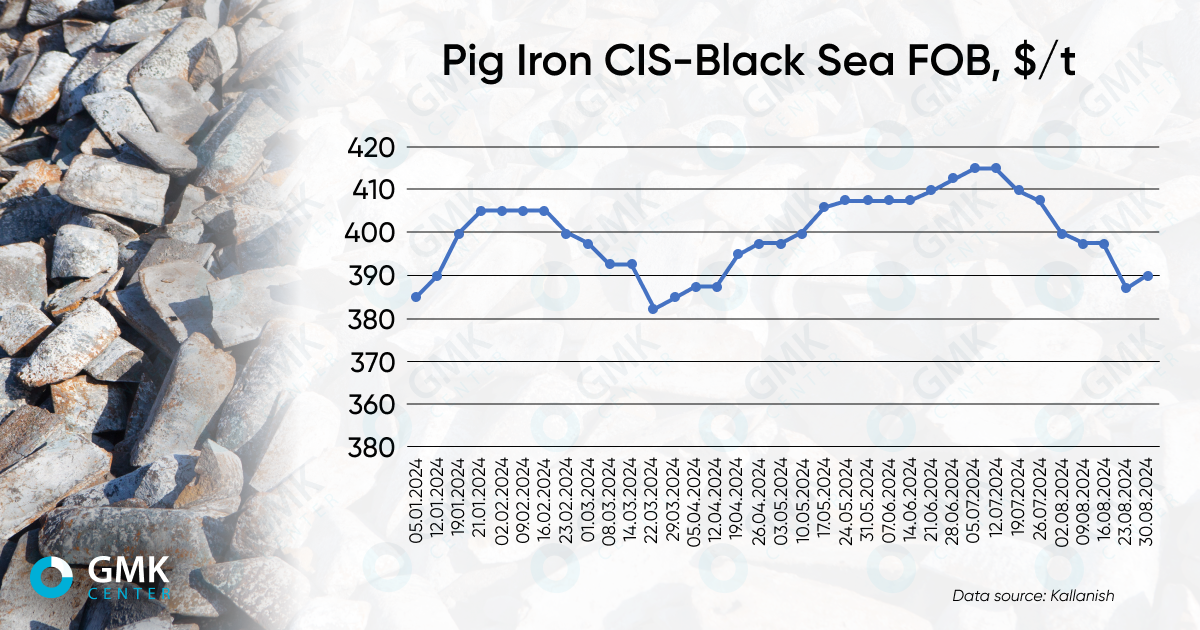

Pig iron prices in the Black Sea ports are quite volatile. In July, they fell by 3.7% – to $395-405/t FOB amid weak demand and suspension of export duties by the Russian Federation, which created an oversupply on the market.

The Black Sea pig iron market mainly offers more competitive Russian-made products. Ukrainian producers are also present on this market, but supply volumes are limited due to lower competitiveness compared to Russian products and problems with energy supply. In just seven months of the current year, Ukraine reduced its pig iron exports by 26% y/y – to 670 ths tons.

Hot rolled sheets

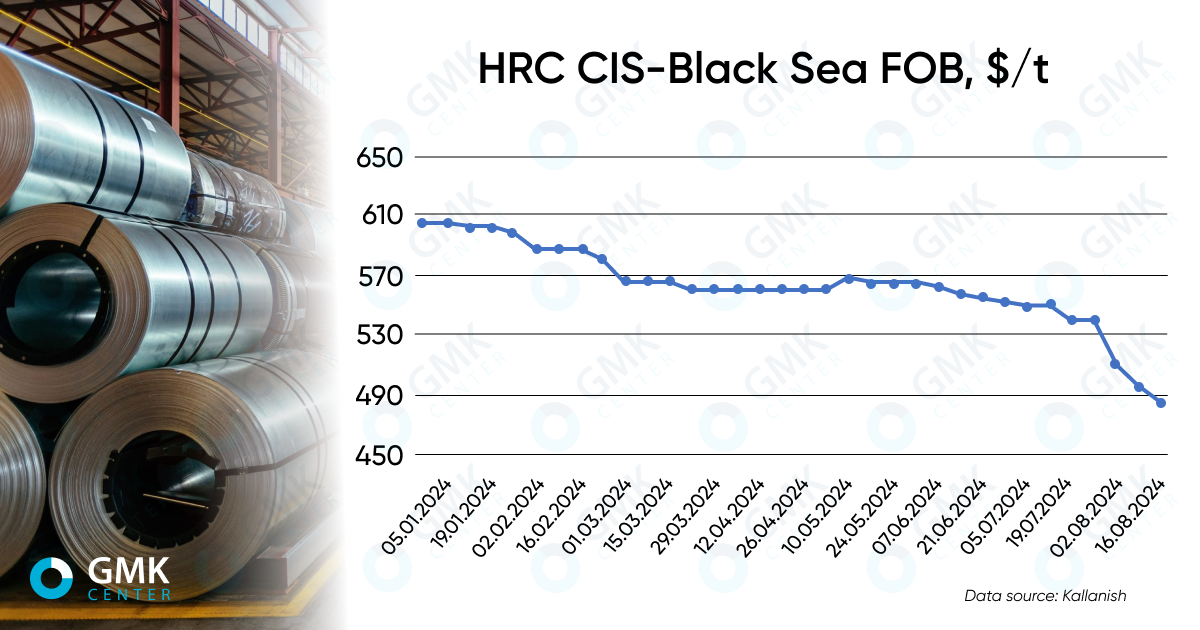

The price situation in the market of hot-rolled coil remains difficult – in July, the price decline in most major markets continued. In particular, Chinese prices reached a 4-year low and US prices reached the lowest level since September 2023. The European market is in decline due to low demand for products.

Due to the significant export volume (701 thousand tons in January-June), prices for hot-rolled coil strongly affect the revenue of Ukrainian enterprises. According to GMK Center estimates, prices for hot-rolled sheet in the EU in Q4 may fall below €600/t, while as of mid-August prices of local mills are at €620/t. The forecast of negative price dynamics is associated with the inflow of cheap imports and a slow increase in activity in the economy and steel-consuming industries.

Long rolled steel

In January-July 2024, Ukrainian steel companies increased exports of long products by 13.7% y/y – to 318 thousand tons. The main volume of exports falls on wire rod – 140 thousand tons (+9.5% y/y) and carbon steel wire – 72 thousand tons (+4.9% y/y). Another 56.5 thousand tons (+27 y/y) of exports fall on rebar (code 7214).

The forecast of the International Long Products Manufacturers and Exporters Association (IREPAS) notes that the outlook for the global long products market remains uncertain. Demand in the global market of long products is still below supply, and production volumes are declining. The leader in this segment – China – reduces prices for billets and increases exports to other countries. In turn, demand for long products in Europe has long been influenced by the crisis in construction.

General trends and forecasts

The general trend of recent months and most forecasts for the near future suggest that almost all major items of Ukrainian iron & steel exports will have downward price dynamics by the end of this year.

According to GMK Center estimates, Ukraine may lose 16% of pig iron exports (200 thousand tons), 13% of semi-finished steel exports (150 thousand tons), 8% of flat rolled steel exports (100 thousand tons), 14% of long rolled steel exports (50 thousand tons). These are exports to markets that are relatively far away from Ukraine, so in case of lower prices for products, the competitiveness of Ukrainian producers will suffer the most. Due to the war, logistics costs of Ukrainian enterprises are significantly higher than those of similar enterprises from other countries. Amid it, a further reduction in product prices may make supplies from Ukraine economically unprofitable.

Ukrainian exporters are literally struggling to continue exports, which are vital for the Ukrainian economy. Internal negative factors are overlaid with external factors that are beyond our influence. In such conditions, it is important to find solutions that would not aggravate the current situation at the state level, but would contribute to its improvement by easing regulatory, tax and other barriers.