Posts Global Market China 10508 26 October 2023

There will most likely no longer be an order from the Chinese authorities to reduce production, but steel mills are voluntarily reducing output

Throughout most of 2023, Chinese steelmakers increased steel production. Amid weak domestic demand, this forced Chinese steelmakers to increase exports by 30%, reaching local highs. This situation has once again exposed the problem of excess steelmaking capacity in China.

Although many expect the Chinese authorities to introduce an order to limit the level of steelmaking at the level of 2022, but, apparently, it will not happen, as the Chinese authorities prioritize the goal of achieving GDP growth of 5%, which requires maintaining high performance in the production sector, including in the steel industry.

Unjustified expectations

In the first half of 2023, Chinese steelmakers mainly increased steel output amid expectations of economic recovery after the zero tolerance policy to COVID-19 was abolished from December 2022. In January-September, Chinese steelmakers produced 795 million tons of steel, up 1.7% from the same period in 2022. Everyone expected that there would be more activity primarily in the construction sector. But this did not happen.

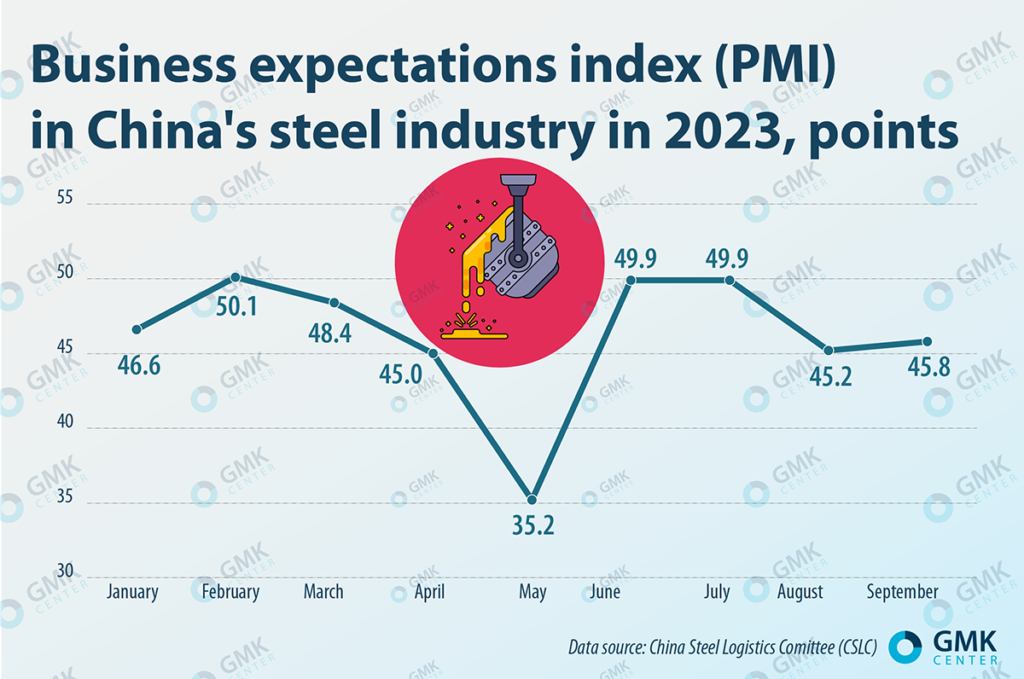

This explains why, despite the growth in production, the sentiment of Chinese steelmakers in 2023 was very volatile. The business expectations index (PMI) in China’s steel sector was above or near the 50-point level at the beginning of the year and during the summer, indicating relatively positive sentiment in the industry. In turn, the collapse of the PMI in April-May was due to weak demand and lower prices for steel products despite the peak season.

Reference: PMI above 50 points indicates increased activity in the steel

Waiting for a decline

Despite the overall growth in production in the last 9 months, there has been a month-on-month decline in recent months. In August-September, the monthly decline in steelmaking was about 5% – to 86.4 million and 82.1 million tons, respectively, compared to 91 million tons in June and July.

For the past few years, the Chinese authorities have followed a policy of stabilizing steel production at the previous year’s level. This was presented as measures to reduce greenhouse gas emissions. Earlier it was expected that this year also such restrictions would be introduced, as these intentions of the Chinese authorities were announced at the beginning of this year. However, in fact, there have been no official announcements of steel production cuts so far, except for official directives in a few provinces, such as Tangshan and Yunnan. It is likely that there will be no official industry-wide measures until the end of 2023.

«Decisions on output restrictions in China occur with a certain time lag. The discussion only arises a few months after the emergence of imbalances caused by unreasonably high output volumes. This usually manifests at the end of the year. Whereas traditionally the first half of the year is when output is rising. According to the same scheme, the first half of 2024 again has a chance to be marked by excessive steel output,» says Andriy Tarasenko, chief analyst at GMK Center.

The lack of a centralized order to limit steelmaking may be due to the fact that the priority for the Chinese authorities is now to achieve the GDP growth target of 5%. This requires keeping production performance at a high level. In other words, the pursuit of economic goals forces to abandon administrative restrictions.

Nevertheless, weak domestic demand, which is difficult to push up significantly even by economic incentives, low domestic prices for steel products, high prices for raw materials lead to a drop in margins and force Chinese steelmakers to voluntarily reduce production. For example, steelmakers in a number of Chinese provinces in September-October reduced production of steel products in the construction segment to avoid losses amid low prices and the general weak situation on the construction market.

The rise of exports

This year, Chinese steelmakers are breaking all local records for steel exports. At the end of January-September 2023, Chinese steel companies increased export shipments by 31.8% compared to the same period of 2022 – up to 66.8 million tons.

The dynamics of steel exports showed very high growth during February-May – 40-55% year-on-year, but since June the figure has declined to +/- 30% due to slowing demand from foreign customers. In September 2023, exports totaled 8.06 million tons of steel, down 2.6% from August.

The significant growth of Chinese steel exports was due to insufficient domestic demand and low domestic prices for steel products, as well as the devaluation of the yuan against the dollar, which made Chinese steel products more competitive. In addition, strong demand from some importing countries – in the Middle East, Southeast Asia and North Africa – as well as China’s efforts to promote projects under the One Belt, One Road program contributed to exports.

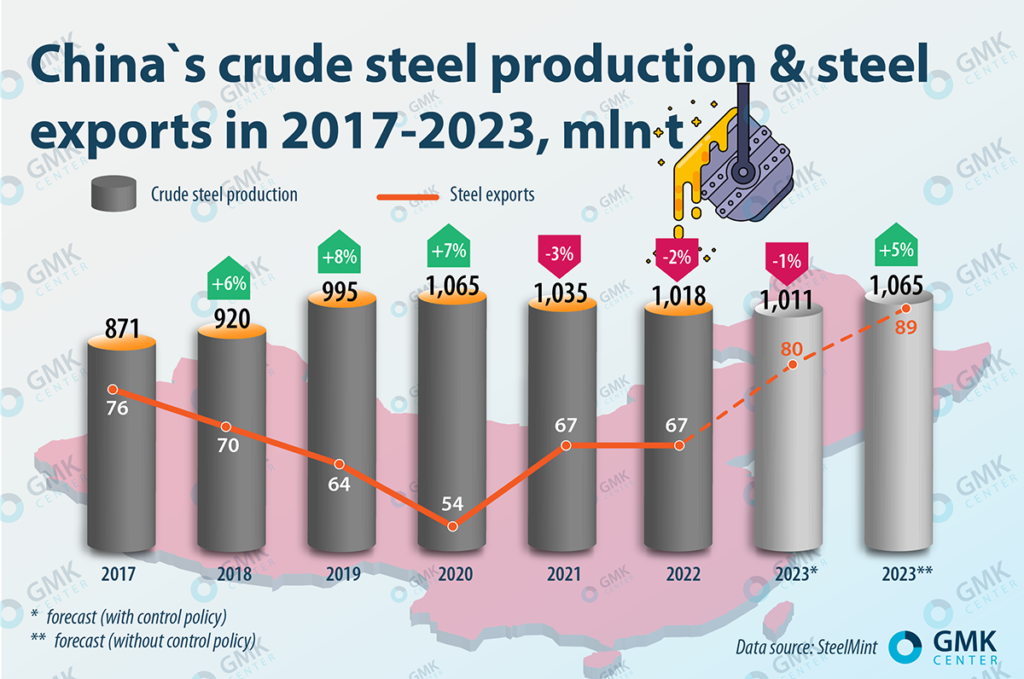

Until the end of this year, there may be a slight slowdown in export dynamics due to the expected decline in steel production and lower demand from foreign buyers. SteelMint estimates that depending on the absence or presence of measures to reduce steelmaking, exports through 2023 could be around 79.5 million tons or 89 million tons, respectively.

Nevertheless, periods of sharp growth of steel exports from China will appear in the future, as the problem of overcapacity has not gone anywhere, domestic demand in China may be weak for some time, and control over production levels may not be timely.

«China’s overcapacity problem has come to a head with renewed vigor. Every self-respecting researcher of the global steel industry expects a reduction in steel production in China due to objectively declining domestic steel consumption. But this reduction is happening in a painful way for the global steel industry, with overcapacity leading to falling prices and margins around the world. Therefore, it is likely that we may see a new round of protectionism in the industry, similar to what we saw after the previous surge in Chinese exports in 2015,» adds Andriy Tarasenko.

Steel forecasts

SteelMint estimates that if the measures to reduce smelting are not implemented, China’s steel production could end the year 47 million tons (to 1.065 billion tons) higher than last year’s figure (1.018 billion tons in 2022). If the Chinese authorities do introduce a control policy, SteelMint estimates that China could end 2023 with an estimated steel output of 1.011 billion tons, just 7 million tons less than last year. Steel output in Q4 (no more than 300 million tons) could be the lowest this year.

Prospects for 2024 remain uncertain, but the most likely scenario in the association Worldsteel called the continuation of demand growth at the level of 2023 – by 2%, to 939.3 million tons after a decline in 2022 by 2%. This will be supported by infrastructure investment and a likely stabilization in the real estate market.

«The real estate market is expected to stabilize in the second half of 2023 as the Chinese government has taken some measures to stabilize the economy since July. Infrastructure investment growth remained strong in 2023 due to the authorities’ stimulus measures. Infrastructure investment is expected to remain moderately positive in both 2023 and 2024. Assuming the Chinese authorities take additional measures to support the economy, steel demand in 2024 could remain at 2023 levels. There is a downside risk in both 2023 and 2024 if the stimulus effect is weaker than expected,» Worldsteel said in its October report.

Stimulating measures of the Chinese authorities will be a supporting factor for steel production and consumption in China next year. Thus, in mid-October, the Chinese Central Bank allocated the largest since 2020 financial support for banks in the amount of $39.6 billion. In addition, the continuation of high exports and the priority of the Chinese authorities in favor of achieving the planned level of economic growth may have a positive impact on steel production in 2024. The latter excludes measures of administrative restriction of production in the Chinese steel industry.