Posts Global Market economy 11587 20 November 2024

The outlook for the German economy negatively affects the expectations of steel market participants

Germany’s economic model is not yet broken, but it is experiencing significant difficulties amid a loss of competitiveness. The German economy was based on three points that have already completely lost their significance: exports of industrial products to China, cheap energy from Russia and the positive economic effect of nearshoring – the deployment of some production facilities in neighboring countries with cheaper labor.

GMK Center observed what is happening in the German economy now and what prospects await it.

Political crisis

The main factor that negatively affects the economic prospects of Germany is the political crisis in the country. – Main reasons of this situation include: disagreements within the ruling coalition on economic policy, rising cost of living, the war in Ukraine and Germany’s participation in it, as well as a decline in confidence in the government of Olaf Scholz. Such conditions make it difficult to implement economic programs and fight economic stagnation.

The consequences of the crisis are already clear: the collapse of the coalition and early parliamentary elections. They are expected to take place on February 23, 2025. On December 16, a vote of confidence in Scholz’s government will take place, and it is likely to be rejected.

The economic strategy of the country depends on the results of the elections. Perhaps the next chancellor will be the chairman of CDU Friedrich Merz. The politician already has his own plan of Germany’s economic revival, which provides for tax cuts, business deregulation and partial reduction of social payments. The economic programs of election participants have not been fully formalized yet, but what has been announced beforehand does not bring any optimism to the markets – there are no new growth factors for the economy.

The deplorable state of the German economy

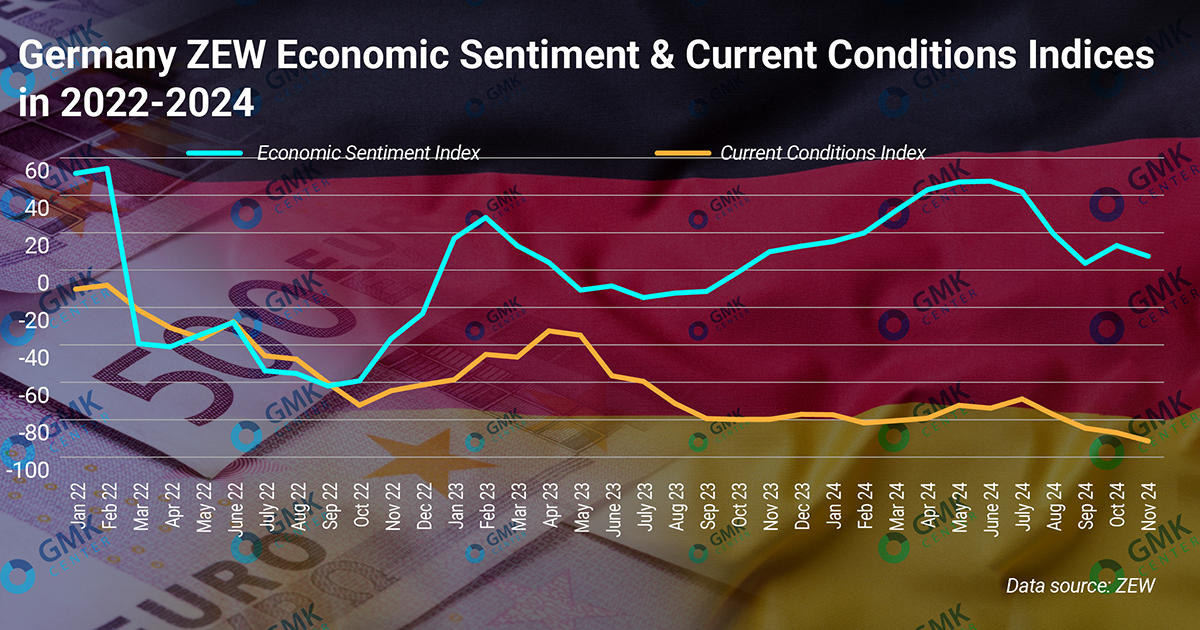

The partial recovery of the business climate in 2024 already ended in June. The ZEW index of current economic conditions collapsed to -91.4 in November from -68.9 in July. This deterioration was due to the weak economic outlook for German exports, political uncertainty, and the potential impact of the US presidential election on Europe.

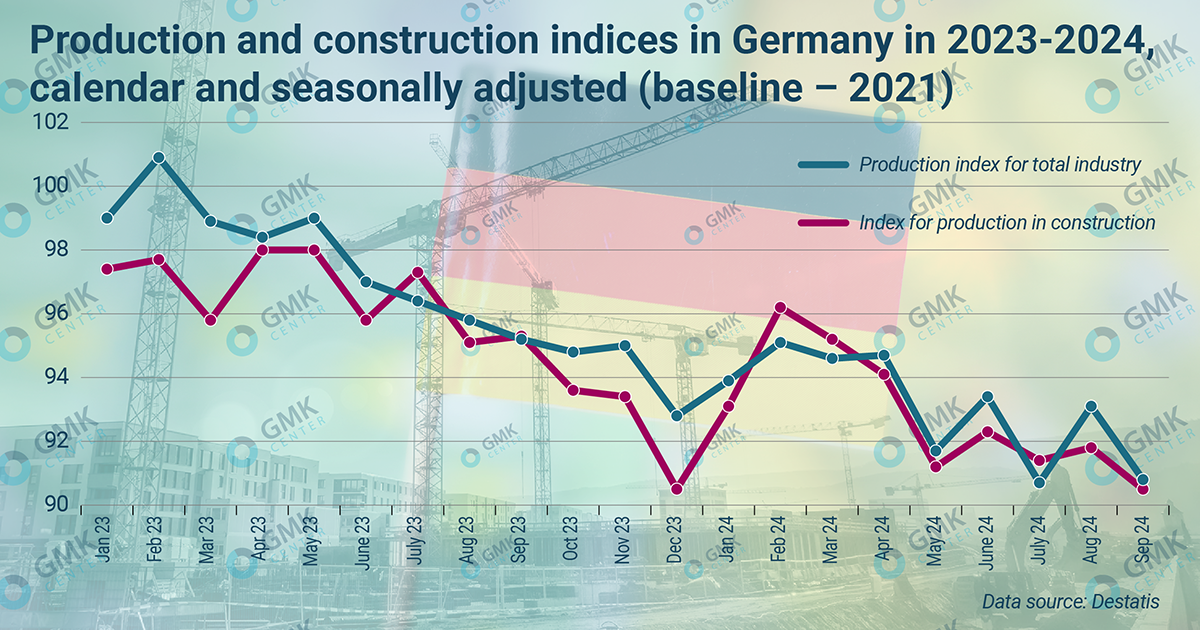

Certain glimmers of recovery in manufacturing activity appeared at the end of summer. In August of this year, industrial production in Germany unexpectedly increased by 2.6% compared to the previous month. Such dynamics were mainly due to the growth in the automotive industry by 15.4% m/m against a decline of 8.1% m/m in July.

At the same time, this positive surge was not supported by the dynamics in September, in which industrial production contracted by 2.5% m/m. In September, the auto industry had already dragged the whole industry down (-7.8% m/m).

On an annualized basis, the negative dynamics in industrial production in September also intensified – the decline amounted to 4.6% against -3% a month earlier. Recall that industrial production in Germany in 2023 decreased by 2% y/y due to the decline in the energy sector, chemical industry and steel sector.

The situation is not better in the construction industry in Germany. In the first eight months of 2024, construction sales fell by 1.1% y/y and new orders fell by 0.6% y/y. Continued decline in residential construction can cause negative consequences for the entire economy of the country.

Second annual decline in GDP

Quarterly dynamics of the economy is quite volatile. In the second quarter of 2024, the German GDP grew (preliminary estimate) to 0.2% compared to the previous quarter (Q2 – -0.3%).

In turn, the annual dynamics of the economy has been in the negative zone for five quarters already – in Q2-Q3 of the current year there was a decline of 0.2% and 0.3% y/y respectively.

The current dynamics roughly corresponds to the German authorities’ forecast of the economy contraction by 0.2% y/y in 2024 (early expectations predicted growth by 0.3% y/y). At the same time, the country’s leading economic institutions (Ifo, DIW, etc.) worsened their forecast for 2024 from growth of 0.2% y/y to contraction of 0.1% y/y. This will be the second year of decline for Europe’s largest economy – in 2023, Germany’s GDP contracted by 0.3% y/y.

Negative outlook for the German economy

Germany remains the weak link in the European economy, and forward-looking business expectations are now at rock bottom. The ZEW economic sentiment index (leading indicator) collapsed to 7.4 in November from 41.8 in July.

There are no prospects for industrial production growth in Germany in 2025 at the moment. One of the drivers – automobile production – is facing high costs, fierce competition and stagnant demand for electric cars. Sentiment in the German auto industry is worsening, with Volkswagen planning to close at least three plants in Germany and lay off tens of thousands of workers.

“It is not quite clear to me why it was necessary to start a trade war with China in the auto industry if it was clear before the beginning. There are many models of cooperation and opportunities to preserve jobs, market shares and protect investments. But perhaps the German authorities and industrialists are not ready to accept the new realities of the world economy,” comments Stanislav Zinchenko, CEO of GMK Center.

Now analysts are lowering their estimates for the German economy for the next year. In its October report, the IMF downgraded the forecast of German GDP growth in 2025 to 0.8% (previously 1.3%), German economists – to 0.5% from the previous 1.1%. With such figures, Germany, which is Europe’s main economy, is trivially dragging it down. For 2025, the IMF lowered its forecast for eurozone GDP growth by 0.3 pp – to 1.2%.

Positive improvements in the German economy in the short term may be associated with the impact of lowering interest rates, which began in June 2024, and the likely end of the political crisis in the spring of 2025.

Negative expectations are linked to the risk of higher import duties on German imports to the US. German GDP, according to analysts’ estimates, may decrease by 1% due to this, as the US is the largest export market for German companies (€14.2 billion in October).

“Of course both trade wars, interest rate, tax policy and social spending optimization can affect the performance of the German economy. But the only long-term drivers of growth are investments in the real economy: in industry, energy, infrastructure. We have not seen any growth in investment and new projects so far. Perhaps they are discouraged by high electricity prices, which make projects less competitive in Germany than in Sweden, France and Spain,” concludes Stanislav Zinchenko.