Posts Global Market rebar prices 5868 20 March 2024

Weak steel demand combined with falling commodity prices weigh on the market

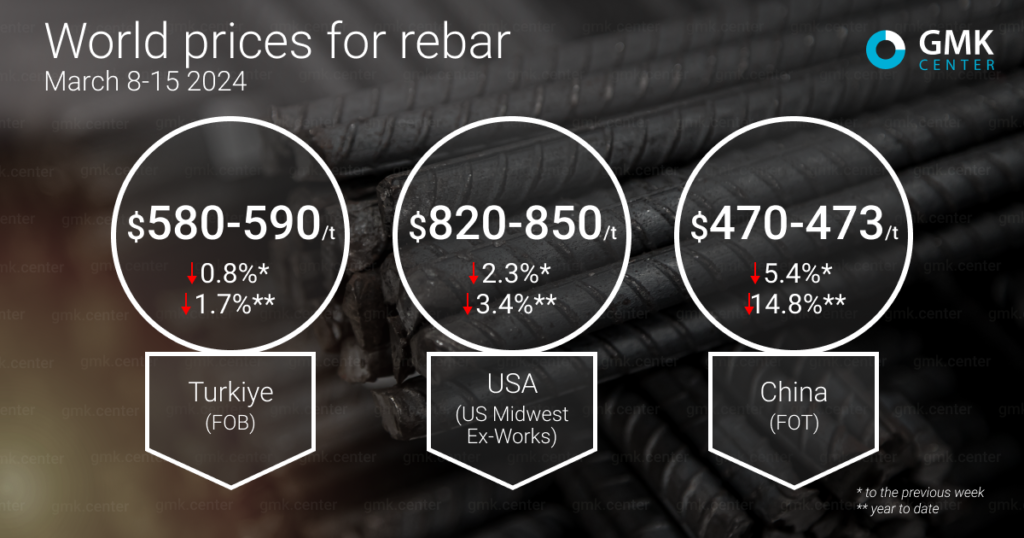

Global rebar prices have fallen significantly in major global markets since the beginning of March. The downward trend has been observed since the beginning of the year, but it was in March that prices in some regions reached monthly highs. The main reasons include falling raw material prices, weak demand for finished products and limited construction activity.

«The fall in prices for finished steel products is interconnected with the fall in raw material prices. This phenomenon is already global. Most likely, the increased volatility will continue for some time until market participants decide that prices are acceptable for continuing operations, and then the situation will stabilize,» said Andriy Glushchenko, GMK Center analyst.

Prices for rebar in Türkiye during the period March 8-15, 2024, remained stable compared to the previous week at $580-590/t FOB. Since the beginning of March, product quotations have decreased by $5/t (-0.8%), and since the beginning of the year – by $10/t (-1.7%). At the same time, in the second half of January, the Turkish rebar market was dominated by an upward trend, which contributed to the price increase to $620/t. Since the beginning of February and up to now, quotations have been gradually falling.

At the beginning of the year, rebar prices in Türkiye were mainly supported by rising scrap prices and improved global demand for steel in the post-holiday period. Turkish producers signed contracts with European, Yemeni and Israeli consumers, as well as customers in the domestic market. However, after reaching $620/t, the growth stopped as scrap prices stabilized and demand was insufficient for further growth.

In general, activity in the Turkish rebar market, which had been pushing prices up, slowed down rather quickly. Consumers filled their immediate need for products within a few weeks and adopted a wait-and-see attitude to reduce the rapid price increase.

Despite the slowdown in demand, Turkish producers were forced to keep prices high due to rising labor costs: steelworkers received a 157.4% increase in wages. Some companies reported that the direct impact on production costs from higher wage costs was almost $15/t.

Although local steelmakers resisted further declines in rebar prices and expected them not to fall below $610/t, they were unavoidable. Scrap prices continued to fall, and demand did not recover. At the end of February, the quotes still fell below $600/t.

However, in the short term, traders expect prices to recover and the decline to be limited. Most global consumers already have minimal stocks. This prevents a sharp drop in prices, as demand is regular. However, in the Turkish market, everything depends on the prospects for exports to Israel and Yemen.

Some traders have pessimistic short-term forecasts, pointing to weak sentiment in the global market, particularly in China and the United States, as well as financial problems in the domestic market.

Currently, the main demand for Turkish products comes from Europe, but it is limited by quotas. Israel and Yemen have significantly reduced consumption due to the war in Gaza.

In the United States, rebar prices (US Midwest) during March 8-15, 2024, decreased by 2.3%, or $20/t compared to the previous week – to $820-850/t Ex-Works. Since the beginning of March, the quotations have fallen by 2.9%, or $35/t, and since the beginning of the year – by 3.4%, or $30/t.

In contrast to the Turkish market, rebar prices in the US grew in December 2023, and the downward trend began in January this year. In general, prices were stable in January-February, decreasing by $5-10/t, with the main drop occurring in March.

The gradual decline in quotations was caused by a subsidence in scrap prices. At the same time, it was limited by weak consumer inventories, which kept demand at a sufficient level, and delays in the delivery of imported goods. Some pressure on the market came from unfavorable weather conditions in late January, which slowed construction activity and demand for long products.

Although demand for steel gradually slowed over the winter, prices remained more or less stable due to low availability of imports and uncertainty about the recovery of the construction sector.

In March, rebar prices on the US East Coast plummeted amid falling scrap prices and weak demand. The market is concerned that the situation is not improving in March. Despite a significant price adjustment, orders did not increase. However, it is expected that trading activity will pick up when imported cargoes enter the market.

In China, rebar quotations as of March 15 this year fell by 5.4%, or $27/t, compared to March 8, to $470-473/t FOT. Since the beginning of the month, prices have fallen by $44/t, or 8.5%, and since the beginning of the year – by $82/t, or 14.8%.

Prices for rebar in China in the winter were characterized by slight volatility, with a negative trend prevailing, but in March the market fell sharply.

In January and February, product prices depended on the state of the raw materials market and political support for the construction industry. As stocks at steel mills were quite high, most of them carried out maintenance ahead of the lunar New Year holidays to limit the drop in product prices. In particular, amid political incentives, rebar prices rose slightly in late January, although this trend was not supported by demand and quickly ended.

In February, China went on a holiday break and trade weakened. Despite expectations that demand would rebound after the holidays, this did not materialize, and prices continued to decline gradually. Despite some economic stimulus from the Chinese banking system, post-holiday activity in the steel market declined, although these stimuli will have a positive impact on demand in the long run.

In March, rebar prices fell significantly, in part due to the prolonged lull in the construction industry and weakening raw material markets. Construction activity in China did not recover due to unfavorable weather conditions. Together with high inventories, these factors have pushed product prices to their lowest level since May 2023. Amid it, some steel mills are limiting production as the viability of their businesses is under threat in the current environment.