Posts Global Market steel demand 8624 09 September 2024

European industry and construction are recovering too slowly

During the war, the European Union became Ukraine’s largest trading partner. This was facilitated by the lifting of trade restrictions and geographical proximity, which is important in the face of logistical difficulties. In the first half of 2024, Ukrainian exports to the EU amounted to $11 billion, or 56% of the total. Europe is even more important for the iron and steel industry. Supplies of steel products to European countries accounted for 84% of Ukraine’s exports in the first half of the year. Therefore, Ukraine’s export prospects, both in general and in the iron and steel sector, depend on the state of the EU market.

Macroeconomic situation

The European economy is struggling to recover from the storm of 2022, when Russia’s full-scale aggression began, many supply chains were disrupted, and energy prices soared. Later, inflation, rising interest rates, and reduced credit availability were added to this, leading to a slowdown in economic activity, especially in the construction and manufacturing sectors. As a result, the eurozone and EU economies grew by only 0.4% in 2023 after 3.4% in 2022.

Economic activity remains low this year. According to Eurostat, in the second quarter, the eurozone economy grew at the level of the first quarter – by 0.3% q/q.

The largest economies developed in different directions in the second quarter: Germany’s GDP declined by 0.1% q/q, while France, Italy and Spain grew by 0.3%, 0.2% and 0.8% q/q, respectively. Steady development in many key countries allowed Europe to compensate for the decline in the German economy. On an annualized basis, the eurozone economy grew by 0.6% in the second quarter.

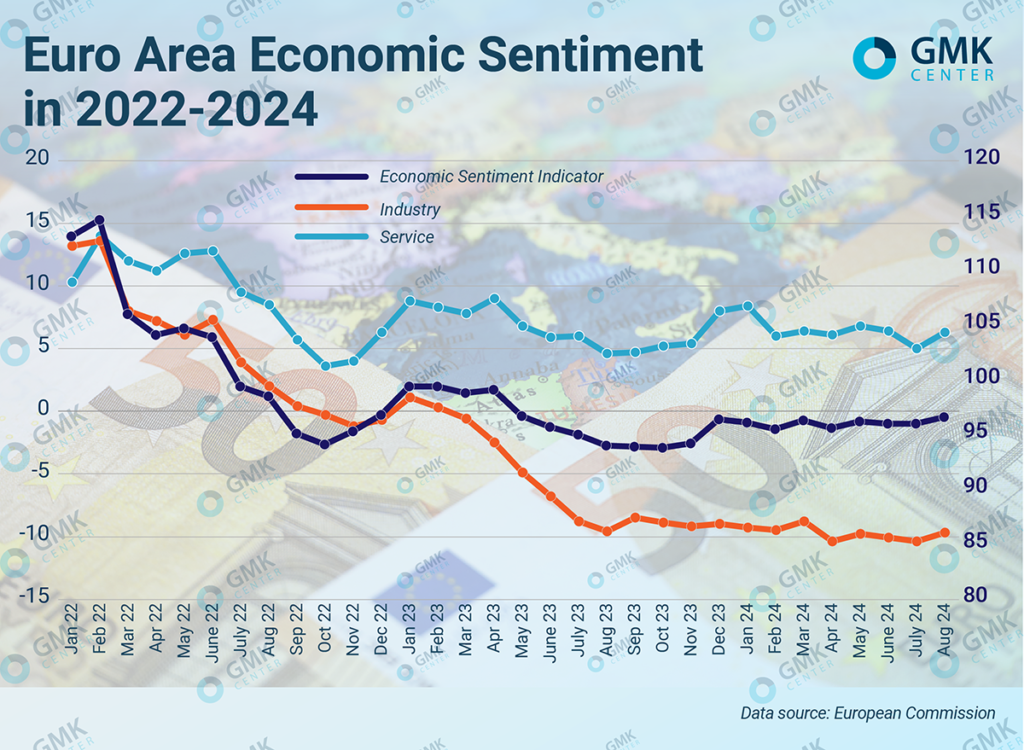

Current assessments of the business climate in Europe are low. According to the European Commission, the overall index of business sentiment in the eurozone (Economic Sentiment Indicator) rose to 96.6 points in August. The business climate in the industry has improved slightly, but has been at local lows for a year now. In particular, in Germany, the PMI is at a 5-month low, and in France, at an 8-month low. The low overall business climate scores are partially supported by a relatively good situation in the services sector, but this is not enough to significantly improve the aggregate business sentiment scores.

The short-term prospects for a recovery in economic activity are largely linked to further interest rate cuts amid easing inflation. The market expects further rate cuts following the ECB meeting on September 12. The regulator cut all three key interest rates by 25 basis points in June. Currently, the base rate for loans is 4.25% per annum, for deposits – 3.75%, and for margin loans – 4.5%. It was the expectation of the start of the rate cut cycle that contributed to the improvement in business sentiment in the euro area at the end of 2023.

Steel demand state

Demand in the European steel market remains rather weak, as it is influenced by numerous macro factors that are holding back its growth.

“The European Union and its steel-consuming industries face numerous challenges: geopolitical shifts and uncertainty, high inflation, tight monetary policy and partial withdrawal of budget support, as well as still high energy and commodity prices,” Worldsteel said in its review.

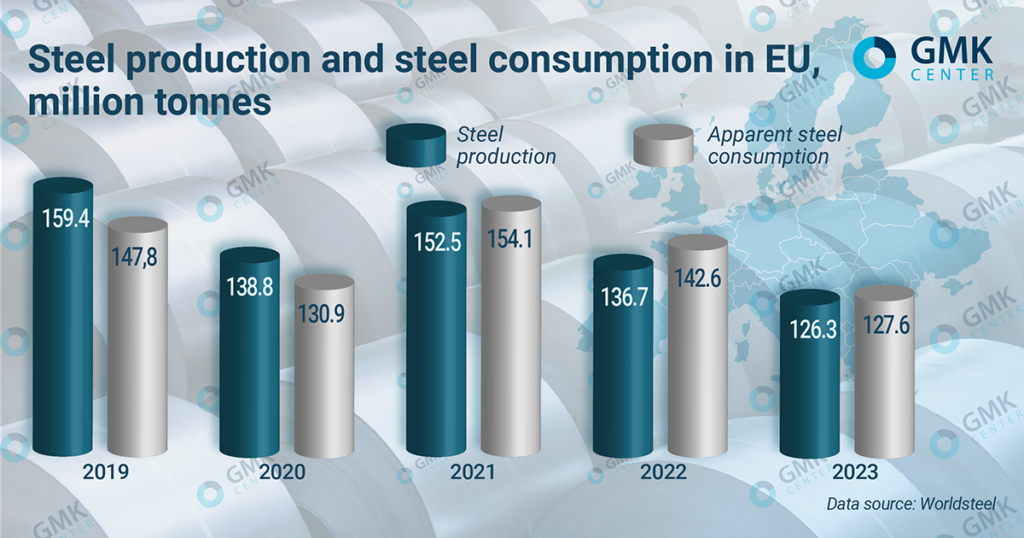

Since the beginning of this year, EUROFER has consistently downgraded its forecast for apparent consumption growth in the European Union twice. Currently, consumption growth is expected to be only 1.4% in 2024, up to 127 million tons. Even this minimal growth is nothing more than a “technical rebound” after the disastrous year of 2023, when consumption fell by 8.7% y/y – to 126 million tons.

An increase in steel consumption can be expected only next year. EUROFER forecasts a 4.1% increase in apparent steel consumption in the EU – to 133 million tons in 2025. Next year, real steel consumption in the EU is expected to grow by 2.4% y/y (previous forecast – 2.1% y/y).

Let us consider the current and prospective situation in the main steel-consuming sectors of the European economy.

Construction

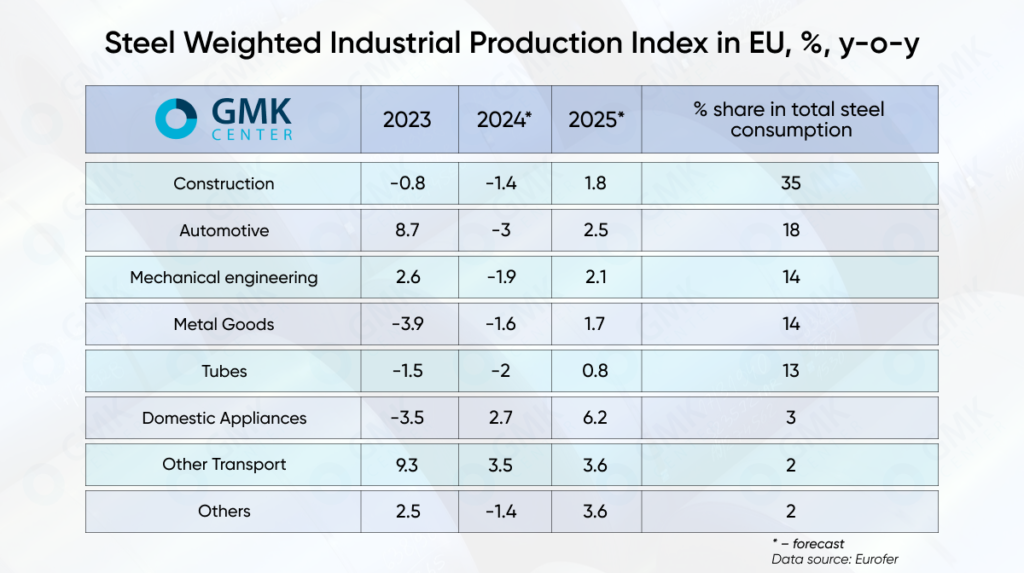

Construction is the largest steel-consuming industry in the European Union, accounting for 33% of total steel consumption. It is under pressure from a number of negative factors.

“Rising prices for construction materials, coupled with labor shortages in some EU countries, rising economic uncertainty and, in particular, rising interest rates due to tightening monetary policy, are having a negative impact on construction volumes,” EUROFER analysts say.

As a result, the construction sector declined by 1% y/y in 2023, although the decline was less than expected (-2.1% y/y). This trend will continue this year, including due to a significant reduction in government support for the industry, which was previously a driver of its growth. It is expected that the volume of construction in the EU will decline by 1.4% y/y in 2024.

At the same time, the easing of monetary policy and improved project financing conditions this year allow us to expect an increase in construction activity by 1.8% y/y in 2025.

Automobile industry

The second most important industry is the automotive sector (18% of total steel consumption). Until recently, the situation here was much better than in many sectors of the European economy. Due to improved demand, production in the automotive industry grew more significantly than expected in 2023, by 8.7% y/y (5.7% y/y in 2022). However, this level remained much lower than in the pre-docking years of 2018-2019.

The improvement in the automotive industry lasted until May of this year, when car registrations fell sharply in three of the four major markets in the region – Italy, Germany, and France. Due to continued stagnation in the industry, uncertainty over electric vehicle standards, and low consumer confidence, EUROFER expects a 3% y/y decline in EU auto production (previous forecast -0.4% y/y) by 2024.

At the same time, the forecast for automotive production for 2025 envisages an increase of 2.3% y/y (previous forecast – 0.8% y/y).

Nevertheless, demand for cars will remain weak until the macroeconomic situation and consumer incomes improve. Consumer demand is also adversely affected by uncertainty over the launch of new car models and a lack of electric vehicles charging points, while the industry’s prospects are affected by increased competition from Chinese automakers.

Engineering

Due to the energy price shock that had an extremely negative impact on the entire EU manufacturing sector, as well as the impact of high interest rates and economic uncertainty, economic activity in the machine building industry, another major steel-consuming sector of the European economy (its share in the structure of steel consumption in the EU is approximately 14%), slowed significantly. After a difficult year for the industry in 2022, when production in the machine building sector grew by 5.7% y/y (up 14.3% y/y in 2021), growth slowed to 2.6% y/y in 2023.

It is expected that the industry will go into the red this year, despite some economic improvements in the second half of the year. According to EUROFER estimates, in 2024, the machine building industry will show a decline of 1.9% y/y. A return to positive dynamics is expected only in the first half of 2025, when the industry is expected to recover by 2.1% y/y.

Cautious optimism

The ECB’s interest rate cuts, which began in June, will not in itself contribute to a rapid recovery of the European economy: the size of the cuts is extremely small, and it will take at least six months for the cost of credit to start falling and affect business activity.

Therefore, analysts expect economic activity in the main steel-consuming sectors of the European economy to improve only next year. This is mainly due to the increased availability of credit and improved industrial and consumer demand.

Such expectations have already led to improved forecasts of the economic situation in the euro area. In particular, the ECB raised its forecast for eurozone GDP growth in 2024 to 0.9%. It is expected that in 2025, the European economy will grow by 1.4-1.5%.

The growth of the European economy next year will create the preconditions for increasing production and exports by Ukrainian iron and steel companies. At the same time, in addition to the favorable economic environment in the EU market, it is important to continue the regime of lifting restrictions on Ukrainian exports and to remove Ukraine from the CBAM, or at least to introduce tools that mitigate the consequences of the launch of this mechanism for domestic exporters.

At the same time, the risks of escalation of hostilities in Ukraine, rising geopolitical tensions, inflationary and debt pressures in the financial markets remain relevant for the European economy.

“The key problem of the EU economy is not the ‘fall of the titan’ represented by the German economy, but the lack of growth drivers. In recent years, the EU countries individually and the EC as a whole have not offered any growth factors. There is no support for the real estate market, when young families cannot afford to buy housing, and this is becoming a social problem. There is no bet on the automotive industry: the forced transition to electric cars and the pre-lost war with the Chinese car industry do not look convincing. No bet on oil and gas production: Diversification of supply sources requires at least a tenfold increase in gas and oil drilling and production. And the all-in bet on green transition requires a lot of investment, but does not bring added value or create growth in the economy, which simply makes energy resources more expensive and taxpayers pay more,” said Stanislav Zinchenko, Director of GMK Center.