taxes

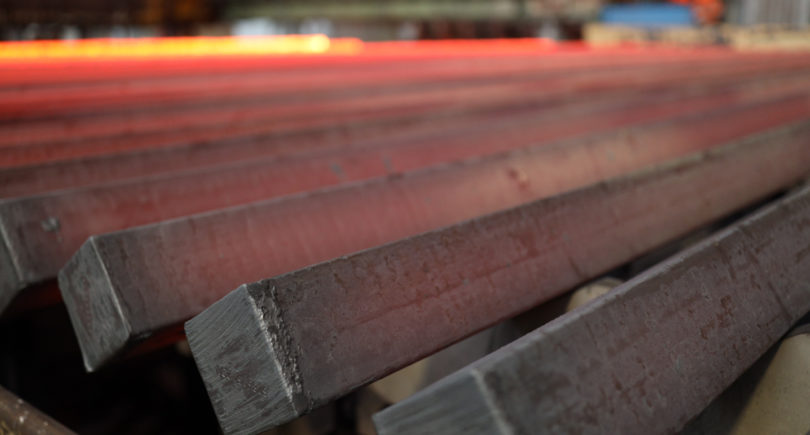

News Companies ArcelorMittal Kryvyi Rih

15 January 2025

The company increased tax payments by 60% despite the difficulties of wartime

News Companies ArcelorMittal Kryvyi Rih

09 January 2025

The company disputes tax claims for UAH 1.35 billion and demands a transparent approach to business