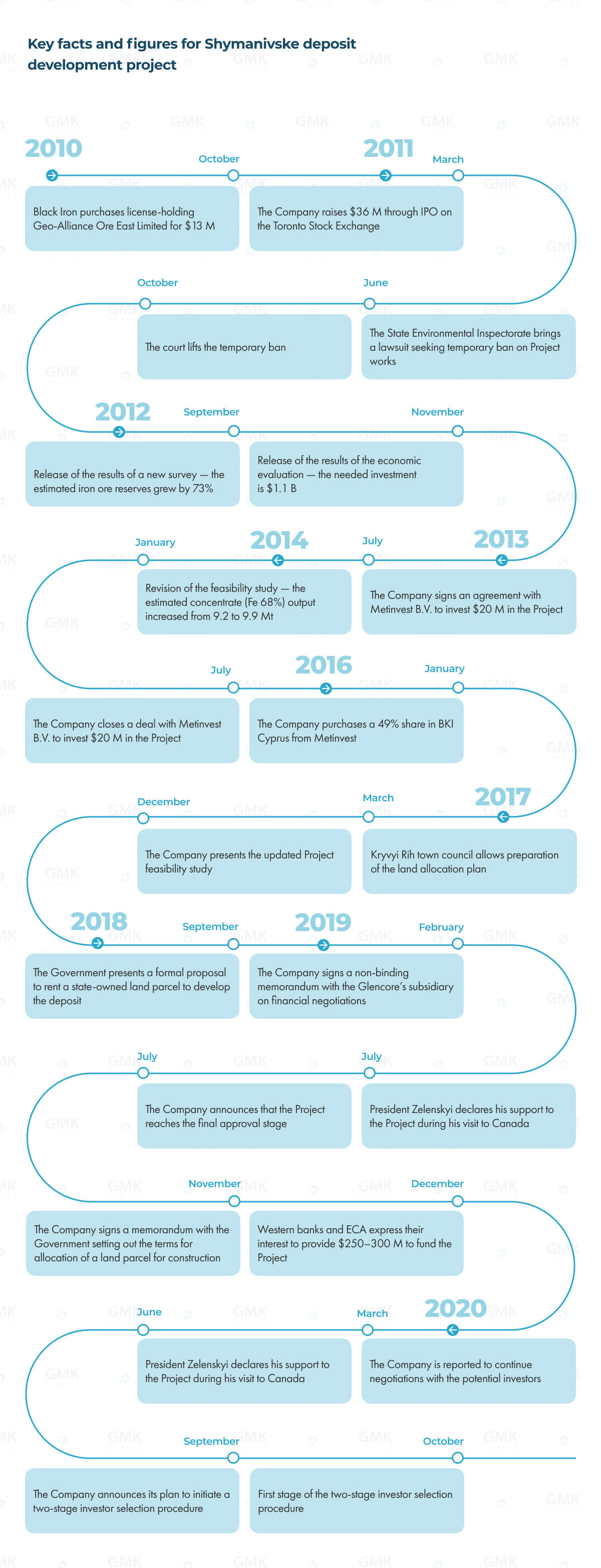

Posts Companies Black Iron 2779 23 October 2020

Of how Canadian Black Iron was looking for partners and money for its new project in Kryvyi Rih

Ukraine is the world’s leader in terms of explored iron ore reserves, its share accounting for around 18% of the total global reserves. If we look at the iron content, our country possesses 10.5–11% of the global reserves, placing it in the top 5. One would probably think that this alone is a quite sufficient reason to develop iron ore projects in Ukraine. The business seems promising. In practice, however, it takes long to make it work.

Shymanivske iron ore deposit has become another never-ending project that has been producing only news instead of iron ore for the last almost ten years. GMK Center conducted its own investigation into the entangled history of the Project initiated by Black Iron, a Canadian producer.

Project profile

Shymanivske deposit is located in Kryvyi Rih. According to the Project profile, the deposit contains 355 million tons (Fe 32%) of measured and 290 million tons (Fe 31.1%) of indicated resources, as well as 188 million tons (Fe 30.1%) of inferred resources.

The owner of the deposit is Black Iron, a Canadian company that purchased the Cyprus-based subsidiary of Viktor Pinchuk’s Geo Alliance for $13 million in October 2010. The subsidiary was a license holder. It was renamed to Black Iron (Cyprus) Ltd. and now holds over 99% in Dnipro-based Shymanivske Steel LLC and Zelenivske Steel. The latter, in their turn, hold licenses expiring on 1 November 2024 and 1 November 2014 (iron quartzite deposit) respectively.

A series of surveys and evaluations presented new figures all the time. Thus, in 2011, a preliminary evaluation showed that the Project needed capital investment in the amount of $896 million. Later, the forecast increased to $1.1 billion.

“The 2011 estimate ($896M) was based on production of 7.3Mtpa whereas the 2014 estimate of $1.1B is based on production of 9.9Mtpa,” says Matt Simpson, Chief Executive Officer at Black Iron Inc.

In 2017 and became much more ‘humble’ and staged. Presently, the key figures look as follows:

- capital investment in production of 4 million tons of iron ore — $452 million;

- expansion of capacities to 8 million tons (second stage) — $364 million;

- payback period — 2.9 years;

- Project life cycle — 17 years;

- raw material stock — 411 million tons;

- expected iron ore quality — Fe 68%;

- prime cost — $32.63 per ton of iron ore.

Importantly, the prime cost of, for example, Ferrexpo’s products in 2019 was $47.8 per ton ($43.3 in 2018).

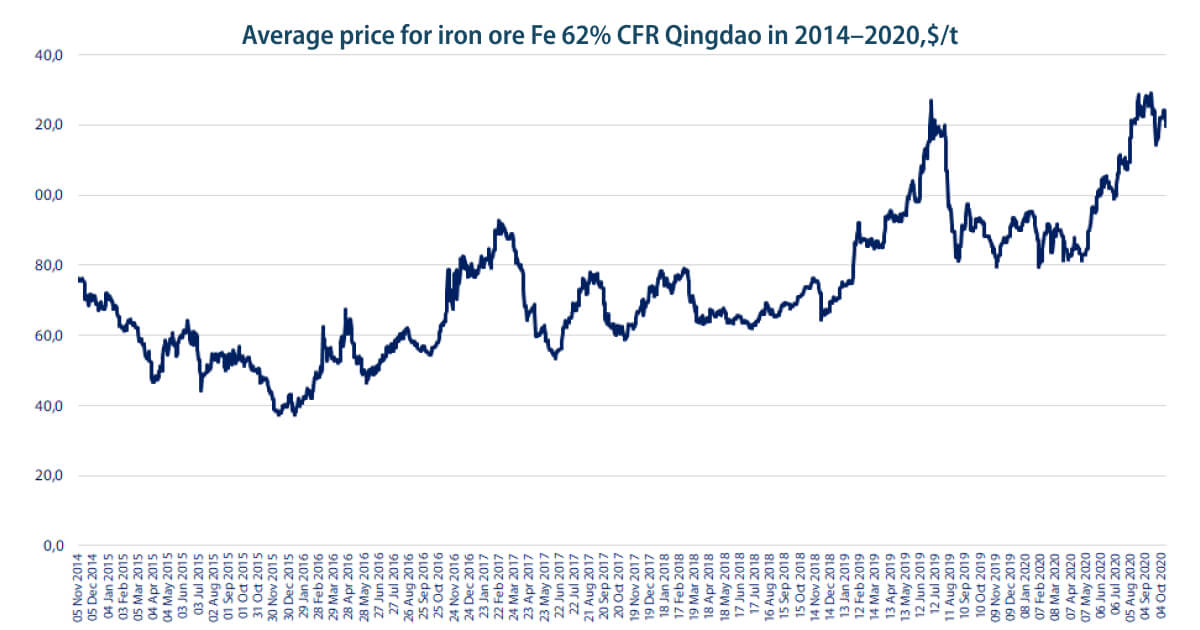

“The Project’s estimated return on investment is rather doubtful. With the projected price for iron ore in the mid-term perspective of $70/t and the prime cost of $32/t, it will take longer to recoup a $450 million investment,” says Andrii Tarasenko, GMK Center Chief Analyst.

“Ferrexpo operating costs of $47.80 per ton is primarily to produce iron ore pellets. Black Iron plans to produce pellet feed which costs ~$15 per ton less to produce and hence our cost estimate is $33 per ton,” says Matt Simpson.

Iron ore is currently selling for ~US$120 per ton for 62% iron content and Black Iron used $62/T in our economic analysis.

“The $62/T selling price is then adjusted for iron content noting Black Iron plans to produce 68% iron content product and each 1% above 62% sells for $3 to $9 per 1%. Today Black Iron would sell its 68% product for ~$145/T and if we use a medium term price of $70/T for 62% iron content and conservative $3/ 1% iron, this would equate to a selling price of $98/T against a production cost of $33/T so the payback is very good as Black Iron is stating,” says Matt Simpson.

On the one hand, Shymanivske deposit has an advantageous location — it is surrounded by five other operating mining and processing plants (GOKs). In other words, the area offers a possibility to connect to the existing power grids, access to the railway infrastructure, the needed commercial services, which will allow a relatively quick commencement of the Project. On the other hand, however, some of very same factors are at the same time restrictive: Kryvyi Rih’s existing railway infrastructure needs expansion, the struggle for the labor force will toughen and so on.

The story of the ‘quest’

Since Black Iron entered the Ukrainian market, it has been constantly looking for sources of funding of its Project, of which it regularly informs the ‘business society’ and describes all the challenges it faces in this ‘financial quest’.

A long and rather unsuccessful search for a partner has inevitably resulted in a more than tenfold fall of shares in the period from the IPO in March 2011 till June 2013. However, the Company tried to convince the shareholders of ‘great prospects’ and ‘high potential growth’.

In 2013 Black Iron had signed a binding contract with Metinvest in which they initially invested US$20M to acquire 49% of Black Iron and had a requirement to invest a further US$536M as part of project construction.

“In addition to Metinvest, Black Iron was weeks away from closing an offtake agreement that would have resulted in an additional US$280M investment for a total of US$836M of the required US$1.1B for project construction,” says Matt Simpson.

The project did not go into construction because war broke out in Eastern Ukraine resulting in investors being concerned to build the mine until the outcome of the war was clear so the company was put on care and maintenance for a few years.

“During this time Metinvest fell into financial distress and had to renegotiate their bond covenants resulting in Black Iron purchasing back their 49% ownership. In late 2017, Black Iron’s management and board felt comfortable to restart the project resulting in the lower cost phased build approach to make it easier to secure funding for construction since the company had to start over,” says Matt Simpson.

The initially scheduled production commencement date was between mid- and end of 2015. In 2014, in the framework of the preparations, Black Iron signed:

- a memorandum of intent with Pivdennyi Sea Port Authority on arranging transshipment of 9.5 million tons of iron ore (+/-15%);

- a memorandum of intent with the Cisdnieper Railway on transportation of up to 20 million tons of iron ore to Pivdennyi Sea Port;

- an agreement of intent with DTEK Dniproblenergo on arranging power supply to the deposit.

The Project implementation gained momentum only in 2018–2019. In early 2019, Black Iron announced signing a non-binding memorandum with a subsidiary of Glencore as part of the negotiations concerning an investment of $180 million in the share capital. Also, the Company spoke about a possibility to get loans from European banks and export credit agencies in the amount of $250–300 million.

“In any large project in Ukraine, it’s hard to find investors. Unfortunately, it’s obvious that Ukraine is not a dream country for investors. It’s a large project that needs large investments that can be returned only in a long-term perspective. Since it is impossible to make any forecast in Ukraine for more than six months ahead, no investment project can expect a rapid development,” underlines Andrii Tarasenko.

Today, the overall scheme of raising funding secured with an entitlement to receive up to 4 million tons of iron ore products annually looks like this:

- 40%, or $180 million — equity. The potential candidate shareholders are large western metals companies and traders.

- 60%, or $261 million — borrowed capital (loans or debt securities). The potential sources of funding are European banks and export credit agencies.

The negotiations were not limited to the above-mentioned business entities. A certain Asia-based construction company expressed an interest to invest $50 million of equity in kind in exchange for being awarded the construction contract. Glencore also negotiated with the potential investors. Importantly, the investor interest in Black Iron is rated as ‘strong’.

The media support to the Project came from the record hike of global prices for iron ore in 2020 and the Government’s ambition to demonstrate a progress in attracting foreign investments. During his visit to Canada, President Volodymyr Zelenskyi made statements supporting the Project, and the Deputy Head of the Office of the President Igor Zhovkva even played the role of an ‘investment nanny’ for the Project.

Project bottlenecks

1. Unstable political and economic situation in Ukraine, military conflict in the east of the country.

2. The need to tackle problems by addressing top officials. The Project scale and the need to resolve numerous issues, including those relating to permissions, required close communication with the top officials. This has not always been a strength of this small (compared to the Project scale) Canadian company. The achieved progress was due to the ‘mentions’ of the Project by the President and the meetings with the top officials of the Cabinet and the Ministry of Defense in 2019.

Apparently, Black Iron realizes the importance of РR/GR. Every step within the Project gets media coverage. One could also reckon it as a must as the Company’s shares are listed on the Toronto Stock Exchange.

President Zelenskyi is not the most famous public figure supporting the Project. In late 2011, the Company engaged a famous US TV personality Larry King as a special advisor. The Company also attempted to invite famous top managers with ‘useful connections’ to join the Board. Another important factor is that the Embassy of Canada to Ukraine offered its support and joined the ‘game’ in 2018. The purpose of all the aforesaid is top-level lobbying of the Project.

3. Land allocation issues.The Project has not managed to quickly get all the required permissions to use three land parcels for ore mining and GOK construction. In particular, one of the three land parcels is managed by local authorities, the second one by the Ministry of Defense, and the third one by the State Forest Resources Agency. One of the most baffling tasks was the transfer of 1,263 ha from the Ministry of Defence in exchange for social commitments.

4. Volatility in the iron ore market. The rapidly changing situation in the iron ore market has brought troubles to the Project at least twice. At first, in January 2016, Metinvest withdrew from the Project.

“The sale of a share in the Project is mostly due to our decision to focus on development of our existing GOKs, on similar projects. And today, considering the situation in the global market and the global market forecasts, we believe it irrational to develop a new GOK,” explained later Yuriy Ryzhenkov, CEO of the Metinvest Group, according to Interfax-Ukraine.

Source: Kallanish Commodities

For this very same reason, the Company had to revise the Project feasibility study in 2017 as it had been based on the assumption that the price per ton of concentrate in the long-term perspective would be around $95, and the exchange rate would be ₴8/$1.

5. Coronavirus and the lockdown. According to the Company’s statement, the coronavirus pandemic disturbed the plans of the potential investors that intended to complete the investment analysis after the visit to the Project construction site.

Project prospects

It should be noted that the new GOK can become the largest project created from scratch in the mining & metals industry in the history of independent Ukraine. Some $70 million has already been invested in the Project.

In July 2019, the Company announces that the Project reached the final approval stage and started another round of infrastructure analysis. In 2019, Black Iron and the Ukrainian Railways (Ukrzaliznytsia) negotiated a possibility of transportation of up to 10 million tons of iron ore to Pivdennyi Sea Port annually. The updated start point of construction is mid-summer next year. Provided no force majeure occurs.

In early October, the first stage of the two-stage investor selection procedure officially commenced in line with the best traditions of a reality show. According to Black Iron, several multi-billion companies already participate in the process.

Frankly speaking, this is a precedent in Ukraine’s business practice — no investor selection process in the past has got so much promotion, despite being confidential at the same time. The second round of the selection procedure is expected to end in the middle of the first quarter of 2021.

Black Iron believes that the Project is attractive for the following reasons:

- Iron ore mining is becoming of more interest due to the increasing prices for this product;

- China is committed to become less dependent on Australian iron ore.

At the same time, the Project is associated with certain risks:

- Due to the second wave of the quarantine restrictions, the negotiations with the investors and the start of the Project implementation might be delayed again;

- Further negotiations on allocation of a land parcel managed by the Ministry of Defense for construction of the Project facilities, tailing dams and dumps, and on the compensation package;

- Unstable situation in the iron ore market where analysts predicta fall in prices in the long-term perspective;

- No possibility to increase iron ore transshipments at ports. In particular, Pivdennyi Sea Port has already reached its maximum capacity.

A port business expert who preferred to be anonymous shared the following opinion with GMK Center:

“Ore transshipments in Ukraine break records. The total ore transshipment volume in 2019 was 37.3 million tons, of which 26.8 million tons were transshipped at Pivdennyi Sea Port. This year we’re going to reach 45 million tons. In the first nine months of the current year, ore transshipments grew by 25.7% to 33.9 million tons, in which Pivdenny’s share increased by 43.4% to 27.5 million tons. But the overall capacity of Pivdenny’s wharves, as the state stevedore, is 15 million tons. The total capacity of TIS-Ore and TIS-Coal terminals is 19 million tons. So, the aggregate capacity is 34 million tons. This means that by the end of this year, Pivdennyi will not only reach, but exceed its design capacity. I believe Pivdennyi can do another 4 million tons or so, but that will be at the verge of its real capacity. Any additional increase will pose the risk of idle time and congestion, and will require additional investment in expansion of the railway infrastructure.”

The situation in the iron ore market is of particular interest among the existing risks. Since the beginning of 2019 when iron ore prices grew to record high levels due to the Vale accident, analysts have been forecasting a decline in prices. Their argument was that force majeure cannot possibly keep the prices that high for so long. The accident, however, was followed by a series of other force majeure events, such as hurricanes, coronavirus-related suspensions of operations, tension between China and Austria, China’s quick recovery after the lockdown and huge infrastructure investments. All of this keeps the iron ore prices high, leaving no chance for the analysts’ forecasts to come true.

“The fact is that the history of independent Ukraine knows no projects with foreign investments of $450 million implemented from scratch,” summarizes Andrii Tarasenko. “Actually, successful foreign investments have been a rare thing in Ukraine.”