Posts Industry scrap market 5033 31 January 2024

In the conditions of post-war economic recovery, the role of scrap for the steel industry will inevitably increase

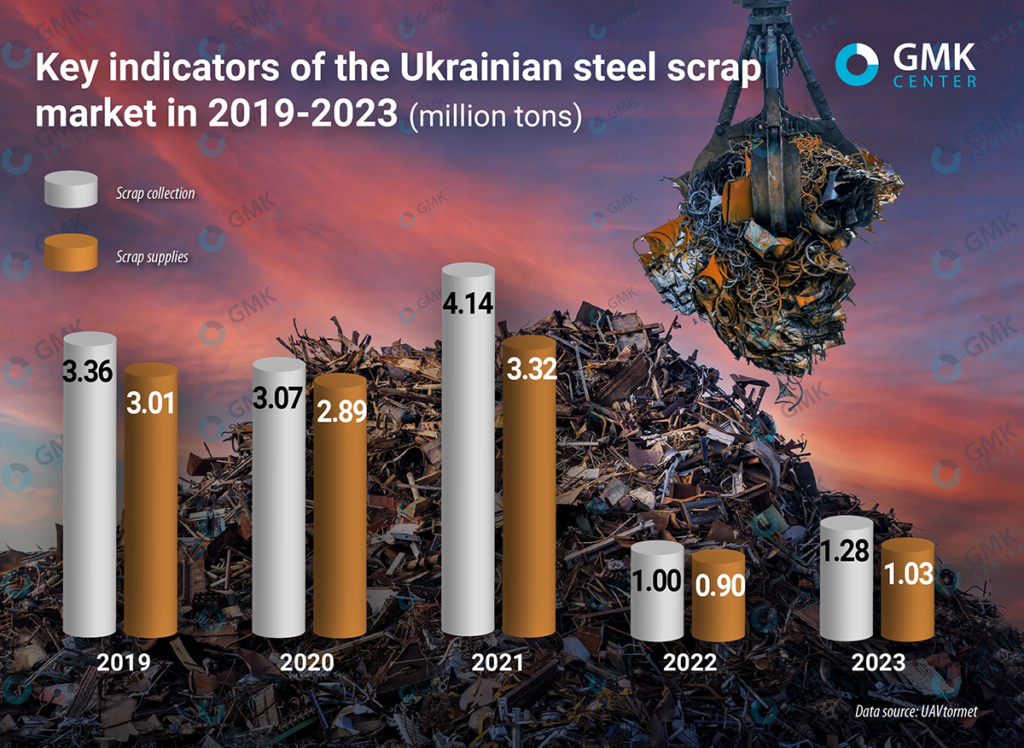

Last year, the scrap industry’s performance improved slightly, as both scrap collection and consumption increased, although steelmaking in 2023 remained virtually unchanged compared to the previous year. Industry experts expect a slight growth in scrap collection in 2024, expecting to increase exports.

Improvement of the situation amid problems

After a 4-fold drop in scrap collection in 2022, the performance of the scrap industry improved slightly last year. According to the UAVtormet association, the volume of scrap collection in Ukraine in 2023 increased by 28.1% – to 1.27 million tons compared to 996.7 thousand tons in 2022. This roughly corresponds to the balance forecast of 1.2-1.25 million tons.

Last year, scrap deliveries to steelmakers totaled only 1.034 million tons (+15.4% y/y), while steelmaking amounted to 6.23 million tons. In 2022, raw material deliveries to consumers were at 895.7 thousand tons with approximately the same volume of smelting.

There are many factors on the market that are holding back the growth of scrap collection. Industry representatives name the following current problems:

- Staff shortages. Scrap logging companies are not among the “critical” enterprises that can armor their employees from mobilization. Now the companies lack qualified loader drivers, gas cutters, etc. Problems of staff shortage may appear when there is a need to significantly increase the volume of scrap harvesting for internal needs or external supplies. UAVtormet counts on the support of the Ministry of Strategprom in solving the problem of staff reservation.

- Low domestic price of scrap. This reason has been voiced for a long time as a deterrent to the growth of scrap collection. But there are no calculations on the cost of scrap to understand the profitability of the business and justify the higher price. It is also unclear where additional scrap will come from with such a decline in machine building and lack of investment in infrastructure.

- Impact of the law on waste management. The ferrous metal scrap market must radically restructure after the law comes into force. Market participants are obliged to obtain new authorization documents to work with waste. Interpipe Vtormet expects that the process will not be painless for the industry. The Ministry of Environmental Protection understands this problem and is working out mechanisms to minimize the negative impact on business in cooperation with the largest consumers. But there is little progress, as any new licensing in Ukraine faces various problems.

- Inspections by law enforcement agencies of enterprises of the scrap collection industry. The law enforcement agencies are increasingly coming with inspections to the scrap industry enterprises.

Export of raw materials

Throughout the last year there was an increase in exports of ferrous scrap from Ukraine. This indicator grew 3.4 times and amounted to 182.5 thousand tons worth $52.7 million. That is, scrap collection grew by 28%, while exports grew by 3.4 times, which naturally causes concern of scrap consumers. The volume of scrap exports turned out to be much higher than expected, which at the beginning of the last year was at the level of 50-80 thousand tons.

Ukrainian scrap is mainly exported to EU countries. The largest consumers of Ukrainian raw materials last year were: Poland – 160.6 thousand tons, Greece – 13.2 thousand tons and Bulgaria – 2.7 thousand tons.

The growth of raw material exports to the EU was promoted not only by geographical proximity, but also by the absence of customs duty of €180 per ton. The duty on scrap exports to Europe until recently was only €3 per ton, and since the beginning of this year it became zero (according to the Association Agreement). To export, it is sufficient to obtain an EUR.1 certificate confirming the Ukrainian origin of raw materials.

«If until 2022 the export of scrap was carried out mainly to Turkiye and Transnistria and from each ton the state levied 180 euros of duty, then for the whole year 2023 the Ukrainian state budget received practically nothing, except for symbolic €3 per ton. All 180 thousand tons were exported to the EU countries. And from January 1, 2024, the export duty was reduced to zero. Thus, the state budget is deprived of this source of income. But Poland, the main export destination for Ukrainian scrap exporters, is a surplus country in terms of market supply. Thus, Polish ports are, in fact, a transshipment base for Ukrainian scrap exporters and a way to avoid paying €180 duties,» says Valentyn Makarenko, chairman of the board of Interpipe Vtormet.

UAVtormet expects scrap exports to increase by 37% to 250,000 tons in 2024. However, this may be hindered by logistical difficulties (possible resumption of blockade of western road crossings, conventions on railroads). There is one potential problem. The EU is a net exporter of scrap (in 2022 – 17.4 million tons), and therefore the supply of this raw material from Ukraine is not very important and meaningful for consumers.

According to Volodymyr Bubley, president of the UAVtormet association, given the weak situation on the European steel market, it cannot be ruled out that scrap collectors in neighboring countries (following the example of the ban on the export of agricultural products) may start lobbying for the introduction of restrictive measures against Ukrainian scrap.

Scrap has been and remains a strategic raw material for the Ukrainian steel industry, and the trend towards higher export volumes is of great concern to steelmakers. Last March, Interpipe even halted production due to scrap shortages.

«The increase in export shipments will have a significant impact on the scrap market, as Ukrainian steelmakers plan to increase steelmaking in 2024. External market conditions remain favorable, plus maritime logistics have improved. If in 2023 scrap exports amounted to 182 thousand tons, then in 2024 we can expect its increase by 2-3 times. This is already a significant threat to both jobs at Ukrainian steel companies and revenues to budgets at all levels,» emphasizes Valentyn Makarenko.

Steelmakers talk about the shortage of raw materials, which affects technological processes and production indicators in the steel industry.

«As of today, the level of scrap shortage fluctuates within 20% (in 2023 it reached 40%). This forces enterprises not only to use up their available scrap stocks intended to ensure uninterrupted operation of production facilities, but also to go for a forced increase in pig iron consumption in the same open-hearth and converter furnaces. Thus, the cost of production increases significantly, or production has to be reduced. And this is despite the current export duty on scrap in the amount of €180 per ton,» says the president of Ukrmetalurgprom Oleksandr Kalenkov.

Ukrmetalurgprom has repeatedly appealed to the relevant authorities with a demand to impose a moratorium on the export of scrap metal, at least until the end of hostilities, but the issue remains open.

More than 65 countries of the world have imposed restrictions on scrap metal exports, including a direct ban on exports. Scrap is an essential raw material for the production of steel with low CO2 emissions.

Prospects for scrap collection

The industry is expected to continue its recovery in 2024. UAVtormet forecasts an increase in scrap collection to 1.45-1.5 mln t or by 13.5-17.5% y/y this year. Scrap deliveries to consumers in 2024 may reach 1.2 million tons (+16% y/y) with an expected steel production level of 6.8-7 million tons.

«The main source remains depreciation scrap. If demand from steelmakers grows, the industry will be able to meet it and increase scrap procurement,» notes Volodymyr Bublei.

Prospects for scrap from other sources look uncertain at the moment. For example, Ukrainian Railways sold 76.4 thousand tons of scrap in 2023, although it planned to sell 170 thousand tons. According to the president of UAVtormet, the state-owned company has not yet fulfilled its earlier commitments – it delivered only 50% of the volumes sold last year at auctions, but the industry expects that Ukrainian Railways will return to selling scrap on the open market.

«Starting from Q4 2023, Ukrainian Railways (UZ) stopped putting scrap on sale, although its volumes could have saturated the market. Such sales actions by UZ introduce a high degree of uncertainty into the market balance. But UZ could have received additional funds from the sale of property,» adds Valentyn Makarenko.

In 2023, Ukrainian Railways asked the government to release it from the obligation to sell scrap through the Prozorro.Sales system in order to be able to export raw materials under direct contracts to Europe. However, it was refused.

Another potentially large source is “conversion” (military) scrap resulting from military operations. Already at the primary stage there are problems of collection and accounting of scrap, the need to sort it, etc. The Ministry of Defense (the Ministry of Defense) has no time to deal with this. The Ministry of Defense (the owner of such scrap) has neither sufficient funds nor people, nor the necessary competencies. As of the summer of 2023, the volume of military scrap was estimated at 730 thousand tons, but only 12+ thousand tons are accounted for. At the same time, pounded armored vehicles, for the production of which alloyed alloys are used, practically cannot be used as ferrous scrap. Currently, already the Ministry of Defense wants to have the right to export scrap independently.

«For almost two years now there has been talk of extracting useful parts and assemblies from military equipment. However, the market has yet to see the sale of at least one ton of this property and an established process of selling this scrap metal,» adds Valentyn Makarenko.

According to Volodymyr Bubley, in 2024, one should not expect the Ministry of Defense to offer large volumes of military scrap. In this case, many regulatory and organizational problems have not been solved.

In the conditions of post-war recovery, the role of scrap for Ukrainian steel industry will inevitably increase. Restoration and modernization of the enterprises of the industry will take place with the use of new technologies – smelting steel in electric arc furnaces (EAF) with the use of scrap and DRI. Availability of sufficient volumes of scrap metal is the most important prerequisite for decarbonization of Ukrainian steel industry and implementation of rehabilitation projects.