Posts Global Market scrap prices 9408 12 March 2024

Turkish steelmakers have suspended purchases

Global scrap prices fell in most major markets in early March. In the EU and the US, prices came under pressure from Turkish importers, who had almost stopped purchasing since early February, and were also negatively affected by domestic consumers. Steel producers reported a decline in demand and lower prices for finished products.

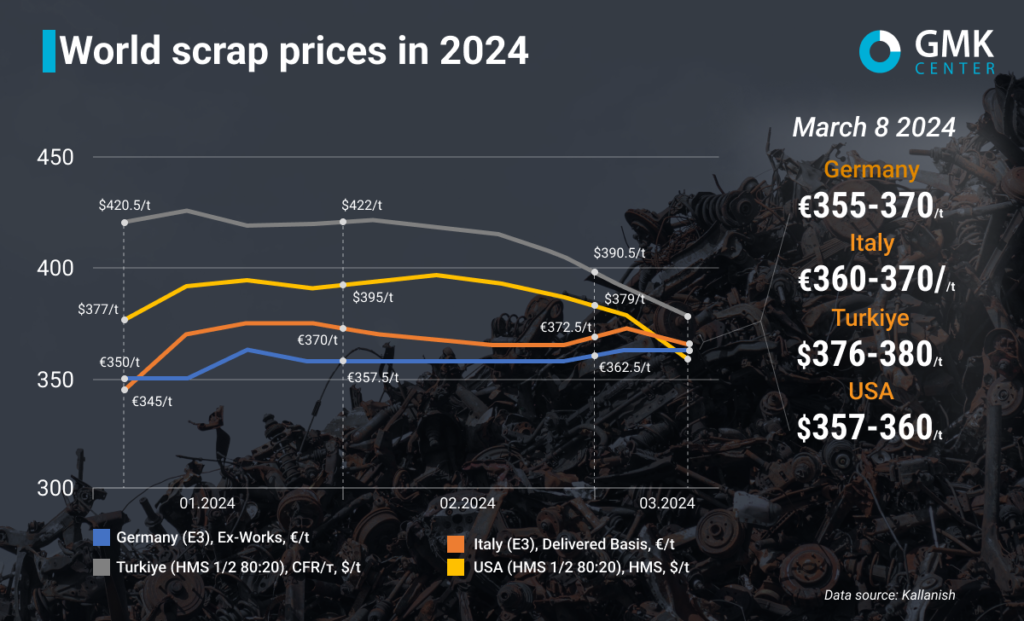

Prices for HMS 1&2 80:20 scrap in Türkiye fell by $11/t, or 2.8%, in March 1-8, 2024, compared to the previous week, to $376-380/t CFR. In February, scrap prices in Türkiye fell by 6.4%. As of February 29, a ton of scrap cost $395/t CFR, while on January 31 it was $419-422/t CFR. In general, since the beginning of the year, the Turkish market has been experiencing volatility in raw material prices. Currently, the quotes are down by 8.6% compared to the prices at the beginning of the year.

The negative trend in the Turkish scrap market has been observed since the beginning of February and continues to this day.

Demand for raw materials began to decline in February after a positive start to the year, as steelmakers again faced a drop in sales of finished products. To some extent, this was caused by a decline in purchases from Asian consumers, in particular due to the Lunar New Year holiday. Turkish metallurgists suspended purchases of scrap in anticipation of China’s post-holiday recovery to assess the future prospects for the steel market. There was also an increase in scrap supply, which eased tensions in the market.

In addition to weakening exports of finished products, domestic demand was also weak during the month, which continued to put pressure on scrap prices. As Turkish steel producers noticed the stable availability of raw materials, they switched to a wait-and-see attitude, buying only urgent volumes, thus putting pressure on the market to bring prices down to the most favorable levels.

Türkiye’s scrap prices crossed the $400/t mark at the end of February, although the market was hopeful that consumer demand would recover. Currently, oversupply, coupled with a lack of demand, continues to have a negative impact on prices. Local steelmakers are not risking buying large tonnages of raw materials amid low steel sales, and most steelmakers are expected to shut down their facilities during Ramadan (March 10-April 9).

In the short term, scrap prices in Türkiye are likely to continue to decline or stabilize at current levels amid a significant oversupply of raw materials. In addition, the market is watching the situation in China, whose economy is still quite weak. The slowdown is also evident in Turkey’s domestic steel market, which has been a major consumer of local steel products in recent years.

«Scrap prices correlate with iron ore prices, which are falling amid the accumulation of significant stocks in Chinese ports. The decline in iron ore prices leads to lower prices for finished products, which in turn encourages electric steelmakers to seek lower scrap prices to maintain competitiveness and margins,» explains GMK Center analyst Andriy Glushchenko.

In the EU market, scrap prices have also been volatile over the past two months, but have increased since the beginning of the year.

In Germany, during the period March 1-8, 2024, prices for E3 scrap remained stable compared to the previous week at €355-370/t Ex-Works. At the same time, they increased by €5/t in February and by €10/t since the beginning of the year.

In Italy, on March 1-8, raw material prices (E3) fell by €5/t compared to the previous week – to €360-370/t Delivered Basis. In February, quotations fell by €5/t, and since the beginning of the year, they have risen by €10/t.

Scrap prices on the German and Italian markets were mostly stable during this period, fluctuating by €5-10/t, as demand from domestic steelmakers and export sales were low amid a slowdown in global activity. The market is dominated by a wait-and-see attitude among consumers amid lower prices for finished products. In addition, Turkish importers, the main export destination for European scrap, have almost stopped purchasing, speculating on prices.

Most market participants doubt that prices will rise in March due to weak export activity and falling scrap prices in the US and other markets. Trade has slowed down and, depending on supply and demand, scrap prices are expected to remain unchanged next month.

Italian association Assofermet predicts a drop in scrap prices in March if steel production does not increase.

On the East Coast of the United States, prices for HMS 1/2 Scrap (80:20) scrap for the period March 1-8, 2024, fell sharply by $21/t – to $357-360/t FOB compared to the previous week. In February, the price level fell by $16/t compared to January, and since the beginning of the year – by $22/t.

Last week’s sharp drop in scrap prices is the result of the start of March trading amid declining steel prices and a sharp drop in prices in Türkiye. The long pause in purchases by Turkish producers has led to an increase in oversupply and forced suppliers, including those from the United States, to make concessions and significantly reduce prices.

Market participants believe that prices will continue to decline due to a slowdown in trade in the US market in the current environment. According to forecasts, quotations may fall by at least $20-50/t during March trading. Some are hopeful that the seasonal improvement in steel demand will support the scrap market, although a drop is still inevitable.

Fastmarkets expects global scrap prices to come under pressure in the short term due to slowing steel demand. In the US market, prices will stabilize, while in the EU they will decline slightly due to weak steel consumption, especially in the construction sector. In Turkey, reconstruction works after the earthquake are expected to pick up in the medium term, which should provide some demand for steel and, in turn, increase the requirements for scrap stocks.