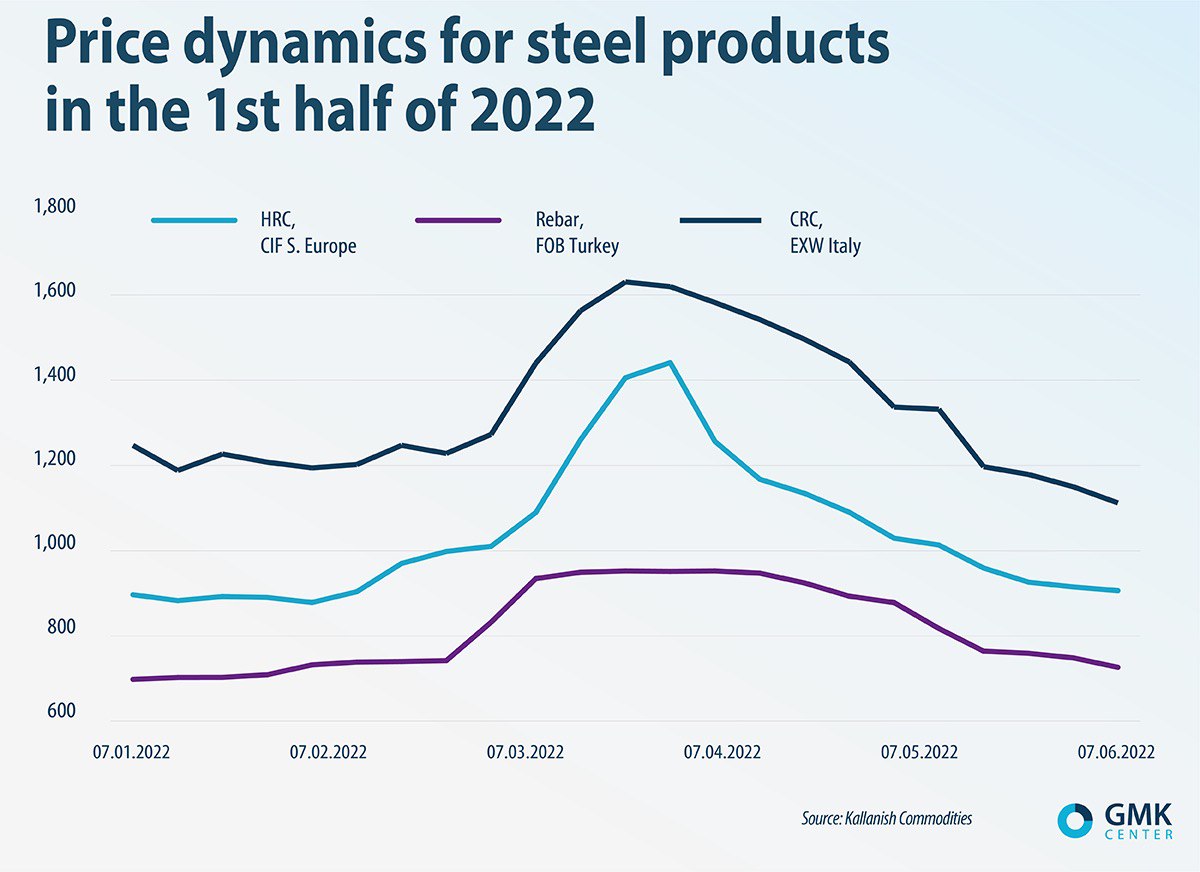

Opinions Global Market steel prices 575 16 June 2022

In June, steel prices made back to pre-war levels

The war in Ukraine was a shock to the world economy. Ukraine and Russia were among the largest steel suppliers, exporting an average of 40 million tons of steel products per year, but with the outbreak of war, these supplies significantly reduced. The disruption in supply chains led to 30-60% price growth in March (depending on the product). Prices for hot-rolled flat products, for the production of which Ukraine supplied slabs to the EU, rose particularly strongly.

Data Source: Kallanish Commodities

However, growth is not endless. In April, the price trend changed, and we saw that by June, prices had reached pre-war levels. For many, this turn of events was unexpected. Let us try to figure out what factors led to such a situation on the market.

1. Inflation caused by rising energy prices. In particular, in the US, inflation reached its highest levels over the past 40 years – 8.6% over the past 12 months including May. Annual inflation in May in the Eurozone was 8.1%, while in April it was 7.4%. With accelerating inflation, economic growth is expected to slow down. So, in June, the Fed worsened its forecast for US GDP growth in 2022 from 2.8% to 1.7%. European Central Bank believes that the eurozone economy will grow by 2.8% in 2022, although back in March the forecast was +3.7%. That is, inflation has a negative impact on economic growth, and the steel consumption depends on it. Also, high inflation leads to a worse consumer sentiment, including steel products market.

2. Slowdown of the Chinese economy. In China, during March-May 2022, lockdowns were in many cities. Quarantine restrictions have negatively affected the Chinese economy, in particular the manufacturing industry and construction. The demand for steel decreased.

Meanwhile, according to market sources, there is no reduction in steel production in China. If the government sees an imbalance between supply and demand, it may impose administrative restrictions on steel production. This step will negatively affect the prices of raw materials and finished products.

If the oversupply of steel persists, China could increase exports and pressure on prices. For example, now the price of steel billets in the EU is 15% higher than in China, although back in early January the difference was at the level of 2%. China may increase the export of steel products to the EU, given the lack of Ukrainian and Russian suppliers on the market.

3. Aggressive trade policy of Russian suppliers. To support exports, Russian steelmakers offer discounts of up to 15% to world prices. The export of Russian steel products has not been completely stopped. Russian products enter the markets of countries that did not support the sanctions (in particular, Turkey and China), so Russian exports affect world market prices, increasing downward pressure.

4. Decrease in scrap prices. Turkish factories refuse to buy scrap. It is obvious that supplies of cheap Russian products that satisfy local demand contribute to this.

With the falling prices, buyers are in no hurry to make even those purchases that they need, since in the future it will be possible to buy cheaper. There is uncertainty in the market right now. Obviously, it will be so for a long time, at least until September. Market players expect that by this time the situation with the war in Ukraine, and with sanctions, and with the revival of economic activity in the leading countries will clear up. However, the chances are high that these hopes will not come true and in the future we may again face unexpected changes in the market situation.