Posts Global Market scrap metal 4906 26 November 2024

Scrap supply exceeds demand amid weakness in the steel market

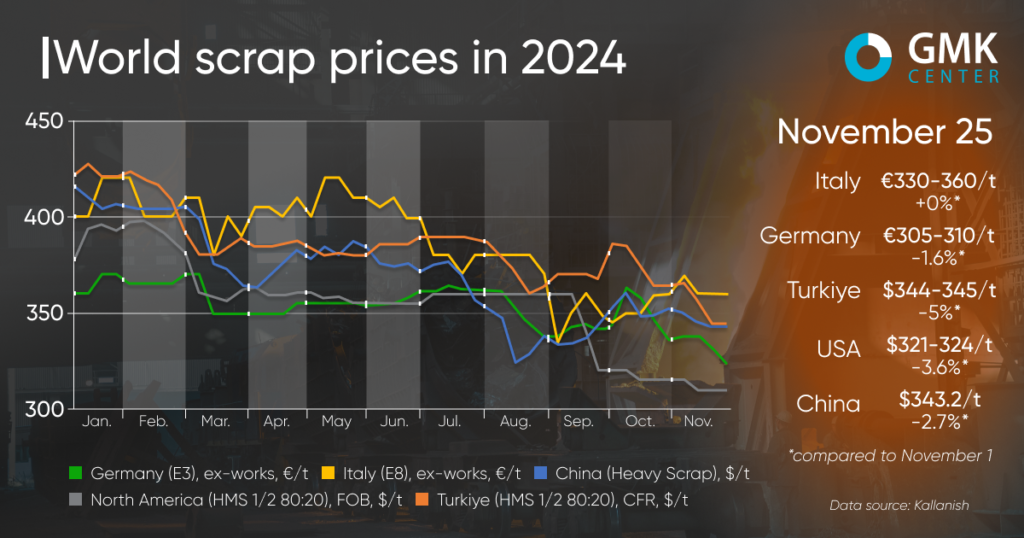

The global scrap market showed a decline in prices in most key regions during November 1-25, 2024. In Turkey, supply fell to its lowest level in 2 years, while in the US it fell by 3.6%. The European market was characterized by multidirectional trends, where stagnation prevailed in general. In China, quotes fell by 2.7%. A partial recovery is expected only in January 2025.

November 2024 was a period of falling scrap prices in Turkey. Prices for HMS 1&2 80:20 raw materials decreased by 5% – to $344-345/t CFR for the period of November 1-25, which is the lowest level in the last two years. Prices continued the decline that began in October (-1.4%), driven by several key factors, including oversupply and weak demand for steel.

At the beginning of the month, the market remained weak due to ample supply of scrap, particularly from the EU and the UK, which met the needs of Turkish steel mills. Although suppliers tried to raise prices amid rising freight costs and expectations of Chinese economic stimulus, Turkish mills resisted any attempts to increase prices. Deals were concluded at $355-360/mt CFR, but at the end of the first week, offers began to fall to $350-355/mt CFR.

Expectations of Chinese incentives played a significant role in shaping market sentiment. However, after a limited package of measures was announced on November 8, suppliers’ optimism declined significantly. Turkish rebar prices continued to decline, falling from $610-625/t to $595-615/t ex-works by mid-month.

The rate of decline in scrap prices accelerated in the second half of November. Deals for the purchase of HMS 1&2 80:20 from the EU were fixed at $344-345/t CFR, while those from Romania were $325/t CFR. Until November 20, deals were concluded at $340/mt CFR from the UK, the lowest level since 2022.

The main reasons for the decline were oversupply: European suppliers, in particular from Benelux, continued to put pressure on the market with many cargoes; weak demand: Turkish mills postponed purchases due to problems with steel sales in the domestic and export markets; currency fluctuations: the weakening of the euro against the dollar allowed suppliers to offer scrap at a lower price.

Despite the significant drop, market participants expect prices to recover in January when European demand returns. However, the market will remain under pressure until the end of 2024. Steel mills that have cut production have met the minimum demand for December, and weak demand for steel does not provide prerequisites for a significant increase in scrap prices in the short term.

«The scrap market is a mirror of the steel market. Demand for steel in the European market directly affects the state of the Turkish steel industry and the scrap market. At the moment, we see no prerequisites for a rapid improvement in the situation, given the situation in the European economy,” said Andriy Glushchenko, GMK Centeranalyst .

In November, the European scrap market showed a mixed trend. After the autumn downturn caused by low demand and limited exports, the situation gradually stabilized but remained challenging due to weak demand for finished steel.

Scrap prices in Italy rose by €10-15/t in early November, reaching €325-370/t Ex-works for E8. However, by the middle of the month, they had recovered to €330-360/t, meaning that the lower limit rose by €10/t compared to November 1, while the upper limit remained the same.

The fluctuations were driven by increased demand from local steel mills after the October drop, which made the country one of the cheapest markets in Europe. Positive sentiment was supported by price stabilization, particularly in Turkey, which remains a key importer. However, the situation remains fragile due to the planned prolonged production stoppages at Italian factories in December. Some companies have announced downtime of up to 4 weeks, which may reduce demand and price stability in the future.

In November, the German scrap market saw a €5-10/t price drop to €305-310/t for E3. The reasons are low domestic demand and limited exports due to lower purchases by Turkish mills. Economic stagnation in Germany does not contribute to the growth of demand for scrap.

Similar stability was observed in neighbouring Austria, where prices remained at €300-305/t. Most market participants expect this trend to continue until the end of the year.

In France, Belgium and Luxembourg, scrap prices remained almost unchanged, despite expectations of a decline due to weak performance in Turkey. For example, E40 was sold for €335-340/t, and E8 – for €320-335/t. Most European steel mills agreed to fix prices in November, which maintained stability in the market.

Despite short-term positive price fluctuations in November in some countries of the bloc, the outlook for December remains uncertain. Pre-holiday production stoppages in most parts of the EU and a decline in activity could again change price dynamics.

On the US scrap market, as of November 25, prices fell by 3.6% compared to November 1 – to $321-324/t (US East Coast FOB), driven by weak demand, low export quotations and lower steel prices.

At the beginning of the month, market participants expected prices to stabilize, but a reduction in contract orders from steel mills created uncertainty. This was especially true in the Southeast of the US, where there was an oversupply. At the same time, prices in the Midwest remained stable due to low inventories of steel mills.

External markets showed negative dynamics. In Taiwan, offers for HMS 1&2 80:20 from the US dropped to $310-320/t CFR due to low demand for rebar. Turkey, the largest importer of scrap metal, was lowering quotations, preferring more affordable raw materials from other regions.

The middle of the month brought a mild price adjustment in the southeastern United States, where prices fell by $10/t. Despite expectations that severe weather and the holiday season could limit supplies, demand remained weak due to weak rolled steel sales.

Towards the end of November, the market outlook remains uncertain. Some market participants predict that deteriorating weather conditions and preparations for winter may support prices, but weak export markets and low demand in Turkey are creating additional pressure.

In China, the price of scrap (Heavy Scrap) in the period 1-25 November fell by 2.7% – to $343,3/t. The main reasons for the decline were lower domestic steel prices, oversupply and limited demand from electric arc steel mills.

After rapid growth in October, driven by rising steel prices, the dynamics changed in early November. Increased supply in the market and increased supply from downstream processors put pressure on prices. These factors limited any possible market recovery.