Posts Global Market HRC prices 5607 25 January 2023

The trends in the Chinese HRC market will be determined after the holiday period

Europe. Despite the decrease in demand from distributors, European producers of hot-rolled coils (HRC) determine further increase prices. This trend became apparent at the end of 2022 – in northern Europe HRC offers for January 2023 gradually increased above €700/t ex-works compared to €650-680/t in December. Europe’s steel mills were expecting an increase in demand and hoped for better deals due to reduced supplies.

With the start of 2023, European market participants have been watching trends closely to understand whether price growth will continue after the end of the winter holidays, whether buyers will accept this level and what the demand will be.

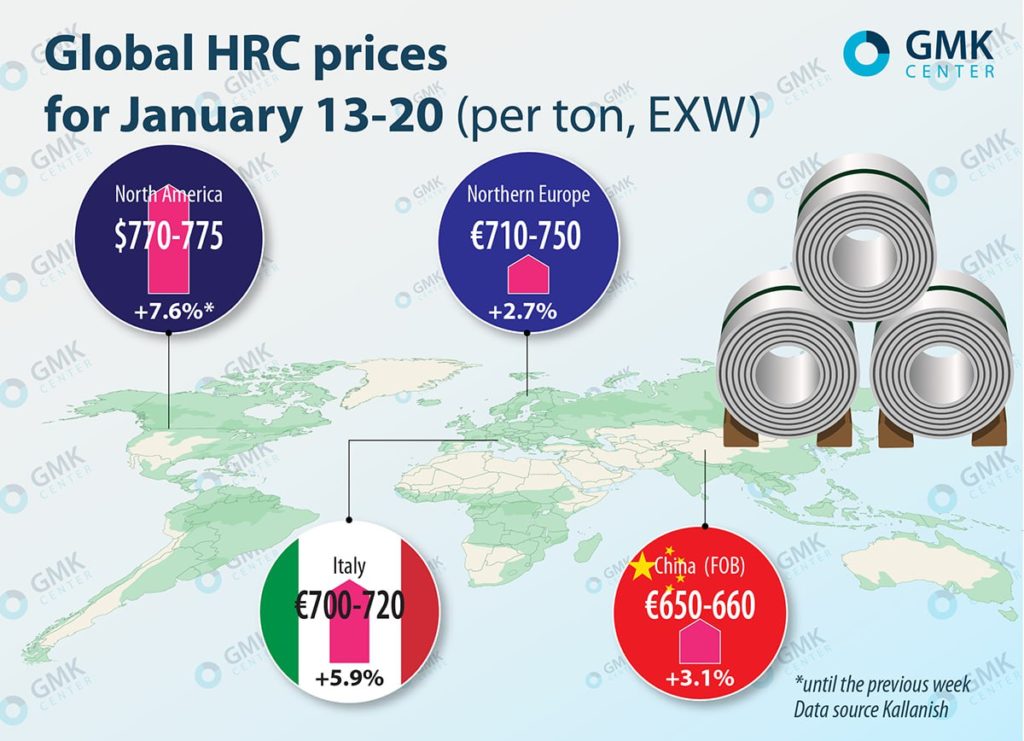

During the week of January 13-20, HRC prices in northern Europe increased by €20 – up to €750/t ex-works. According to S&P Global’s data, European HRC producers plan to focus on a new level – €800/t EXW Ruhr.

At the same time, buyers are in no hurry to fill warehouses and book only the minimum necessary volumes. This approach is explained by fears that the current rise in prices will not be sustainable. At the beginning of the year, its recovery was due to the replenishment of stocks and a decrease in HRC supply. Currently, buyers are worried about the lack of demand recovery and the start-up of blast furnace capacities in Europe after their temporary shutdown. According to buyers, this may put an end to the upward trend that has been observed in the European market since mid-2022.

Several European producers have shut down blast furnaces in 2022 in an effort to balance supply and demand and support prices. However, in January, ArcelorMittal Spain and US Steel Kosice in Slovakia confirmed the restart of the blast furnaces, and this was enough for buyers to expect further such announcements from companies and lower steel prices.

Currently, the opinions of experts differ. One trader told S&P Global, that the current price increase will not last long enough for producers to make a profit. Other sources believe that the upward trend will be facilitated by the lack of competitive imports and the cautious approach of steel plants to the restarting capacities.

A favorable situation on the flat rolled market in the EU was formed at the beginning of 2023, says the chief analyst of GMK Center Andriy Tarasenko.

“Firstly, this was facilitated by warm weather and stabilization of electricity prices. This caused a boom of positive perception and a record rapid improvement of business expectations in the industrial sector of the eurozone countries. Another point is that service center inventories continued to decline in December, meaning the European market entered the new year with good demand expectations and lower-than-usual inventories. Prices in southern Europe have already increased by 5-7% since the beginning of the year, and further growth of 5-7% can be expected. However, it is still too early to talk about a trend reversal. The construction industry is lagging behind, and recovery there will not happen soon. But the construction market bottomed out, which adds to optimism and has a positive effect on prices. It is also worth noting that the drop in energy prices should support exports from the EU, primarily in the flat rolled segment. This should have a positive effect on production volumes. We are already seeing the start-up of previously stopped blast furnaces,” noted Andriy Tarasenko.

USA. In the United States, hot-rolled coil prices are increasing for a second week in a row as steel producers raised prices. According to sources, Nucor intends to set a minimum price for HRC at $800/t – this level was announced on January 17 by integrated steelmaker Cleveland-Cliffs. However, service centers last week expressed some skepticism about this, citing the lack of a noticeable increase in demand.

According to The Fabricator columnist Michael Cowden’s assessments, it’s a good time for steel mills right now. The market is likely to be moving away from the inventory reduction trend that has been observed for most of the past year. However, for now, demand has not increased enough to support high quotations, as it did during 2021 and early 2022 after the full-scale invasion of Ukraine by the Russian Federation. At the beginning of 2022, the price of hot-rolled coils in the USA reached $1,600/t. However, supply quickly exceeded demand, and service centers lowered prices.

China. China’s market slowed last week due to the start of Lunar New Year celebrations, but export offers rose amid announcements of stimulus for the local economy. General trends will become clear after the holidays. Now, thanks to the opening of the Chinese economy, trends are positive. In February, HRC market is expected to grow against the background of measures aimed at supporting the real estate sector. During the week of January 13-20, the price of HRC in China increased by $20/t compared to the previous week – up to $660/t FOB.

HRC prices in January 2023

Trends. According to SteelMint’s data, global offers for the export of hot-rolled coils in January 2023 reached a six-month high, and in the short and medium term, the upward trend may be maintained. This will be facilitated by the need to replenish stocks in the EU, where energy prices have fallen, the opening of the Chinese economy, which will influence global trends, and the resumption of construction work after the winter period.