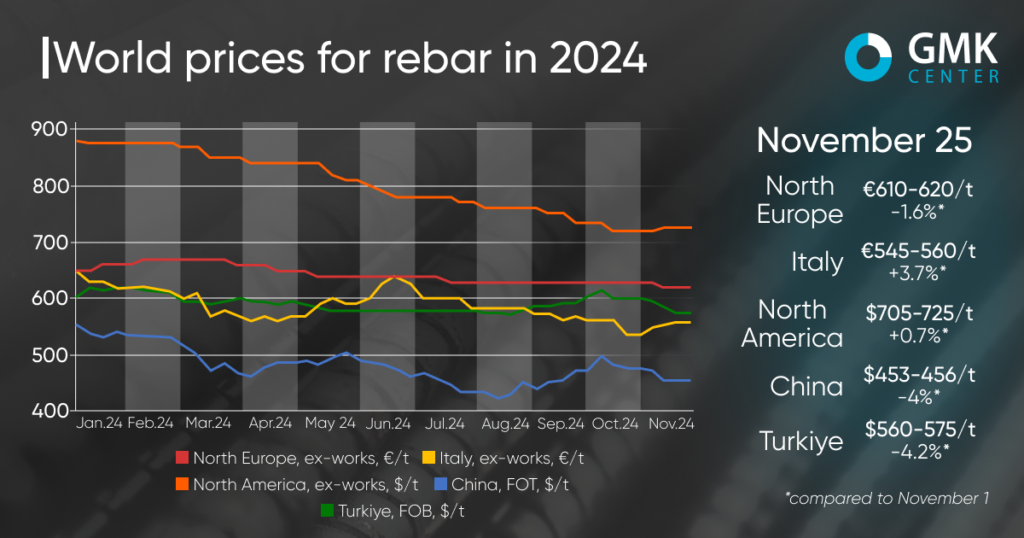

Posts Global Market rebar prices 4256 28 November 2024

Offer prices are declining in China, Turkey and Europe, while the US is showing signs of stabilization

November 2024 was marked by a general decline in rebar prices in key global markets due to weak demand, economic uncertainty and a seasonal decline in construction. In China and Turkey, prices fell by 4%, driven by a slowdown in the construction sector and lower scrap prices. In Europe, mixed trends were observed, while in the United States prices rose slightly amid a pickup in residential construction activity. However, all markets remain exposed to the risks associated with reduced demand in the winter.

The Turkish rebar market is showing a gradual but steady decline in prices. During the period from November 1 to 27, they fell by 4.2%, reaching $560-575/t FOB. The main reasons for this decline were weak demand in both the domestic and export markets, falling scrap prices and increased competition in key export destinations.

At the beginning of the month, Kardemir, a key Turkish steelmaker, cut rebar prices by TRY 535/t ($15.6/t), which allowed the company to quickly sell 40,000 tons of products by taking advantage of an installment plan with favorable interest rates. Other producers also reduced their prices by $5/t, but this did not lead to a significant recovery in the market. Export offers dropped to $590-600/t FOB, although some producers were forced to accept prices below $590/t to conclude deals with the Balkan countries.

The market situation remained difficult even after the second significant price cut by Kardemir on November 20 – by TRY 505/t ($14.6/t). In the domestic segment, prices in some regions, such as Izmir and Bilecik, dropped to $555-575/t ex-works. However, weak demand persisted despite significant discounts. A similar situation was observed in the export market, where most producers’ offers fell to $575-580/t FOB, but deals were made only in limited volumes.

The key factors behind the negative market dynamics were a drop in scrap prices, which reached $340-345/t CFR, and a low level of activity in traditional export markets. The Balkans, Africa and South America did not provide sufficient demand to support prices. In addition, Turkey has lost a part of the Brazilian market, which now imports rebar from Egypt, and in other markets is facing increased regional competition from Egyptian producers offering products at around $560/t FOB.

Despite the attempts of some Turkish producers to find new markets, logistical and political barriers, such as difficulties in confirming shipments to Palestine, limit export opportunities. The market is also under pressure from the financial situation in the country: the key policy rate of the Central Bank remained at 50%, which significantly hampers economic activity.

“Turkey’s domestic market is stagnating, and steel production in the country is unlikely to grow, given that the Central Bank is trying to contain inflation and cool economic activity. Hypothetically, Turkey can maintain its current production volumes of steel products, including long products, but only if exports continue,” said GMK Center analyst Andriy Glushchenko.

In the short term, rebar prices are expected to remain under pressure if demand does not recover and scrap prices do not stabilize. At the same time, any positive news, such as China’s stimulus measures for its economy, could have a significant impact on global steel markets and help to level the playing field.

The European rebar market showed mixed price trends in November. In Northern Europe, after three months of stability, prices fell by 1.6% – to €610-620/t Ex-Works due to weak demand and import pressure. At the same time, the Italian market was marked by a 3.7% increase in prices to €545-560/t Ex-Works, which was the result of producers’ determination to implement the increase despite limited demand.

In early November, Italian producers announced a €20/mt increase in the base price, but real offers remained only €5-10/mt higher than the initial ones. The market remained cautious, with distributors buying small volumes due to weak demand, and some considering importing cheaper products from North Africa. However, import pressure eased due to logistical and regulatory barriers.

In the middle of the month, the announced increase was partially realized, and prices increased by €15-20/t. However, some companies reported financial difficulties of their clients in the construction sector, which further restrained demand. At the end of the month, prices stabilized at €545-560/t Ex-Works, with most buyers refraining from purchasing, waiting for seasonal discounts.

The situation in Italy was in contrast to the European situation: in France and Germany, prices remained stable, but demand continued to fall. In France, Italian producers were actively offering products at prices lower than local ones, which put pressure on the local market. At the same time, Italian factories announced production suspensions in December, which could reduce supply and support prices in the first quarter of 2025.

In the short term, prices are expected to stabilize in Italy, provided that producers maintain their discipline. However, a prolonged demand deficit may limit further growth, especially in the face of financial difficulties in the construction sector and high production costs.

In the United States, the rebar market showed a slight but important increase in prices during the period, which amounted to 0.7%, to $705-725/ton Ex-Works in the US Midwest region. This is the first monthly price increase since the beginning of the year, which was a strong signal to the market after a long period of decline. Nevertheless, rebar supply remained low, limiting the ability to meet demand.

The key driver of price growth was the increase in base prices by producers such as Gerdau Long Steel North America and CMC. Gerdau, in particular, raised prices by $30/t since the beginning of November, while Nucor refrained from similar steps, which led to uneven implementation of new price levels. However, there were significant regional differences in some regions, such as the southeast of the US, caused by fluctuations in scrap prices.

Demand for rebar remained limited due to the weak performance of the construction sector. However, improvements in the residential construction segment and rising construction indices, coupled with stable non-residential project starts, signal a possible positive trend in the coming months. In October, non-residential construction starts increased by 14% m/m, and the AIA construction index showed the first increase since the beginning of 2023.

At the same time, scrap prices, which remain stable or slightly decreasing, make it possible to restrain the growth of rebar costs. At the same time, given the harsh winter weather conditions, supply during the cold season will be limited, which will help maintain price stability.

In December, rebar prices in the US are likely to remain at their current levels or show a slight increase. Further developments will depend on the activity of the construction sector, the stability of scrap prices and the actions of leading producers. Low inventory levels are expected to be another factor supporting prices during the winter holidays.

In the Chinese market, rebar prices fell significantly in November, by 4% – to $453-456 per tonne FOT, ending a three-month period of growth. Initial optimism, driven by expectations of new government stimulus measures, gave way to pessimism due to the weak impact of the approved debt quotas and concerns about possible increased protectionism following the US election.

In the middle of the month, major producers such as Zenith and Yonggang cut prices by 100-120 yuan/t ($14-16/t), and Shagang offered subsidies to support sales. Despite the pickup in purchases at the end of the month, demand remains weak due to cold weather and a downturn in construction, as well as significant problems in the real estate sector, where investment has fallen by 10.3% since the beginning of the year. Although rebar inventories declined and production volumes increased, a significant improvement is not expected due to the seasonal decline in demand.