Posts Infrastructure construction 3510 17 March 2025

The western regions of the country have become the new hotspot for industrial, logistics and other non-residential real estate development

As a result of Russia’s full-scale aggression, industrial construction in Ukraine has expectedly declined, and nearly 500 large and medium-sized enterprises have been severely damaged or destroyed. According to KSE Institute estimates, as of November 2024, direct losses of Ukraine’s industrial infrastructure due to the war amounted to $14.4 billion. However, in relatively safe areas of western and central regions of Ukraine, industrial investors have already resumed activity since 2023.

The indicator of the total area of industrial buildings and warehouses before the start of construction now exceeds the pre-war 2021 level by 25%. In other words, investors have significantly increased their plans to build warehouses and industrial real estate, helped by the massive creation of industrial parks.

Recovery of industrial construction

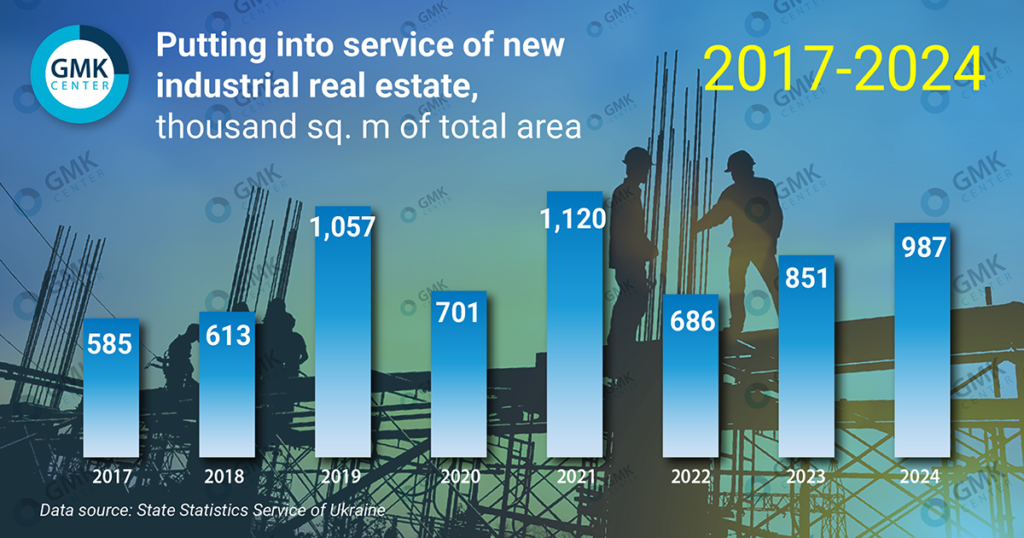

After the onset of full-scale aggression, the commissioning of industrial space predictably declined sharply. In 2022, the decline amounted to 39% – to 686 thousand sq. m. However, in the subsequent periods there was a recovery. The index of commissioning of industrial buildings and warehouses in 2024 increased by 16% compared to 2023 – up to 987 thousand square meters. m. This is only 12% lower than in pre-war 2021.

It is important to note that construction as a process stretches on average from a year or more. It implies a long cycle, including permits, site preparation and construction works, and only at the very end – commissioning. This is the final stage, which is characterized by the execution of documents for a particular building. Also, the commissioning rate partly reflects the favorable environment that allows investors to complete construction.

Regional aspect

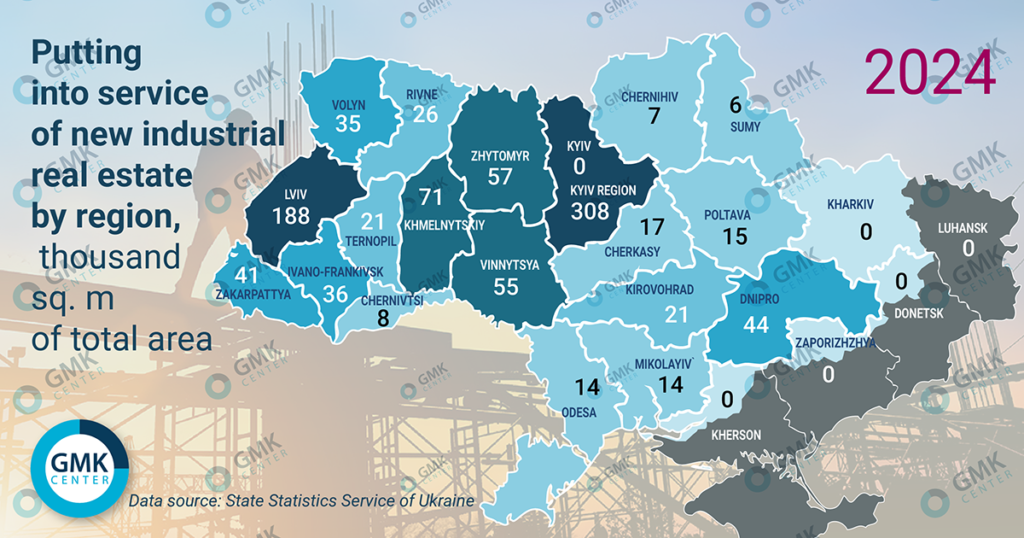

Even before the war, the commissioning points of new industrial real estate shifted from the east of Ukraine towards the west and center of the country. Full-scale aggression has only reinforced this trend. Among the leaders in commissioning of industrial facilities at the end of last year are Kyiv (31.2%), Lviv (19.1%), Khmelnytsky (7.2%), Zhytomyr (5.8%) and Vinnitsa (5.5%) regions. The highest increase in the specific weight of the indicator in 2024 compared to pre-war 2021 was in such regions:

- Kyiv – up to 31.2% from 23.5%;

- Khmelnytskyi – up to 7.6% from 3.6%;

- Zhytomyr – up to 5.8% from 2.6%.

The boom in construction of industrial and other non-residential real estate mainly concerns rather safe western regions of Ukraine. This is confirmed by the rate of commissioning of hotel facilities, which at the end of last year is 36% higher than pre-war 2021.

“Western Ukraine has now become a big construction site. We see that there is active hotel and recreational construction in the Carpathians and industrial construction (including in industrial parks) for agro- and food enterprises – grain elevators, various processing facilities, etc.,” Vitaliy Pritula, director of Eurometal, told GMK Center earlier in a commentary.

Lviv officials even complain that almost all areas of industrial parks in Lviv region are booked, and there are practically no large vacant plots for industrial enterprises left in the region.

For obvious reasons, Donetsk, Luhansk, Kharkiv and Zaporizhzhya oblasts and other frontline regions, which used to be the leaders in industrialization, are now showing zero figures for commissioning of industrial facilities. According to the results of last year, such regions lost their positions compared to 2021:

- Dnipropetrovsk – to 4.4% from 8%;

- Poltava – to 1.5% from 4.3%;

- Odessa – to 1.4% from 3.4%.

Thus, a number of regions of Western (Lviv, Khmelnitskyi, Zakarpattya and Ivano-Frankivsk) and Central Ukraine (Kyiv, Zhytomyr and Vinnitsa) remain attractive for the construction of industrial facilities, and in the conditions of the war and the subsequent relocation were able to increase their industrial potential.

The trend of opening new production facilities in the western regions is not new. For example, in the west of the country, since the early 2000s, production facilities oriented to the European market have been opening and expanding – in particular, cables and other products for the automotive industry, and various electrical appliances. Now there are many new production facilities for furniture, building materials, minerals, agro-products processing enterprises, as well as light and food industries, which are also oriented to the domestic market.

Is there an industrial boom?

We can now see an increase in the level of investor interest in launching new industrial and logistics facilities, already above the pre-war level. The indicator of the total area of industrial buildings and warehouses before the start of construction in January-September 2024 (1.66 million square meters) was 25% higher compared to the same period in 2021. In other words, the current plans for construction of industrial real estate are higher than the pre-war ones. At the same time, the commissioning of industrial space at the end of last year (987 thousand square meters) is still 12% below the level of 2021 (1.12 million square meters).

Among the major industrial facilities commissioned recently are the following:

- Austria’s Kronospan launched a new €200 million line in Rivne region to produce OSB boards.

- A new Philip Morris factory was launched in Lviv region, investments in which amounted to $30 mln.

- French group Saint-Gobain opened the first plant for production of dry construction mixtures in Ivano-Frankivsk region. Investments in production amounted to more than €11 mln.

- In 2024, two biomethane plants became operational in Ukraine: one from Vitagro Group in September and the other from Hals Agro in November.

Currently, a significant part of new production facilities and warehouses are being built or opened within industrial parks. The leaders in the number of industrial parks registered in 2024 were the western regions: Lviv (6 parks), Zakarpattia (5) and Ivano-Frankivsk (3).

“As of the end of 2024, 25 factories are being built or have already been built in industrial parks in Ukraine. These are companies in the sectors of food production, agro-processing, construction materials, woodworking, machine building, etc. In addition, more than 100 thousand square meters of industrial real estate for relocated and new enterprises have been commissioned”, says Valeriy Kirilko, CEO of the Industrial Parks of Ukraine Group of Companies.

The investment plans look even more grandiose. Among the announced industrial projects are the following:

- Astarta will invest $76 million in the construction of a plant in Khmelnytsky region for processing of oilseeds with a capacity of 400 thousand tons per year. Commissioning is scheduled for 2026.

- A new Knauf plant for production of gypsum board and dry building mixtures is under construction in Ternopil region. Investments of the German company in this project will amount to 150 mln.

- Fire equipment manufacturer Pozhmashina plans to set up a new plant with investments of $15 million in Lviv.

Another 13 factories in industrial parks are under construction. According to Andriy Ropitsky, the director of Bila Tserkva IP, three factories are currently under construction in the park, in particular, two of them for foreign companies, namely for British Unilever (plant for the production of personal care products) and Finnish Peikko (facilities for the production of building materials). One more facility may be added to this list in the near future.

Despite the war, industrial companies continue to realize their investment plans, although this is happening in rather safe western and central regions of Ukraine. Obviously, investors in their actions proceed from the premise that active hostilities will cease in the foreseeable future.