Posts Global Market EU 10647 05 July 2023

The European automotive industry shows good development dynamics this year

The situation in the European automotive industry is a good indicator of the «health» of the entire EU economy. Over the past few years, growth in this sector began only in August 2022 and it has been continuing to this day. However, forecasts for the future for the European auto industry are contradictory.

Industry dynamics

The importance of the automotive industry for the EU economy cannot be overestimated. The volume of the auto sector is 7% of the EU GDP. There are 42 car factories in Germany, 31 – in France, 23 – in Italy, and 17 – in Spain. 46% of Slovakia’s exports outside the EU in 2022 were cars. In other words, positive trends both in the economy of the European Union and in individual countries that are part of it largely depend on the performance of the European automotive industry.

According to the European Automobile Producers Association (ACEA), in 2022, 10.9 million passenger cars were produced, 8.3% more than in 2021. In 2021, there was a drop of 6.7%. In 2022, the EU increased car exports by 24.4% – to €158 billion, imports by 14.8% – to €62 billion. Germany became the largest exporter, selling abroad cars for €92 billion (59% of the total European exports).

Last year, 9.3 million new passenger cars were registered in the European Union – it is the lowest level since 1993 (9.2 million cars). In 2022, the EU car market decreased by 4.6%, mainly due to a shortage of components in the first half of the year. Among the four largest EU markets, only Germany ended the year in positive territory – growth compared to 2021 amounted to 1.1%. The other three markets showed declines: Italy – -9.7%, France – -7.8% and Spain – -5.4%.

But from August to December 2022, a positive trend began in the European market, which continued into 2023.

“In the five months of 2023, the production of passenger cars in the region increased by 25% y/y. And, although orders for new cars in Germany in January-May fell by 8% y/y, but there is a huge pent-up demand – delivery times can reach up to 12 months,” notes GMK Center Chief Analyst Andriy Tarasenko.

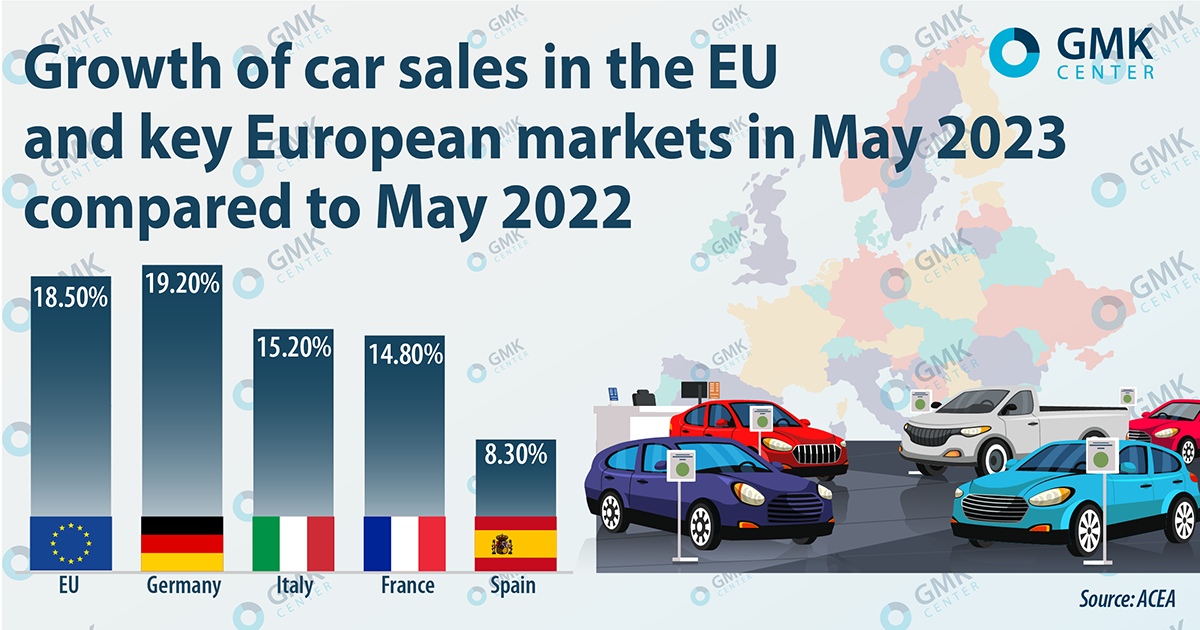

Car sales in the EU in May 2023 increased by 18.5% – to 939 thousand units. All major EU markets in May showed strong sales growth: in Germany by 19.2%, in Italy – 15.2%, in France – 14.8%, in Spain – 8.3%. In total, car sales in the European Union in January-May increased by 18% compared to the same period in 2022 – up to 4.4 million, in Europe as a whole – by 17.4%, up to 5.324 million.

Autotrends

Among the main trends in the automotive industry in Europe are the following:

- The shortage of semiconductors for the automotive industry has largely decreased. The problem of semiconductor shortage was relevant in 2021, but its importance decreased in 2022-2023.

- High inflation and rising interest rates. This reduces the real budgets of households, and rising interest rates make cars more expensive. Loans are also more expensive. Potential weakness in demand could complicate the auto industry’s recovery.

- Growth in production and sales of electric vehicles, gradual decrease in the share of vehicles with internal combustion engines. According to analysts at LMC Automotive, electric vehicles amounted to 11% of new car sales in Europe in 2022. The share of electric cars in Europe in May 2023 increased to 13.8% compared to 9.8% a year earlier. In general, in 2022, global sales of electric vehicles grew by 55% and exceeded 10 million cars. The share of electric cars in total car sales was 14% in 2022 and may reach 18% in 2023.

The EU authorities have agreed on the rejection of such cars by 2035, with an exception for Germany, which has taken a course on synthetic fuel. By that date, the use of gasoline and diesel vehicles, as well as hybrids, will be prohibited. They will give way to electric cars, with the exception of those that will run on synthetic fuel. In other words, the regulation of the EU authorities obliges to produce in Europe new cars without CO2 emissions by 2035.

“The automotive sector could be one of the first leading markets to drive demand for low CO2 steel products. In turn, this can help steelmakers gain confidence to invest in low-CO2 steel production, as well as reduce emissions in the automotive supply chain”, emphasize the EUROFER association.

Automotive steel

On the one hand, steel consumption in the EU in 2023 will decrease due to problems in the construction sector. On the other hand, steel demand will be supported by a moderate recovery in the automotive industry.

In the automotive sector, the consumption of steel products during 2021-2022 grew by 3.3% annually, but in 2023 slowdown in the indicator is expected to 1.2% due to changes in demand and supply of steel in the market. In 2024, steel demand from the automotive sector is expected to fall by 1.8% y/y. EUROFER estimates that the automotive sector accounts for 17% of steel consumption in the EU and is showing good growth.

“Demand for steel could increase due to the growing number of electric vehicles that will be produced in the coming years. WorldAutoSteel, the automotive group of the World Steel Association, estimates that an electric car could require 260-280 kg more steel than an internal combustion engine car, which requires about 900 kg of steel”, add Argus.

Prospects for the EU auto industry

Sentiment in the European auto industry in the first quarter was positive. However, in the second half of the year, EU automakers are preparing for increased competition and reduced demand.

“European automakers had significant order books for the second quarter and supply and demand are expected to level off by the third quarter after supply-side concerns normalize. The removal of obstacles in logistics and supply chains, combined with the expected decline in the number of orders, is forcing individual automakers to prepare for increased competition,” said Argus.

ACEA predicts a 5% growth in the EU car market in 2023 – to almost 10 million cars (2020 level). In turn, GMK Center expects an increase in car production in the EU by the same 5% this year, while in Germany the growth will be even higher – 9%.

“The sector will continue to show modest growth after very low output for several quarters, but absolute output will remain well below levels seen in 2018 (the peak of the previous cycle), even into 2024. The EU auto industry is expected to grow moderately (+1.2%) in 2023 due to moderately positive developments on both the supply and demand sides. However, production is forecast to decline again in 2024 (-1.8%),” notes EUROFER.

The Ukrainian iron and steel industry is an important element in the value chain of the European automotive industry. Thus, mining companies supply iron ore to the European Union, from which local steelmakers make automotive steel, Ukrainian manufacturers produce stainless pipes for this industry. The Ukrainian export-oriented iron and steel also depends on the health of the European economy and the state of the automotive sector.