Infographics China 7413 14 August 2024

Due to weak domestic consumption, local steelmakers direct surpluses to unprotected export markets

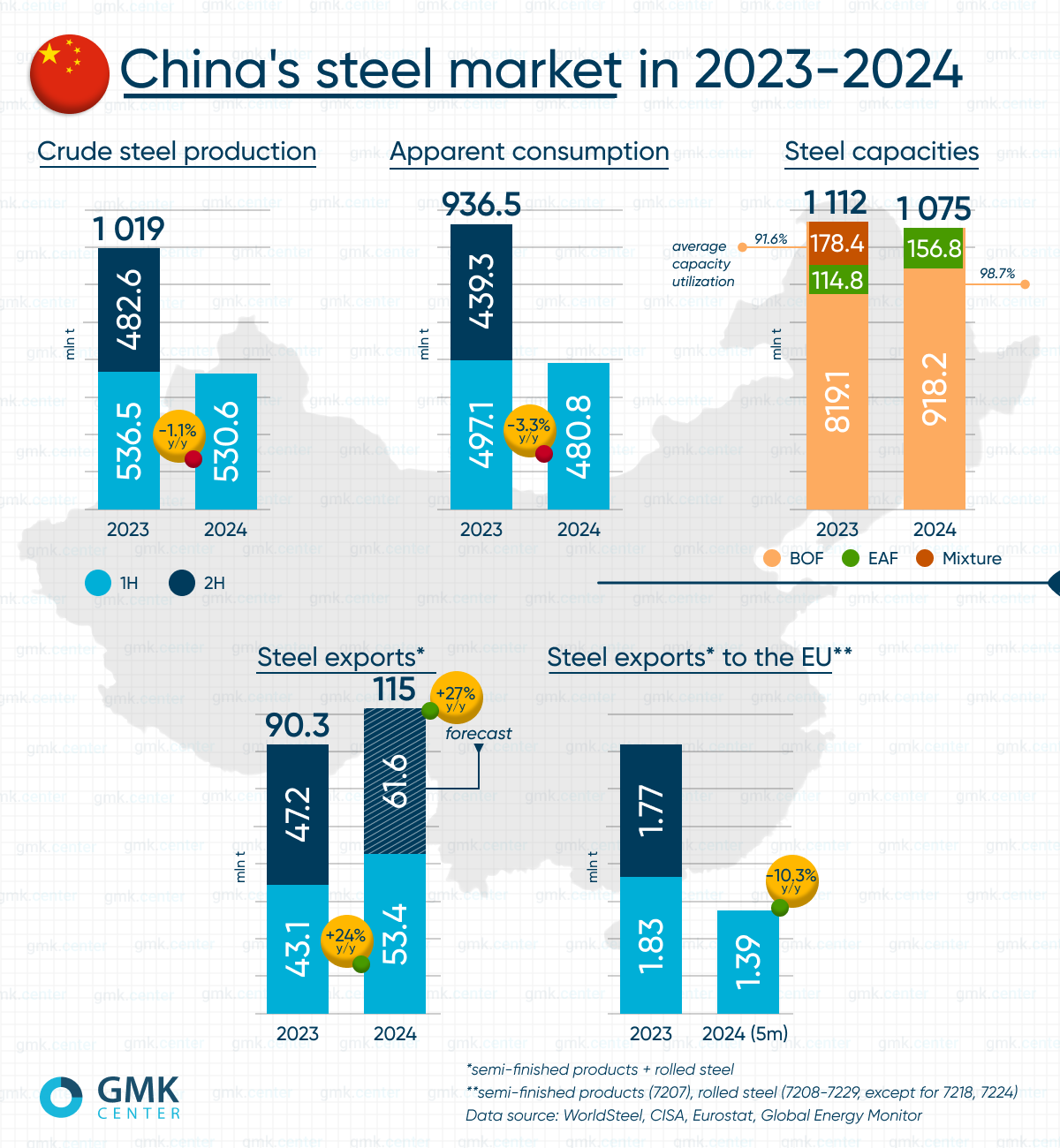

In the first half of 2024, Chinese steelmakers significantly increased steel exports by 24% compared to January-June 2023 (to 53.4 million tons). Local producers are trying to find markets for their products, suffering from low domestic demand and declining profits. At the same time, Chinese companies are facing challenges in export markets due to the introduction of protective measures aimed at restricting Chinese imports. These factors create a challenging environment for the development of China’s steel industry, which needs to adapt to new realities both domestically and globally.

The sharp rise in steel exports from China began in 2021, when local authorities stepped up support for the steel industry in response to the COVID-19 pandemic. In 2021-2022, export was maintained at 66-67 million tons per year, thanks to stable domestic demand from the construction sector. However, in 2023, construction in the country slowed down significantly, steel consumption fell sharply, which resulted in an increase in exports by more than 34% y/y – to 90.3 million tons.

Experts believe that in 2024, Chinese steel shipments abroad will again grow by at least 27% y/y, exceeding the record 110 million tons observed in 2015.

As of April 2024, according to the Global Energy Monitor, China’s steel production capacity was estimated at 1.074 billion tons annually, compared to 1.112 billion tons in March 2023. At the same time, in the first half of the year, steel production in the country decreased by 1.1% y/y – to 530.57 million tons. However, the rate of decline in existing capacities and steel production still does not exceed the rate of decline in apparent consumption, which fell by 3.3% y/y over 6 months to 480.79 million tons.

Despite the weakness of domestic demand, Chinese steelmakers are in no hurry to reduce production capacity, which leads to excessive exports and falling steel prices. This, in turn, creates serious problems for steelmakers in many countries, including the European Union, where 1.39 million tons of steel were exported from China in the first five months of 2024 alone (-10.3% y/y). Although the figure is down year-on-year, Chinese products are still entering the EU market in large volumes, bypassing existing quotas and restrictions through the markets of Egypt, India, Japan and Vietnam, which have significantly increased imports of the relevant products in recent periods.

“Chinese steel companies can afford to operate at a loss for some time in order not to cut production. They are looking for ways to market their products. The hopes that more steel would be consumed in China did not materialize, as no effective measures were introduced to support construction. As a result, we are seeing more and more steel from China being shipped to foreign markets,” said Andriy Glushchenko, GMK Center analyst.

More and more countries facing an influx of imports from China are trying to protect domestic producers by applying various restrictions. The number of anti-dumping investigations worldwide has increased from five in 2023, three of which involved Chinese goods, to 14 launched in 2024 (as of early July), ten of which involved China. This number is still low compared to the 39 cases in 2015 and 2016, the period when the Global Forum on Steel Excess Capacity (GFSEC) was established amid a sharp rise in Chinese exports.

On August 8, 2024, the European Commission announced the launch of an anti-dumping investigation into imports of certain types of hot-rolled steel products from Egypt, India, Japan and Vietnam.

Amid growing pressure on global markets due to excessive exports of Chinese steel and increased protective measures by other countries, China is forced to look for new approaches to stabilize the situation. Continuing to expand in export markets without taking into account global competition could lead to further escalation of conflicts and new restrictions. In the long run, this could have a negative impact on China’s steel industry, which emphasizes the need to find a more balanced development strategy and cooperation at the international level.