Posts Global Market construction 7924 28 June 2023

The situation varies by country, but pessimism is observed in the largest EU economies – Germany and France

The situation in the European construction industry is an indicator of the state of the economy. This market is no less important for the steel sector, as European builders form approximately 35% of the total steel demand in the EU. Although the volume of construction in the EU increased in 2022, the results of the first months of 2023 show a decrease in indicators, primarily in the construction of buildings.

Market Dynamics

Estimates of the European construction market vary significantly, the reasons for which obviously lie in the methodology. According to Expert Market Research, the European construction market in 2022 has reached about $2.62 trillion. At the same time, according to Research & Markets’ estimates, it amounted to $ 3.02 trillion. The importance of the construction sector is great and the attention of steel producers is focused on it right now. According to the European Commission, the construction sector directly employs 18 million people, it forms about 9% of EU GDP.

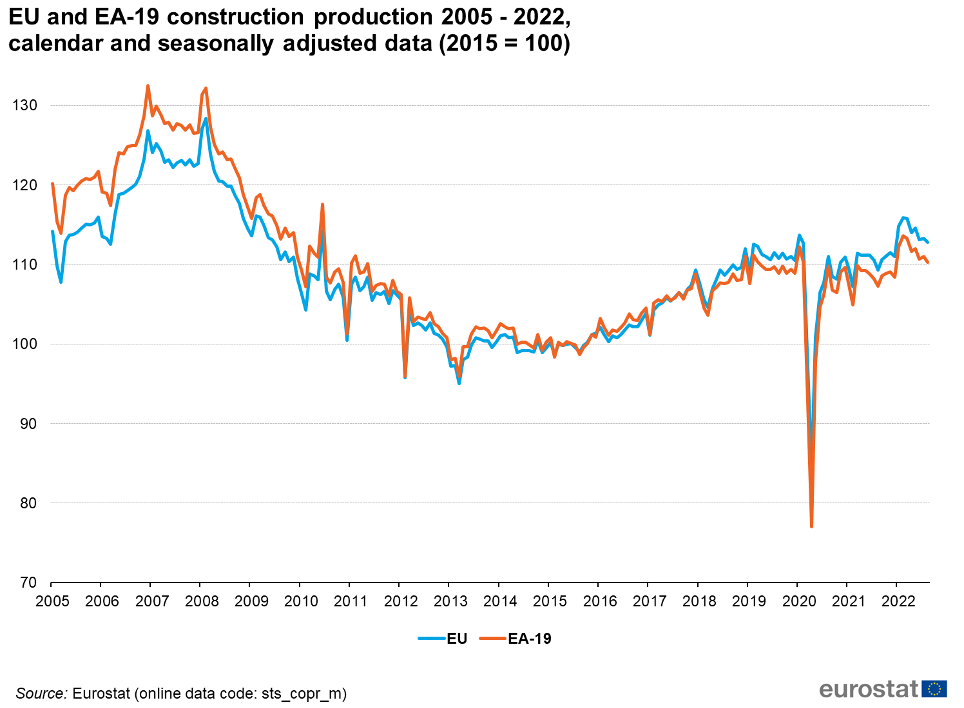

The volume of production in the European construction sector increased in 2022 by 4.8% (this is higher than expected of 4.4%) after a more significant growth of 6.7% in 2021. First of all, this was due to pan-European and national programs to support the modernization and refurbishment of buildings to improve their energy efficiency. Another reasons for construction growth are connected with the expansion of infrastructure development activities, as well as stable demand for urban housing.

Dynamics of construction volumes in the EU and Eurozone in 2005-2022

Source: Eurostat

The positive dynamics in the European construction sector, which has been observed since the fourth quarter of 2020, ended in the last quarter of 2022 due to rising prices for building materials, labor shortages in certain EU countries and increased economic uncertainty.

According to Eurostat, in March and April 2023, construction volumes in the EU decreased by 1.6% and 0.4% compared to the previous month, respectively. In the first quarter, construction volumes increased by 0.4% compared to the same period last year.

Construction of buildings in the EU in April decreased by 0.9% y/y, while infrastructure construction increased by 3.9% y/y. The situation in infrastructure construction looks more positive, as many countries invest in green energy and upgrade existing infrastructure.

The situation in the construction markets of separate European countries varies significantly. In April 2023, compared to the same month last year, construction volumes increased in Slovenia (by 23.3%), Romania (12.6%) and Belgium (8.7%). While in Slovakia it decreased by 6.9%, in the Czech Republic – by 6.4% and in Finland – by 5.5%.

At the same time, the construction industry in the largest EU economies is experiencing difficulties. For example, the situation in Germany is deteriorating. According to German construction federation Bauindustrie’s estimates, in 2023, the number of incoming orders in the residential construction sector in Germany will be reduced by 40% y/y. Orders from German construction companies in the first quarter were 18% lower than in the same period of 2022. The German construction industry is pessimistic.

Sentiment in the construction industry in France in May fell sharply. The surveyed companies speak of pessimistic market forecasts due to high uncertainty. This forces them to purchase only small quantities of the necessary materials and take a wait-and-see attitude.

According to Andriy Tarasenko, Chief Analyst at GMK Center, we are seeing a 20-30% drop in new construction in the first 4 months of 2023 in residential real estate in Western Europe. But the situation is very different across regions and segments.

«For example, in the Czech Republic, the residential construction market has not experienced sharp bursts of activity in previous years and is also showing stability today. In Spain, in the first 4 months of the year, the number of real estate transactions decreased by 7% y/y, but by 11% higher than the average for the last 8 years. But construction activity has stagnated since 2011. The situation is similar in other countries of Southern Europe, which suffered less from the tightening of credit policies less than Northern and Western Europe. The situation also varies by segment. For example, in Germany, many have heard about forecasts of a fall in orders in residential real estate by 30-40%. It really is. But the dynamics of new orders in the sectors of commercial construction and infrastructure (with the exception of roads) allows us to suggest that orders for construction are at average level. That is, the situation is not catastrophic,» Tarasenko notes.

Influencing factors

The European construction sector is influenced by many factors, the market focuses mainly on the following:

- High interest rates on loans. High rates hinder economic development in the euroarea and in construction. On June 15, the European Central Bank (ECB) raised all three key interest rates by 25 basis points, in particular, the base interest rate on loans was increased to 4%, on deposits – up to 3.5%. Moreover, the ECB has not yet reached its target of curbing inflation and is likely to continue raising rates in July. And it will be the same until inflation in Europe returns to the target value of 2%. The rate hike could take several years.

- Consumer uncertainty amid recession. According to Eurostat estimates, Eurozone GDP in the first quarter of 2023 was -0.1% q/q compared to the May estimate of 0.1% q/q. Q4 2022 also revised down to -0.1% q/q compared to growth of 0.3% q/q previously. In addition, the German Central Bank expects a 0.3% decline in the country’s GDP in 2023, although this estimate is better than the 0.5% expected in December last year. In the first quarter of 2023, German GDP decreased by 0.3% compared to the previous three months.

- Energy crisis. Although the 2022/2023 energy season passed rather painlessly in the EU, problems with the availability of energy resources may reappear in the 2023/2024 season. High energy prices significantly affect the cost of building materials and the intentions of customers to start and continue the construction of various kinds of objects.

- Falling house prices. Potential buyers have taken a wait-and-see position. Why should they buy when prices are falling? A prolonged situation with low interest rates has led to a boom in new housing construction across Europe, but sales have slowed and there is now an oversupply in many countries.

- The need to meet climate targets and improve energy efficiency. Buildings account for the largest share of total final energy consumption in the EU (40%) and generate about 35% of all greenhouse gas emissions. The growing demand for energy efficient buildings is one of the trends shaping the European building market. Particularly in Germany, an increasing number of customers require energy certification of buildings. With strict energy efficiency regulations and a growing awareness of the benefits of energy efficient buildings, the construction sector is focusing on developing energy efficient and sustainable projects.

Steel consumption

The question «what is really happening in the EU construction industry» is one of the key questions for understanding the state of steel demand in the region.

«We often hear that «construction in Europe has fallen by at least 50%». However, if you clarify the source of these estimates, it turns out that this is one of the familiar, industry insiders. There are no other justifications. Patterns of the past add to the fear in the assessments – never before has the monetary policy tightening cycle been without a crisis in the real estate market and a recession. But if you look at the dynamics of production in construction in the EU, we will not see a significant decrease. But the market is dominated by the idea that the industry is having problems with new orders and the decline will inevitably begin,» says Andriy Tarasenko.

The construction industry, which accounts for 35% of total steel demand in the EU, is now showing a slow recovery and low activity. The use of steel in construction is expected to decline towards the end of the year amid lower investment in civil and infrastructure projects due to tight monetary policy and high interest rates.

According to the EUROFER association, the demand for steel in the European Union in 2023 will increase by just 0.3%. In 2024, according to the association’s forecasts, demand will recover by 1.3% y/y. At the same time, in 2022, the indicator increased by 3.1% y/y.

According to the latest EUROFER forecast, the apparent steel consumption in the EU in 2023 will fall by 1% (in the previous February forecast, it was about a fall of 1.6%), and in 2024 it will increase by 5.4%, subject to positive changes in the industry and a recovery in demand for steel.

Forecast calculations made by GMK Center at the end of June 2023 show that real steel consumption in the EU will decrease by only 0.9% this year.

In turn, Worldsteel (April forecast) expects that in the EU and the UK, steel demand will fall by 0.4% in 2023 after falling by 7.9% in 2022. A 5.6% recovery is projected in 2024.

Outlook for the steel sector

Analytical assessments of the prospects for the construction sector in Europe vary significantly – from a slight decline in 2023 to stable growth in the medium term. EUROFER expects decrease of growth dynamics of the EU construction sector in 2023 by 1.6%. A moderate recovery of 1.3% is expected in 2024. The Euroconstruct research group estimates that construction growth in Europe will fall to 0.2% in 2023 and to 0% in 2024. The key reasons for low expectations are the war in Ukraine, inflation and the tightening of monetary policy – a decrease in demand for residential real estate due to high mortgage rates, high prices for building materials, etc.

«It looks like it could be a rough period of adjustment for the industry,» says chief economist at Experian Mohammed Chaudri, adding that «nearly all factors which affect construction demand are negative, including the economy, consumer prices, interest rates and consumer confidence».

According to Tarasenko, a gradual and smooth decline in construction activity in the EU is expected by 2-3% per year for 2-3 years. This should not have a significant impact on the steel market. On the other hand, it is possible to predict an improvement in the situation in the sphere of housing construction.

«We expect a gradual improvement in the situation with new orders and the start of new construction projects in residential real estate. First, in the euroarea, real interest rates (adjusted for inflation) are negative. That is, it is profitable to take loans even at higher rates. Secondly, prices for the sale of residential real estate are falling, while prices for rent are rising, which increases the capitalization rate. The attractiveness of investment in residential real estate is increasing. Thirdly, there is a structural shortage of real estate in some countries and cities, which will draw out construction activity,» emphasizes the chief analyst of GMK Center.

Today, the demand for infrastructure construction is supported by investments in green energy and transport infrastructure projects. At the same time, the situation in the housing segment worsens the prospects of the market as a whole.

There are also optimistic mid-term and long-term forecasts on the market.

According to some estimates, the EU construction market expects a positive trend in the medium term. Expert Market Research predicts that the EU construction market will grow in the period 2023-2028 with an average annual growth rate of 4.9% and will reach $3.5 trillion by 2028. In turn, Research & Markets believes that due to the growing demand for environmentally friendly building materials, advances in building technologies and various government initiatives, the European construction market will grow by an average of 3.5% between 2023 and 2028 and will reach $3.73 trillion by 2028.

In general, the dynamics of the construction market in different EU countries in 2023 will vary greatly. If we take as a basis the results of the first quarter compared to the same period in 2022, then a significant growth in the construction industry at the end of the year can be in Slovenia (24.4% in the first quarter), Greece (24.4%), Latvia (17.1 %) and Romania (12.5%). Outsiders in the first quarter are: Estonia (-11.4%), Hungary (-9.2%) and Denmark (-6.3%).

There are not many drivers for the development of the economy in the EU and the situation in the construction sector, including the slightest fluctuations in it, greatly affects the consumption and production of steel in the EU. A stable EU economy guarantees the absence of sharp drops, but possible positive scenarios in the construction sector significantly depend on the general policy of the European Commission and the economic policies and infrastructure programs of the leading countries.